Day 2 on Twitter. Coming to the next set of awards - The "Foot in Mouth" Awards. A clear winner in this category is DSP Mutual Fund. I have shortlisted them for their sheer cockiness. Thread. (1/10)

In September, 2018, the Fund House triggered a panic by selling DHFL bonds at distressed levels. It was a business call; and hence a benefit of doubt could be given. (2/10)

What cannot be forgiven though, is the brazenness with which the Fund house eulogised their portfolio selection capabilities. 3/10

In an article titled 'How 3 mutual funds weathered the toxic-paper debt fund crisis' by a leading daily (29 April, 2019), a fund manager of the Fund, showered praises on the Fund, as if it is God's greatest gift to mankind. 4/10

The fund house preached that 'Although the promoter or group provides an overreaching comfort, we prefer fundamentally sound businesses with potential to generate stable cash flows in addition to parameters such as debt and interest coverage.' 5/10

Ironically, a few months later, DSP Mutual Fund took a 50% haircut on its exposure in Coffee Day Natural Resources - a promoter entity of the Coffee Day group. 6/10

In the aforementioned article, the Fund also noted that "It is important to assess the ability of companies to refinance debt through banks or capital markets". 7/10

Tragically again, the Fund house was holding DHFL, IL&FS group companies and Sintex in its portfolio. All these entities failed to refinance their debt. So much for 'assessing the ability of companies to refinance debt'. 8/10

The preachy fund house further gloated that it also considers the structuring of the instrument in a way that provides greater security to the lender. This includes ring-fencing of assured cash flows, priority payments through waterfall structure and cash kept aside. 9/10

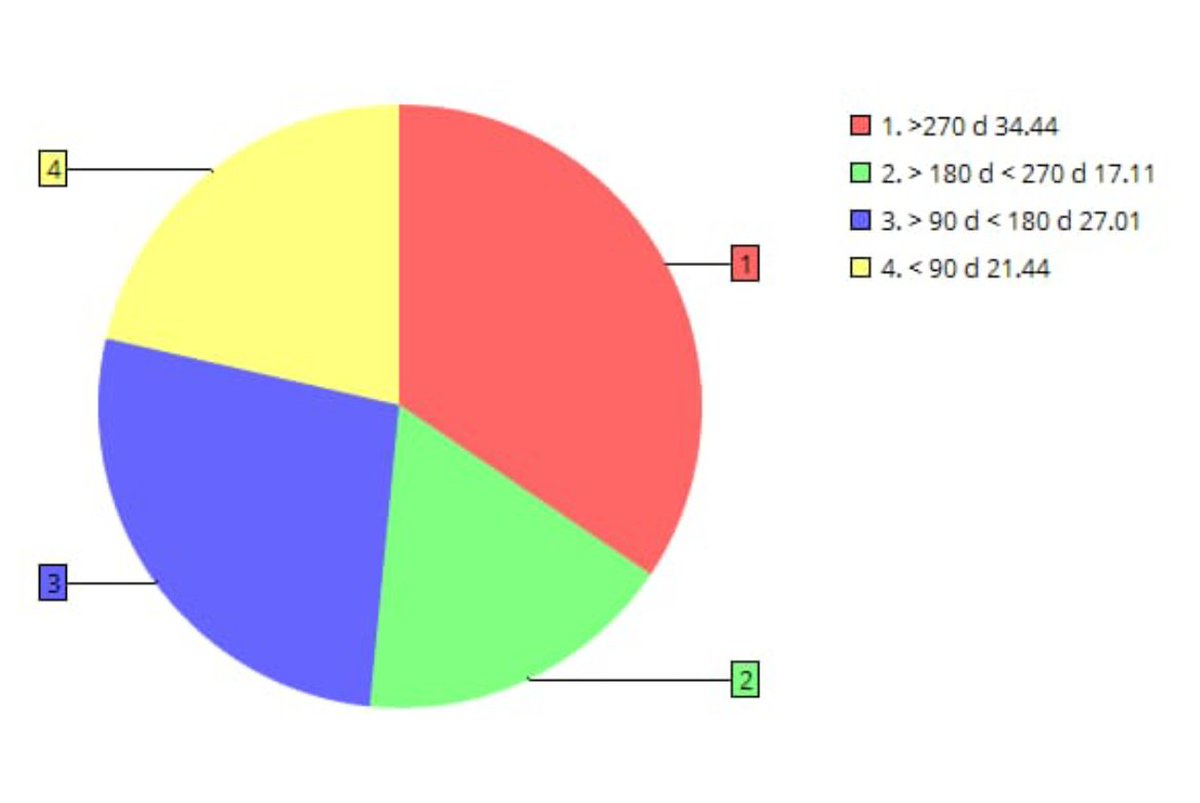

With all the safety measures in place, it is surprising that the fund house not only suffered credit setbacks but also saw the AUM of Credit Risk Fund shrink from ~ Rs. 6, 880 Cr (Aug 2018) to ~ Rs. 3, 300 (July 2019). The 1 year return is -3.67%. Preachy parrot. Huh! 10/10

@_soniashenoy @AbhinandanSekhr @ActusDei @deepakshenoy @TheMFGuy1 @latha_venkatesh @menakadoshi @dugalira @kayezad @invest_mutual @dmuthuk @SalariedTaxpay1

@NagpalManoj @andymukherjee70 @akashbanerjee @ShekharGupta @sagarikaghose @sardesairajdeep @sandipsabharwal @BDUTT

@_soniashenoy @andymukherjee70 @invest_mutual @BMTheEquityDesk @dmuthuk @rohitchauhan @contrarianEPS @shyamsek @chokhani_manish @pvsubramanyam @BalakrishnanR @Sanjay__Bakshi @TamalBandyo @CafeEconomics @menakadoshi @latha_venkatesh @AmolPlanRupee

@deepakshenoy @dugalira @Iamsamirarora @SunilBSinghania @mrinagarwal @IamMisterBond @NagpalManoj @SalariedTaxpay1 @YashwantSinha @ayushmitt

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh