Here for fun and finance. Before suing me for defamation, message me; I will apologize :P

3 subscribers

How to get URL link on X (Twitter) App

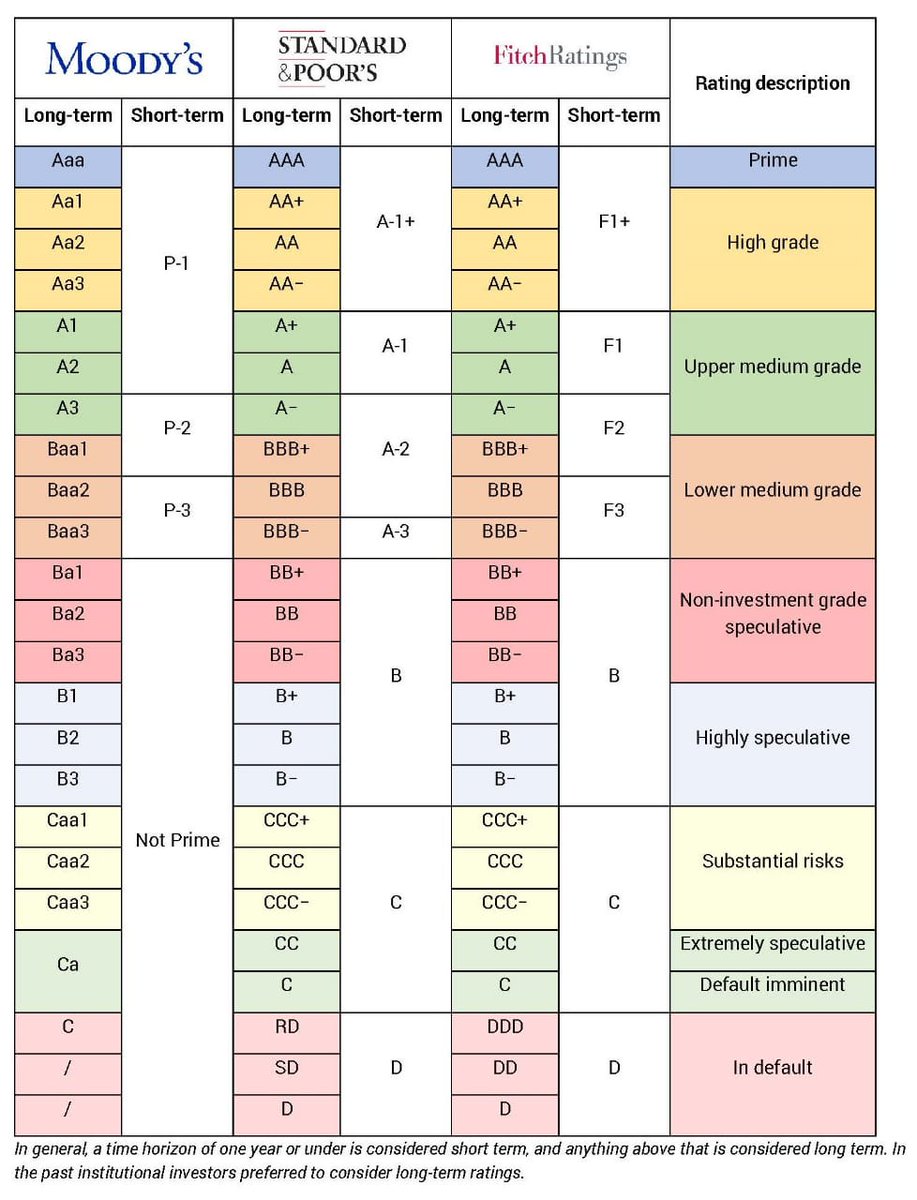

SRs of 3 agencies - S&P, Moody's and Fitch are considered important. Currently, India is rated BBB- (Stable) by S&P, Baa2 (Negative) by Moody's and BBB- (Stable) by Fitch. Simply put, India is barely investment grade as per S&P and Fitch and a notch better as per Moody's. 2/11

SRs of 3 agencies - S&P, Moody's and Fitch are considered important. Currently, India is rated BBB- (Stable) by S&P, Baa2 (Negative) by Moody's and BBB- (Stable) by Fitch. Simply put, India is barely investment grade as per S&P and Fitch and a notch better as per Moody's. 2/11

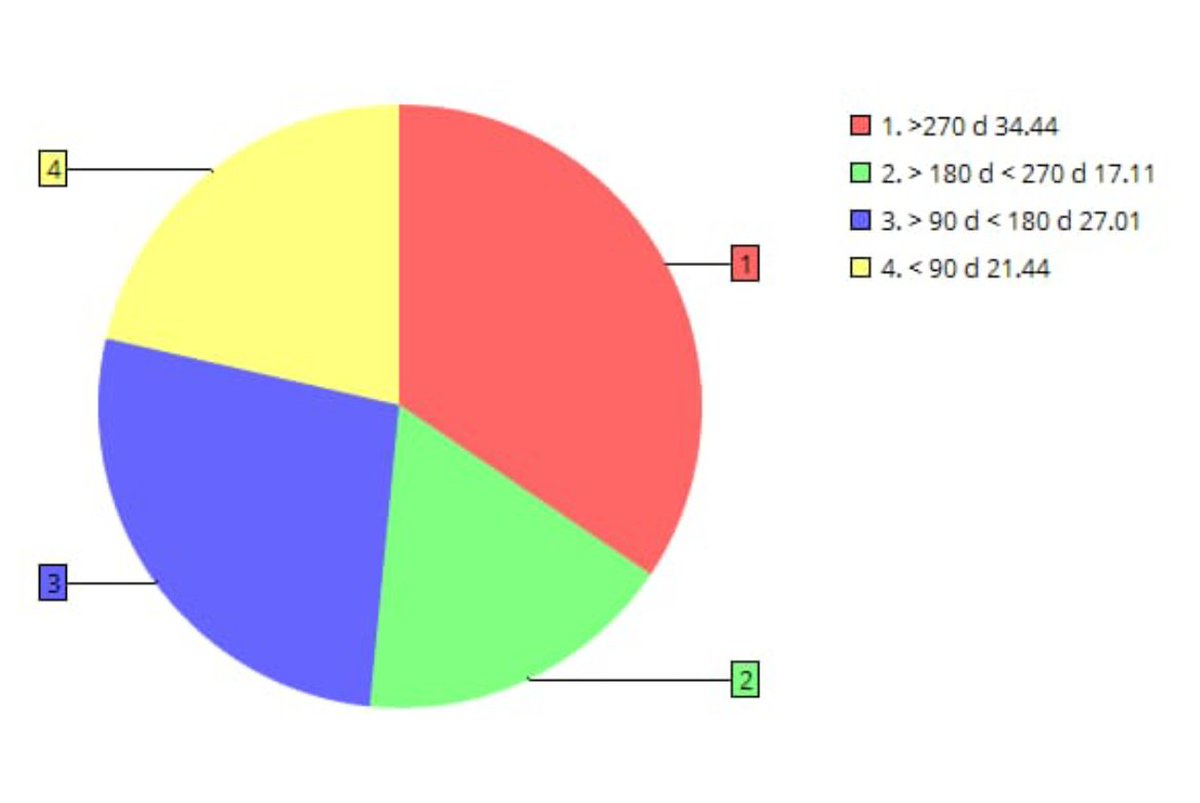

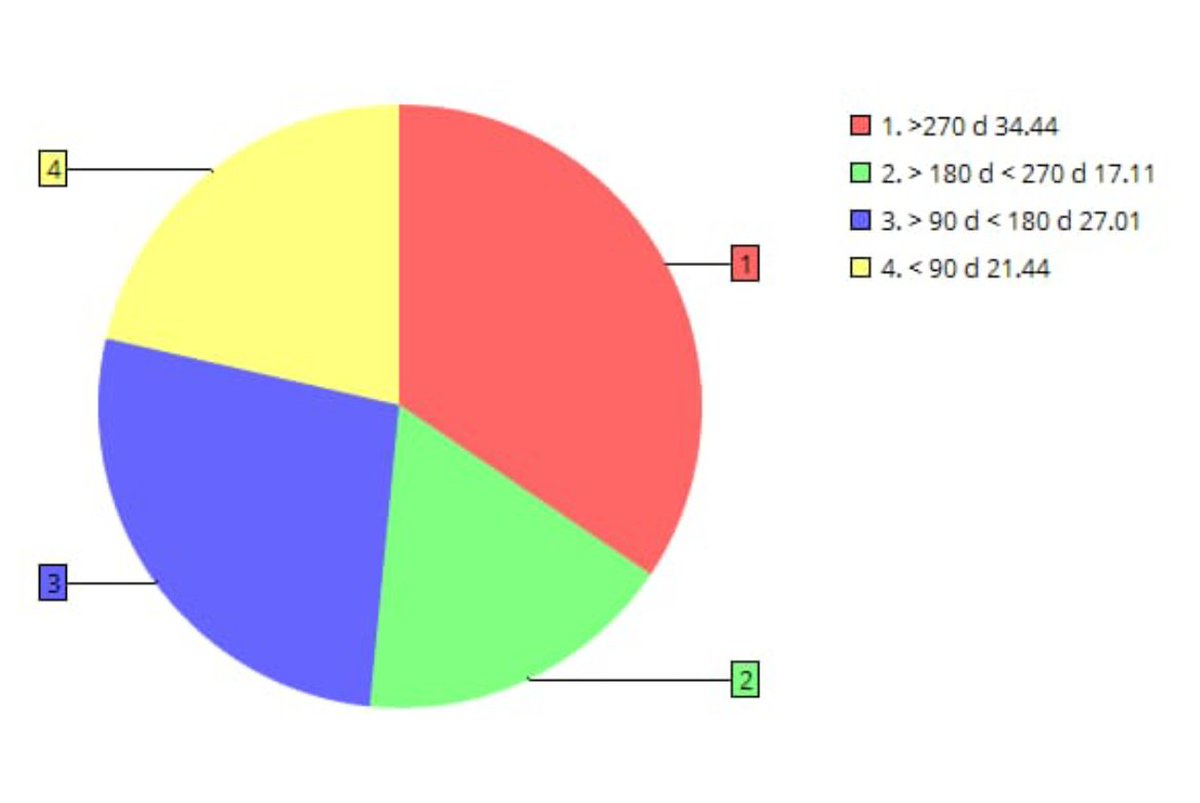

As per SEBI data, the total outstanding corporate bonds in India aggregate to ~ Rs. 30.63 lakh crore.

As per SEBI data, the total outstanding corporate bonds in India aggregate to ~ Rs. 30.63 lakh crore.

1) 2-Wheeler Sales - dipped by ~17% in July, 2019. Motorcycle sales fell by 19% while Scooter sales declined by 12%. Scooters sell more in urban India. Motorcycles sell in both urban as well as rural India. The data shows distress in both India and Bharat. 2/13

1) 2-Wheeler Sales - dipped by ~17% in July, 2019. Motorcycle sales fell by 19% while Scooter sales declined by 12%. Scooters sell more in urban India. Motorcycles sell in both urban as well as rural India. The data shows distress in both India and Bharat. 2/13

For many-many years, people cast aspersions on lending practices of Yes Bank and doubted the low NPA numbers it reported quarter after quarter.

For many-many years, people cast aspersions on lending practices of Yes Bank and doubted the low NPA numbers it reported quarter after quarter.