1/ The H1 2019 @ElectricCapital Developer Report is out!

@MariaShen compiled this with data infra built by @jubos and contributions from @puntium and @thuanlee.

We analyzed 22 million commits across 22k+ code repositories. Read it here: medium.com/@ElectricCapit…

Some tidbits 👇

@MariaShen compiled this with data infra built by @jubos and contributions from @puntium and @thuanlee.

We analyzed 22 million commits across 22k+ code repositories. Read it here: medium.com/@ElectricCapit…

Some tidbits 👇

2/ Why study developer ecosystems

Adoption and liquidity require wallets, infra, and apps/services. And engineers follow distribution + revenue, so winning platforms draw more devs. It is as important to understand developer ecosystems as users, miners, exchanges, and regulators

Adoption and liquidity require wallets, infra, and apps/services. And engineers follow distribution + revenue, so winning platforms draw more devs. It is as important to understand developer ecosystems as users, miners, exchanges, and regulators

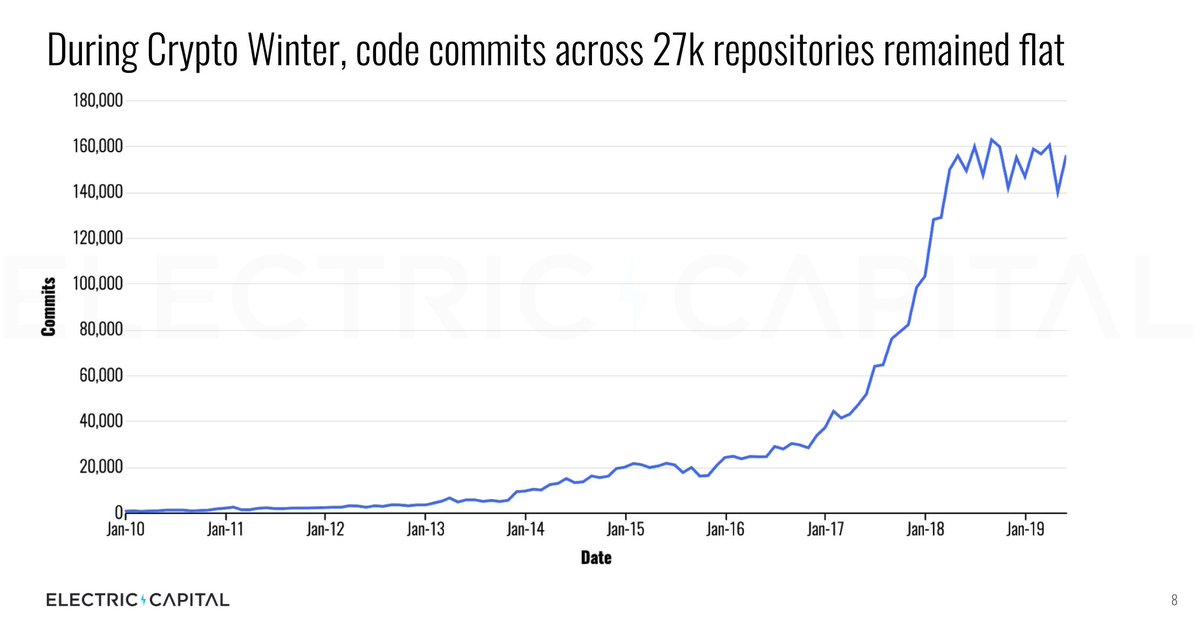

3/ We analyzed 22M commits and 27K repositories.

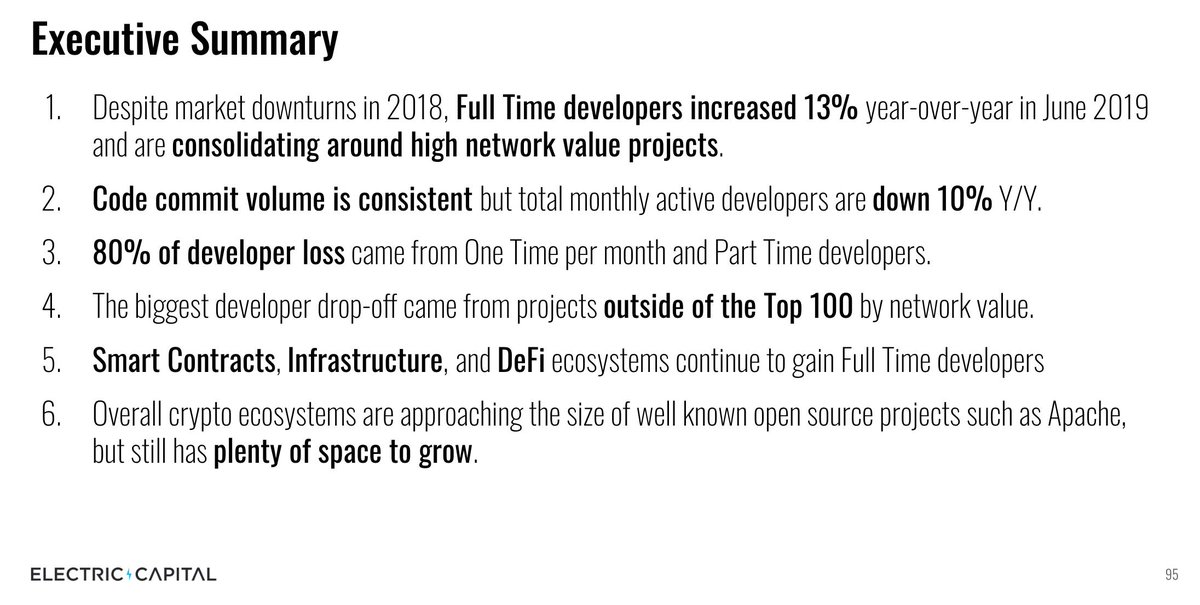

While network values fell 80%+ from all time highs, overall commit rates across all repositories remained flat.

While network values fell 80%+ from all time highs, overall commit rates across all repositories remained flat.

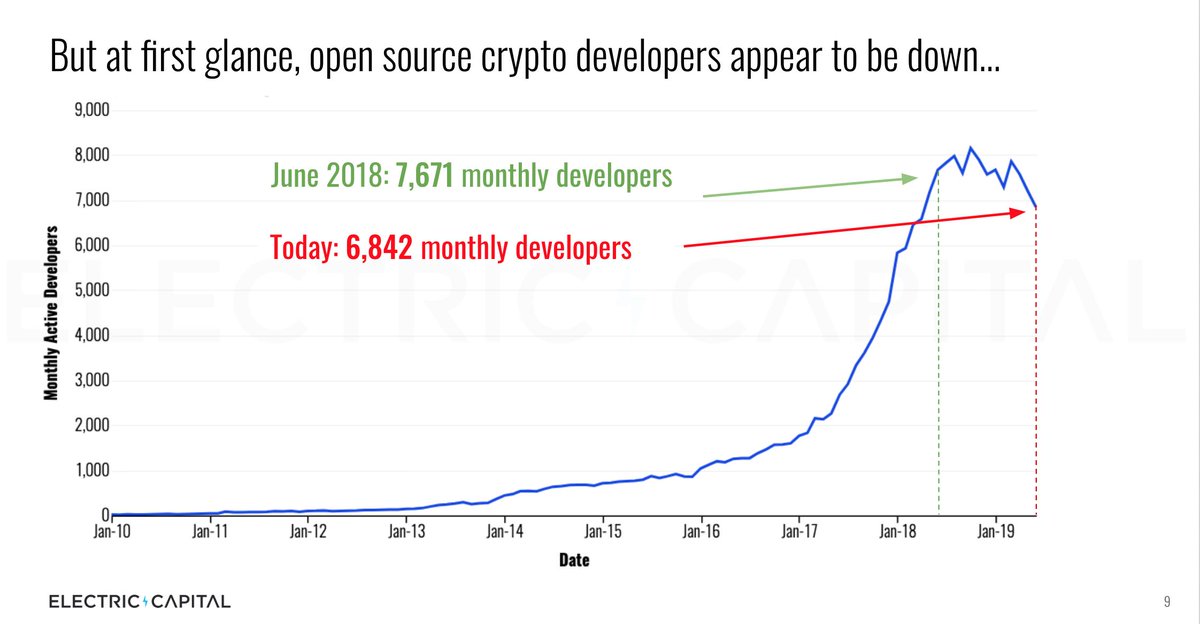

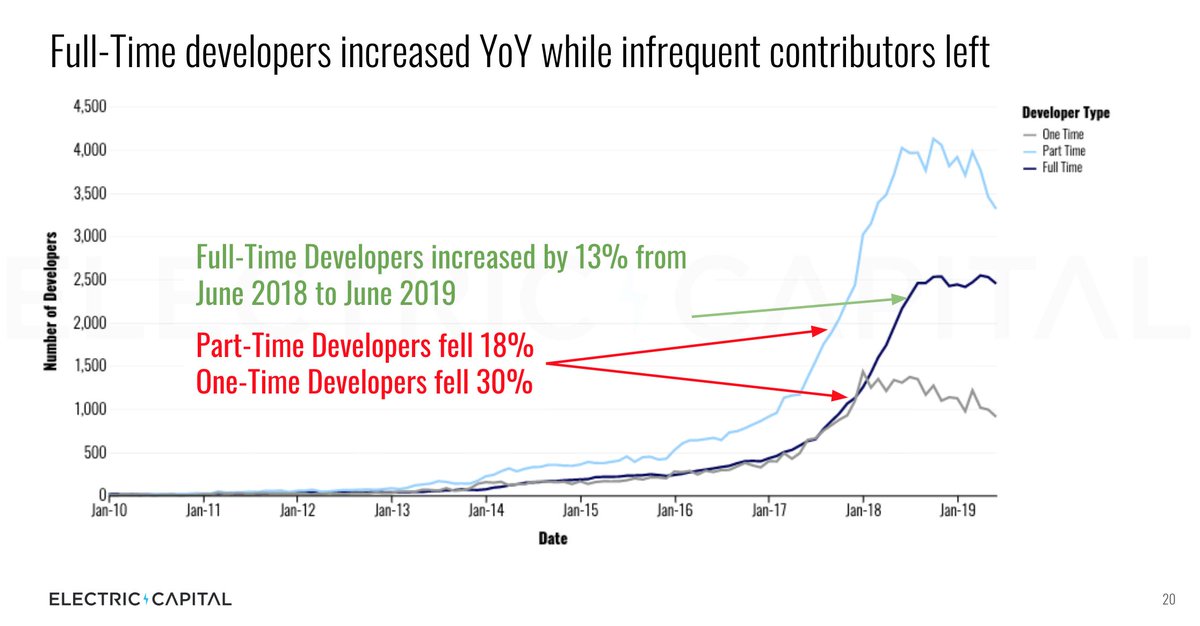

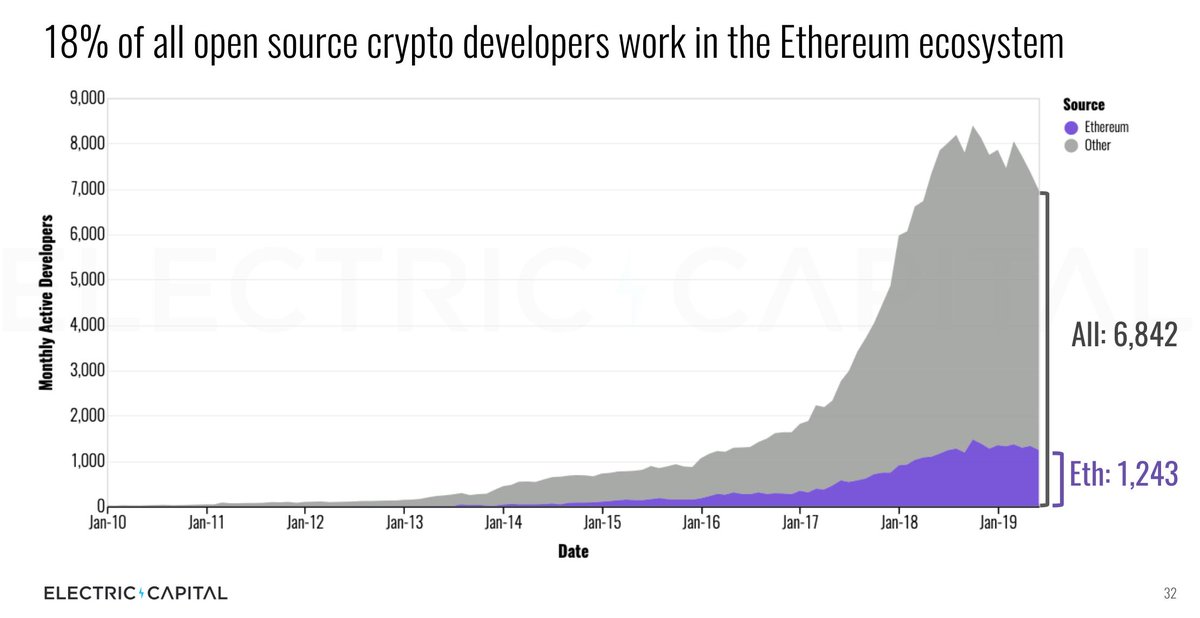

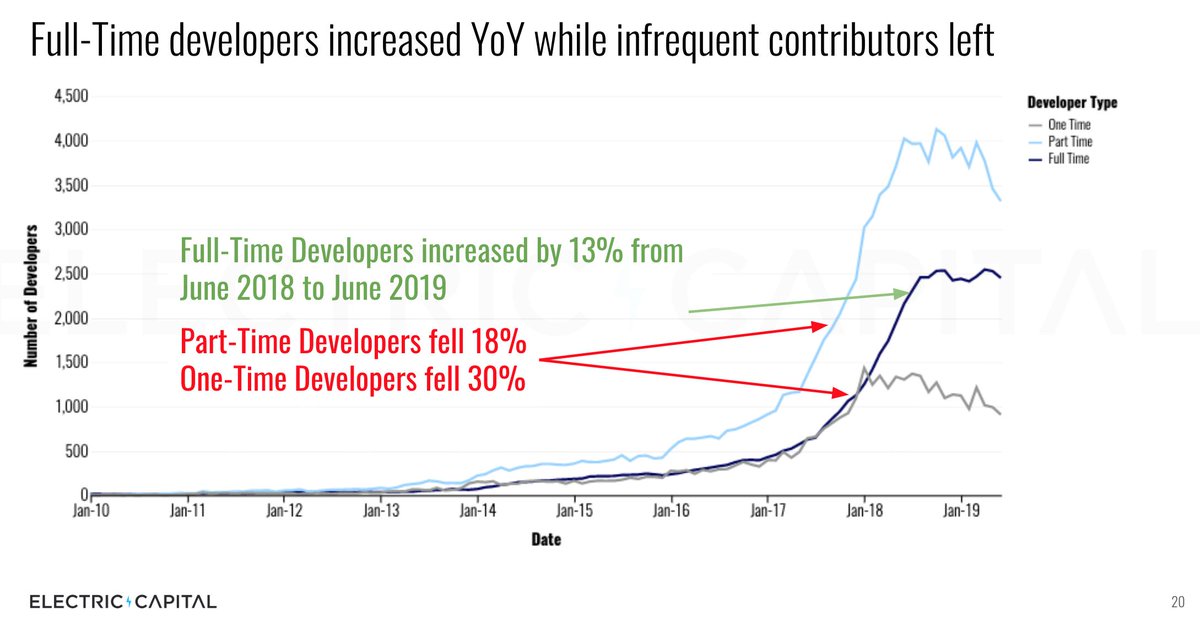

4/ But monthly active developers appears to be down year-over-year by 10% to 6,842. Why the discrepancy vs. a flat commit count?

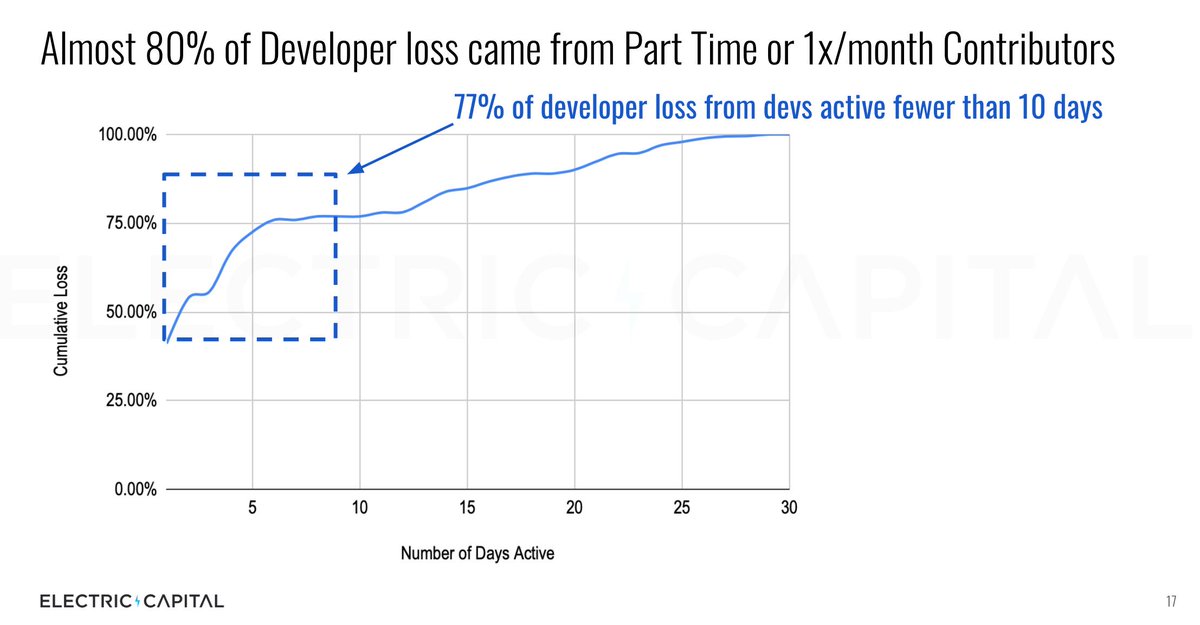

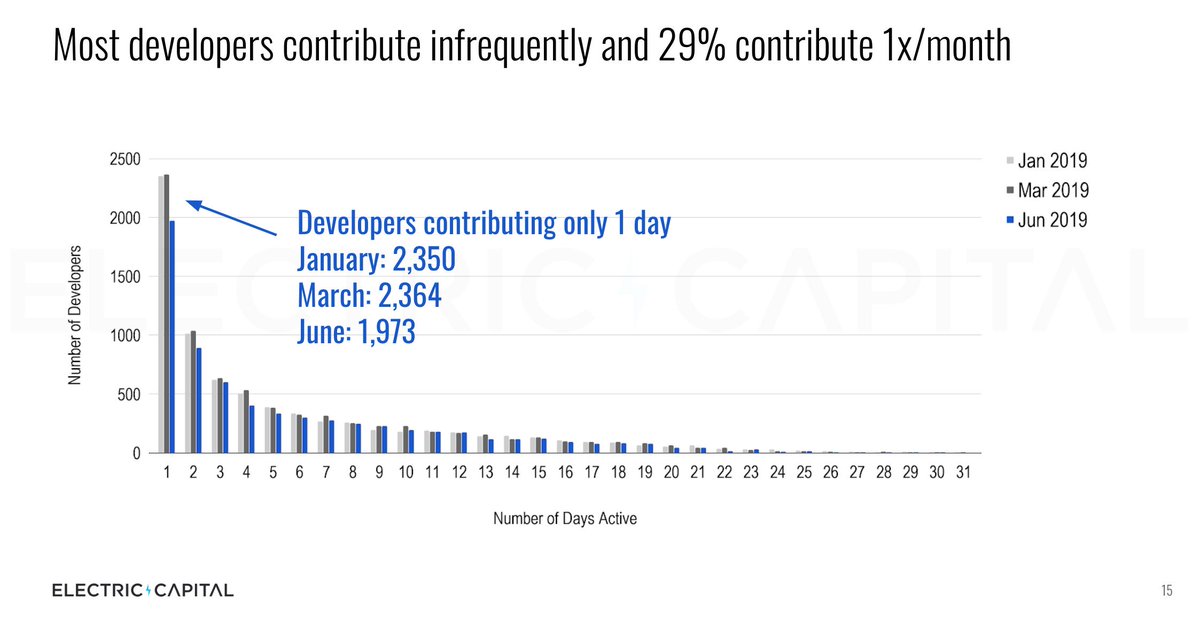

5/ Most of the fall is explained by looking at one-time per month and part-time developers (developers active less than 10 days a month)

7/ The number of full time developers stayed consistent through H1 2019. These developers do most of the code commits (10-30 days worth of commits/month). Which explains why commit counts are flat.

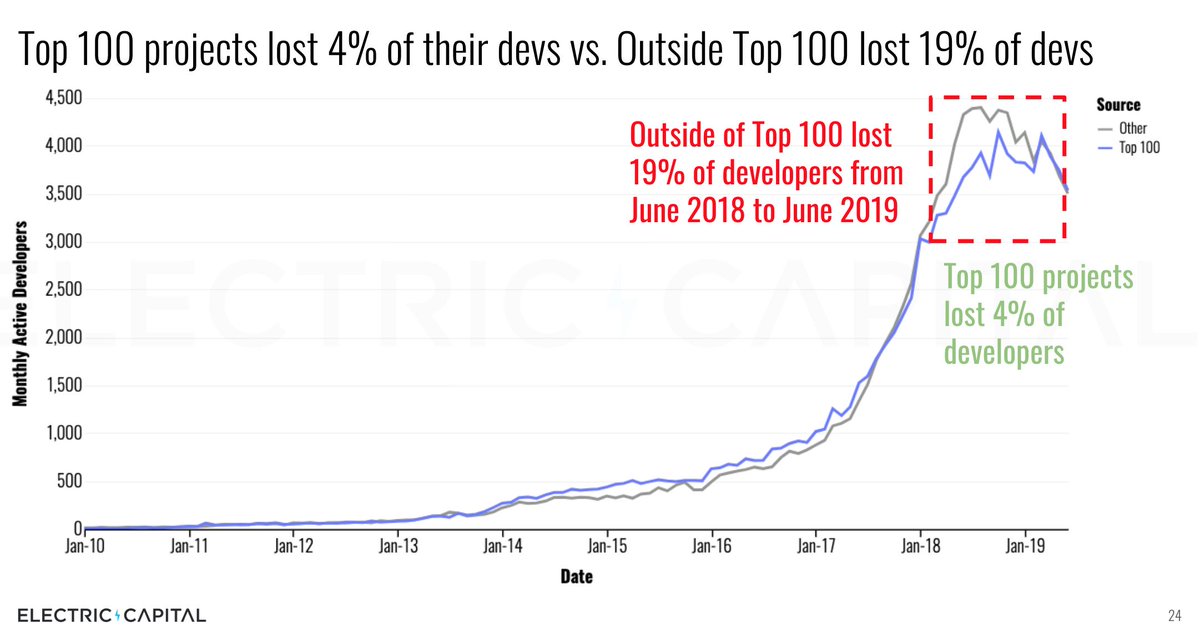

8/ Diving in -- Projects in the top 100 by network value lost 4% of their developers. Projects outside of top 100 lost 19% of their developers.

The top 100 projects are now ~50% of open source crypto developers for the first time since the ICO boom.

The top 100 projects are now ~50% of open source crypto developers for the first time since the ICO boom.

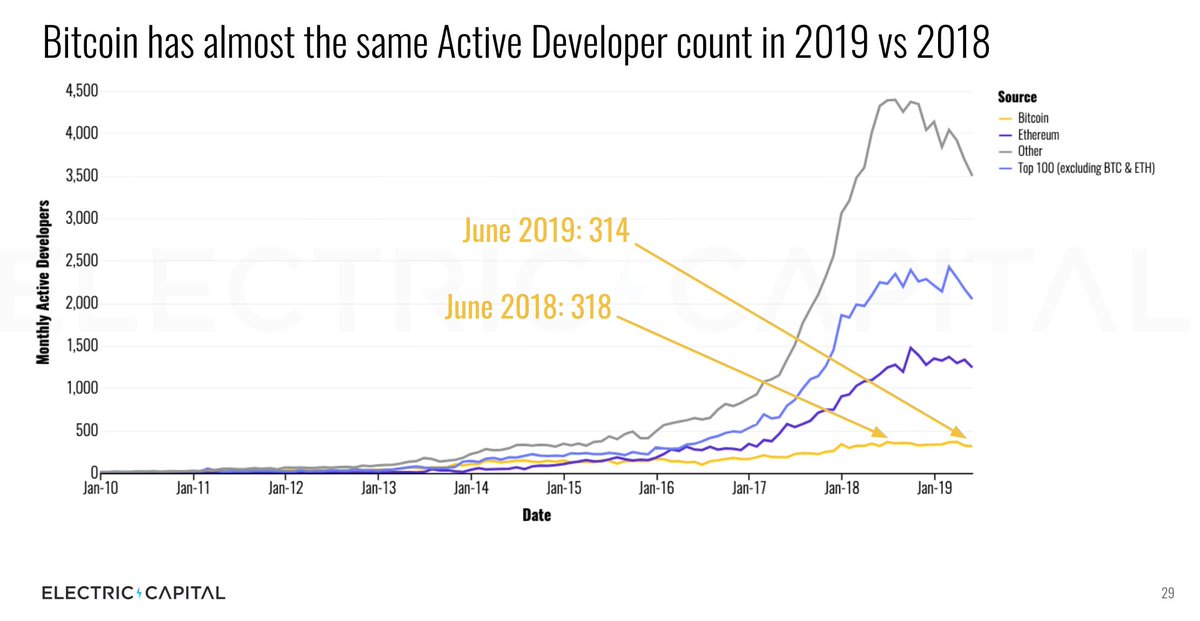

9/ Bitcoin and Ethereum continue to have healthy developer activity. Bitcoin has 300+ developers working in the ecosystem on open source projects.

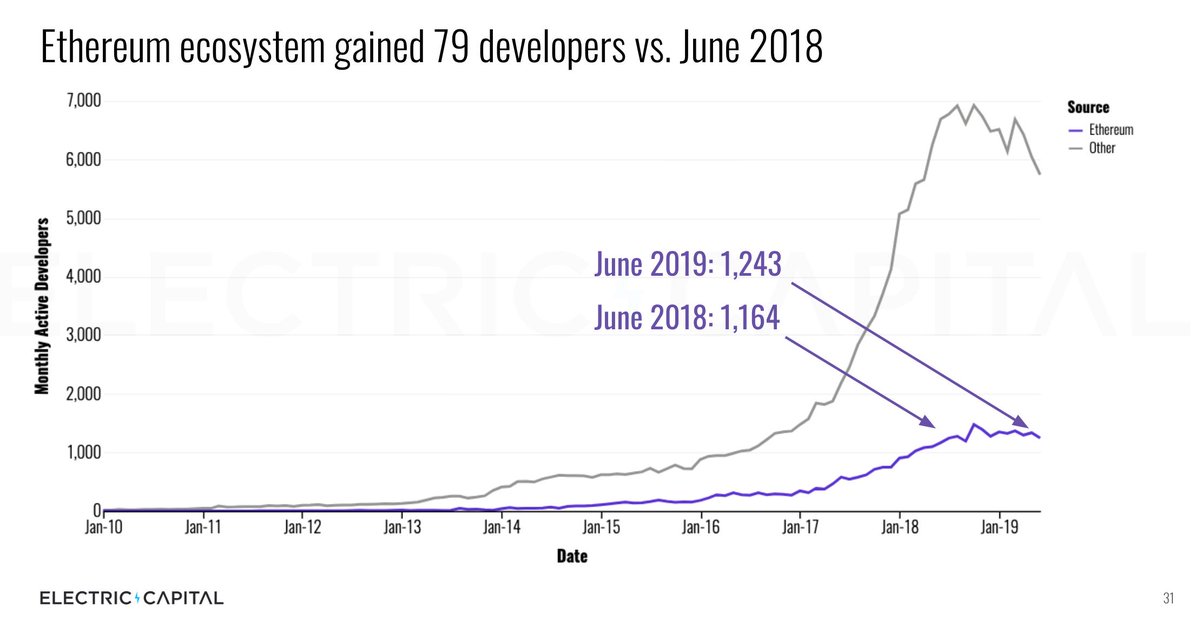

Ethereum now as 1200+ developers in its ecosystem. Remember ecosystem includes things like wallets, infra, etc.

Ethereum now as 1200+ developers in its ecosystem. Remember ecosystem includes things like wallets, infra, etc.

10/ @ethereum ecosystem has almost 1 in 5 of all open source developers in crypto working in its ecosystem right now.

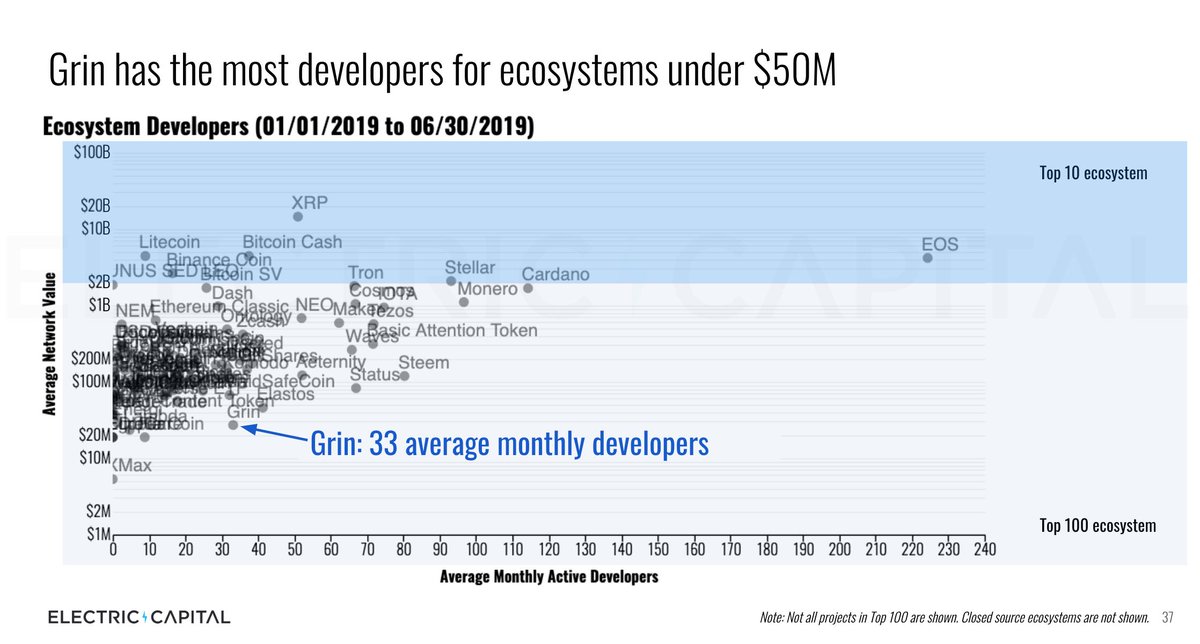

11/ On the far other end of network value...

For projects with less than $50M network value, @grinMW's ecosystem stands out with 33 contributing developers.

Remember ecosystem includes things like wallets, infra, etc.

For projects with less than $50M network value, @grinMW's ecosystem stands out with 33 contributing developers.

Remember ecosystem includes things like wallets, infra, etc.

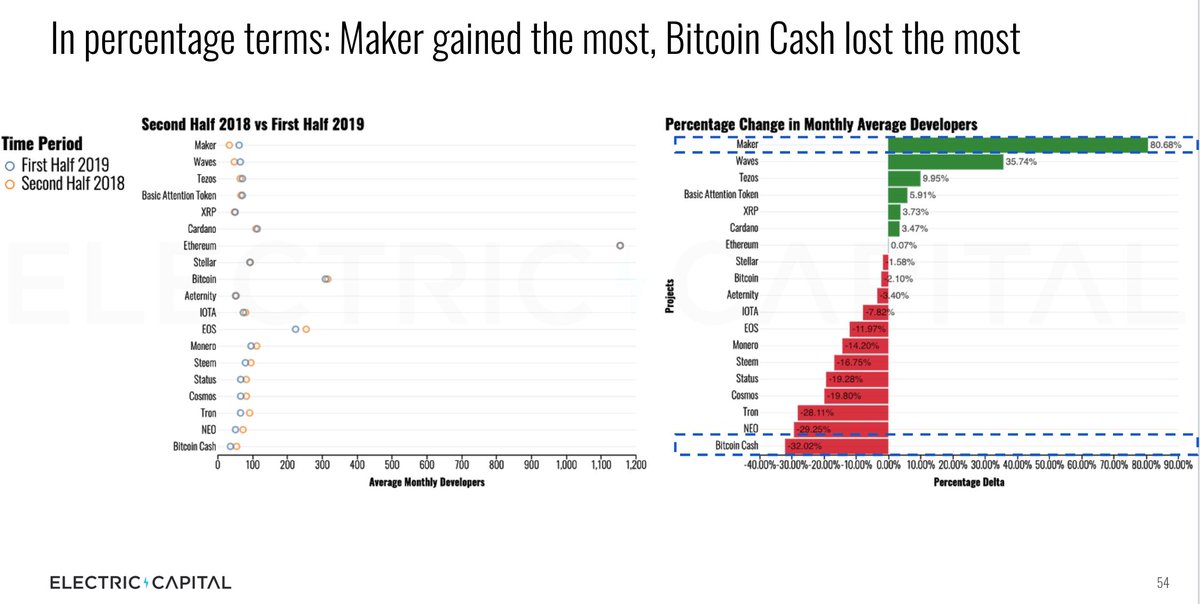

12/ Looking at 12 month trends.

@MakerDao gained the most w/ @wavesplatform, @tezos, @AttentionToken, #XRP, @Cardano also growing.

@BCH, @neo_blockchain, and @Tronfoundation are losing the most.

@MakerDao gained the most w/ @wavesplatform, @tezos, @AttentionToken, #XRP, @Cardano also growing.

@BCH, @neo_blockchain, and @Tronfoundation are losing the most.

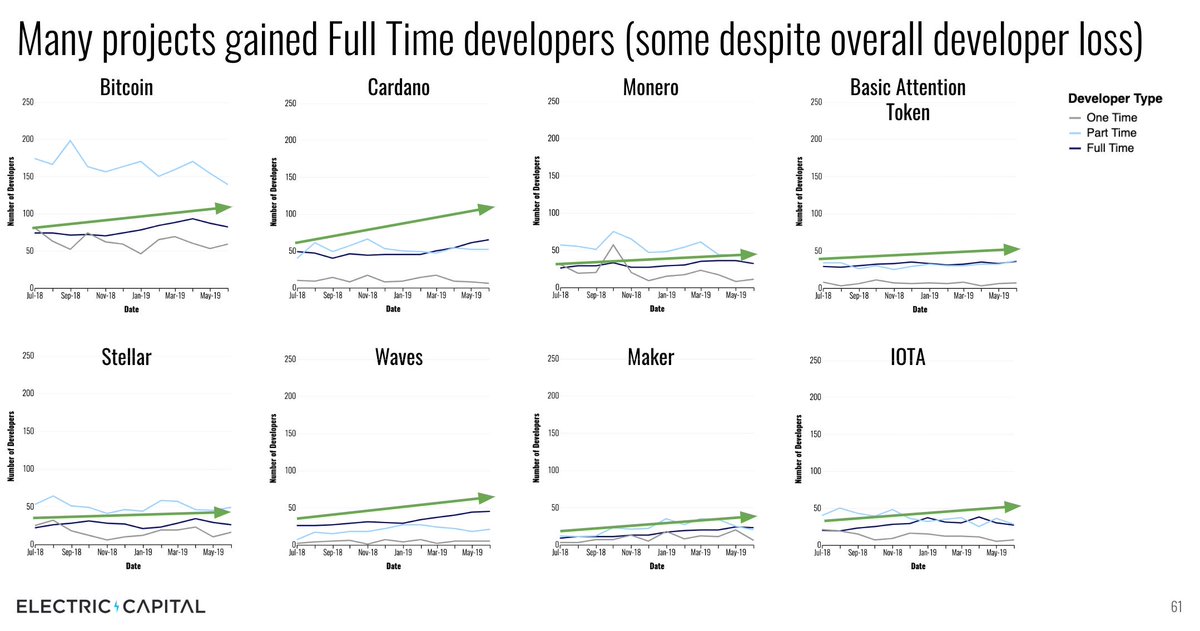

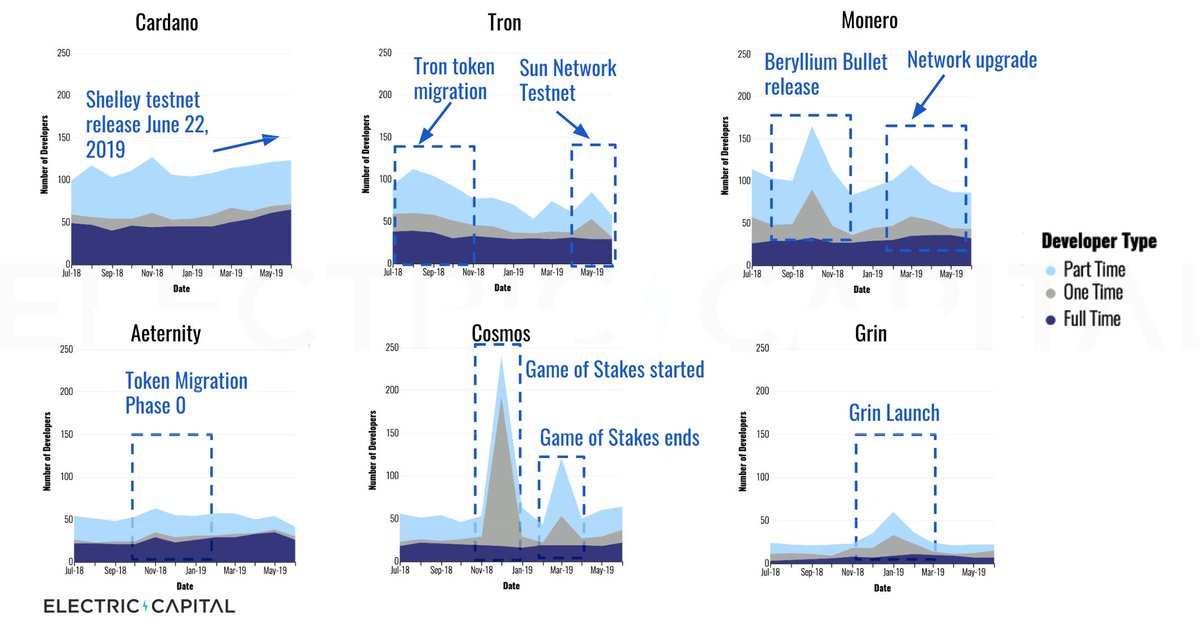

13/ We also broke down many top ecosystems in to 1x/month, part time, and full time developers.

We also see the effect on developer engagement with well executed launches such as @cosmos Game of Stakes and the @monero community's beryllium bullet release.

We also see the effect on developer engagement with well executed launches such as @cosmos Game of Stakes and the @monero community's beryllium bullet release.

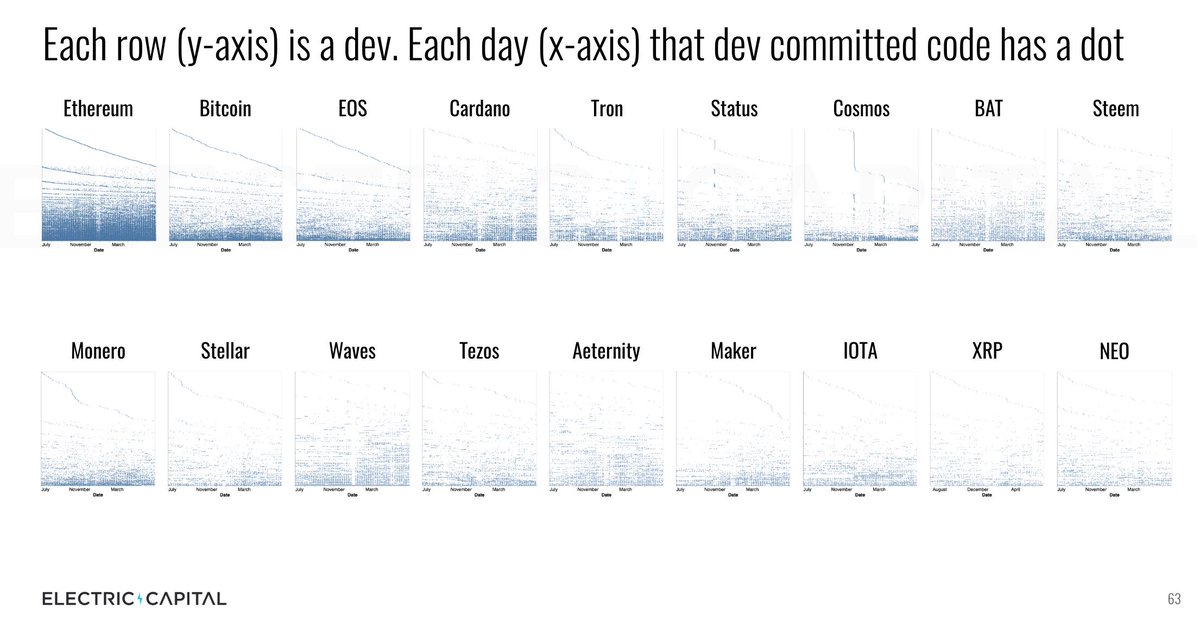

14/ We visualized individual developer commits to spot (pun intended) patterns. Each row is a developer. We place a dot in a row on a day that developer committed code. We sort top to bottom based on frequency. So one time devs are at the top. More frequent devs are at the bottom

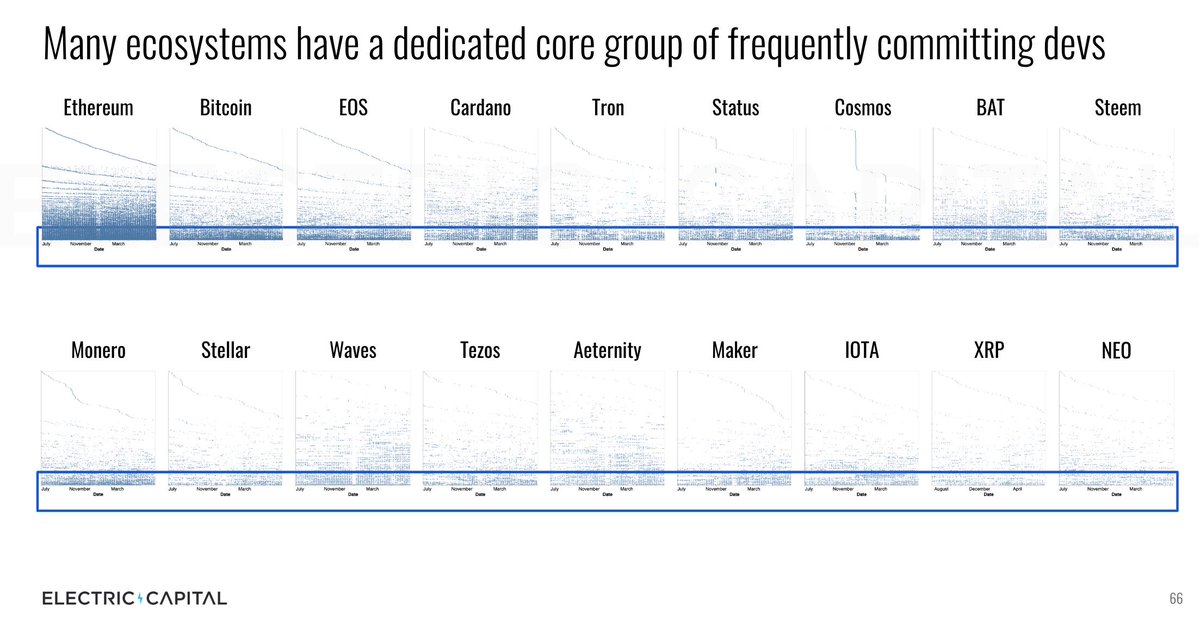

15/ Many ecosystems have long term, full time, committed developers -- a row with lots of dots all the way across indicates a developer who has done many commits in the last year.

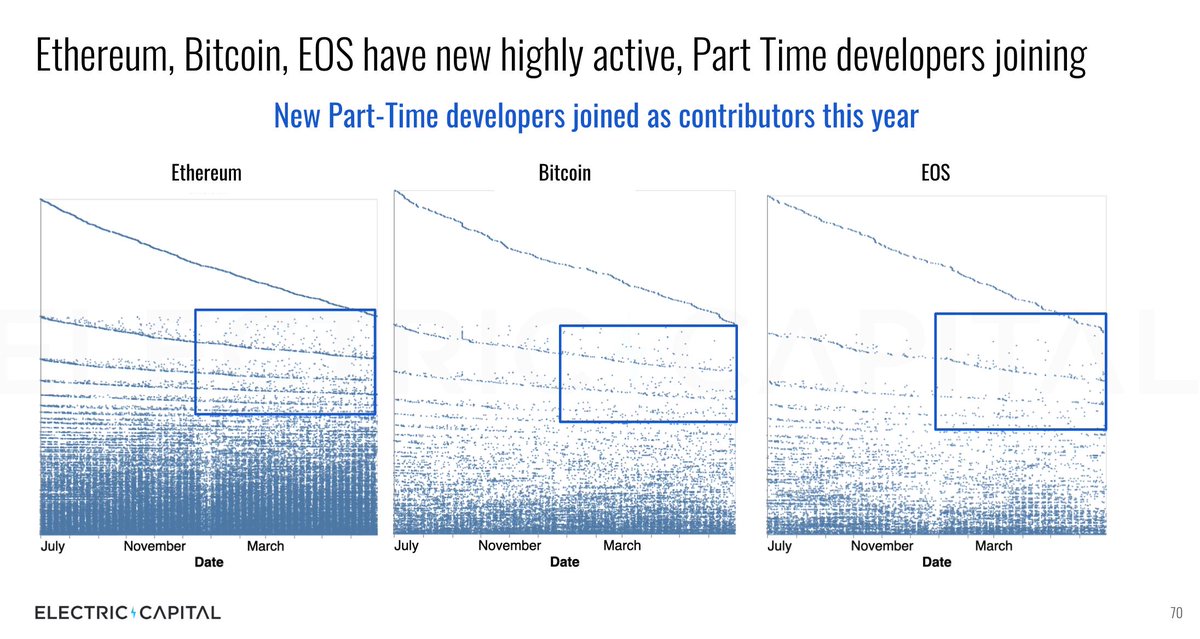

16/ Some projects also have a growing community of part time contributors e.g. @block_one_’s #EOSIO - The emergence of dots on the right indicates new commits this year. Whitespace on the left indicates those devs were not previously active.

17/ Unsurprisingly, developers like to follow momentum, users, and making money. DeFi is growing full time developers and devs are investing more infrastructure projects - perhaps things that businesses and other devs may pay for?

18/ Zooming back out: Remember, developers committing code 10+ days/month are as committed as ever (another pun!)

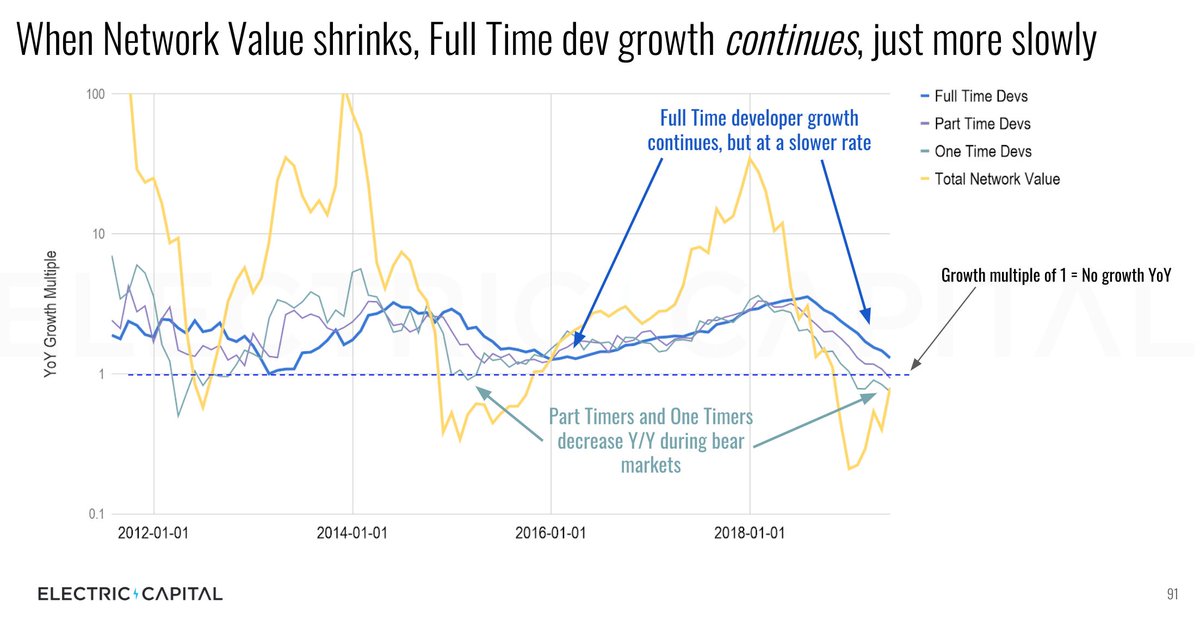

19/ The rate of change of Full Time developer growth (the second derivative) year-over-year does not go below 1. Even in a bear market, Full Time developers come in less quickly but they continue to come.

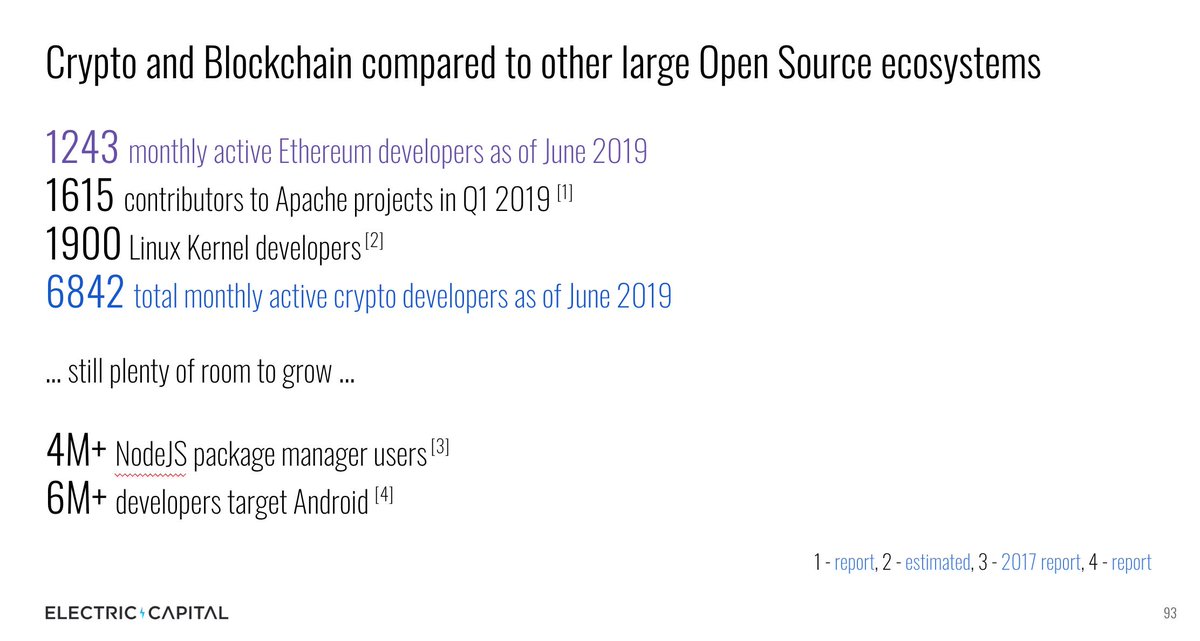

20/ The largest crypto ecosystems are starting become meaningful - obviously it is not 100% apples to apples but interesting to consider scale vs. Apache Foundation @TheASF or @linuxfoundation

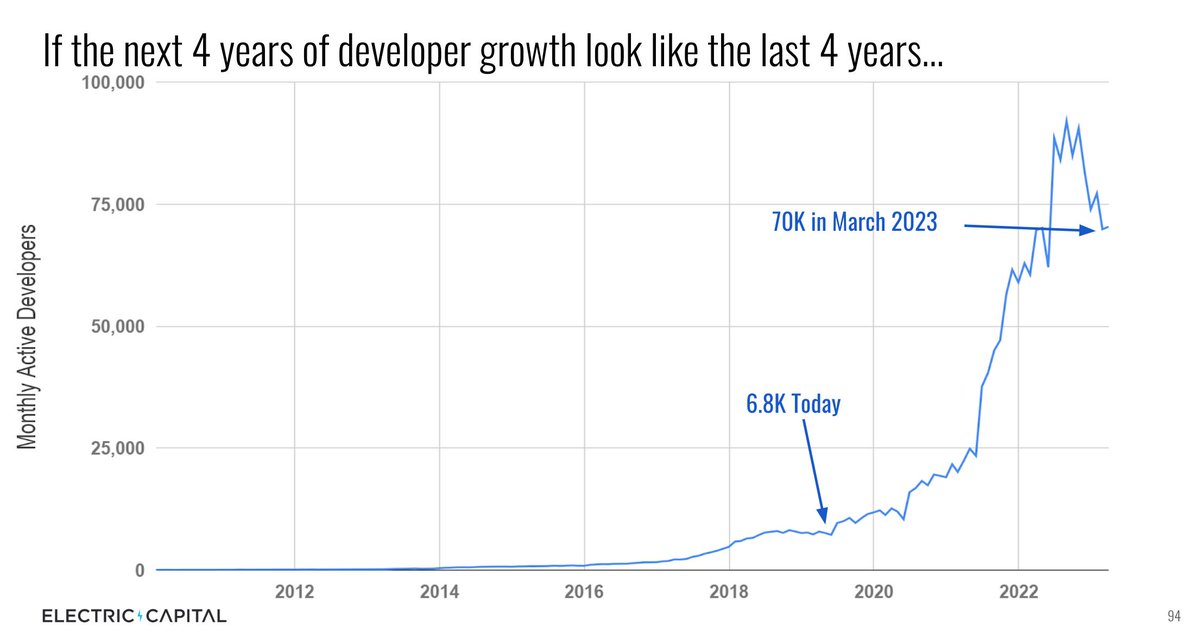

21/ One simple projection: If the next 4 years are like the last 4, we end up with 70k active developers on only open source projects. This does not count people working in financial institutions, exchanges, law firms, or critical non-engineering roles at these organizations.

22/ Summing it up: Full Time devs are sticking around. Total developer count dropped YoY, but mostly because infrequent contributors left. Underneath the boom and bust trends, the ecosystem is getting stronger.

23/ Take all of this as one facet of health in the ecosystem. No metric is perfect but data can be useful if used holistically.

Again you can read the full report here: medium.com/@ElectricCapit…

Again you can read the full report here: medium.com/@ElectricCapit…

24/ Thank you @daranda,@robbiebent1, @CremeDeLaCrypto, @alexbosworth, @eosriobrazil, @jillruthcarlson, @delitzer, @moneyball, @notscottmoore, @kincaidoneil, @kevinowocki, @StellarOrg, @marcantoineross, @fluffypony, @starkness, @yinyinwu, @ljxie for feedback and sending repos!

25/ This work requires mapping many thousands of project repositories. Please contribute any projects you know about so we can continue to improve our report.

The ecosystem mappings are available on Github: github.com/electric-capit…

The ecosystem mappings are available on Github: github.com/electric-capit…

• • •

Missing some Tweet in this thread? You can try to

force a refresh