Co-Founder @ElectricCapital

Chairman @crypto_council

Views are my own; DYOR

6 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/elonmusk/status/19259755077592437412/ The macro lens: Western govts carry $36 Trillion in US federal debt and face aging populations (or $175 Trillion if you follow @balajis math -- )

2/ Software engineers were top of the world from 2000-2020

2/ Software engineers were top of the world from 2000-2020

2/ How Blake started Boom is one of the most inspiring founder journeys I know.

2/ How Blake started Boom is one of the most inspiring founder journeys I know.

Where is on chain innovation happening? Who writes the most new, unique code? From @0xren_cf

Where is on chain innovation happening? Who writes the most new, unique code? From @0xren_cf https://x.com/0xren_cf/status/1867607959712195014

2/ What is FIT21?

2/ What is FIT21?

2/ SEC Accounting Bulletin 121 was released in 2022.

2/ SEC Accounting Bulletin 121 was released in 2022.

https://twitter.com/MariaShen/status/16393276295171604482/ In the @ElectricCapital portfolio alone, founders of companies/protocols worth $5B+ have left the US and given up permanent residency.

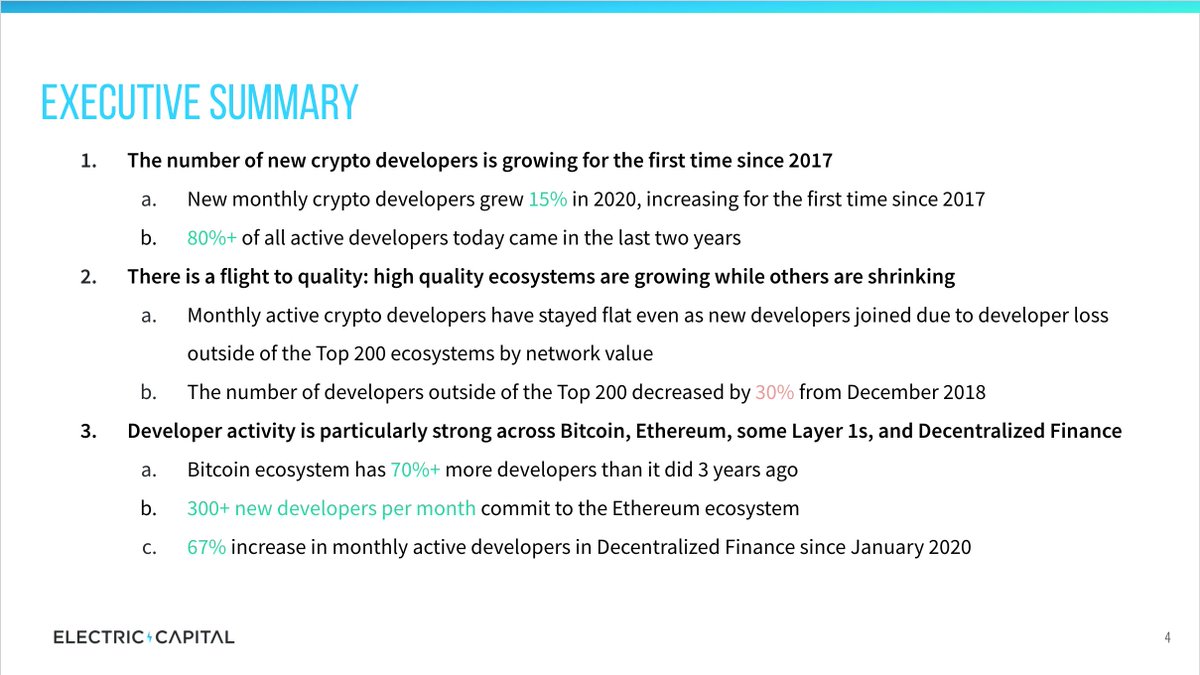

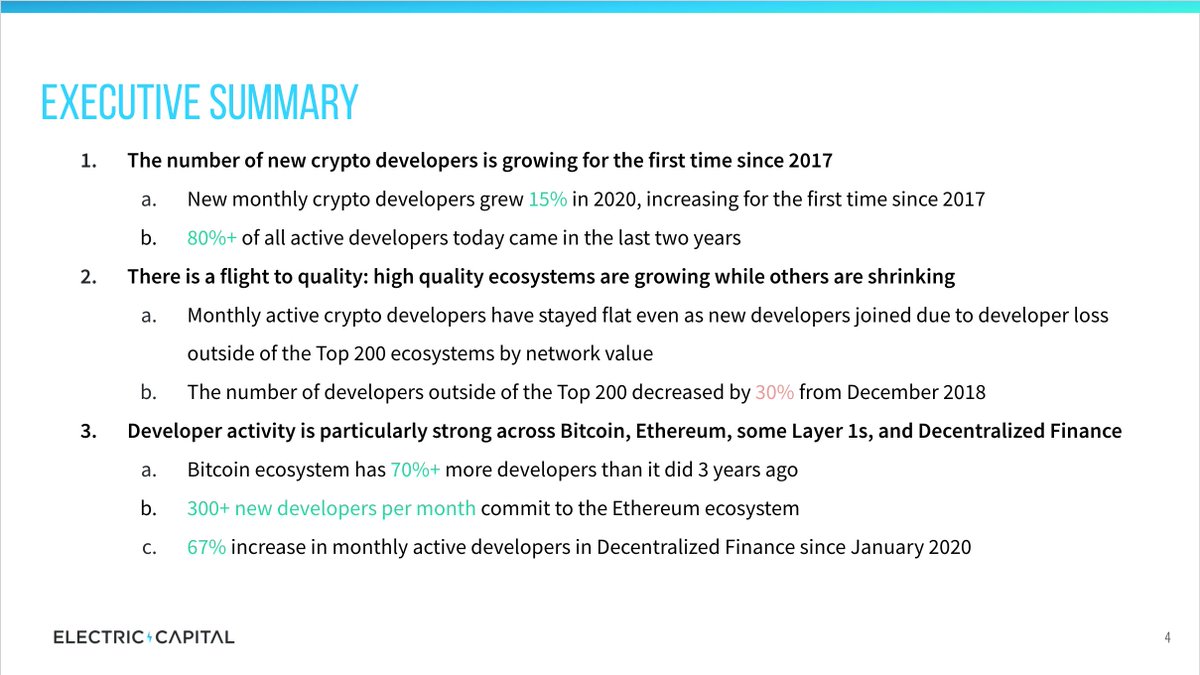

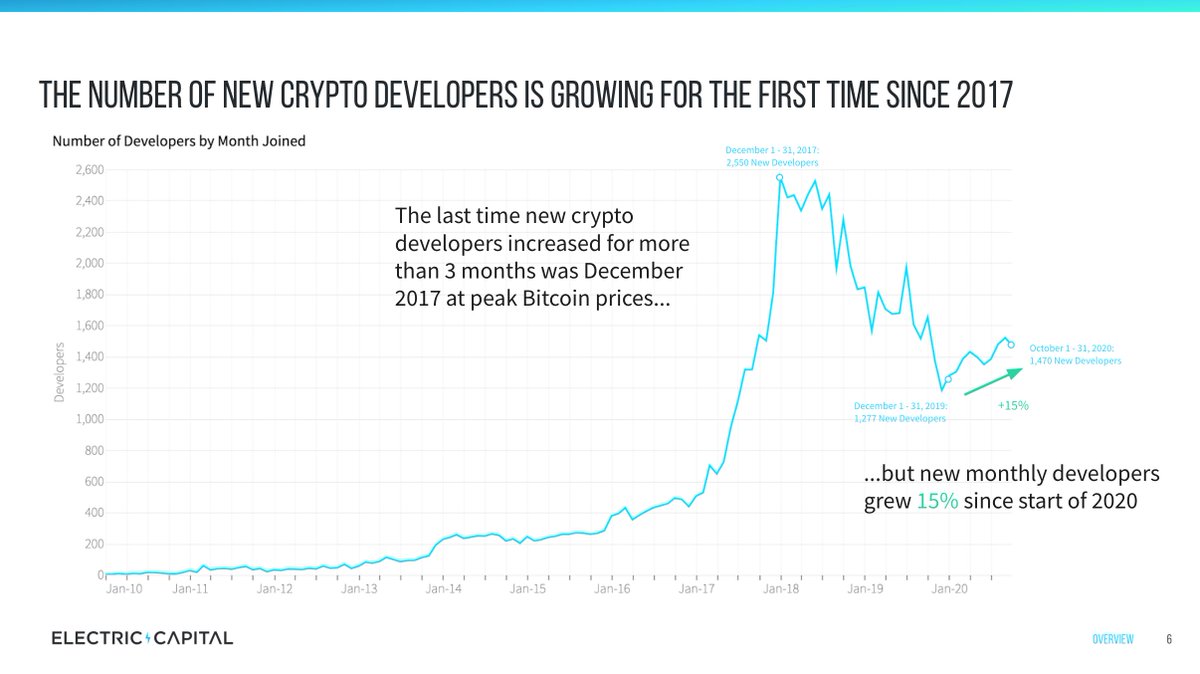

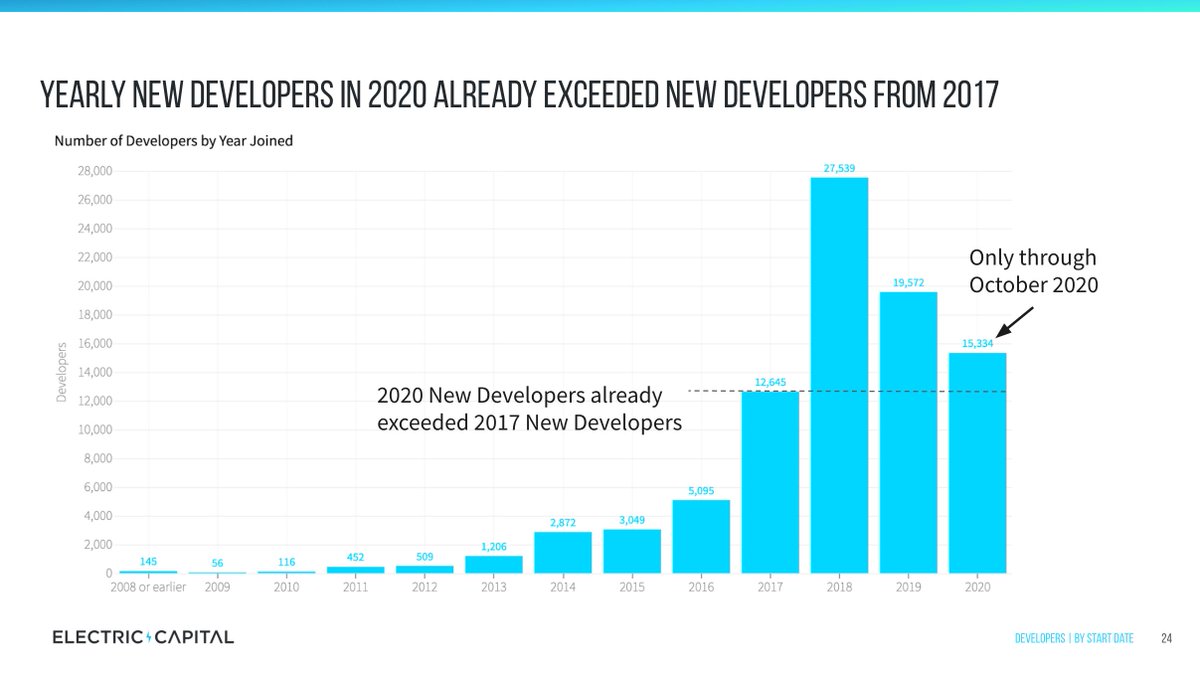

2/ There are 1500 new developers coming in to crypto every month!

2/ There are 1500 new developers coming in to crypto every month!

2/ Food service, retail, and hospitality employs 26.5M people. That is almost 1 out of every 5 jobs!

2/ Food service, retail, and hospitality employs 26.5M people. That is almost 1 out of every 5 jobs!