A lot of the elites are going out to bat for NIRP. Be vigilant & do not let them normalise negative interest rates in the US. If you don’t like inequality where it is today after a decade of ZIRP, think about what happens when NIRP comes to reduce costs of risks entirely.

https://twitter.com/jennablan/status/1161353139607523330

NIRP is not normal & do not let anyone normalise it. Ever.

We all will pay for it. No such thing as a free lunch. We will enter something in which there is NO EXIT, well, let’s just say that no one has exited, yet, & don’t know how to exit as NIRP is a doom loop. Yep.

We all will pay for it. No such thing as a free lunch. We will enter something in which there is NO EXIT, well, let’s just say that no one has exited, yet, & don’t know how to exit as NIRP is a doom loop. Yep.

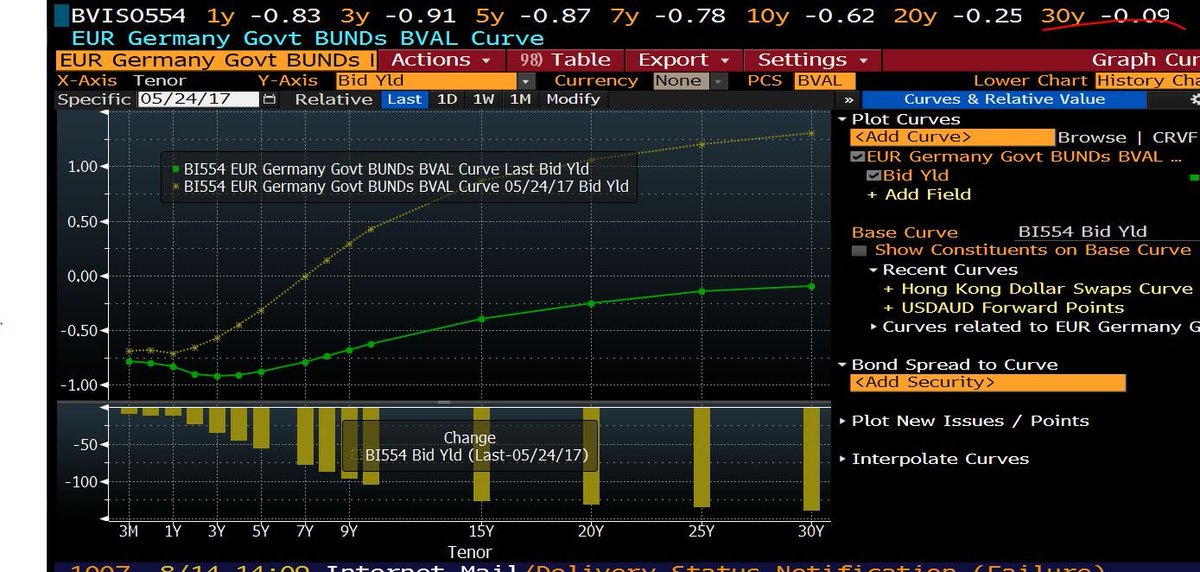

Something else. Look for negative interest rates & their consequences beyond the entire bund yield curve going below zero OP EDS. Do you see them in the FT & key financial journals? No. Do you know why?

George Orwell wrote: the REAL news is what is NOT on the news 👌🏻

George Orwell wrote: the REAL news is what is NOT on the news 👌🏻

Will continue this thread when I have more band-width. Will do something similar to my trade-war one pinned above.

This. Does it say anything about ordinary people. The economy? No.

The abstract says: HOW TO ENABLE NIRP.

What is NIRP for: MAINTAINING THE POWER OF MONETARY POLICY to end recessions.

Really. It says that. To maintain the power of monetary policy 👌🏻

imf.org/en/Publication…

The abstract says: HOW TO ENABLE NIRP.

What is NIRP for: MAINTAINING THE POWER OF MONETARY POLICY to end recessions.

Really. It says that. To maintain the power of monetary policy 👌🏻

imf.org/en/Publication…

That phrase that the zero bound is not the law of nature by the IMF & repeated by some on twitter. Do u know what is the law of nature when mankind doesn't have rules?

Allow me to quote Hobbes on life before the social contract: Life is solitary, poor, nasty, brutish and short👌🏻

Allow me to quote Hobbes on life before the social contract: Life is solitary, poor, nasty, brutish and short👌🏻

The LAW OF NATURE is NO WAY TO CONDUCT MONETARY POLICY and definitely NO WAY TO WRITE A GUIDE ON HOW TO CONDUCT MONETARY POLICY.

This is not sufficient logic. Thread will continue later. Got Asian economics to deal w/ 1st.

This is not sufficient logic. Thread will continue later. Got Asian economics to deal w/ 1st.

Before I go, he summarized his thesis in this sentence for the 89 pages of how to ENABLE NIRP (I didn't say it, author did). Read this: to MAINTAIN THE POWER of monetary policy in the future to end recessions w/in a SHORT time.

ECB started NIRP in 2014. We're 2019. Define SHORT.

ECB started NIRP in 2014. We're 2019. Define SHORT.

Here is food for thought, since NIRP in 2014, the German economy now shrank -0.1% in Q2 2019. Read that thesis again: To MAINTAIN THE POWER of monetary policy in the future to end recessions w/in a SHORT time.

Winter is here & they have burned all the wood 👌🏻👌🏻👌🏻.

Winter is here & they have burned all the wood 👌🏻👌🏻👌🏻.

A technical recession is 2 consecutive quarters of contraction so let's see if Q3 is better. But let's ask a basic question for those pro NIRPers:

The ECB has been lowering the deposit rate since that fateful June 2014 from -0.1% to now -0.4% & bund deep below zero. So where to?

The ECB has been lowering the deposit rate since that fateful June 2014 from -0.1% to now -0.4% & bund deep below zero. So where to?

• • •

Missing some Tweet in this thread? You can try to

force a refresh