India is meant to be the world's fastest-growing coal market.

But investment fell 90% last year, to the point that only one (state-backed) generator got new loans.

This is the beginning of the end in coal's last redoubt (thread):

bloomberg.com/amp/opinion/ar…

But investment fell 90% last year, to the point that only one (state-backed) generator got new loans.

This is the beginning of the end in coal's last redoubt (thread):

bloomberg.com/amp/opinion/ar…

Coal generation is already in terminal decline in the U.S. and Europe.

The market is disappearing, according to the CEO of Colombia's Cerrejón, probably the best coal mine supplying countries bordering the Atlantic: bloomberg.com/news/articles/…

And in China we're around the peak.

The market is disappearing, according to the CEO of Colombia's Cerrejón, probably the best coal mine supplying countries bordering the Atlantic: bloomberg.com/news/articles/…

And in China we're around the peak.

India is thought to be different. @IEA reckons is grows by 3.9% a year to 2023. @BloombergNEF, which tends to be more skeptical about fossil fuels demand, sees coal-fired generation rising by ~50% by 2030:

Indian coal demand (and Bangladeshi, too) is the ultimate justification for the white-elephant Carmichael coal mine being developed by Adani: nytimes.com/2019/08/15/cli…

The weird thing is, the people who know the Indian power market best aren't seeing it. Investment is collapsing. Swathes of the sector are bankrupt. Without state subsidies and state bank lending, there would be nothing.

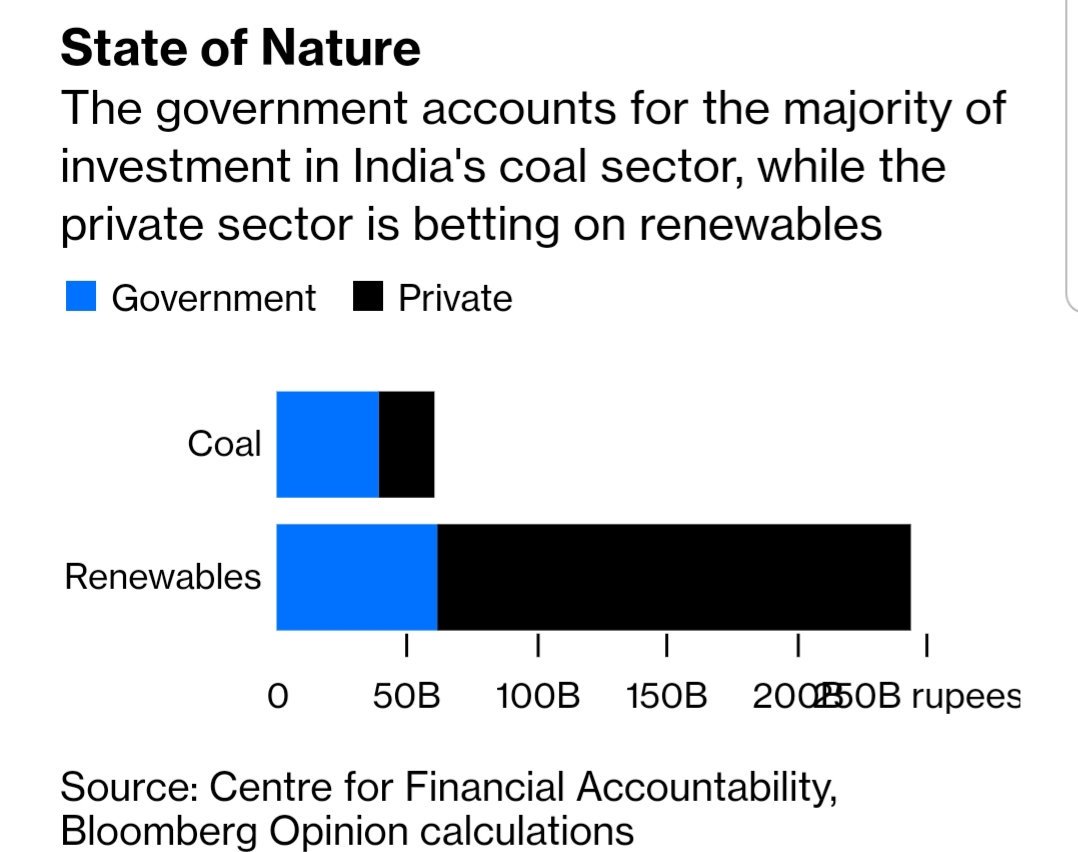

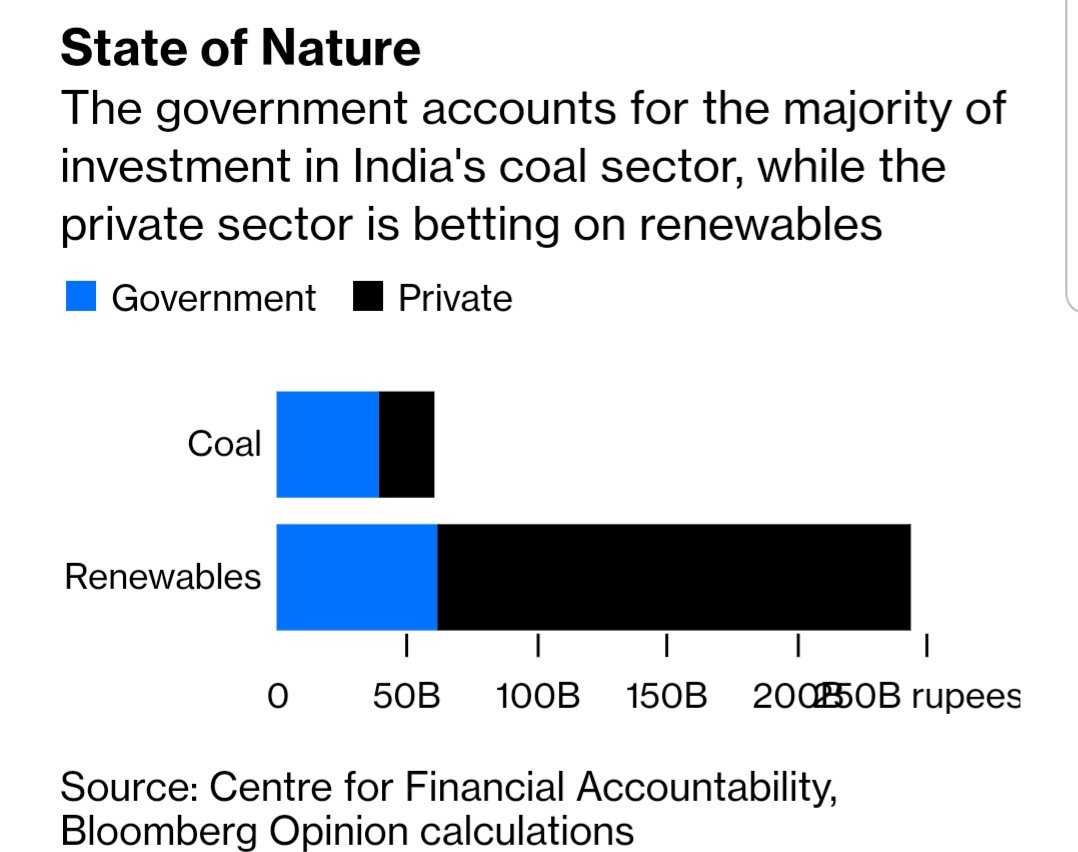

Interesting @cfa_ind report today puts numbers on it: 2/3 of lending to coal projects is from state banks, but 3/4 of the much larger sum of lending to renewables is private sector.

Even then, and with subsidies for coal still outstripping those for renewables, the government's electricity plan sees more coal generation retired than built in the decade to 2027:

My view is that Indian coal demand is at or very close to its peak.

You can build *new* wind and solar for waaay less than buying *existing* coal-fired power, ~$42/MWh and $37/MWh vs @ntpclimited average tariff of @51/MWh. (new generation should normally cost *more*)

You can build *new* wind and solar for waaay less than buying *existing* coal-fired power, ~$42/MWh and $37/MWh vs @ntpclimited average tariff of @51/MWh. (new generation should normally cost *more*)

This view is well outside the mainstream, though. Assumption is that government bailouts for coal, renewables deployment falling short, and problems of integrating variable generation will ensure coal gets majority of demand growth.

But looking at the investment landscape, and indeed the government's economic planning, I find the idea that coal power is on the brink of a renaissance in India just implausible. If the prospects are so good, why are investors rushing the exits?

That's probably bad news if you own coal-fired power in India but good news if you breathe the air there, or live on this planet. Read the whole article here:

bloomberg.com/opinion/articl…

(Ends) #oott

bloomberg.com/opinion/articl…

(Ends) #oott

• • •

Missing some Tweet in this thread? You can try to

force a refresh