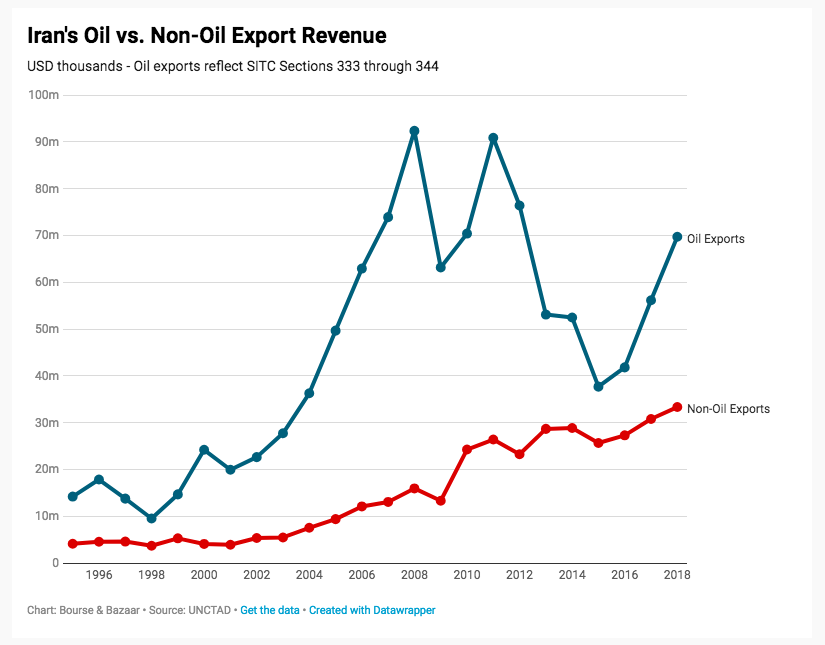

2019 will probably be the first year in #Iran's modern history where non-oil export revenue will exceed that of oil exports, reaching >$40bn.

Iran's non-oil exports have doubled in the last 10 years under sanctions. This is the future of Iran's economy.

datawrapper.de/_/a36Es/

Iran's non-oil exports have doubled in the last 10 years under sanctions. This is the future of Iran's economy.

datawrapper.de/_/a36Es/

For comparison, total exports in 1995:

Pakistan: $8bn

Egypt: $3bn

Iran: $4bn

In 2018, total exports were:

Pakistan: $23bn

Egypt: $29bn

Iran: $33bn

Iran arguably faced greater geopolitical headwinds, but it's non-oil exports now exceed total exports for both Egypt/Pakistan.

Pakistan: $8bn

Egypt: $3bn

Iran: $4bn

In 2018, total exports were:

Pakistan: $23bn

Egypt: $29bn

Iran: $33bn

Iran arguably faced greater geopolitical headwinds, but it's non-oil exports now exceed total exports for both Egypt/Pakistan.

State policy is prioritizing non-oil growth. Iranian companies are learning how to be exporters. The rial is cheaper and so are Iranian goods. Iraq and Afghanistan are more stable. Transport links emerging to Far East and Central Asia. There's a case for optimism here.

The narrative is that Iran is a total economic basketcase, but Egypt and Pakistan are sitting there having had years of US aid, no sanctions, support from the IMF and have let their total exports fall below Iran’s non-oil exports.

Iran is well behind the likes of Russia, Turkey, Thailand, and Vietnam in terms of non-oil exports. But the reorientation of the economy away from oil is something not many energy-rich countries have managed.

Basically, Iran’s economy is a mess, but not a lost cause.

Basically, Iran’s economy is a mess, but not a lost cause.

• • •

Missing some Tweet in this thread? You can try to

force a refresh