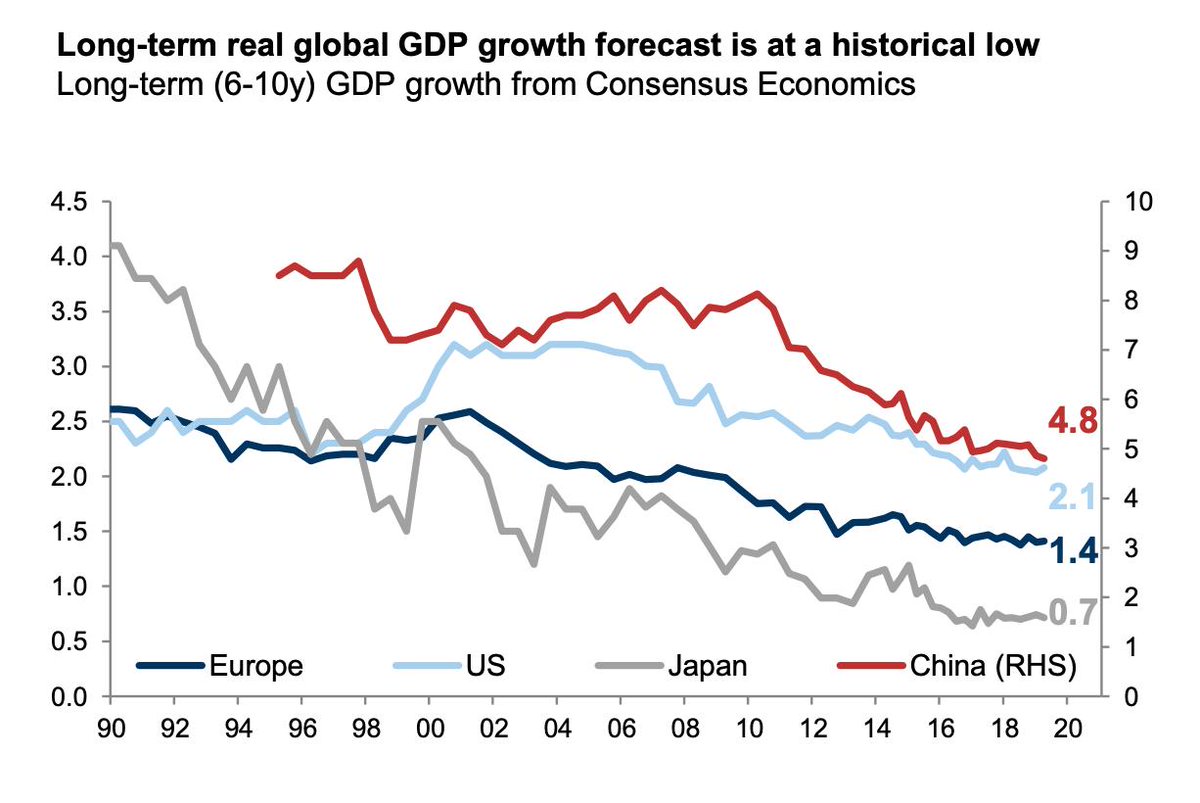

Going to tweet out a lot of interesting charts from Goldman Sachs on "a most unusual cycle". First up, as is widely known, this has been an unusually weak economic recovery.

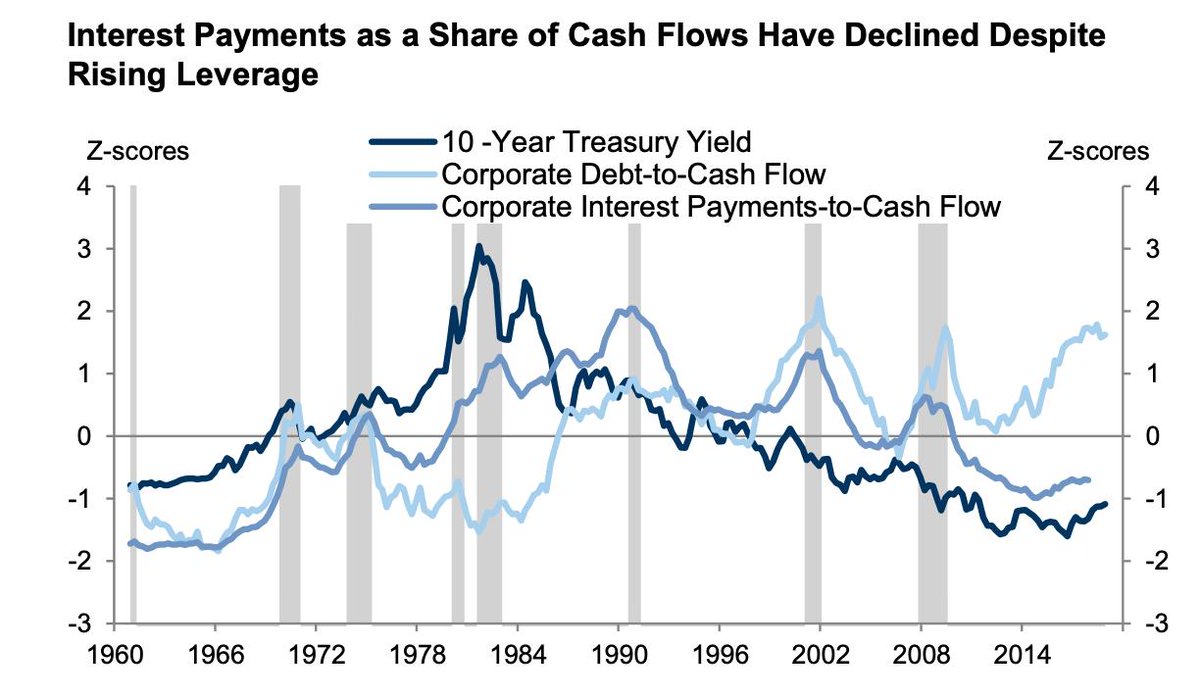

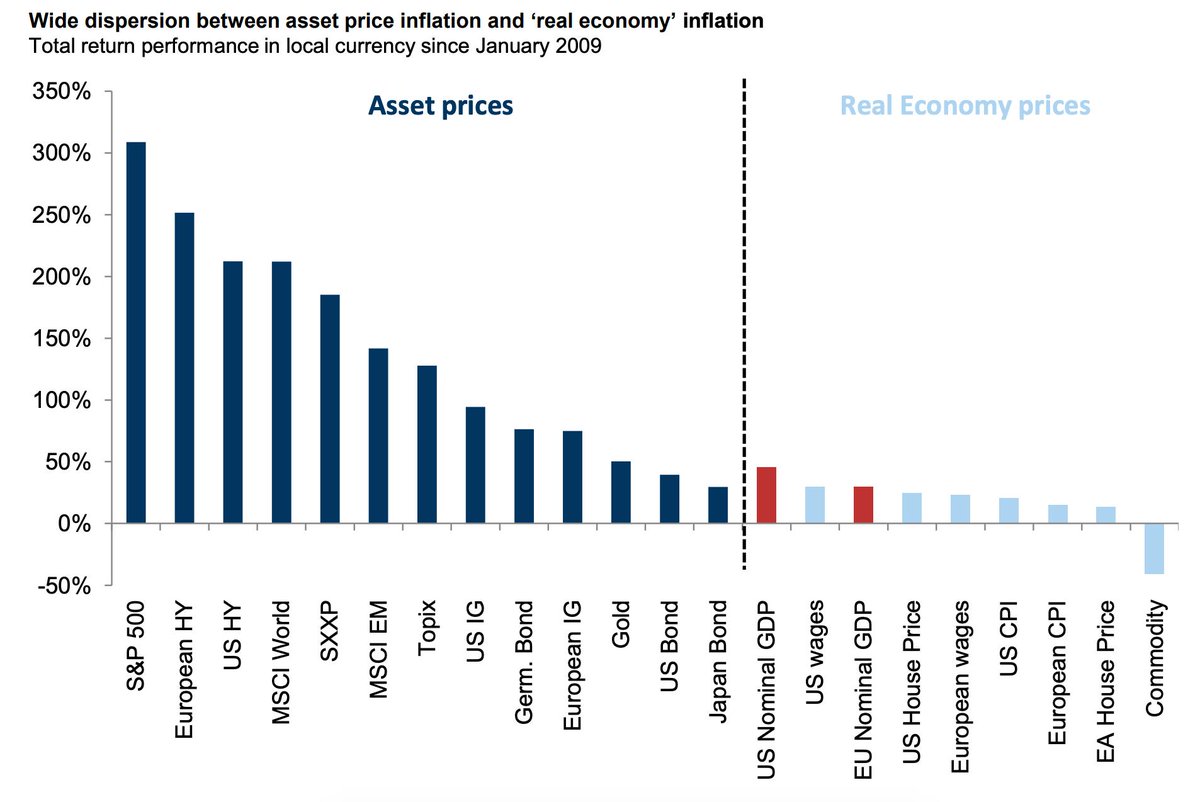

That isn't actually that unusual in the case of true financial crises. But as the second chart shows, the recovery in financial markets has been stunning.

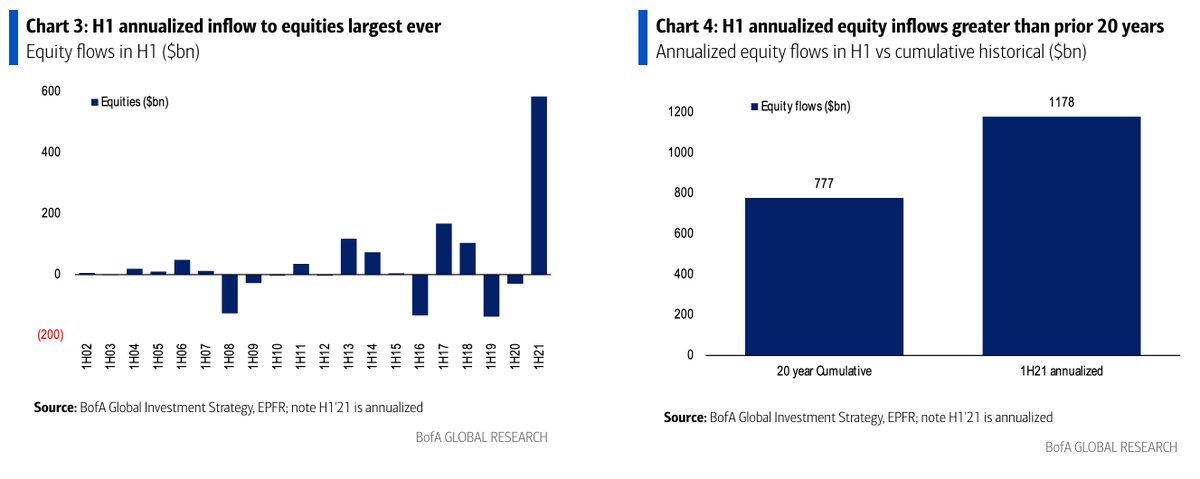

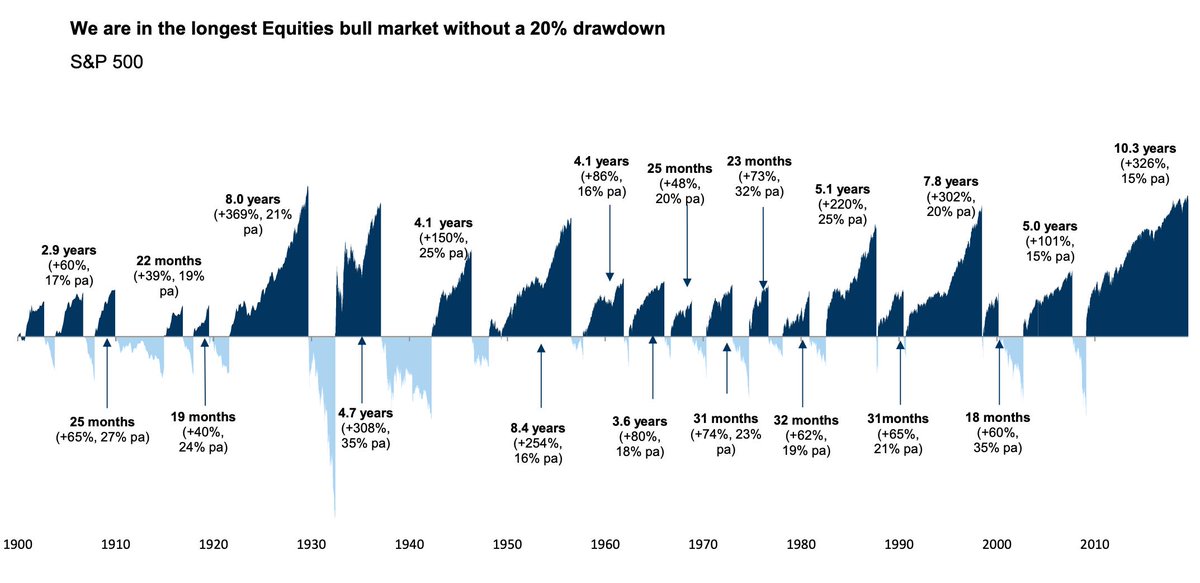

This is now comfortably the longest US stock market bull run in history, and in terms of strength greater than the dotcom bubble and approaching the roaring 20s.

It's quite stark how financial assets have markedly outperformed "real" ones like house prices, or wages and inflation.

One sector stands out as a world-beater: Technology. Tech companies have basically decoupled from the rest of the corporate world.

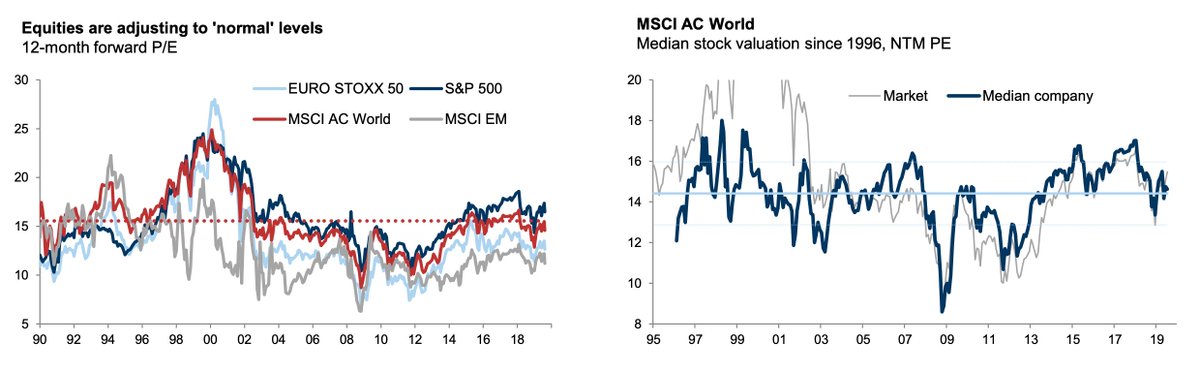

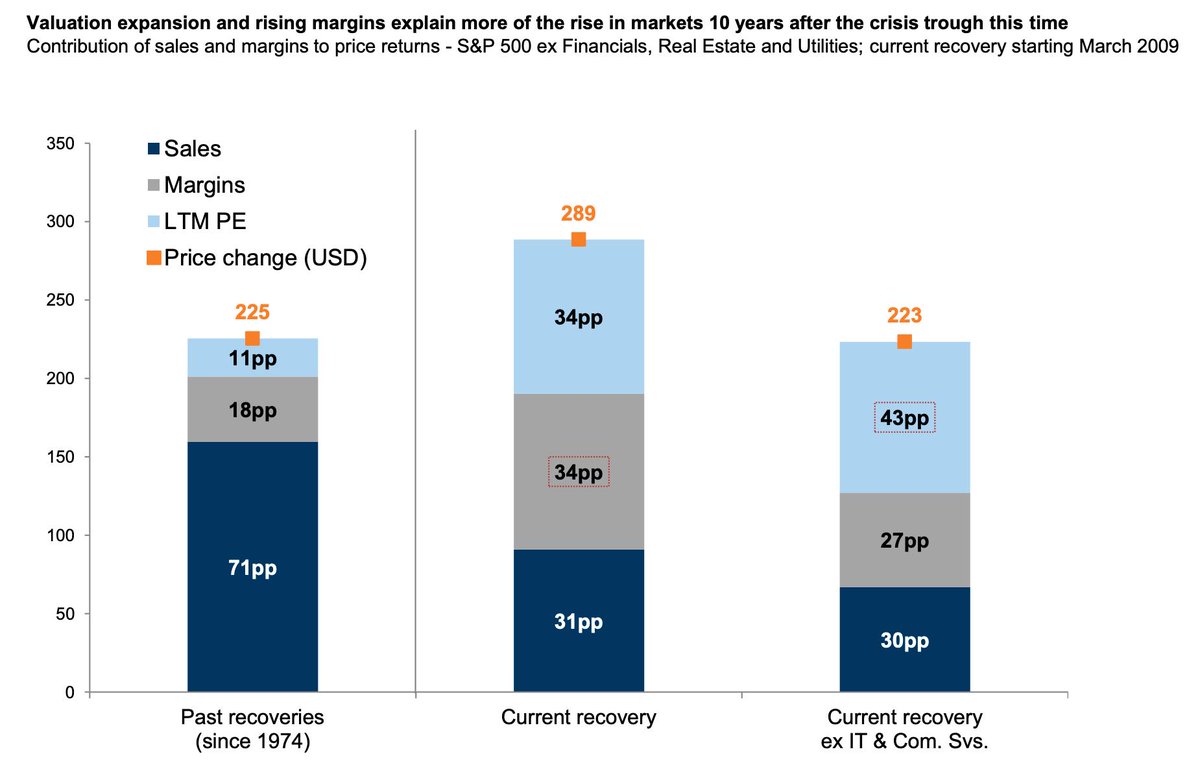

What has powered the broader stock market recovery is fatter margins and higher valuations - but if you strip out technology then it tracks the post WWII average.

There's been a lot of attention paid to the evaporation of market volatility, but this largely reflects a STUNNING decline in economic volatility.

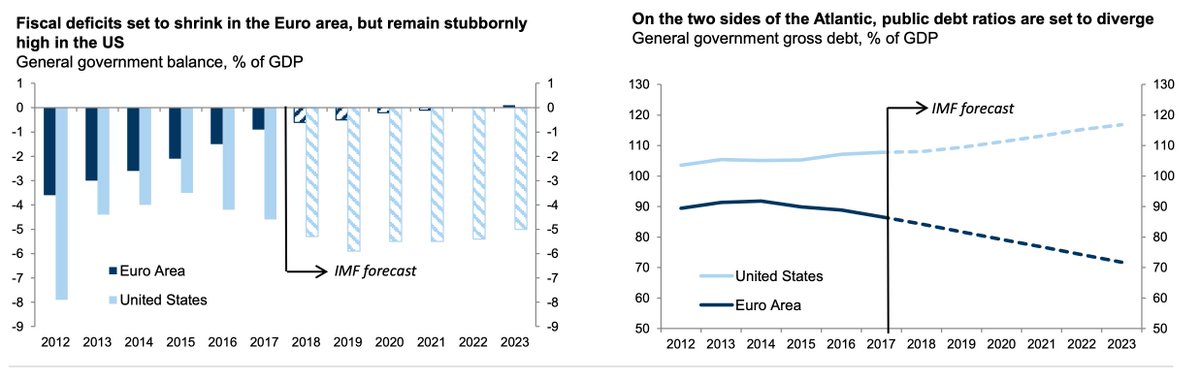

Meanwhile, the fiscal picture is actually improving in Europe, leading to a likely divergence in public debt ratios.

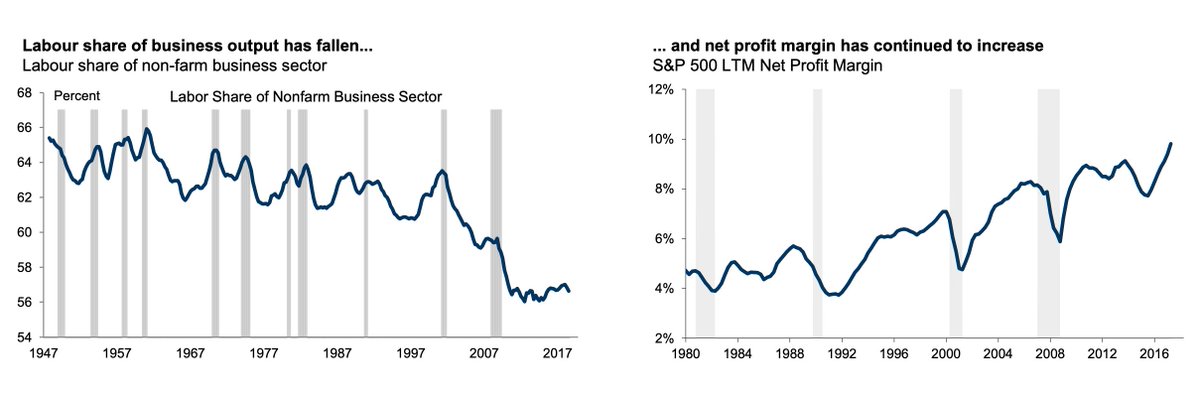

Labour costs as a share of business expenses looks like they are in a secular decline, which is one of the reasons profit margins are so healthy.

But services largely remains healthy, according to PMI surveys. In Europe the divergence is nearly unprecedented.

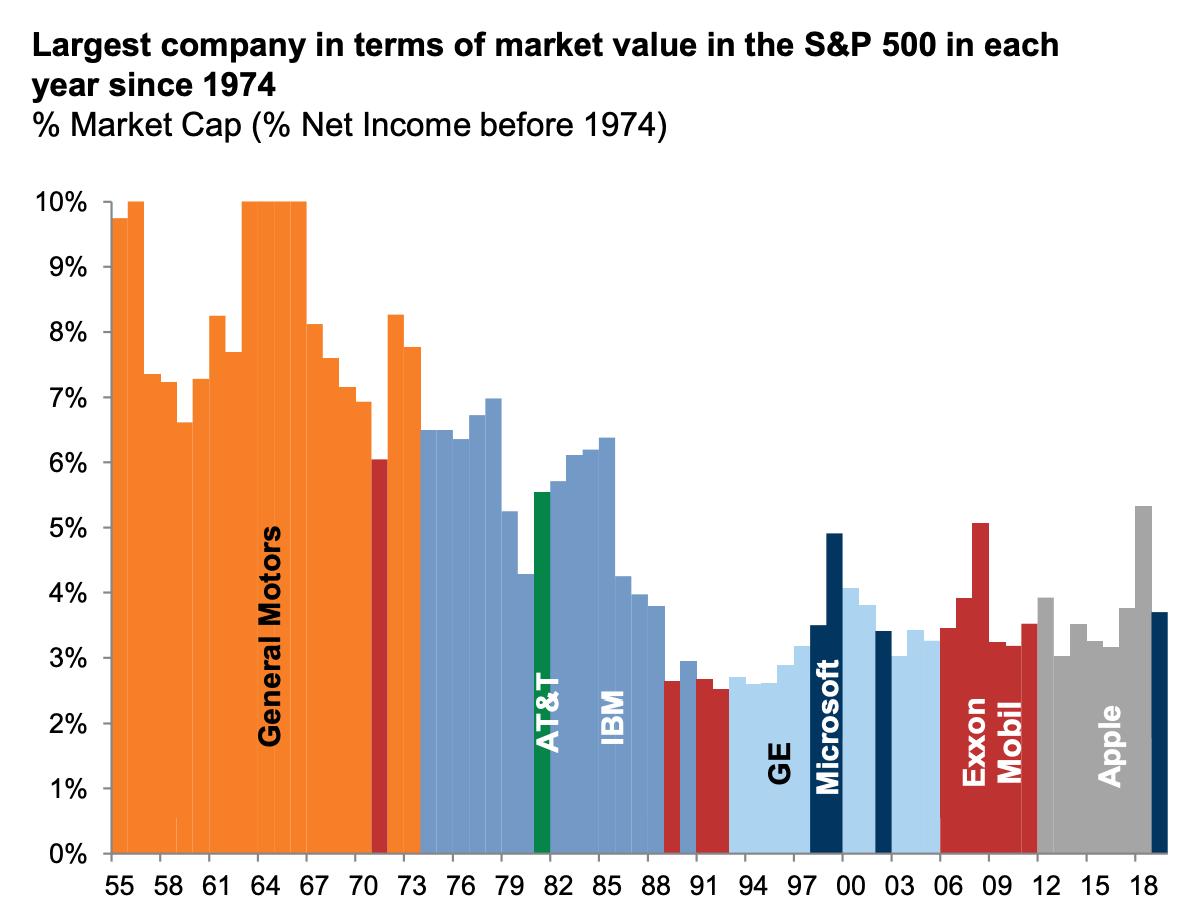

Despite the phenomenal tech sector performance, valuations are actually far below what they were in previous sector bubbles, such as 90s tech bubble and the Nifty 50 bubble

General Motors was also a far bigger chunk of the US stock market in its heyday than Apple or other recent giants ever were.

• • •

Missing some Tweet in this thread? You can try to

force a refresh