Editor of @FTAlphaville. Norwegian despite the Harry Potter-esque name. Author of TRILLIONS. Views mine bla bla.

7 subscribers

How to get URL link on X (Twitter) App

Back in the 1950s, Nick Thorndike was a precocious fund manager at Fidelity, mentored by Ned Johnson himself. In 1960 he and three Bostonian friends set up their own shop, Thorndike, Doran, Paine and Lewis, which kicked arse in the “go-go” boom of the 1960s.

Back in the 1950s, Nick Thorndike was a precocious fund manager at Fidelity, mentored by Ned Johnson himself. In 1960 he and three Bostonian friends set up their own shop, Thorndike, Doran, Paine and Lewis, which kicked arse in the “go-go” boom of the 1960s.

Go home US stock trading volumes, you're drunk.

Go home US stock trading volumes, you're drunk.

https://twitter.com/justinaknope/status/1339231403465117697Basically, I think I (and Quantopian obviously) underestimated the compounding power of collaboration and institutional knowledge. Essentially, you probably had thousands of people independently coding very similar algos on large cap US equities.

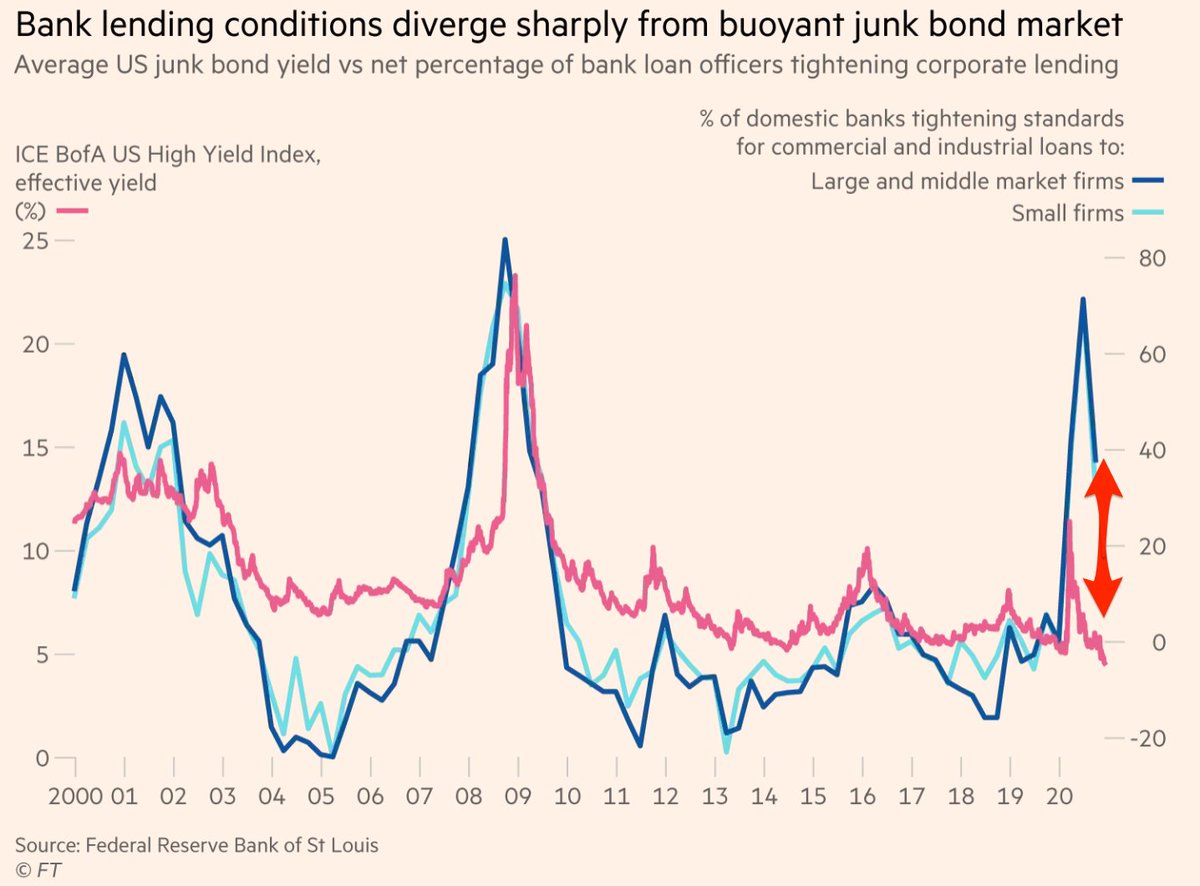

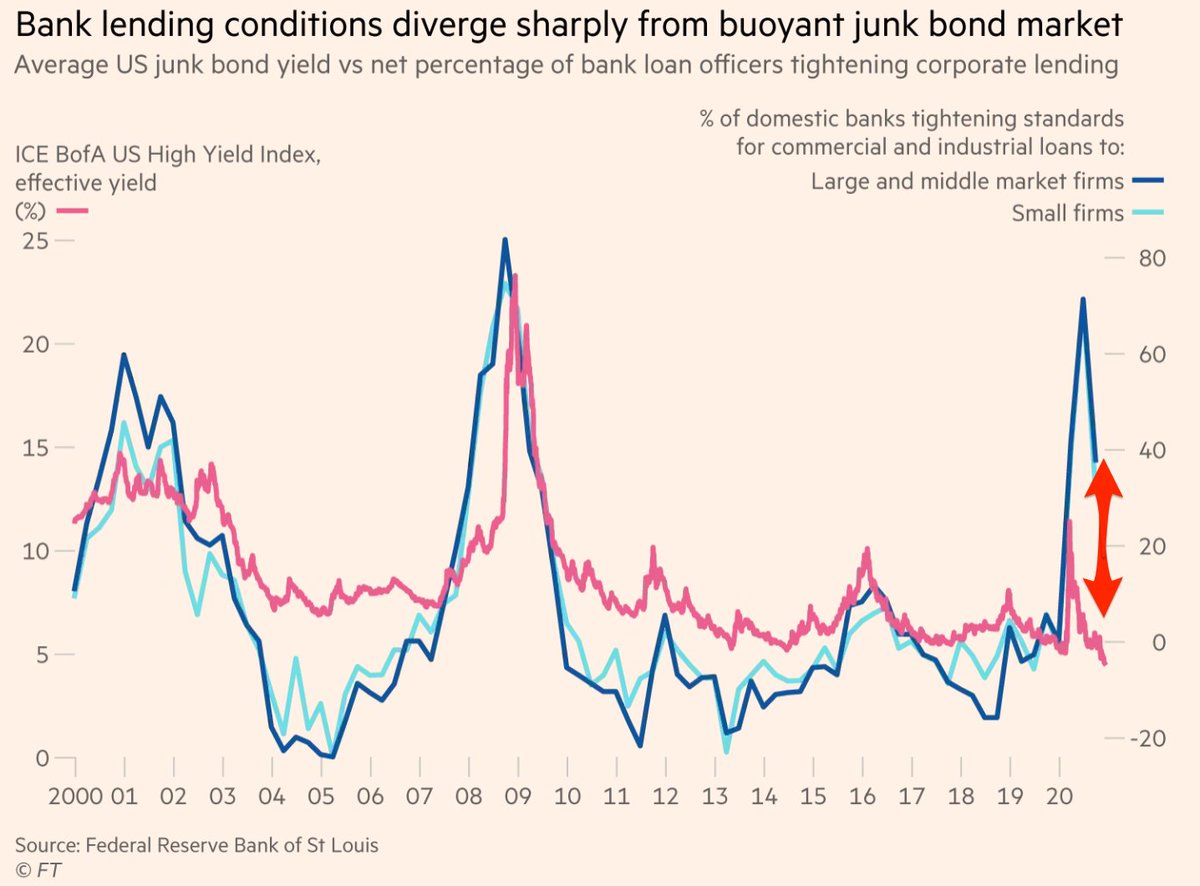

I think the increasingly bifurcated corporate access to credit is a big, underappreciated issue in the US. It is the big downside to the size and vibrancy of the American bond market - if you're too small to tap it, then you're kinda screwed.

I think the increasingly bifurcated corporate access to credit is a big, underappreciated issue in the US. It is the big downside to the size and vibrancy of the American bond market - if you're too small to tap it, then you're kinda screwed.

https://twitter.com/adam_tooze/status/1335841472944304128Yes, hedge fund selling of Treasuries was in pure nominal quantity certainly less impactful than the broad, global “dash for cash” that led foreign central banks and mutual funds to dump Treasuries.

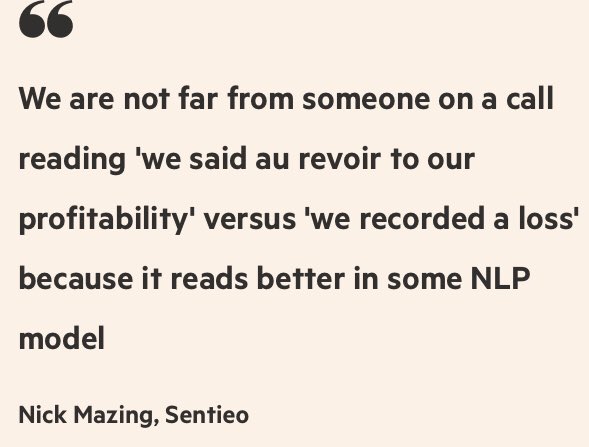

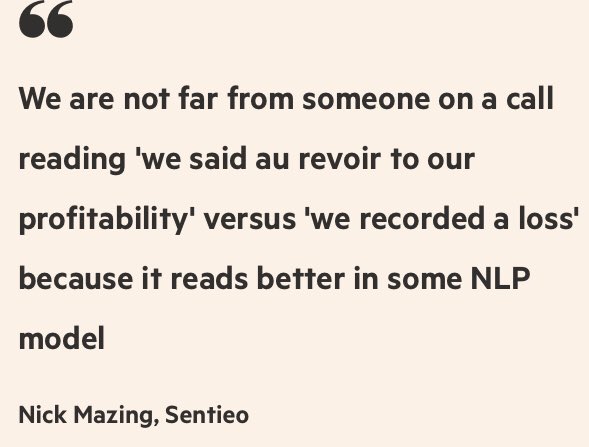

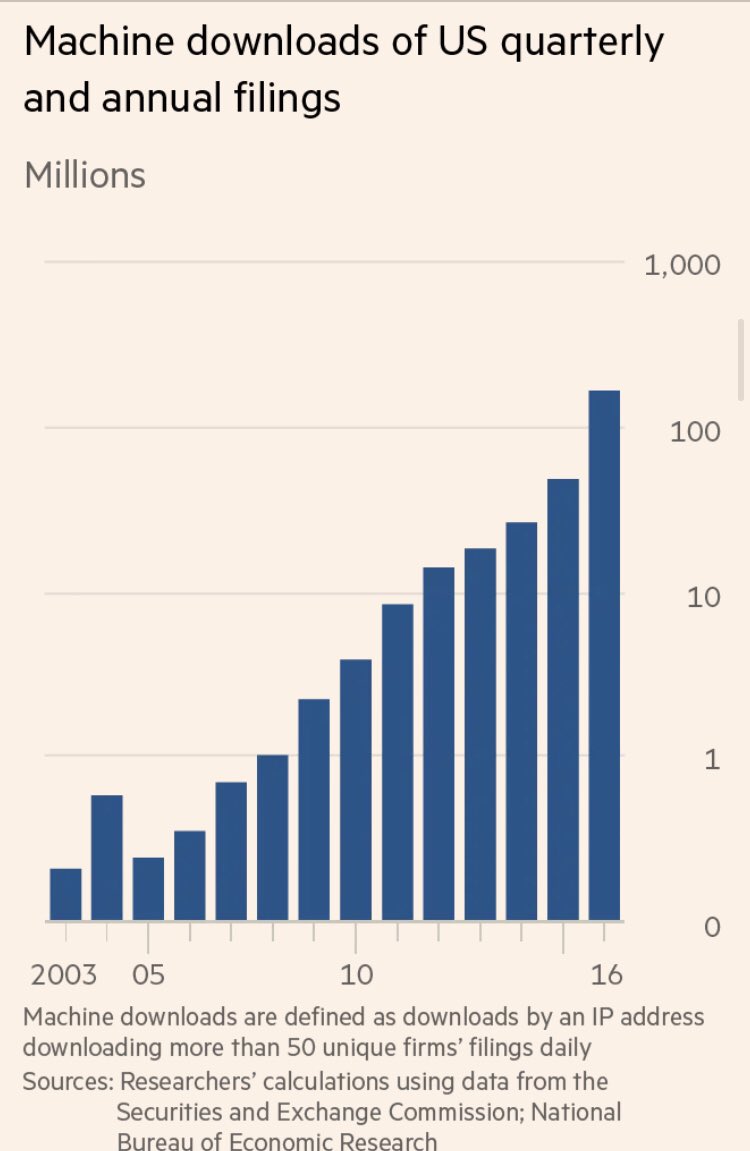

There’s been an explosion of high-frequency machine downloads of US regulatory filings in recent years, as quant hedge funds simply train algorithms to instantaneously read and trade thousands of reports - volumes that no human portfolio manager could ever hope to read.

There’s been an explosion of high-frequency machine downloads of US regulatory filings in recent years, as quant hedge funds simply train algorithms to instantaneously read and trade thousands of reports - volumes that no human portfolio manager could ever hope to read.

For sure, the global economy has bounced far more strongly than we dared hope earlier this year, and corporate profits will follow next year.

For sure, the global economy has bounced far more strongly than we dared hope earlier this year, and corporate profits will follow next year.

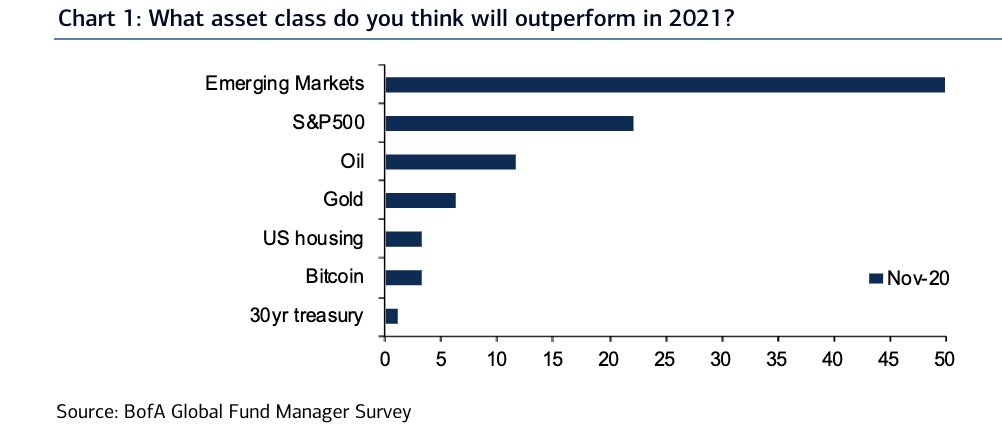

The love for emerging markets is certainly pretty fulsome. cc @AllThatIsSolid

The love for emerging markets is certainly pretty fulsome. cc @AllThatIsSolid

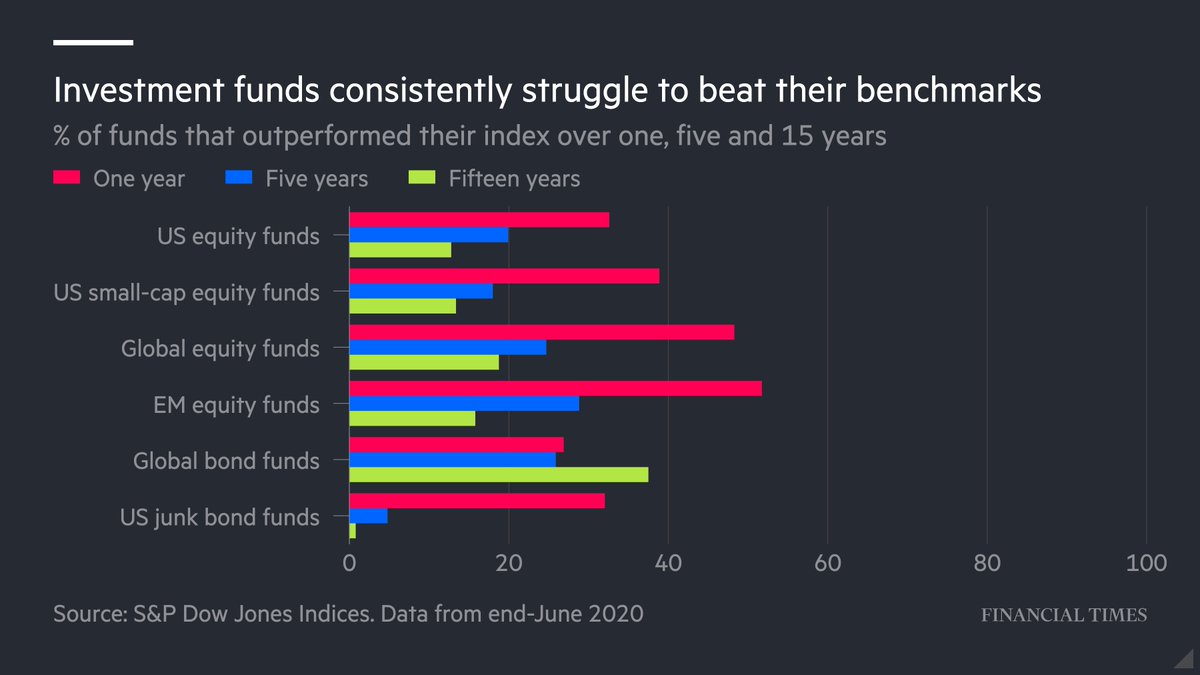

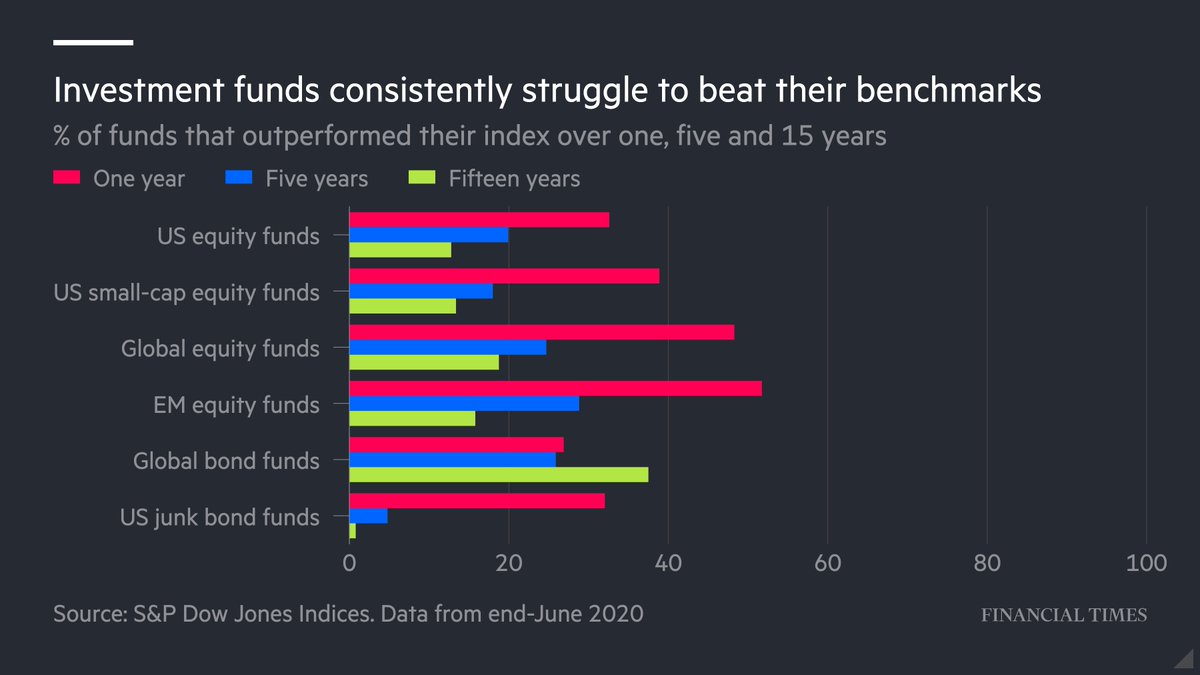

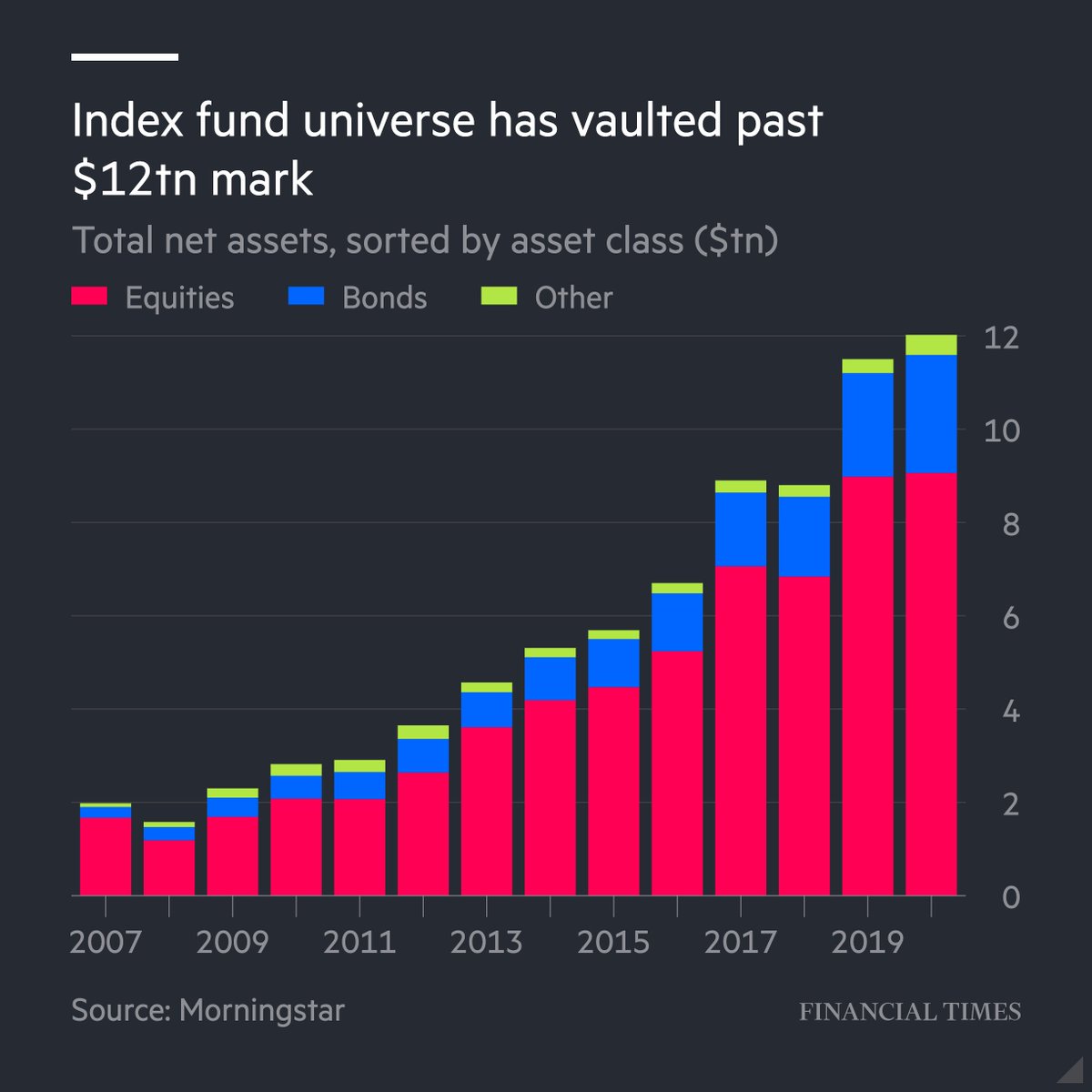

There's now north of $12tn in index funds and ETFs, after a decade of breakneck growth.

There's now north of $12tn in index funds and ETFs, after a decade of breakneck growth.

Here’s Oxford Economics, which warns that Biden is inheriting a “frail” economy.

Here’s Oxford Economics, which warns that Biden is inheriting a “frail” economy.

As the previous chart shows (a massive thanks to @jasongoepfert for the data), the volume of call premiums being traded in small retail-sized lots (10 contracts or less) has gone absolutely PARABOLIC lately.

As the previous chart shows (a massive thanks to @jasongoepfert for the data), the volume of call premiums being traded in small retail-sized lots (10 contracts or less) has gone absolutely PARABOLIC lately.