8 questions to ask before you invest in a Credit Fund.

Q1) How much yield should the fund offer?

A) The principle of 'higher-the-better' does not apply to credit funds. Higher yields come with disproportionately higher risks. Funds offering 11%+ are a clear avoid. Thread 1/8

Q1) How much yield should the fund offer?

A) The principle of 'higher-the-better' does not apply to credit funds. Higher yields come with disproportionately higher risks. Funds offering 11%+ are a clear avoid. Thread 1/8

Q2) How diversified is the fund?

A) A fund with higher diversification is less risky. As per regulations, exposure in a company cannot exceed 10%. Well managed funds cap exposure in one company to 5% or lower. Lower exposure means lower hit on return if an accident happens. 2/8

A) A fund with higher diversification is less risky. As per regulations, exposure in a company cannot exceed 10%. Well managed funds cap exposure in one company to 5% or lower. Lower exposure means lower hit on return if an accident happens. 2/8

Q3) Does the fund have high exit loads?

A) Usually exit loads ensure that investors allow fund managers time to execute strategies. However, very high exit loads often result in debt-traps restricting investors' exit even when there are glaring mistakes made by fund-managers. 3/8

A) Usually exit loads ensure that investors allow fund managers time to execute strategies. However, very high exit loads often result in debt-traps restricting investors' exit even when there are glaring mistakes made by fund-managers. 3/8

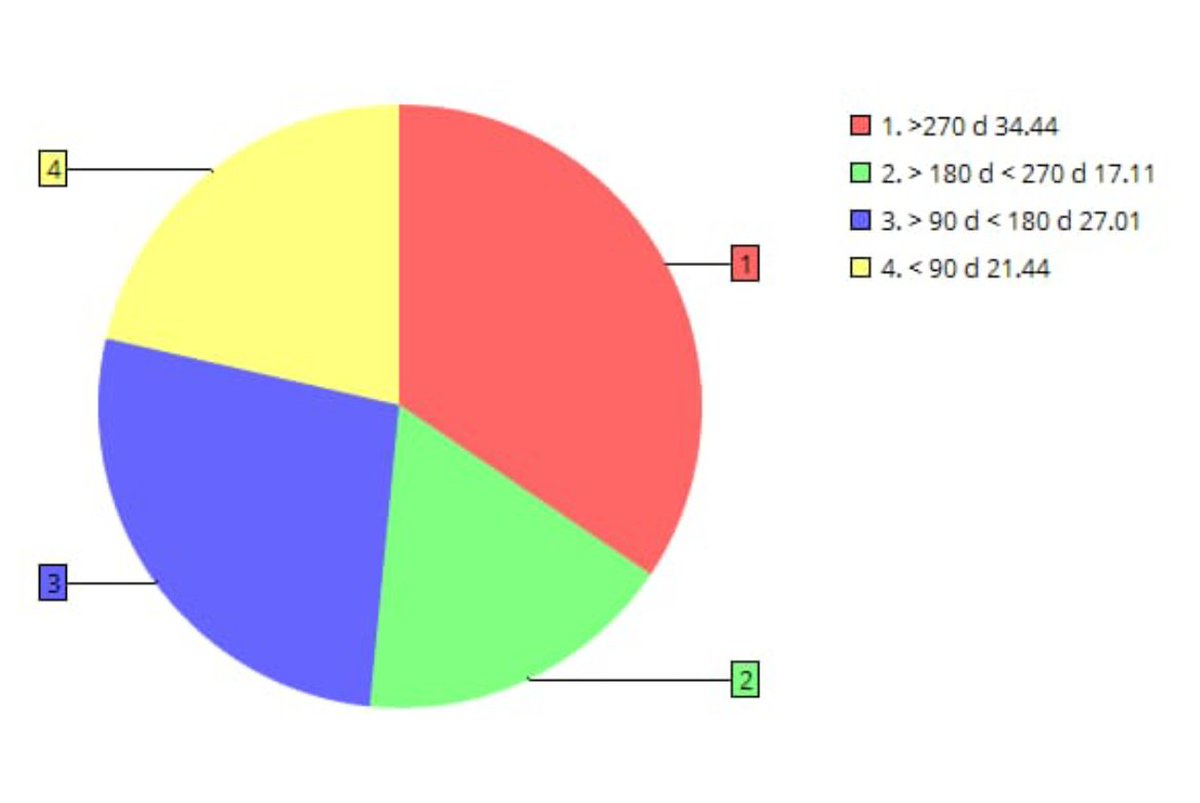

Q4) How does the 'duration' vary with interest rate cycles?

A) Duration is a measure of tenure risk. If the fund managers vary the duration too opportunistically during interest rate cycles, the investors are exposed to unwanted volatility risk. 4/8

A) Duration is a measure of tenure risk. If the fund managers vary the duration too opportunistically during interest rate cycles, the investors are exposed to unwanted volatility risk. 4/8

Q5) How consistent have the returns been?

A) Credit funds are all about giving consistent returns over well spread out time periods. If there is too much of a variance in returns, over different time horizons, the fund manager is not doing a good job. 5/8

A) Credit funds are all about giving consistent returns over well spread out time periods. If there is too much of a variance in returns, over different time horizons, the fund manager is not doing a good job. 5/8

Q6) Is there enough liquidity cushion in the portfolio?

A) Owing to the liability profile of mutual funds there can be a sudden outflow of size in a scheme. A good scheme has 10-20% of very liquid securities to avoid losses owing to distress sale if large withdrawals happen. 6/8

A) Owing to the liability profile of mutual funds there can be a sudden outflow of size in a scheme. A good scheme has 10-20% of very liquid securities to avoid losses owing to distress sale if large withdrawals happen. 6/8

Q7) Does the fund house have a good team?

A) Managing credit is not a one man show. It is complicated and involves in-dept research and continuous monitoring. Good credit managers have a sizable credit risk team to analyse and monitor. 7/8

A) Managing credit is not a one man show. It is complicated and involves in-dept research and continuous monitoring. Good credit managers have a sizable credit risk team to analyse and monitor. 7/8

Q8) What has been the track record of fund managers?

A) Managing credit is a specialist's job. We should always check fund manager's credit credentials. Further, we should enquire about the history of credit events in the fund and how the fund manager tackled those. 8/8

A) Managing credit is a specialist's job. We should always check fund manager's credit credentials. Further, we should enquire about the history of credit events in the fund and how the fund manager tackled those. 8/8

@kayezad @ActusDei @_soniashenoy @andymukherjee70 @invest_mutual @BMTheEquityDesk @dmuthuk @rohitchauhan @contrarianEPS @shyamsek @chokhani_manish @pvsubramanyam @BalakrishnanR @Sanjay__Bakshi @TamalBandyo @CafeEconomics @menakadoshi @latha_venkatesh @AmolPlanRupee

@deepakshenoy @dugalira @Iamsamirarora @SunilBSinghania @mrinagarwal @IamMisterBond @NagpalManoj @SalariedTaxpay1 @YashwantSinha @ayushmitt

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh