$BTC

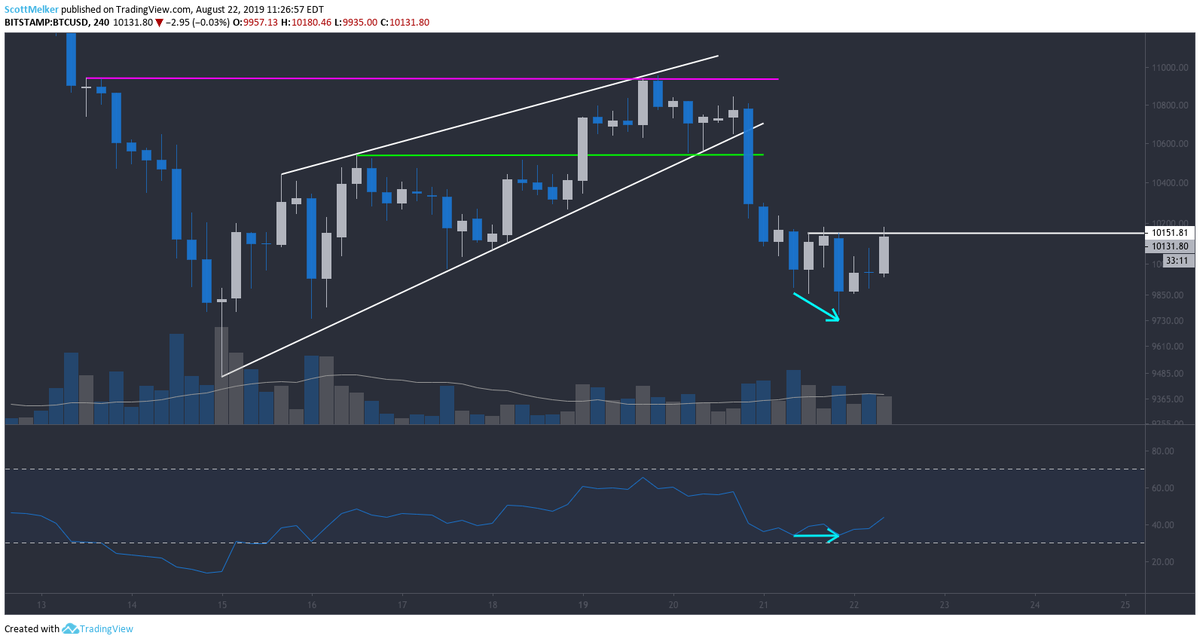

(1) Current low time frame view. Price rejected at confluence of horizontal resistance and the top of the rising wedge. Bitcoin has a tendency to destroy these "bearish patterns" to the upside. Remaining optimistic above the green line and bottom of wedge.

(1) Current low time frame view. Price rejected at confluence of horizontal resistance and the top of the rising wedge. Bitcoin has a tendency to destroy these "bearish patterns" to the upside. Remaining optimistic above the green line and bottom of wedge.

(2) Still being cautious. Price has retraced 50% of the previous move down, which makes this an area of strong resistance, especially considering the top of the wedge and pink line. Could range between green and pink before a decision is made. Definitely a no trade zone for me.

$BTC Hourly

Likely a new trading range has developed based on the recent local high and low. Clear that the EQ has offered both support and resistance. For now, bias remains neutral until a clear break above or below the range. Alarms on, charts off.

Likely a new trading range has developed based on the recent local high and low. Clear that the EQ has offered both support and resistance. For now, bias remains neutral until a clear break above or below the range. Alarms on, charts off.

$BTC

You can only live on the edge for so long before life catches up to you. The ascending wedge that everyone was watching broke down. Oversold bull divs (not shown) printing on hourly, most likely just enough for some mild relief bounces for the moment.

You can only live on the edge for so long before life catches up to you. The ascending wedge that everyone was watching broke down. Oversold bull divs (not shown) printing on hourly, most likely just enough for some mild relief bounces for the moment.

$BTC Hourly Line Chart

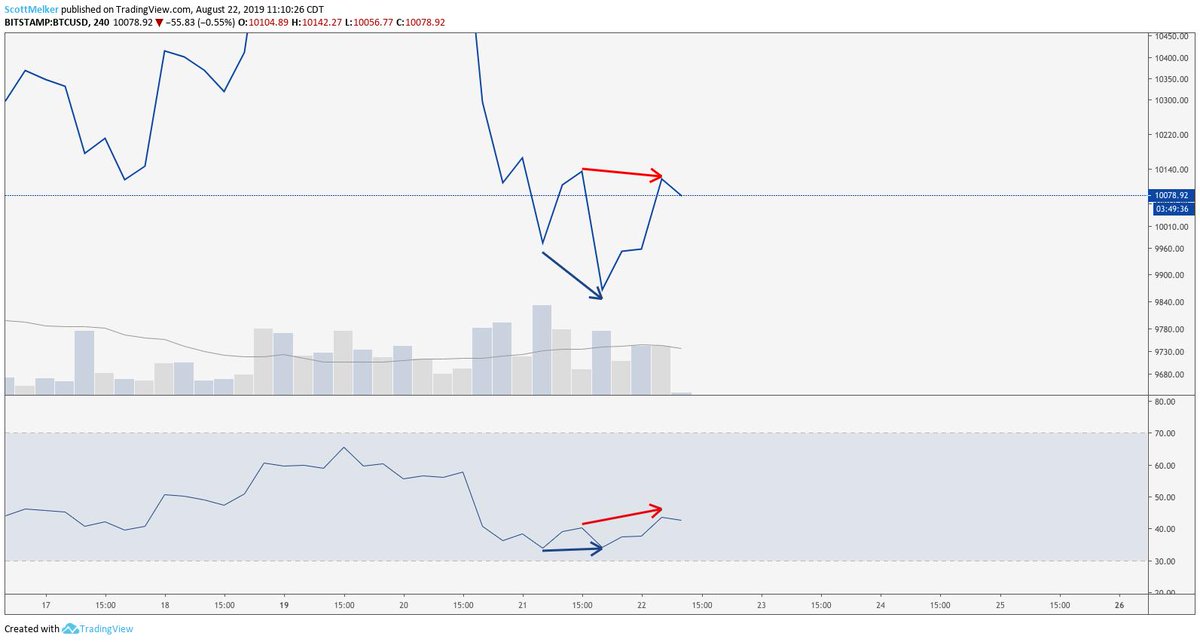

Confirmed bull div a few hours ago sent price up. Now we watch and see if it is followed by a hidden bear div, or if price can continue up and invalidate.

Confirmed bull div a few hours ago sent price up. Now we watch and see if it is followed by a hidden bear div, or if price can continue up and invalidate.

$BTC. The hidden bear div played out as expected. Now price is forming another significant potential bull div on the hourly. 30 minutes to confirm. Should be good for a bounce if it prints.

$BTC

(1) The hourly div I posted last night was the local bottom. If I was only allowed to trade using one strategy, this would be it. Incredibly reliably, incredibly simple. The first bull div shown here led to a $300 move. The hidden bear div a $400 drop.

(1) The hourly div I posted last night was the local bottom. If I was only allowed to trade using one strategy, this would be it. Incredibly reliably, incredibly simple. The first bull div shown here led to a $300 move. The hidden bear div a $400 drop.

(2) The second bull div a $400 rise, so far. Keep in mind, this is on the hourly, so good for scalping. The larger the time frame, the slower but more powerful the result of the divergence. Trading like this makes price action far easier to understand.

(3) Divs are stronger when RSI is overbought or oversold. 4 hour is my favorite time frame for div trading on $BTC. Notice, there was a small bullish divergence on the 4 hour chart, in confluence with the oversold hourly div I shared. That was as reliable a bounce sign as any.

(4) And what do we look for after a confirmed bull div? The appearance of a bear div, or more likely a hidden bear div to signal that the bull div is "complete." 4 hours left to confirm, but there is a potential hidden bear div on the 4 hour $BTC chart.

• • •

Missing some Tweet in this thread? You can try to

force a refresh