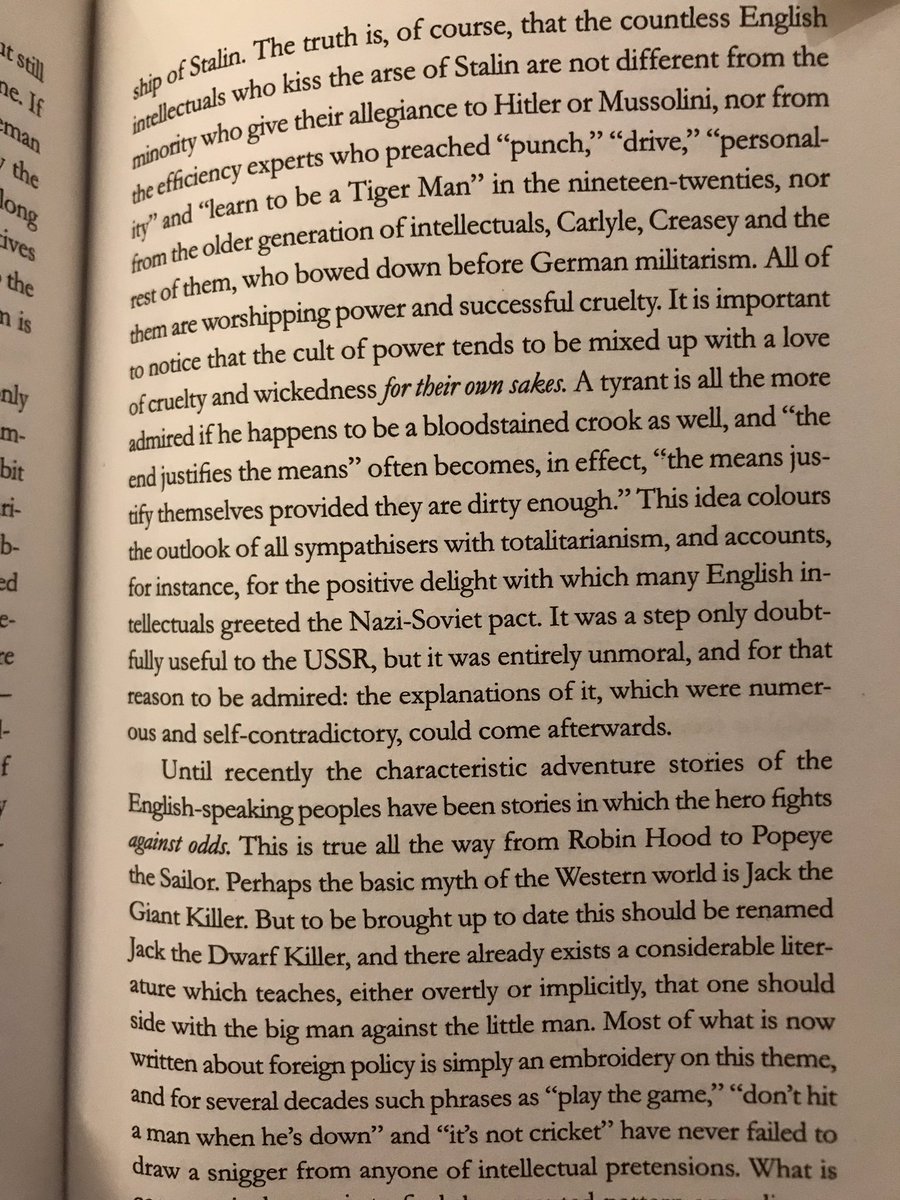

Actually, George Orwell wrote an essay on this regarding English intellectuals “kiss the arse of Stalin are not diff than the minority who give their allegiance to Hitler or Mussolini...Basically discussed the power worship & the age in which intellectual liberty was under attack

https://twitter.com/baldingsworld/status/1164499079352766464

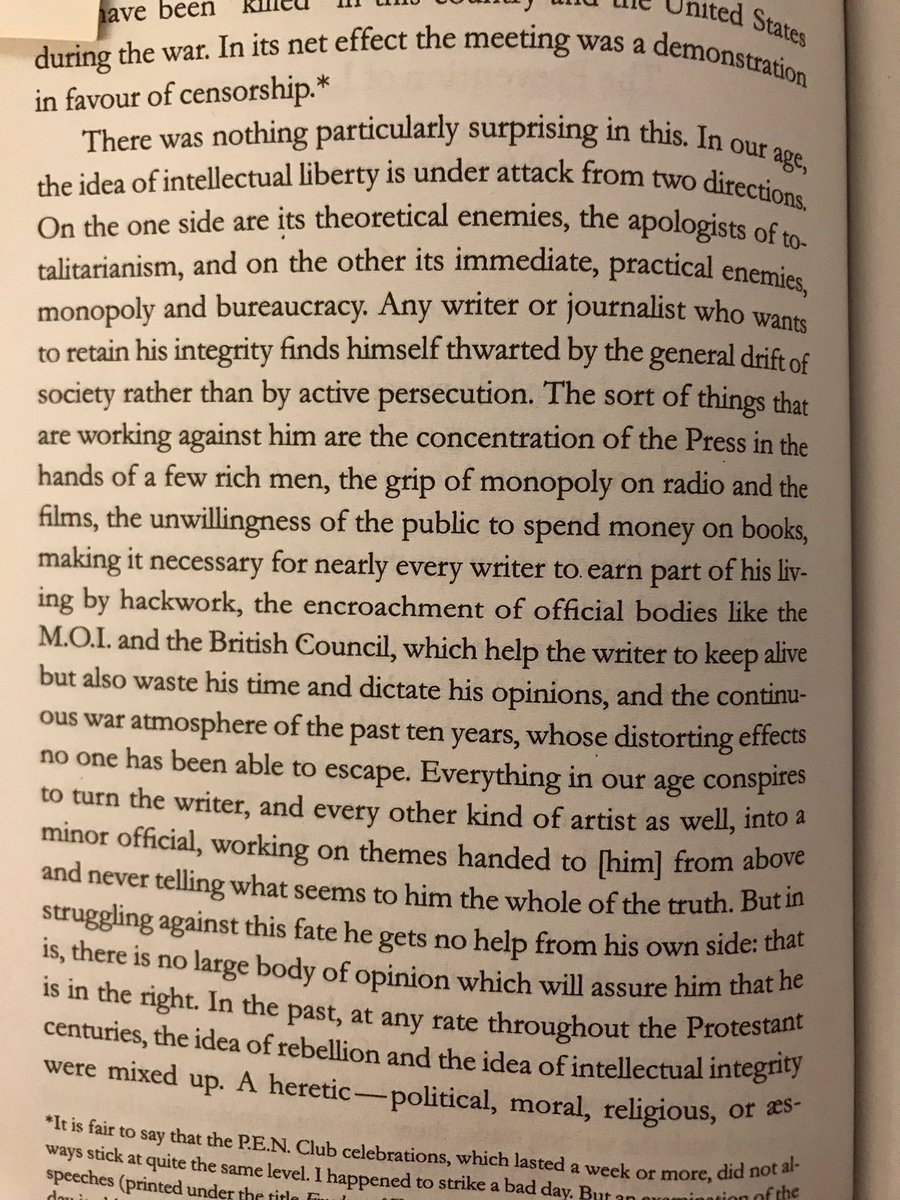

George Orwell was very prolific - he had opinions on a wide range of topic. In this 1 he wrote about intellectual liberty attacked by “the apologists of authoritarian” & also the tide turning the writer/journalist into an officer of society that drifts towards the worship power&$

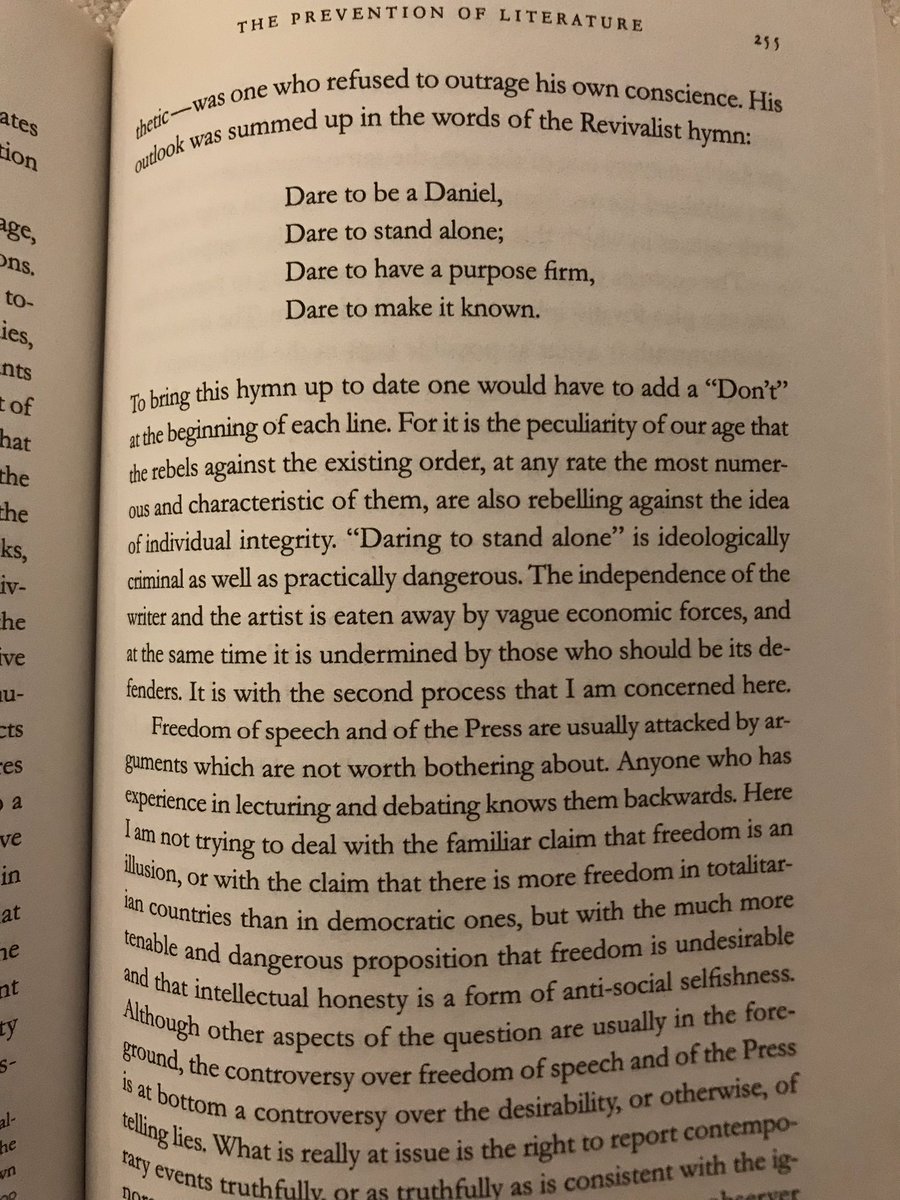

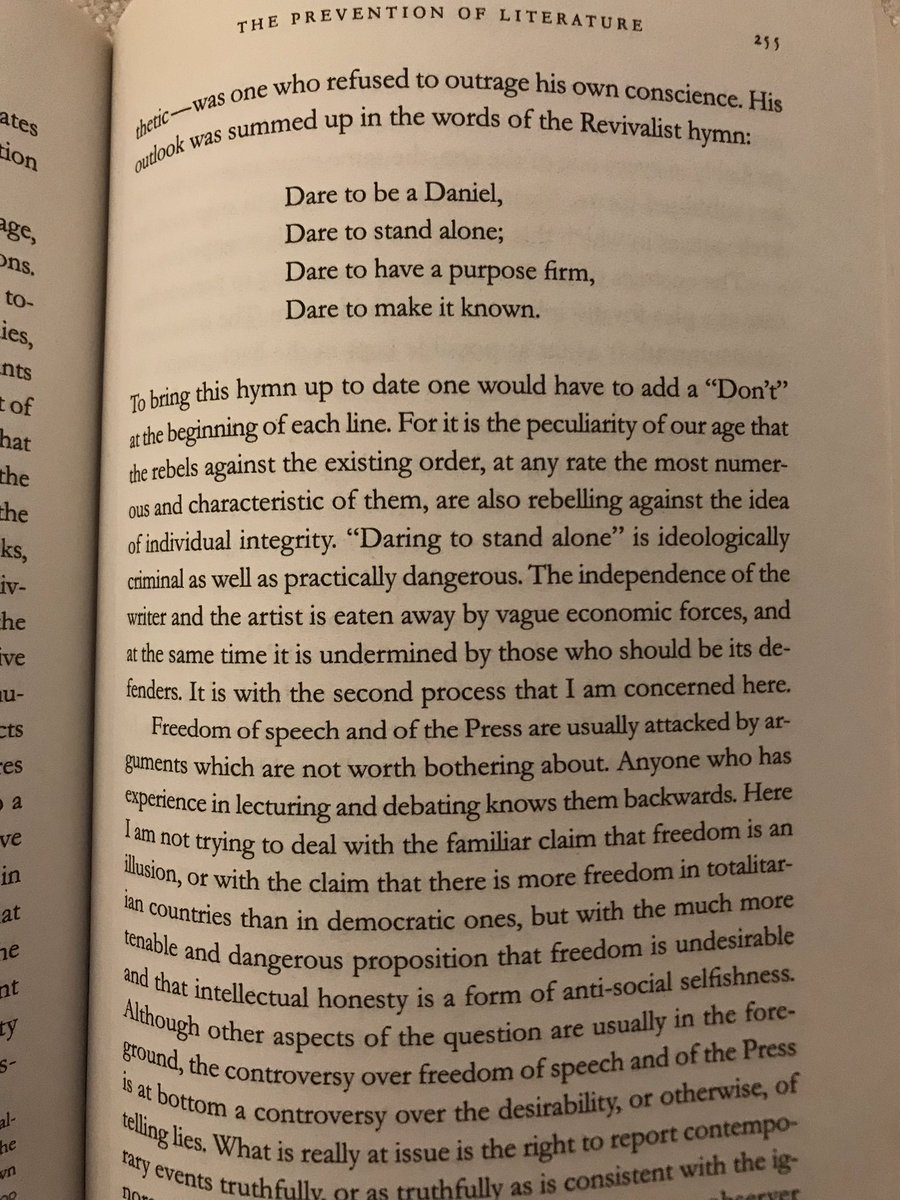

A Revivalist hymn:

Dare to be a Daniel,

Dare to stand alone,

Dare to have a purpose firm,

Dare to make it known.

George wrote, “To bring this up to date, we’d have to add DON’T to the begging of each line.”

Told u, George’s essays are like Tweet storms. Spend time w/ George 🤗

Dare to be a Daniel,

Dare to stand alone,

Dare to have a purpose firm,

Dare to make it known.

George wrote, “To bring this up to date, we’d have to add DON’T to the begging of each line.”

Told u, George’s essays are like Tweet storms. Spend time w/ George 🤗

• • •

Missing some Tweet in this thread? You can try to

force a refresh