It is pretty clear that the U.S. tax reform had a large impact on the U.S. BoP data: FDI flows reversed in 2019, as U.S. firms brought back past investments).

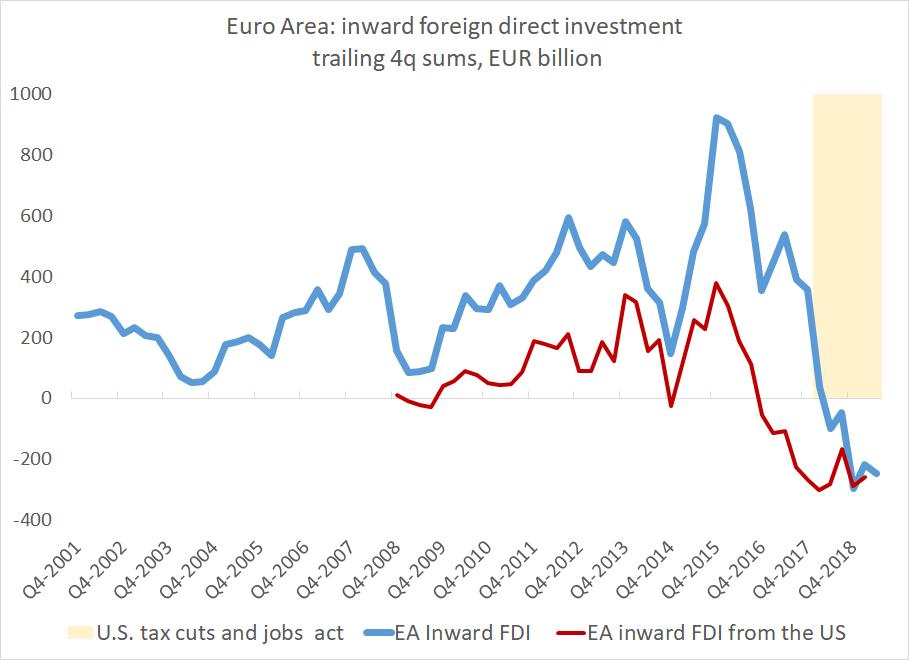

But it also may be mucking around with the global data. The fall in inward FDI to the EA correlates with US tax reform

But it also may be mucking around with the global data. The fall in inward FDI to the EA correlates with US tax reform

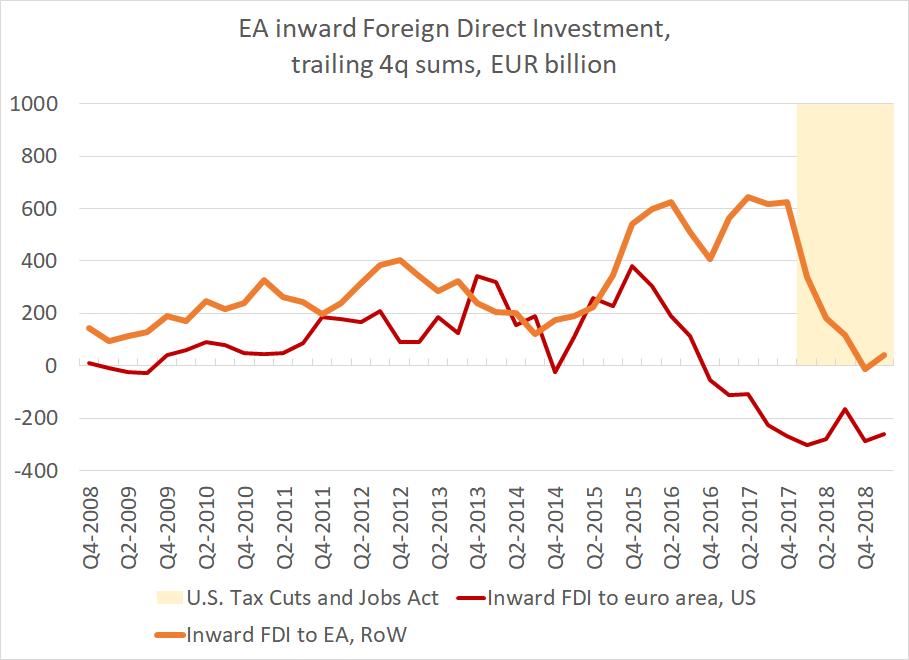

The fit isn't perfect -- the EA data indicates that investment from the US fell off before the tax reform, and I don't understand the mechanism why investment from others into the EA would fall with the US tax reform

the BoP math is sort of straight-forward:

the "reinvested" (tax deferred) earnings of US firms used to count as an increase in US FDI abroad. So when those funds are returned, US outward FDI falls.

and conversely inward FDI into places like the EA and Bermuda should fall

the "reinvested" (tax deferred) earnings of US firms used to count as an increase in US FDI abroad. So when those funds are returned, US outward FDI falls.

and conversely inward FDI into places like the EA and Bermuda should fall

basically, tax avoidance under the old U.S. law led to a buildup of US FDI abroad (technically), and that is now reversing.

Some will say this is globalization going backwards, but in a real sense it is not ...

Some will say this is globalization going backwards, but in a real sense it is not ...

in any case, help understanding the EA data would be most appreciated -- outward EA FDI has also gone done it seems, so the net swing is more modest that the change in gross flows over the last 6qs

• • •

Missing some Tweet in this thread? You can try to

force a refresh