CFR senior fellow. Views are my own. Retweets are not endorsements. Writes on sovereign debt and capital flows.

85 subscribers

How to get URL link on X (Twitter) App

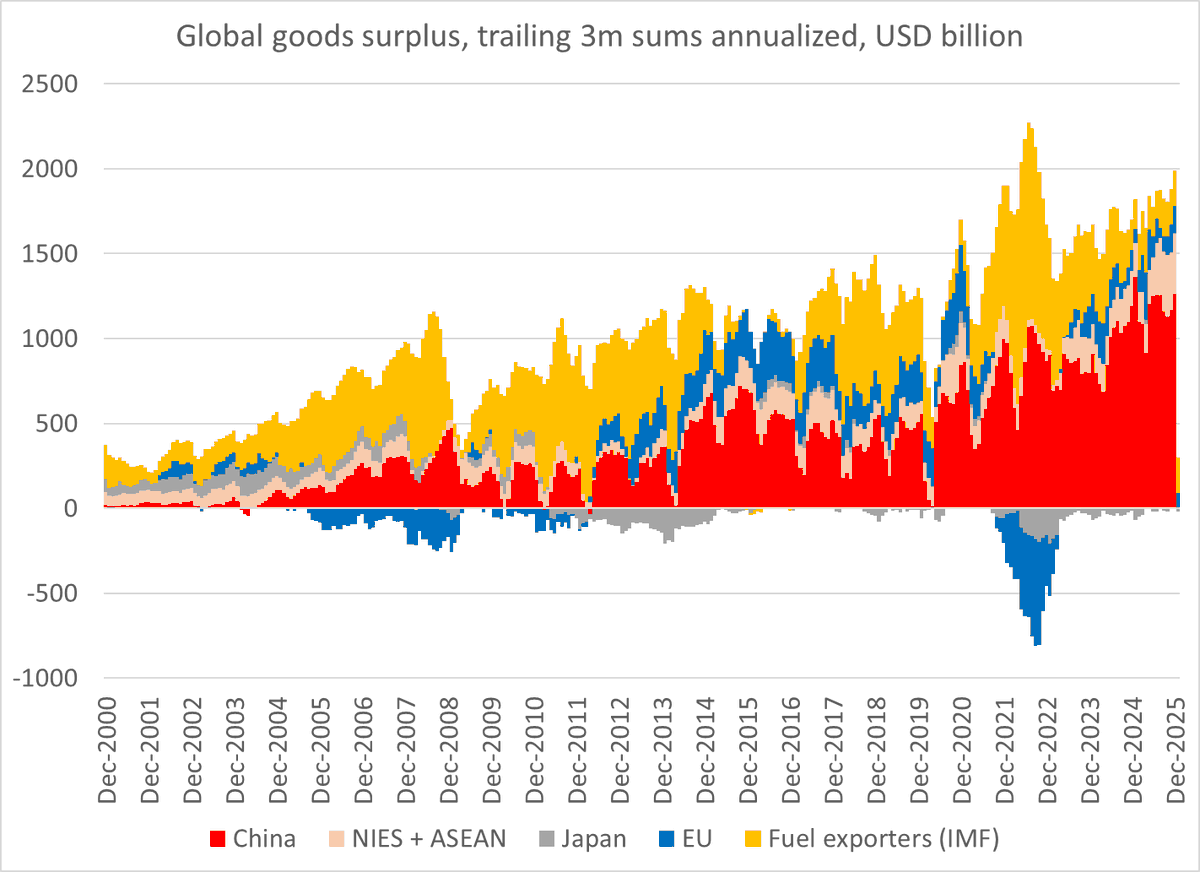

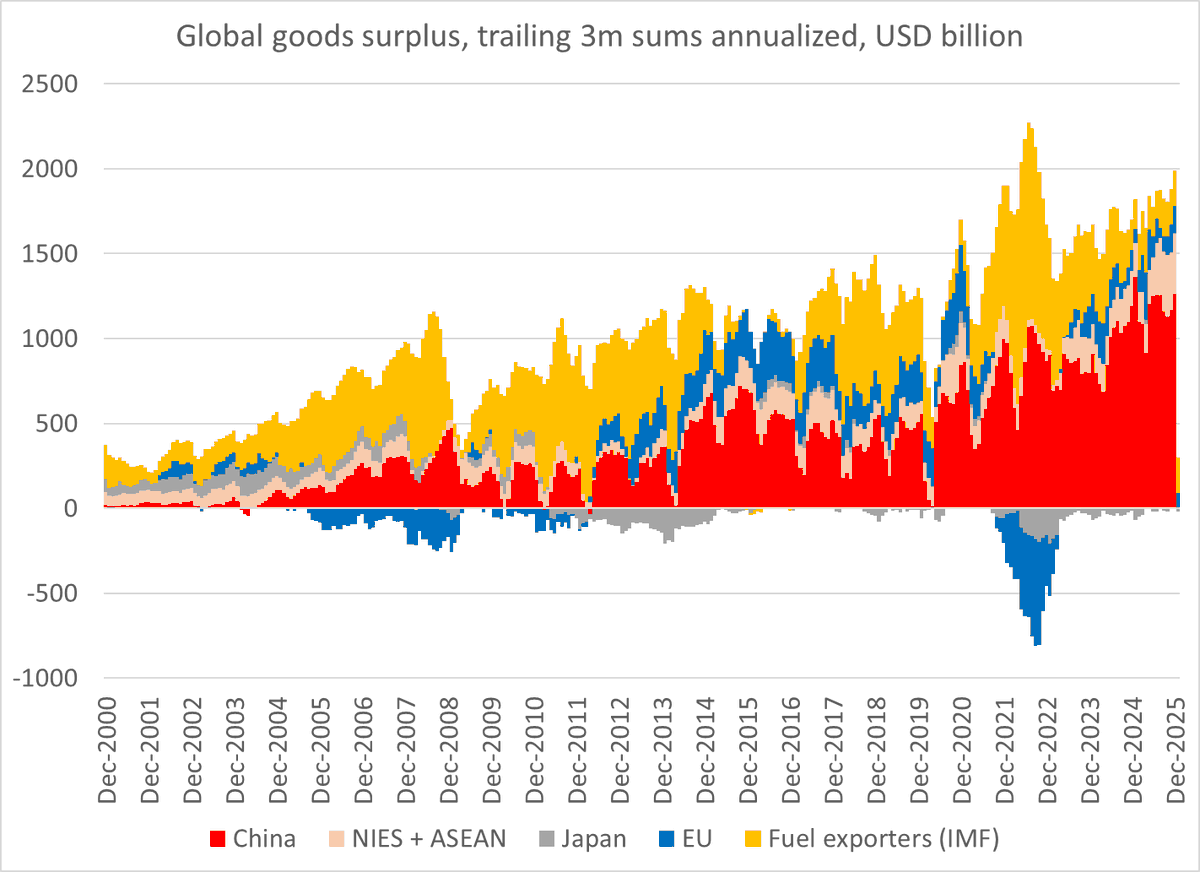

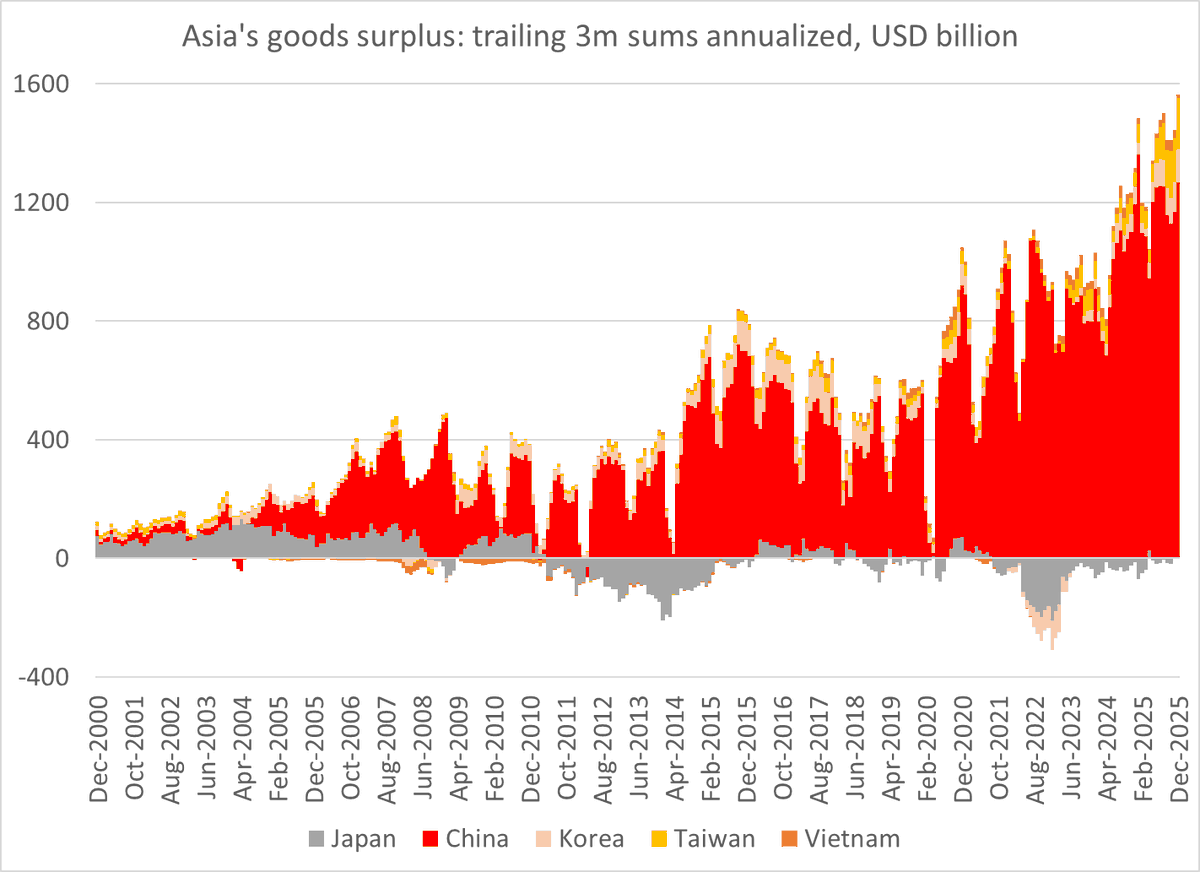

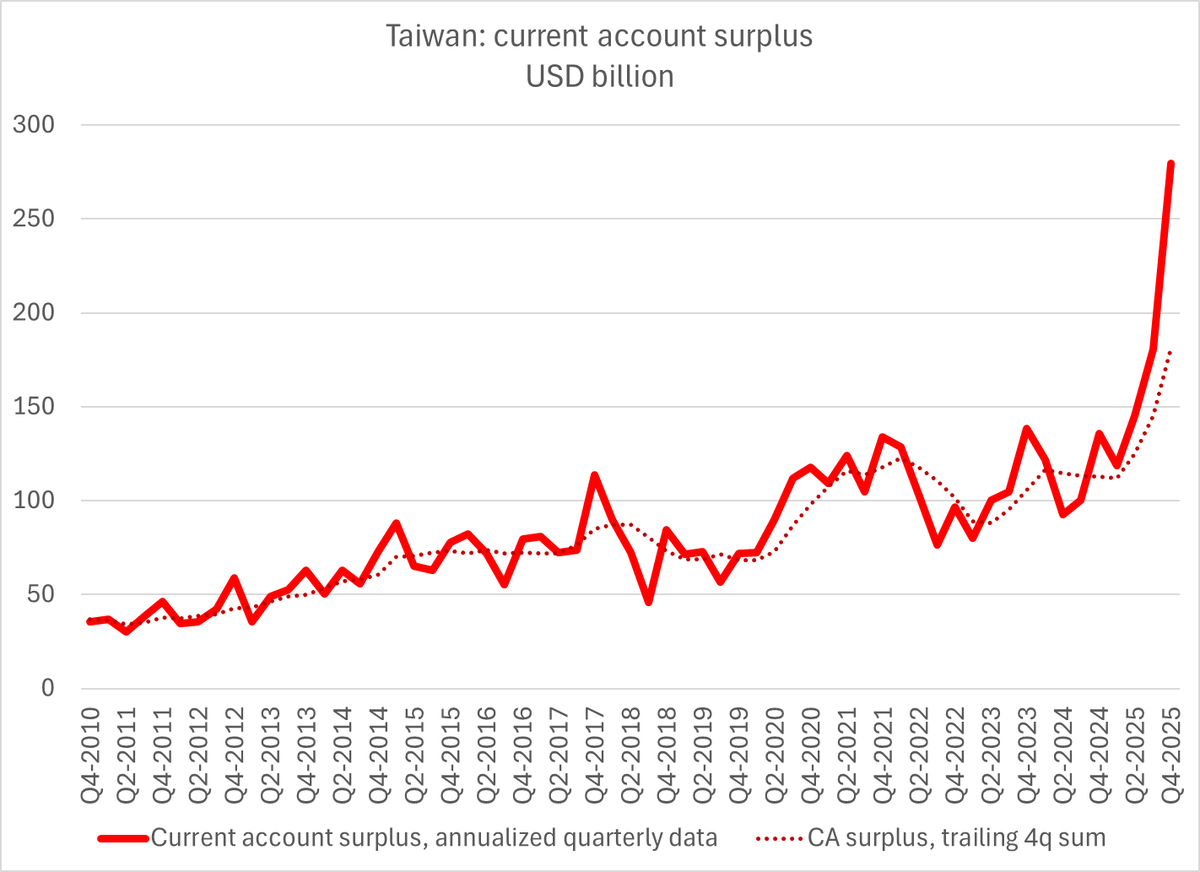

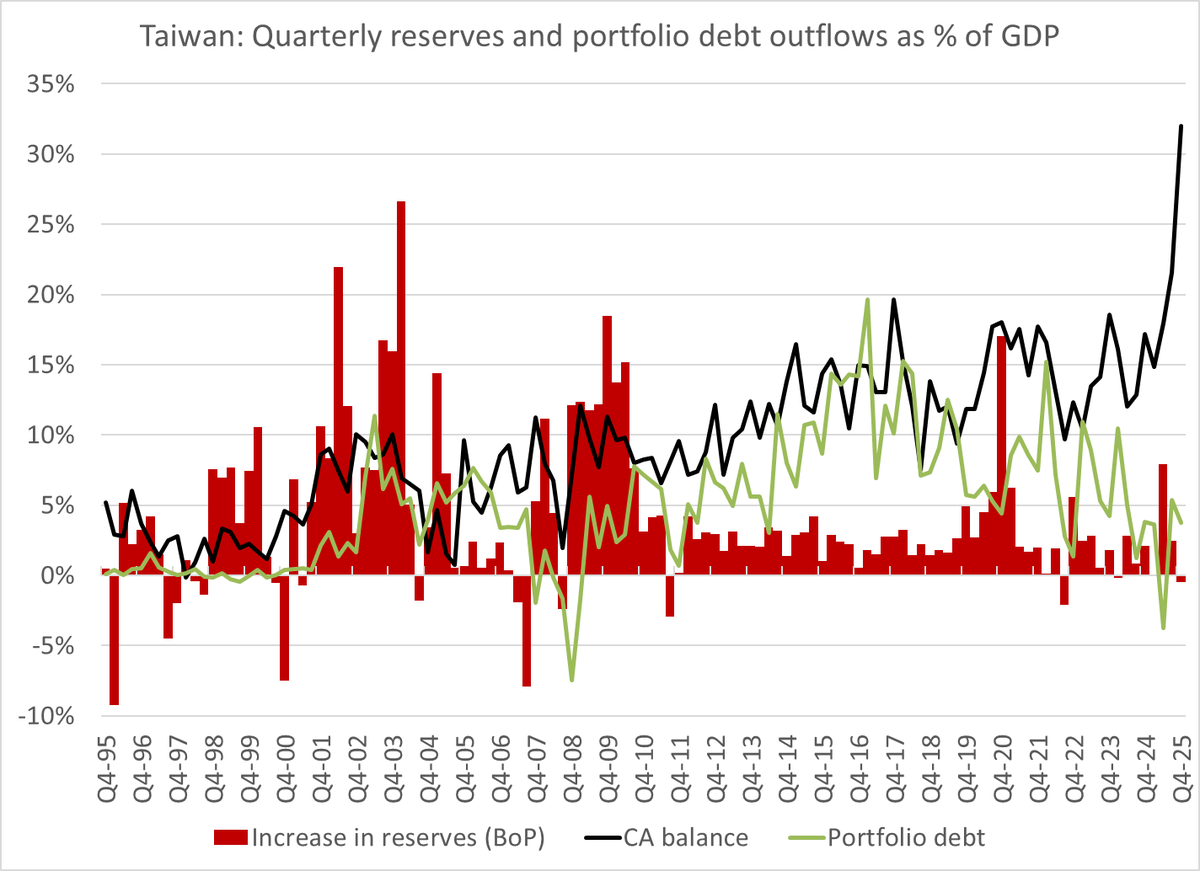

And also an unusually large surplus in East Asia.

And also an unusually large surplus in East Asia.

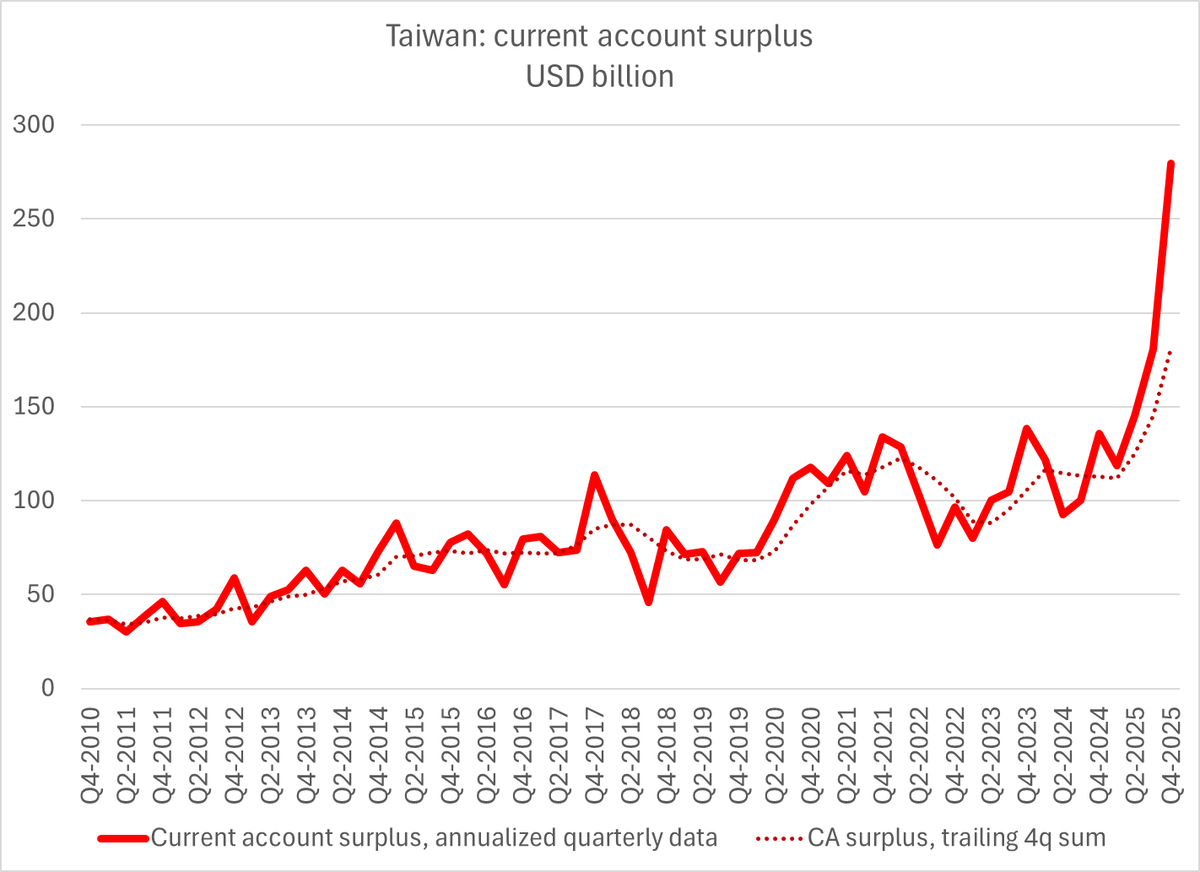

And there is of course a capital flows story -- as the TWD depreciated in q4 in the face of this massive surplus (2x its level in 24), and Taiwan technically sold reserves too!

And there is of course a capital flows story -- as the TWD depreciated in q4 in the face of this massive surplus (2x its level in 24), and Taiwan technically sold reserves too!

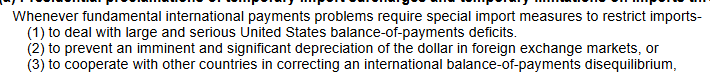

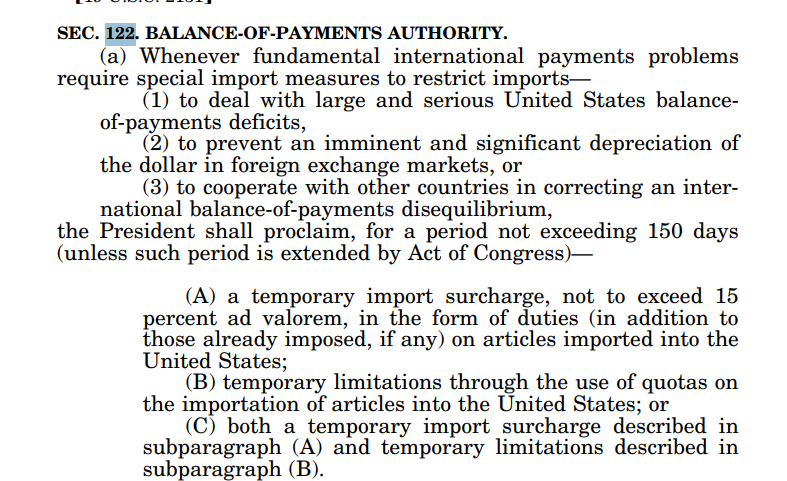

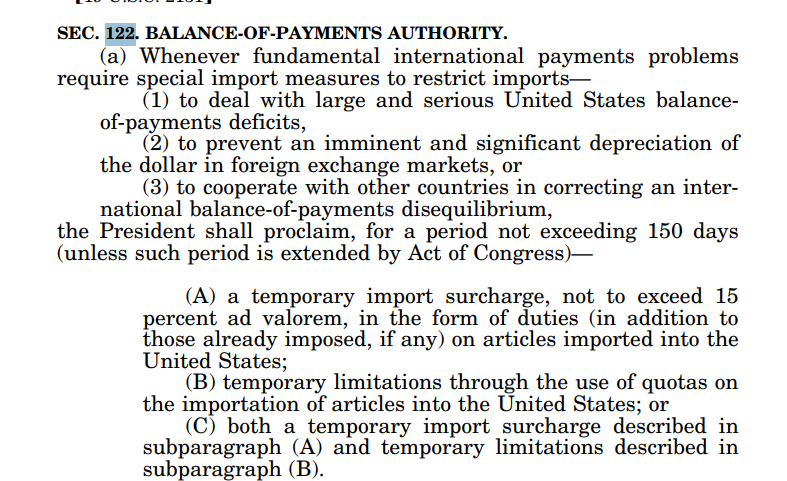

https://twitter.com/sobel_mark/status/2026799851569029185The most policy relevant question is whether the courts will strike down the 122 balance of payments tariffs & I think the answer to that is likely to be no, for the reasons that Peter Harrell (an actual lawyer) laid out today

It is clear from the Senate report on the legislation that the authors were concerned about trade and payments surplus countries (Germany and Japan at the time) & the equitable sharing of balance of payments adjustment responsibilities across surplus and deficit countries

It is clear from the Senate report on the legislation that the authors were concerned about trade and payments surplus countries (Germany and Japan at the time) & the equitable sharing of balance of payments adjustment responsibilities across surplus and deficit countries

What's more, the slightly faster pace of appreciation v the dollar only drives an appreciation in the inflation adjusted CNY if the dollar itself isn't depreciating v other currencies, and if the pace of appreciation is bigger than the inflation differential

What's more, the slightly faster pace of appreciation v the dollar only drives an appreciation in the inflation adjusted CNY if the dollar itself isn't depreciating v other currencies, and if the pace of appreciation is bigger than the inflation differential

Seems like the median outcome for the US is that the efforts of Biden (CHIPS act) and Trump ("deals" negotiated with the threat of semiconductor tariffs) will just keep the US share of global chip production stable.

Seems like the median outcome for the US is that the efforts of Biden (CHIPS act) and Trump ("deals" negotiated with the threat of semiconductor tariffs) will just keep the US share of global chip production stable.

A statement from the heart --

A statement from the heart --

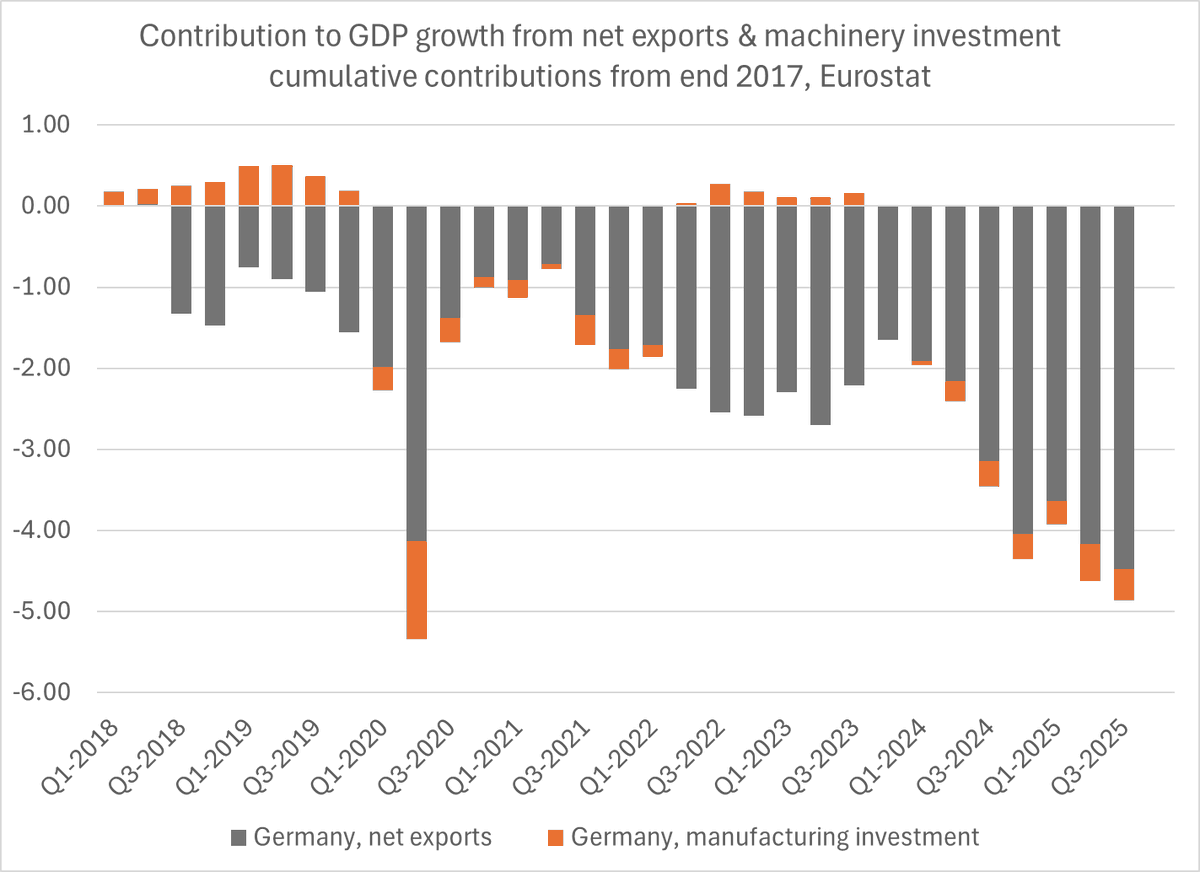

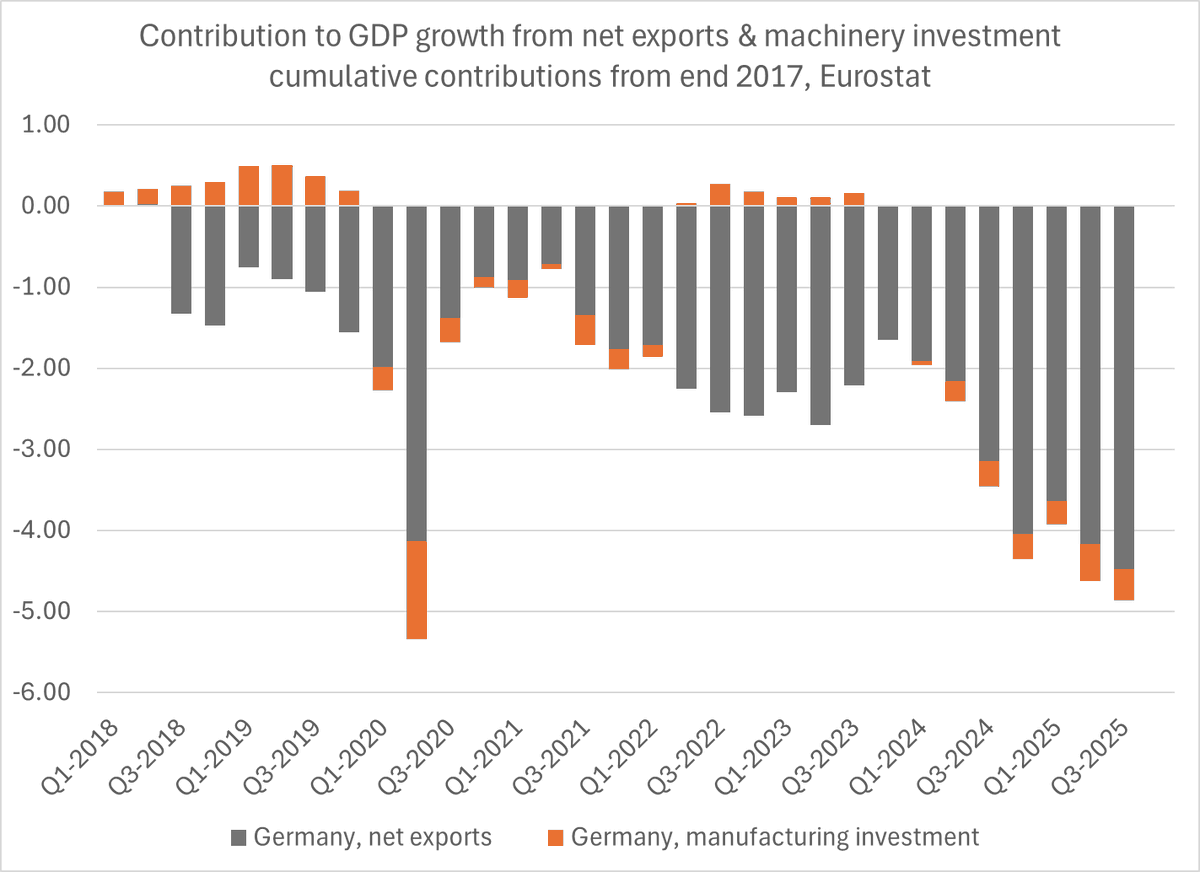

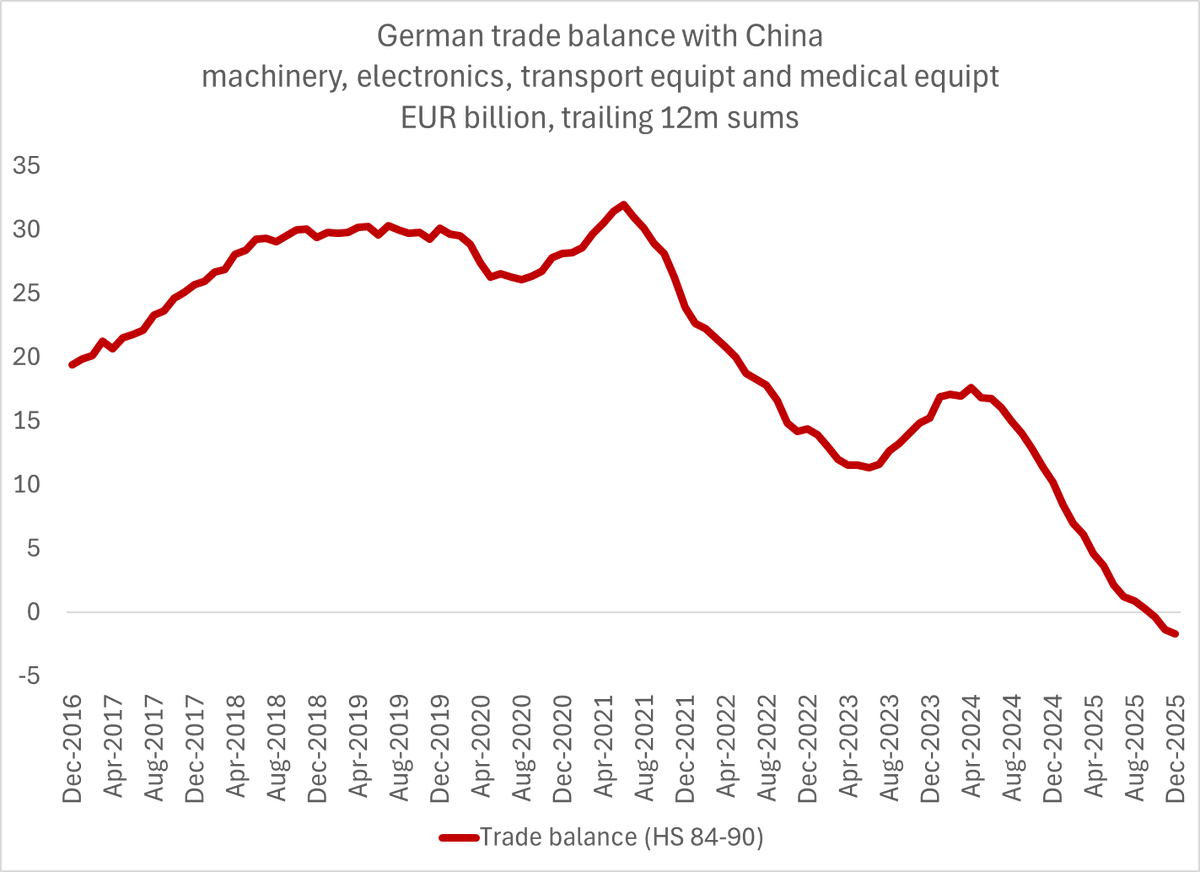

Obviously, this is because Germany's once substantial exports of autos, aircraft and machinery to China have plummeted. Those sectors used to generate a substantial surplus for Germany -- but not any more

Obviously, this is because Germany's once substantial exports of autos, aircraft and machinery to China have plummeted. Those sectors used to generate a substantial surplus for Germany -- but not any more

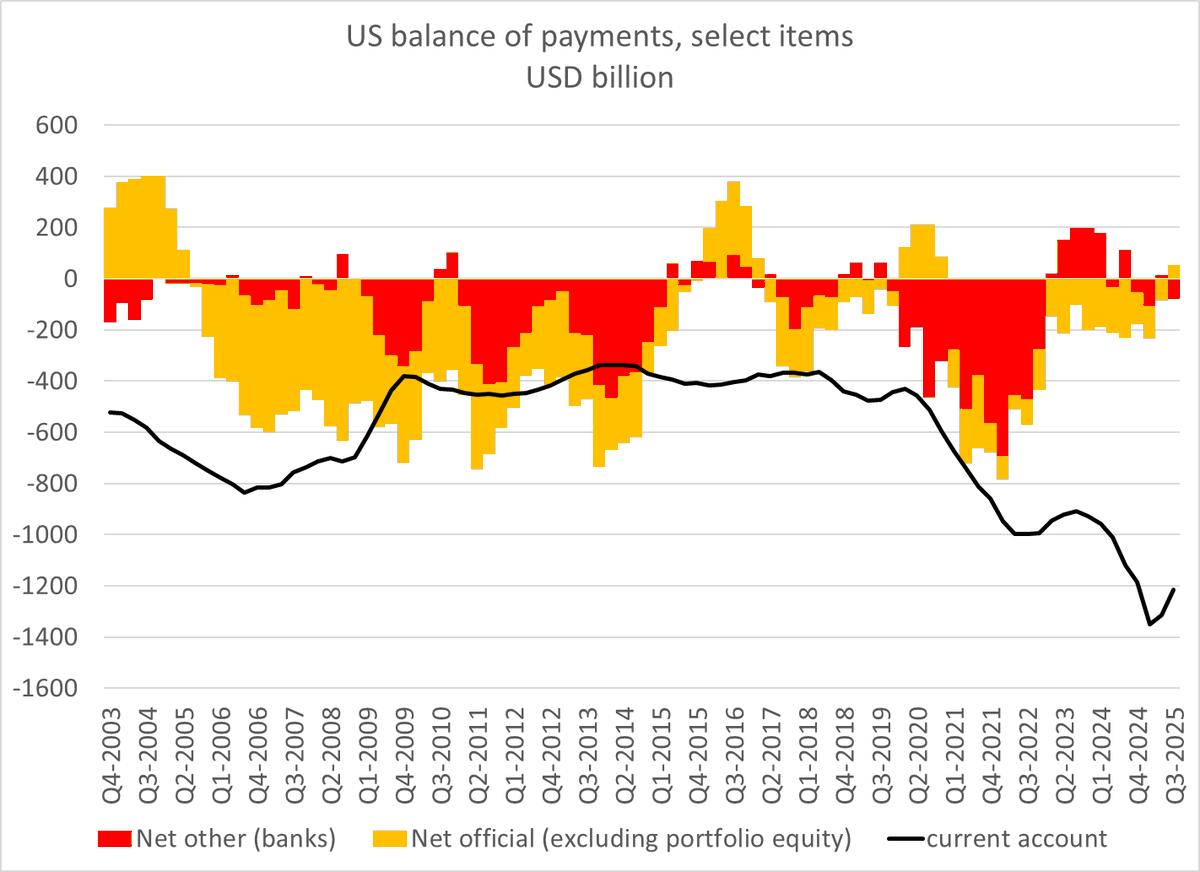

One meaning of a balance of payments deficit is a current account deficit in excess of financial inflows, and thus a draw on reserves -- something that happens in emerging economies, but not generally in advanced economies with floating exchange rates.

One meaning of a balance of payments deficit is a current account deficit in excess of financial inflows, and thus a draw on reserves -- something that happens in emerging economies, but not generally in advanced economies with floating exchange rates.

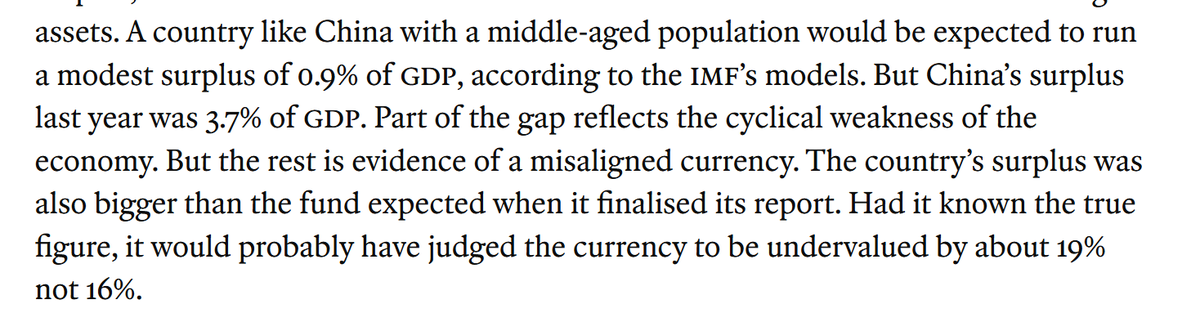

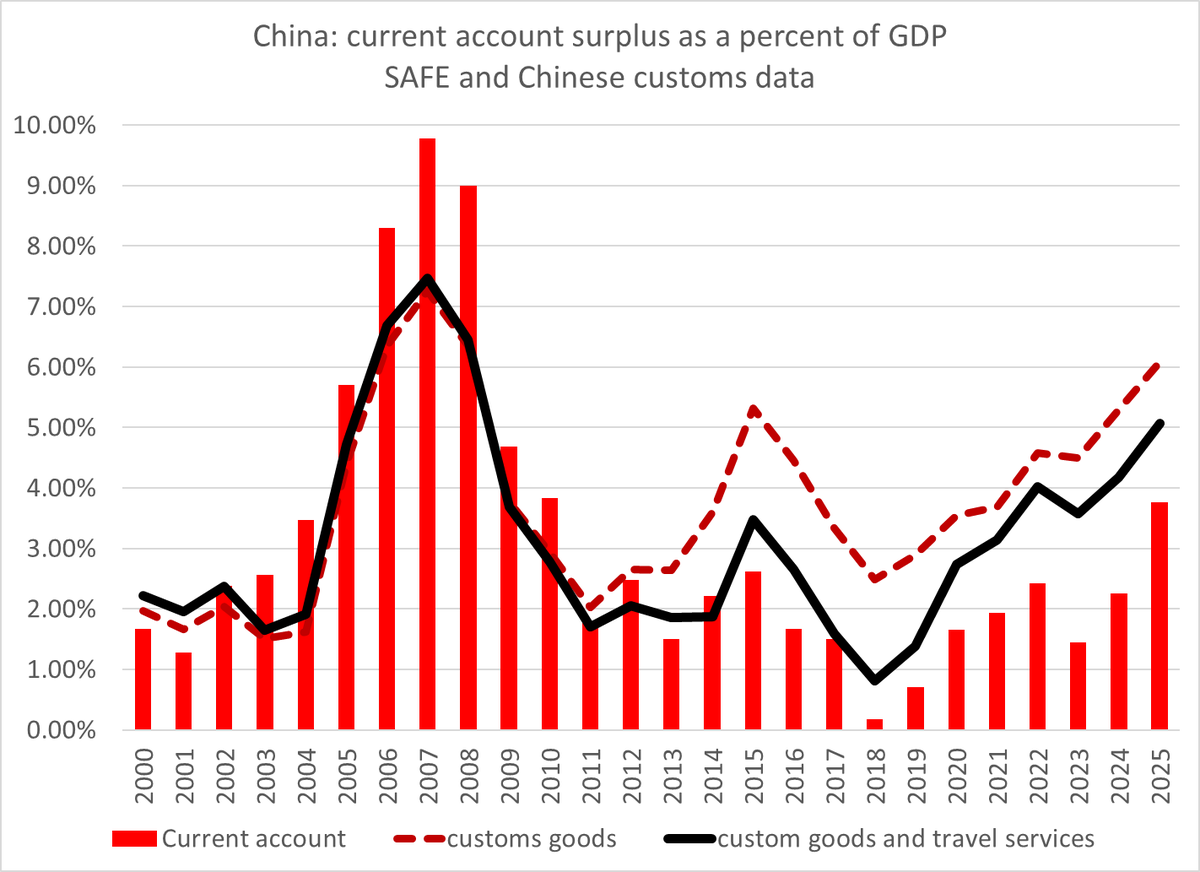

The IMF's 16% estimate in the Article IV was based on China's current account surplus though q3. The q4 data showed a bigger than expected surplus -- it pulled the full year surplus from 3.3% of GDP to 3.7% of GDP, changing the IMF's math ...

The IMF's 16% estimate in the Article IV was based on China's current account surplus though q3. The q4 data showed a bigger than expected surplus -- it pulled the full year surplus from 3.3% of GDP to 3.7% of GDP, changing the IMF's math ...

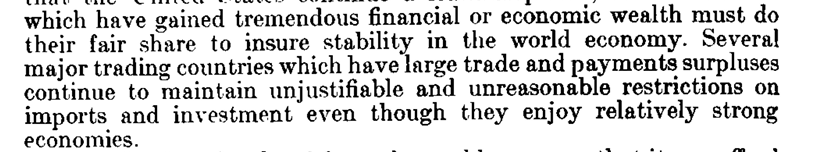

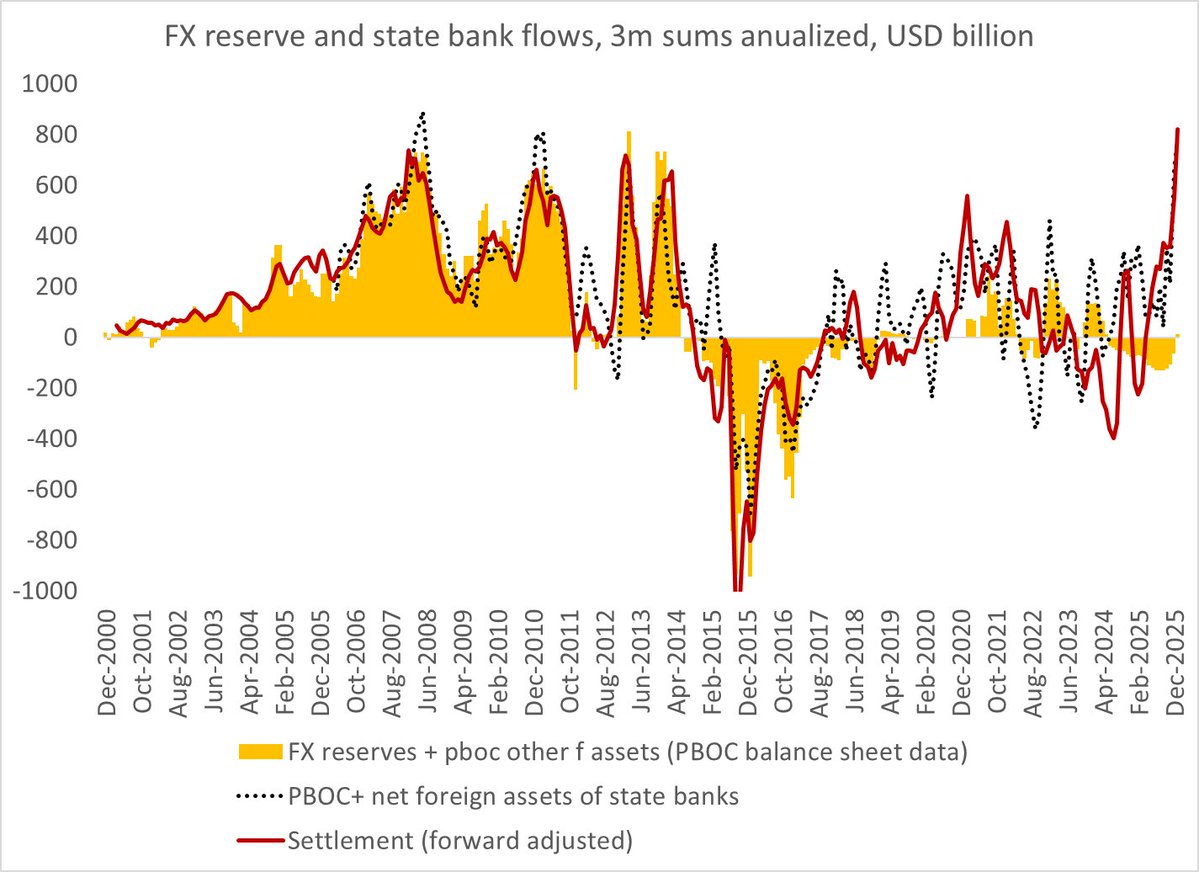

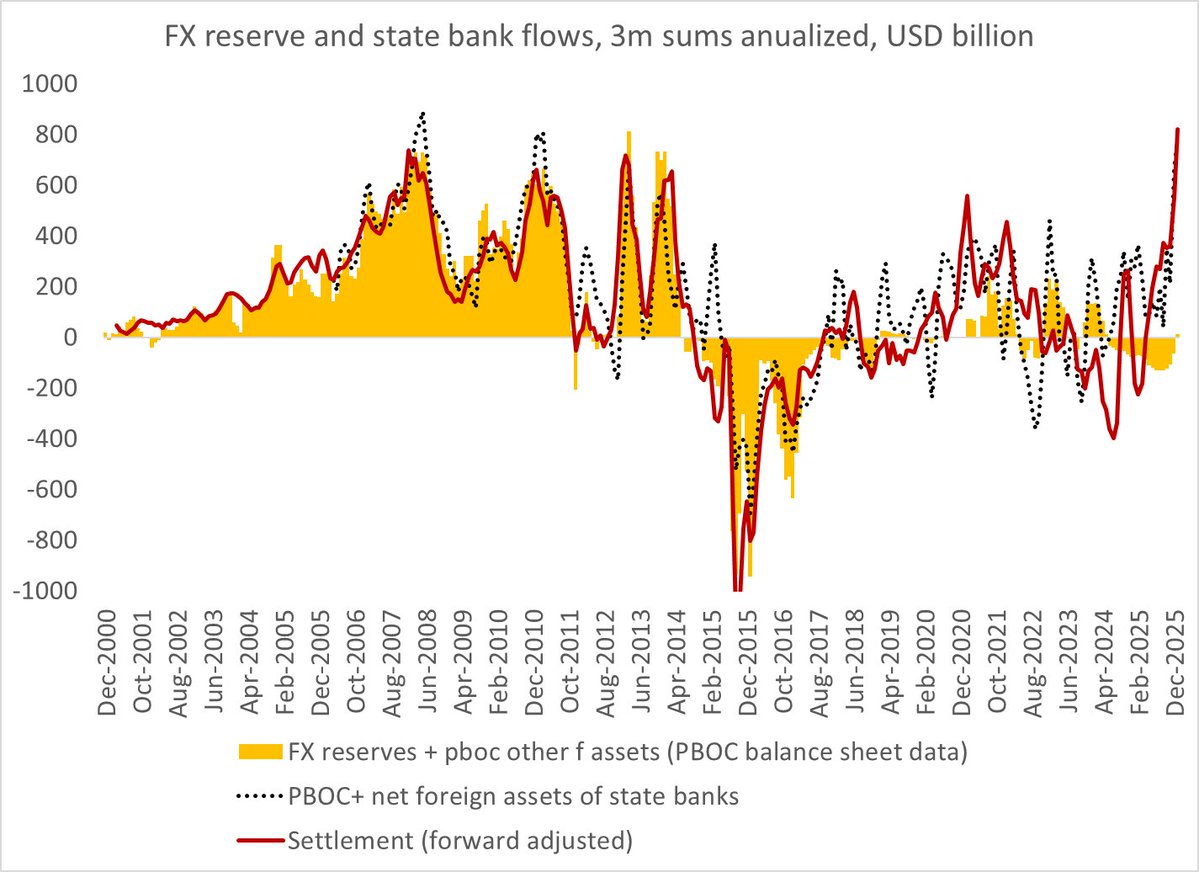

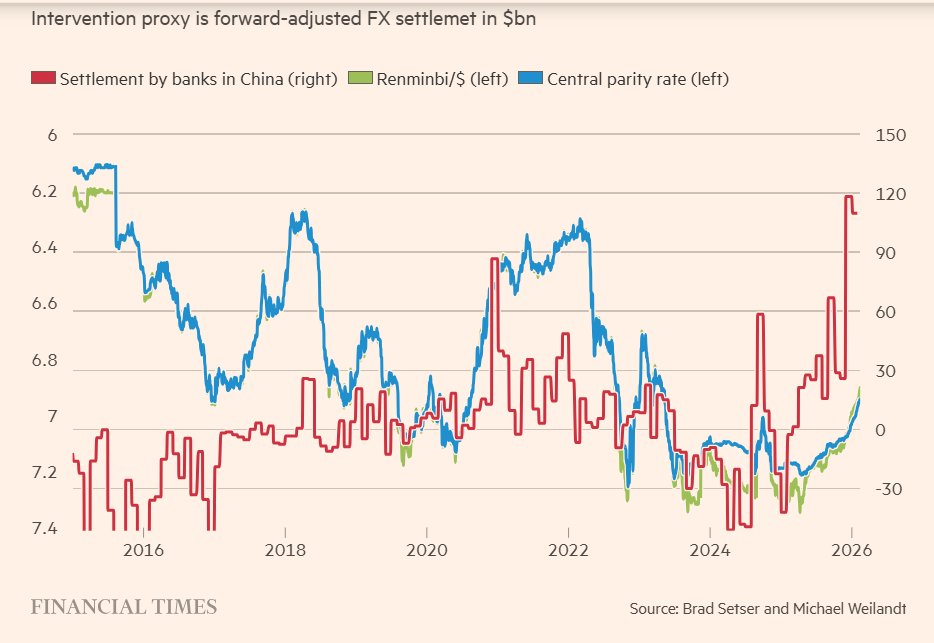

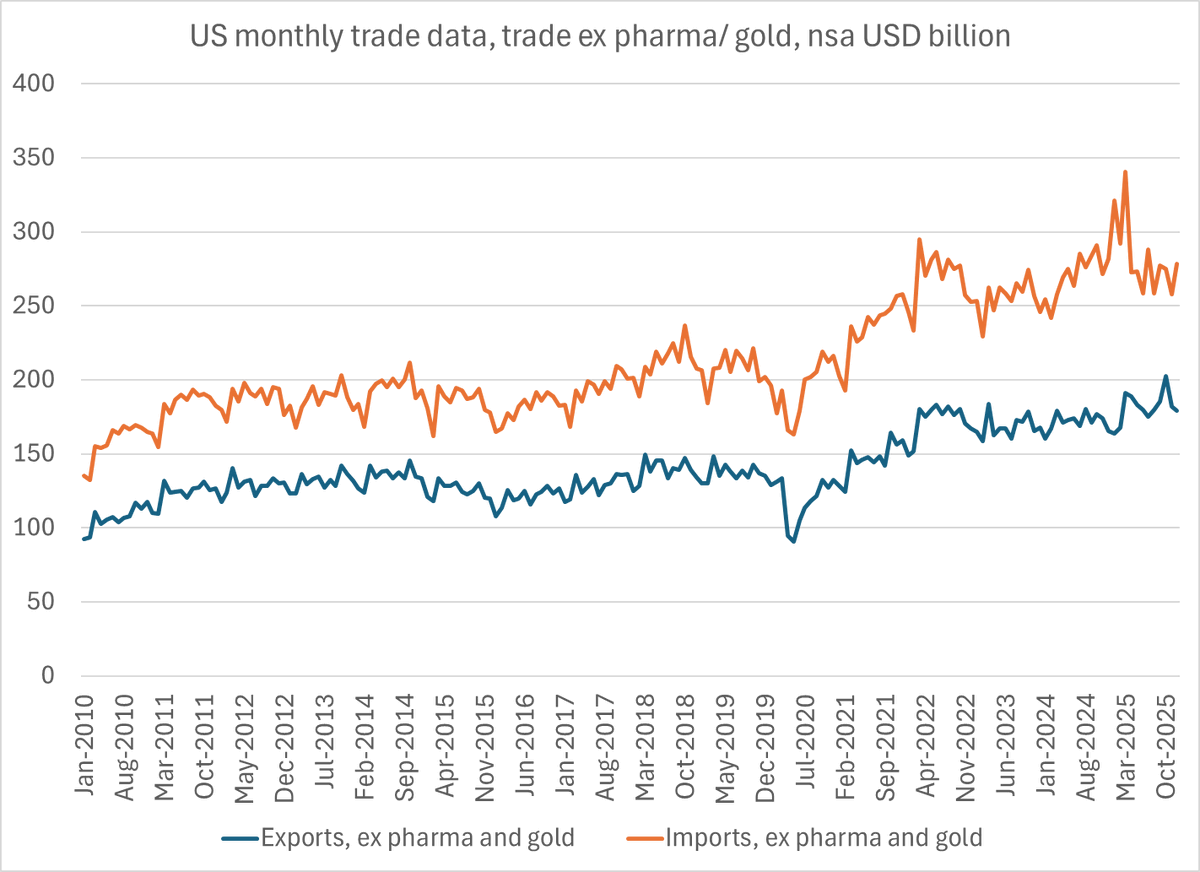

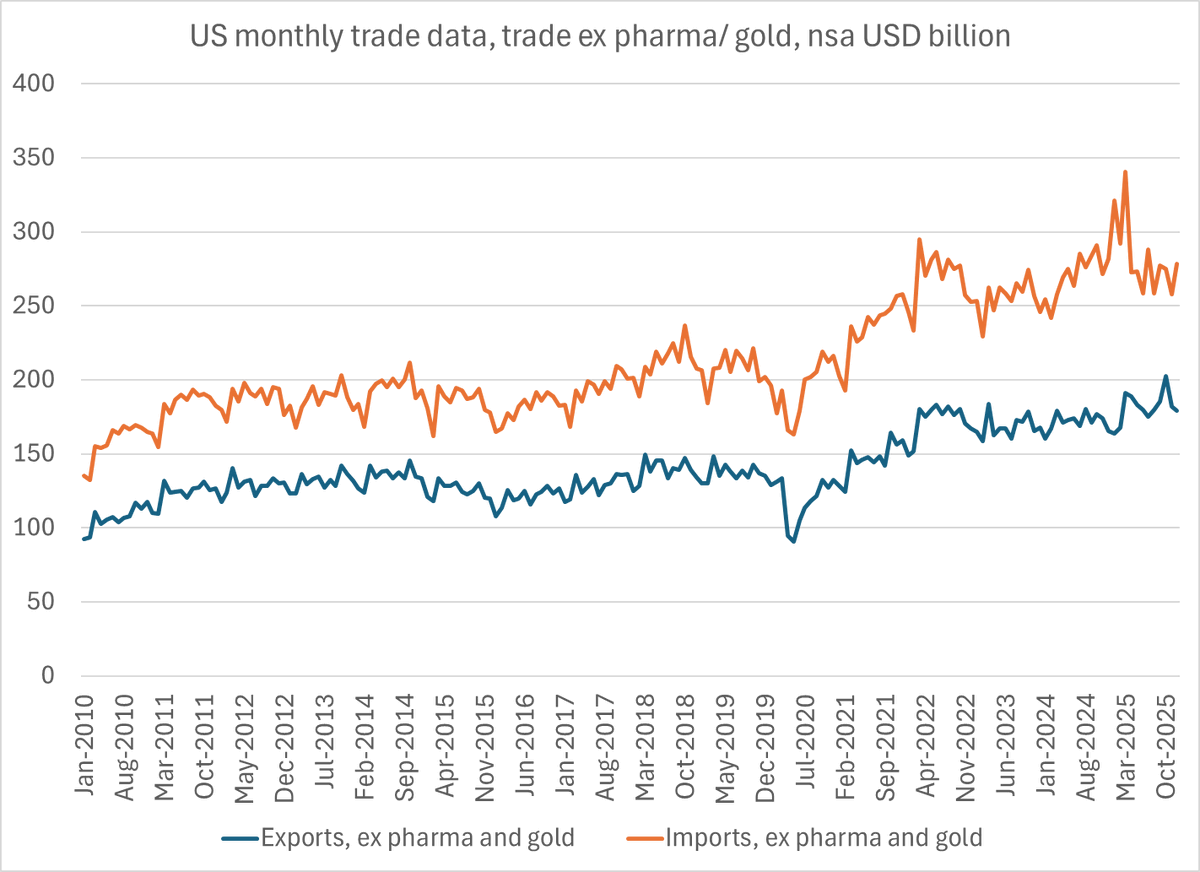

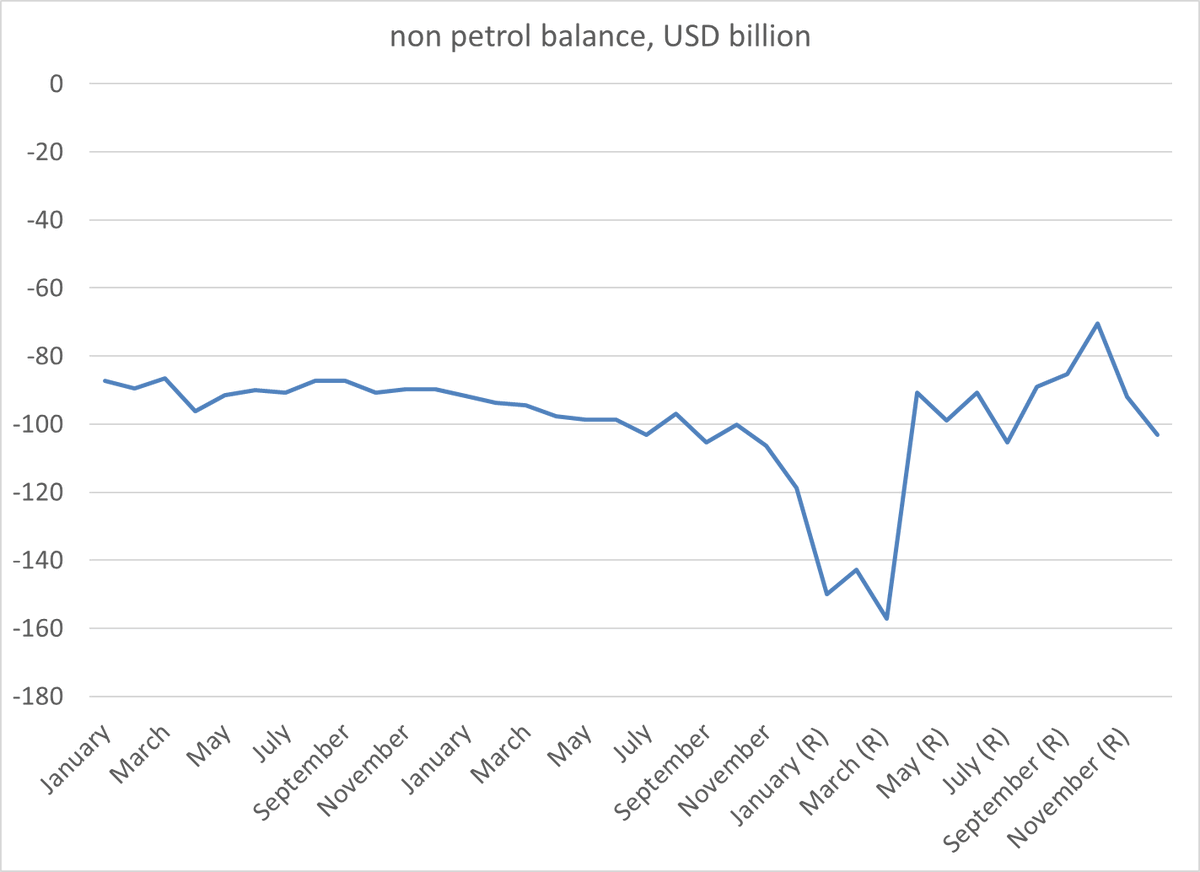

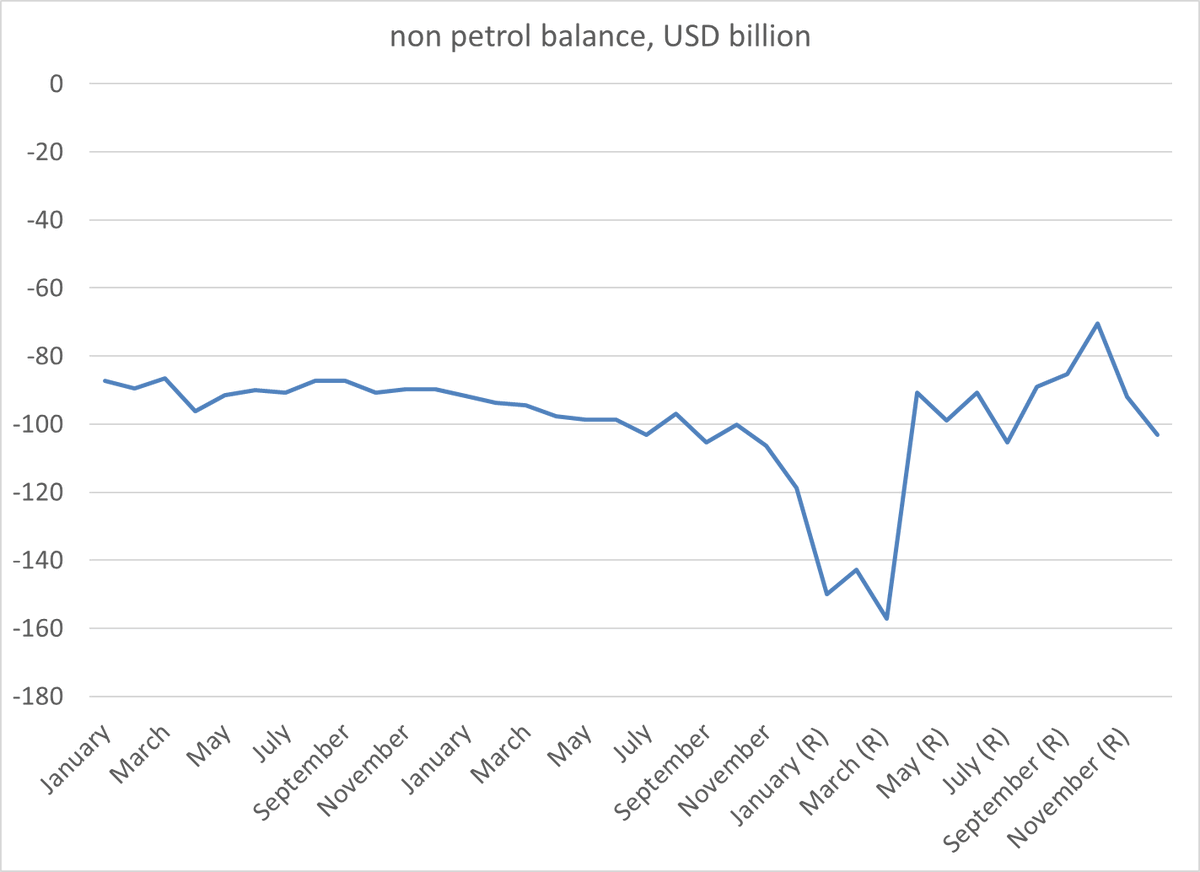

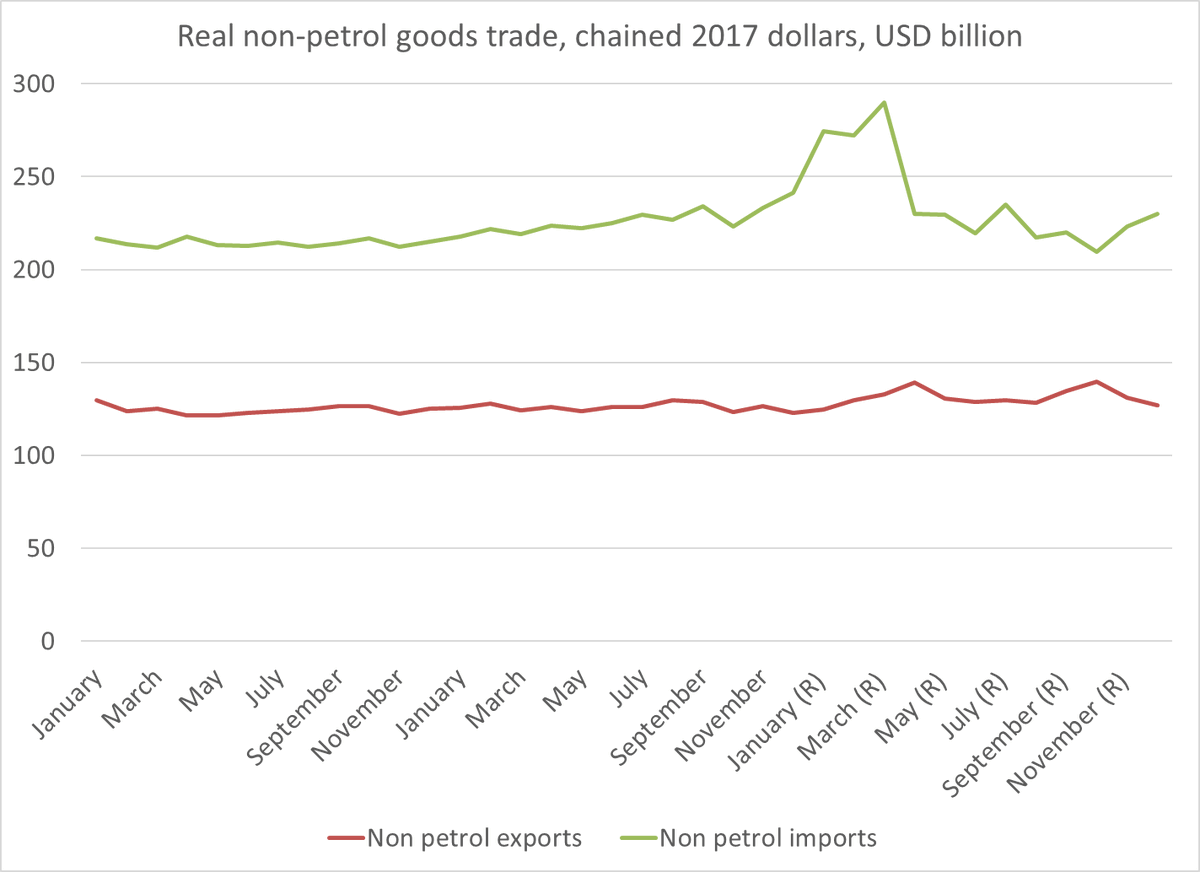

I should note that this adjustment matters less for December than for previous months -- but cleaning up the data for the rest of the year helps isolate the trend

I should note that this adjustment matters less for December than for previous months -- but cleaning up the data for the rest of the year helps isolate the trend

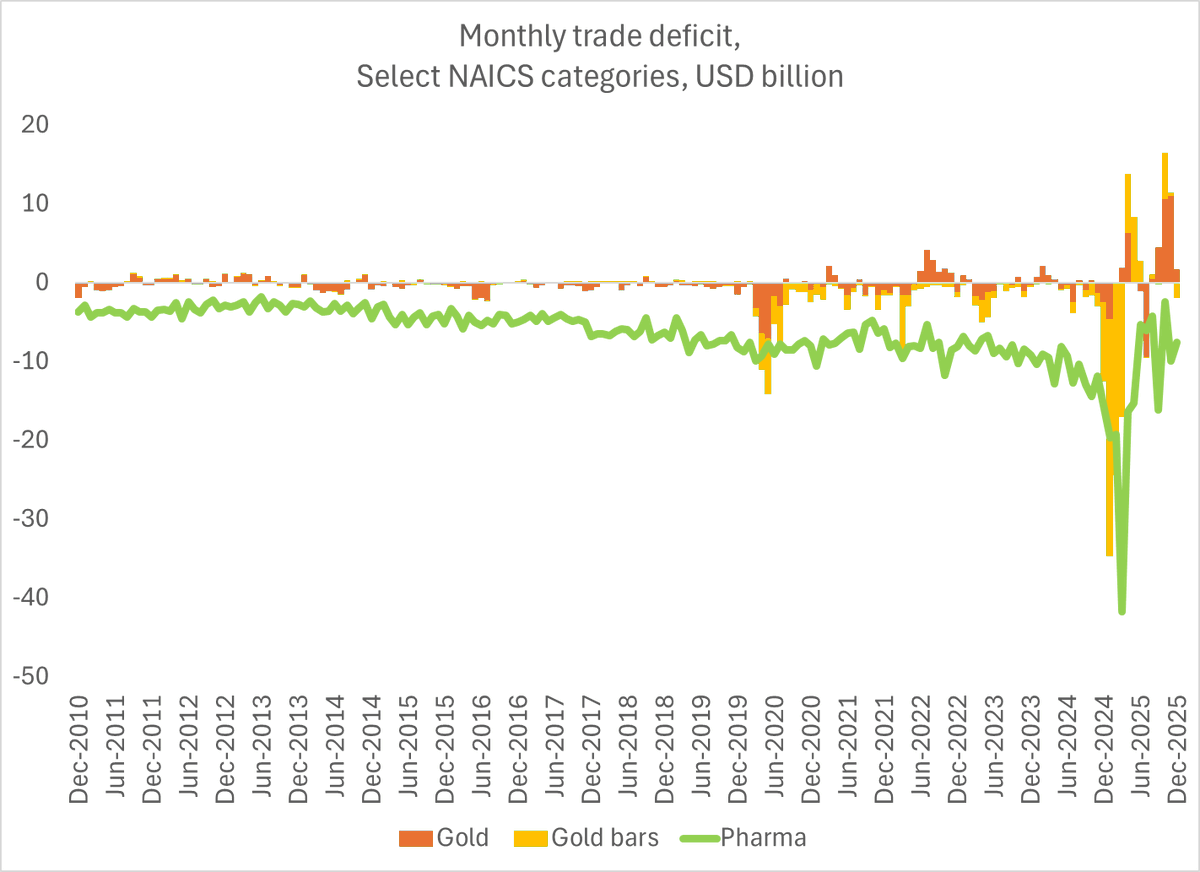

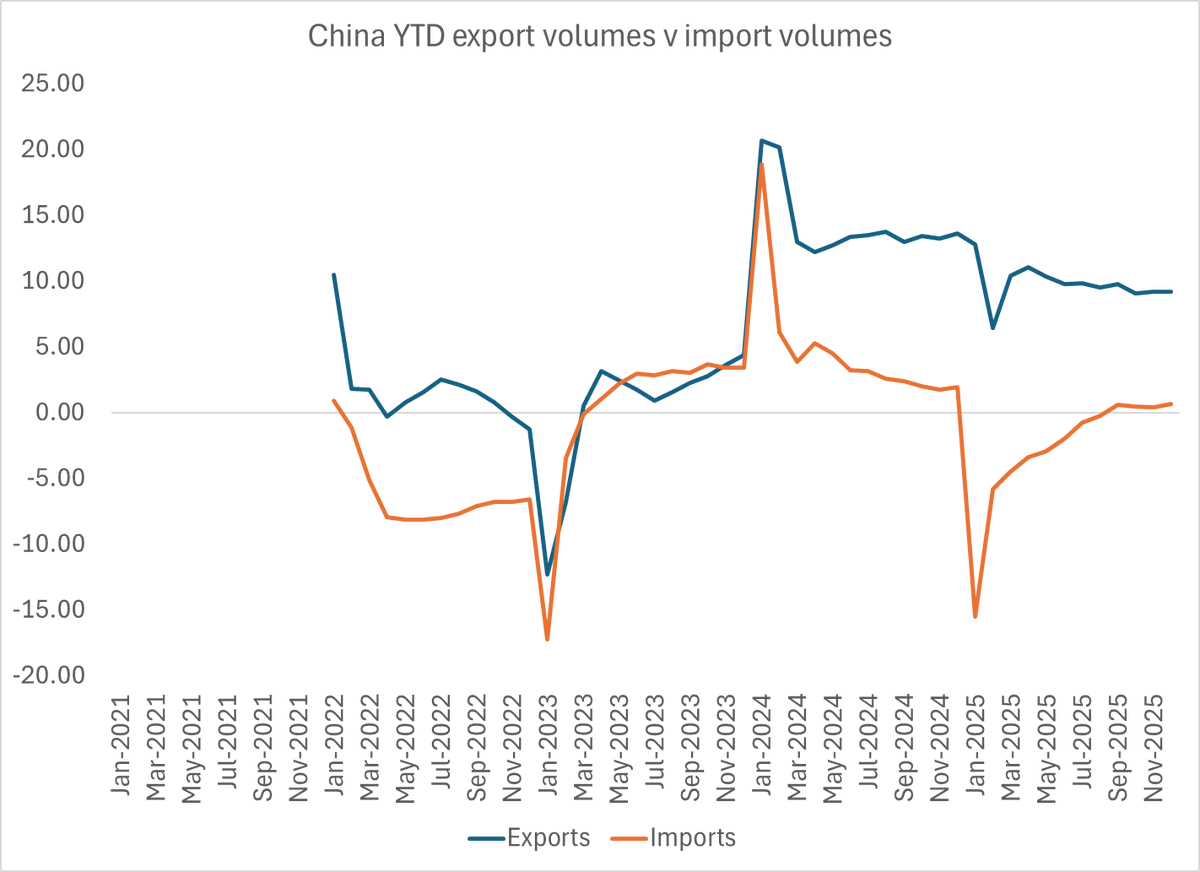

the tariff front running is obvious in the import data for q1 2025 (heavily pharma and gold, which weren't tariffed in the end). there was some payback later in the year ... I think the December uptick in imports tho is a real signal

the tariff front running is obvious in the import data for q1 2025 (heavily pharma and gold, which weren't tariffed in the end). there was some payback later in the year ... I think the December uptick in imports tho is a real signal

James Mayger and Jorgelina Do Rosario of Bloomberg reminded me that the 2024 staff report didn't mention external imbalances at all -- so there has been an important evolution in the IMF's thinking in the last couple of years

James Mayger and Jorgelina Do Rosario of Bloomberg reminded me that the 2024 staff report didn't mention external imbalances at all -- so there has been an important evolution in the IMF's thinking in the last couple of years

Goldman's forecast -- which is almost certainly better than the IMF's forthcoming forecast -- isn't that bold. The customs surplus net of tourism (travel) is already 5% of GDP, and that should be a reasonable estimate of the surplus of a country with a positive NIIP!

Goldman's forecast -- which is almost certainly better than the IMF's forthcoming forecast -- isn't that bold. The customs surplus net of tourism (travel) is already 5% of GDP, and that should be a reasonable estimate of the surplus of a country with a positive NIIP!

https://twitter.com/elerianm/status/2023109728679719176

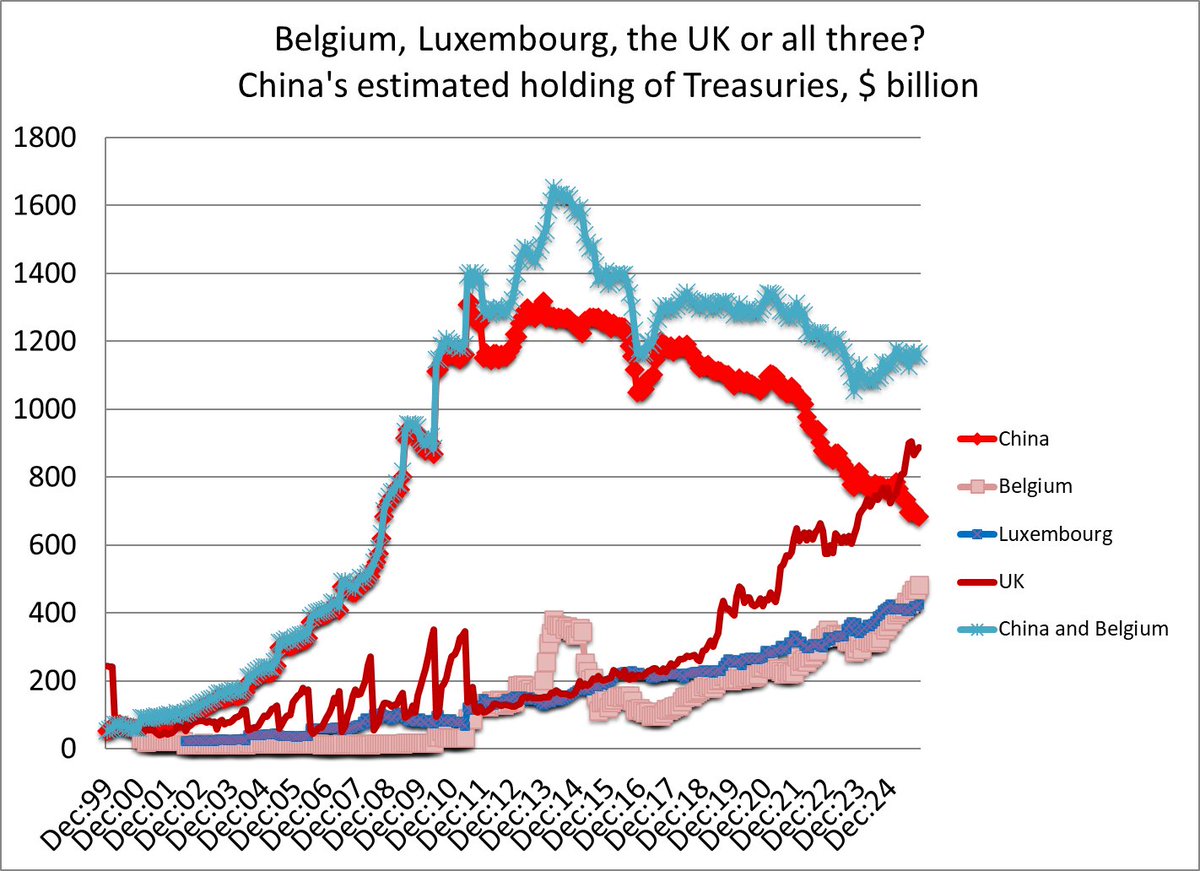

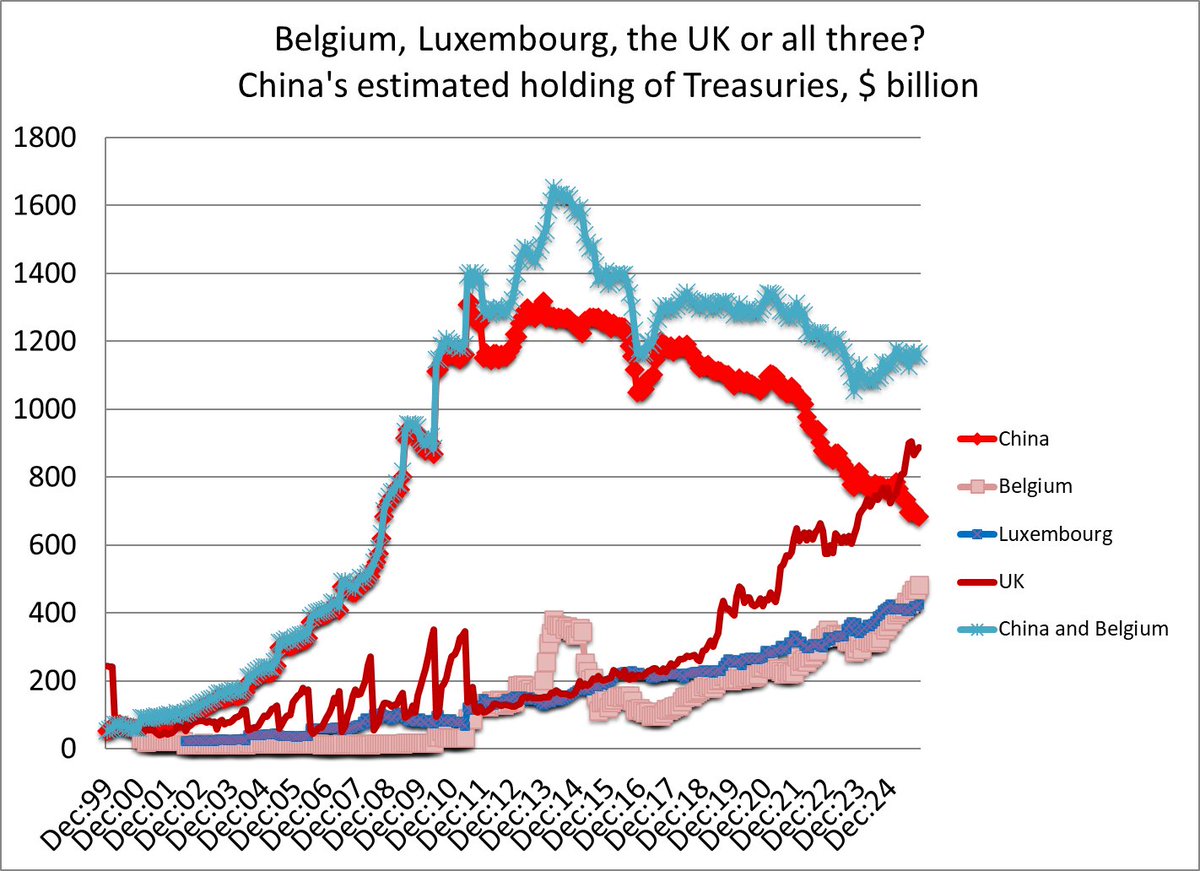

The total offshore assets of SAFE, the CIC, the SCBs (over $1.5 trillion now) and the policy banks likely approaches $7 trillion. SAFE's securities holdings top $3 trillion & other investors hold ~ $700b in foreign securities ...

The total offshore assets of SAFE, the CIC, the SCBs (over $1.5 trillion now) and the policy banks likely approaches $7 trillion. SAFE's securities holdings top $3 trillion & other investors hold ~ $700b in foreign securities ...

https://twitter.com/adam_tooze/status/2023015687573438840Rhodium for example thinks total growth in 2025 was around 3% -- which would imply that the 1.6 pp contribution from net exports "drove" China's growth

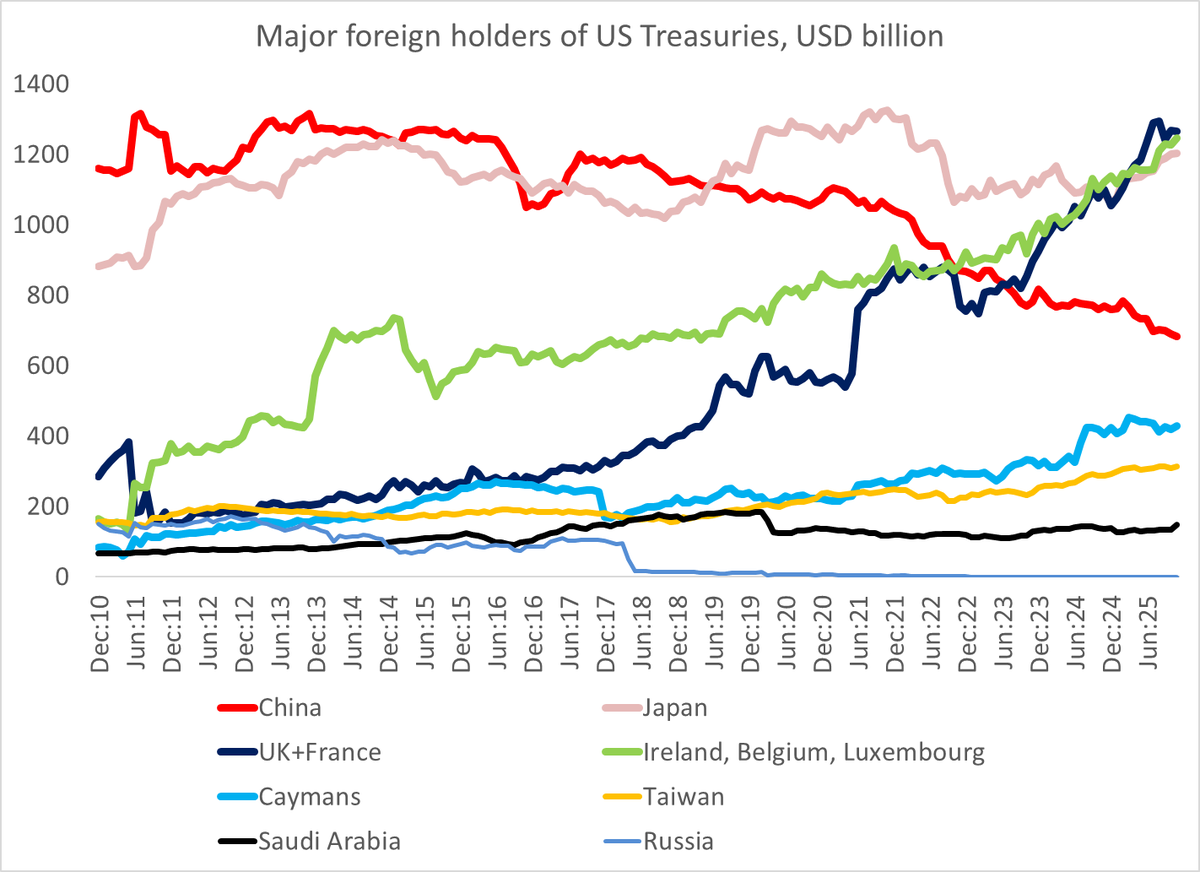

The official US data on foreign holdings doesn't show any basis for Chinese concern -- China's Treasuries in US custodianship (in theory state accounts as well as state bank accounts) are heading down not up

The official US data on foreign holdings doesn't show any basis for Chinese concern -- China's Treasuries in US custodianship (in theory state accounts as well as state bank accounts) are heading down not up

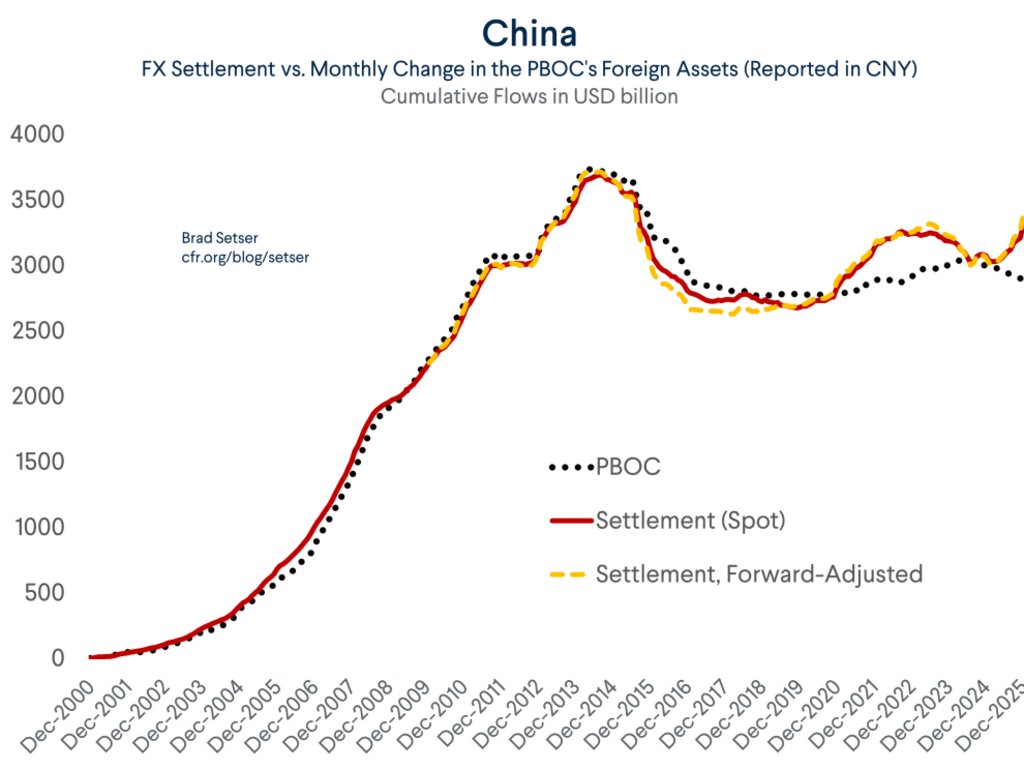

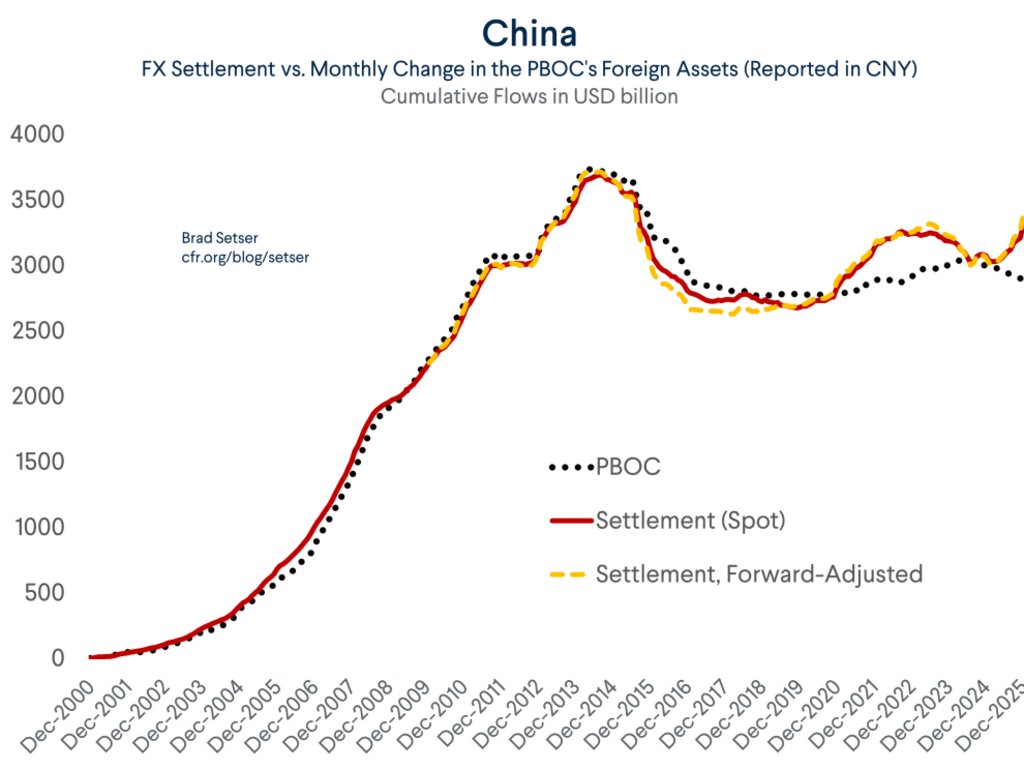

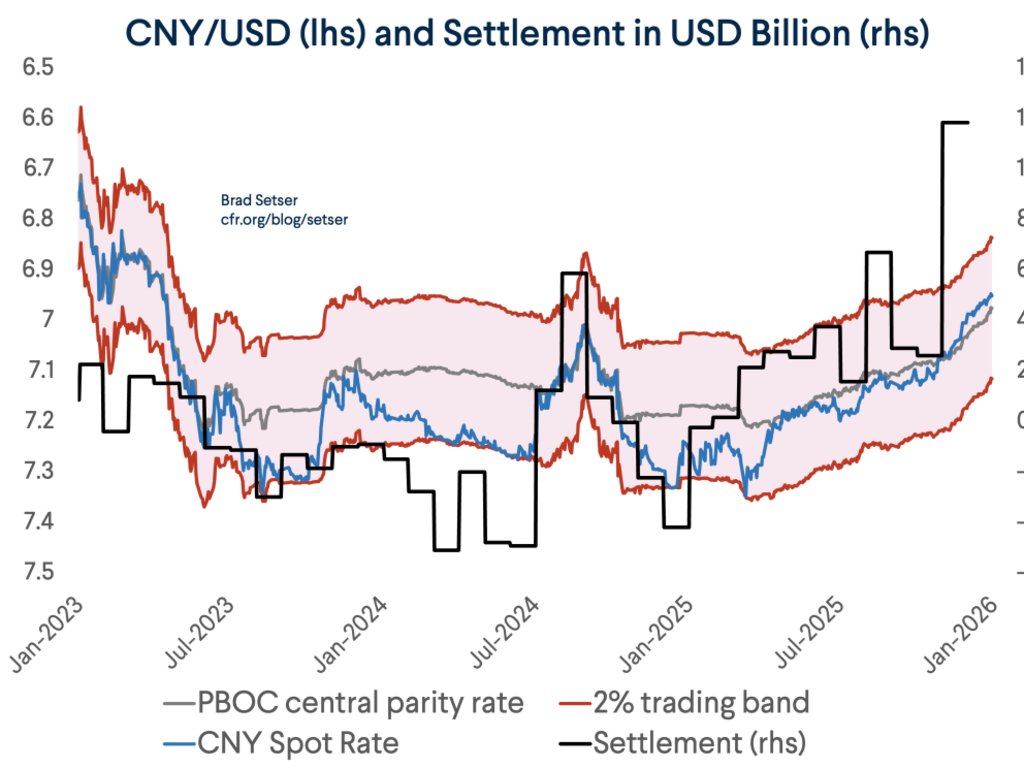

It is quite clear that state bank purchases (and in 23/ early 24 sales) of fx have replaced PBOC purchases and sales and the core technique China uses to manage the band around the daily fx -- i.e. settlement looks like an intervention variable

It is quite clear that state bank purchases (and in 23/ early 24 sales) of fx have replaced PBOC purchases and sales and the core technique China uses to manage the band around the daily fx -- i.e. settlement looks like an intervention variable

This seems clear

This seems clear