Now that we've had a moment to ponder the new twists in the trade war, a thread:

Trying to run out the clock makes sense to Chinese leadership: continue to escalate in hopes that the trade-war-induced fallout brings down Trump.

Trying to run out the clock makes sense to Chinese leadership: continue to escalate in hopes that the trade-war-induced fallout brings down Trump.

This has real costs to China—they sell us 4x more in goods than we sell them. But authoritarian govt’s are willing to sustain such pain, esp when the stakes are threats to their embedded model (eg, state-owned enterprises (SOEs)) and long-term sovereign plans, esp re foreign inv.

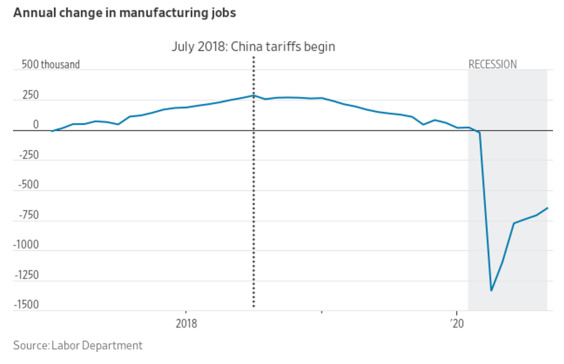

That strategy also has real costs to us, as Trump’s playing with recessionary fire, which doesn't help China, near-term. But longer-term (and they play long ball), it has spillover benefits for them (and all US trading partners/earth/people of color/people in general).

China also assumes the next president won’t be so rabidly protectionist…or crazy. That’s a good bet for them. Yet it’s also the case that all pres candidates pledge to “get tough on China.” What does that mean?

Mostly, as far as I can tell, sanctions by outside institutions, including new tribunals and multi-country approaches—“link arms against China’s unfair practices.” Can’t say how effective that would be but it’s a huge step back from Trump/Navarro.

Also, some candidates serious about mechanisms to fight currency misalignment, which is essential and long due. BTW, have folks seen this bipartisan Baldwin/Hawley plan? Interesting! I’m working on my take, but legislation is unusually readable! baldwin.senate.gov/imo/media/doc/…

Is that enough? What about China’s forced tech transfers, IP theft, SOEs, etc.?!

Meh. I realize I’m an outlier and people I respect feel otherwise, but that’s not the stuff China does that bothers me most—that would be their human rights’ violations.

hrw.org/world-report/2…

Meh. I realize I’m an outlier and people I respect feel otherwise, but that’s not the stuff China does that bothers me most—that would be their human rights’ violations.

hrw.org/world-report/2…

Protecting multinationals' IP will incentivize more, not less, offshoring. SOE's are none of our business--that's their model and anyway, I thought our religion was that the market rules, picking winners is for losers, etc.

washingtonpost.com/outlook/2019/0…

washingtonpost.com/outlook/2019/0…

So, re China, I’d a) end the tariffs, b) punch back hard against currency devaluation, and c) beat them at their own game of investing in new sectors to claim global market share, starting with green tech. [end] washingtonpost.com/news/postevery…

• • •

Missing some Tweet in this thread? You can try to

force a refresh