CEA Chair for President Biden. Former economic adviser to VP Biden. Views are my own. White House acct: @econjared46.

3 subscribers

How to get URL link on X (Twitter) App

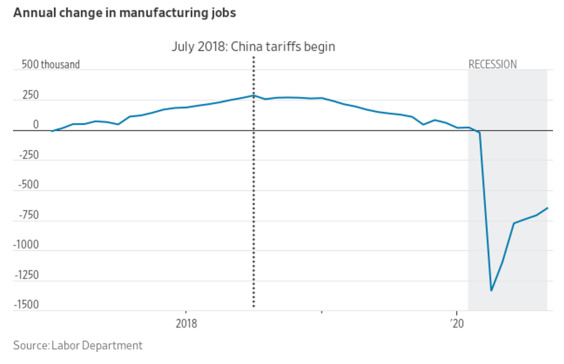

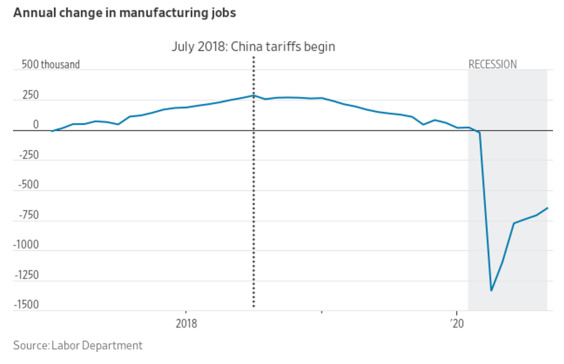

These articles underscore the fact that the trade deficit worsened under Trump, the factory sector was in recession **before** the pandemic, and all his alleged deals and photo ops at factories like Carrier in Indiana were reality TV, not reality.

These articles underscore the fact that the trade deficit worsened under Trump, the factory sector was in recession **before** the pandemic, and all his alleged deals and photo ops at factories like Carrier in Indiana were reality TV, not reality.

As @CenterOnBudget points out, this TTR (terrible trend reversal) continued last year even amid low unemp and job gains. After 6 yrs of decline, unins rate reversed in 2017 adding 2.3 million to the ranks of the uninsured. cbpp.org/sites/default/…

As @CenterOnBudget points out, this TTR (terrible trend reversal) continued last year even amid low unemp and job gains. After 6 yrs of decline, unins rate reversed in 2017 adding 2.3 million to the ranks of the uninsured. cbpp.org/sites/default/…

"Of particular interest for the estimates in this report are the differences in median income and educational attainment, indicating that respondents in 2020 had relatively higher income and were more educated than nonrespondents." This, of course, leads to an upward bias...

"Of particular interest for the estimates in this report are the differences in median income and educational attainment, indicating that respondents in 2020 had relatively higher income and were more educated than nonrespondents." This, of course, leads to an upward bias...

2) Why is that? Simple: because policy has tilted hard against union formation & collective bargaining. Thankfully, @EconomicPolicy has the 12-point plan to counteract this suppression, eg PRO Act, NLRA reform, more. I am SURE these ideas would help.

2) Why is that? Simple: because policy has tilted hard against union formation & collective bargaining. Thankfully, @EconomicPolicy has the 12-point plan to counteract this suppression, eg PRO Act, NLRA reform, more. I am SURE these ideas would help.

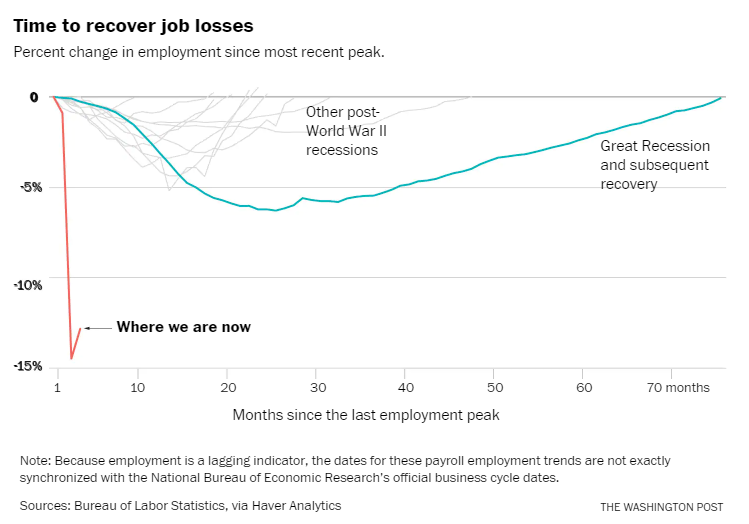

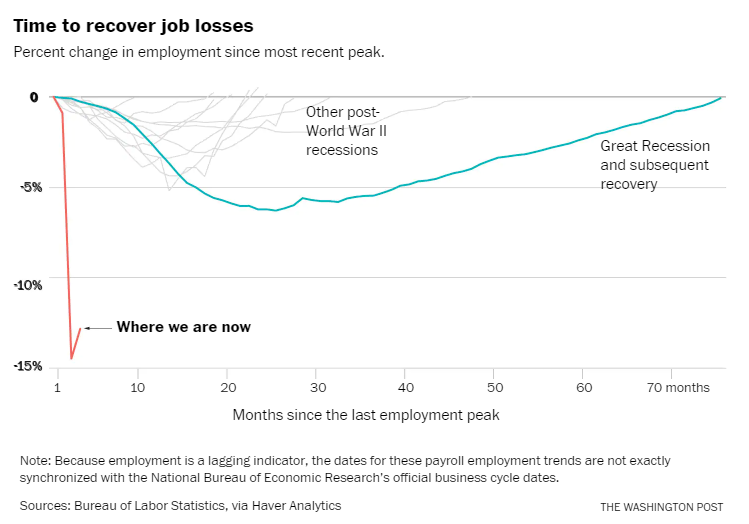

The table below provides the big picture. Payrolls cratered by over 20 mil during the shutdown and are not yet halfway back. At August rate of pvt sector gains, it would take over 10 months to get back to pre-pandemic peak. That's a low bar, tho, due to growth of working-age pop.

The table below provides the big picture. Payrolls cratered by over 20 mil during the shutdown and are not yet halfway back. At August rate of pvt sector gains, it would take over 10 months to get back to pre-pandemic peak. That's a low bar, tho, due to growth of working-age pop.

Exhibit A here is the extent to which expired UI benefits have been boosting spending for jobless persons. As the figure shows, such spending is "poised to decline." That's bad micro (households) and bad macro (overall growth).

Exhibit A here is the extent to which expired UI benefits have been boosting spending for jobless persons. As the figure shows, such spending is "poised to decline." That's bad micro (households) and bad macro (overall growth).

https://twitter.com/sam_a_bell/status/1289590210850779136--Congress should have discretion

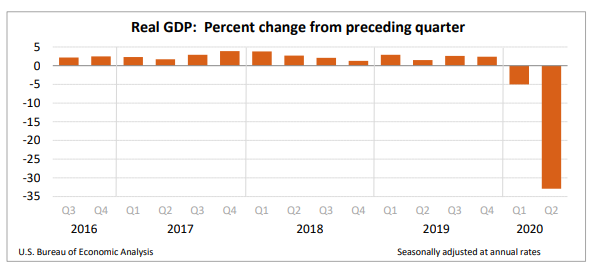

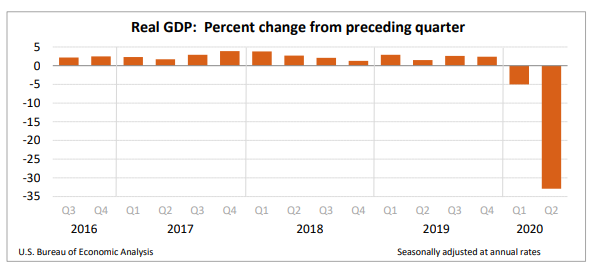

"Annual" means -33% would be GDPs pace of decline for a year if this same pace persisted for 4 quarters. But we know that didn't happen. The jobs data tell us that the Q2 damage was done in April due to the shutdown. As commerce returned, May/June were stronger.

"Annual" means -33% would be GDPs pace of decline for a year if this same pace persisted for 4 quarters. But we know that didn't happen. The jobs data tell us that the Q2 damage was done in April due to the shutdown. As commerce returned, May/June were stronger.

Germany is doing a particularly good job on both virus control and the economic response. EG, their “work-sharing” system which keeps people on the job, compensating them for diminished hours and the magnitude of their fiscal response: 55% of their GDP (we’re at ~15%).

Germany is doing a particularly good job on both virus control and the economic response. EG, their “work-sharing” system which keeps people on the job, compensating them for diminished hours and the magnitude of their fiscal response: 55% of their GDP (we’re at ~15%).

https://twitter.com/JStein_WaPo/status/1282661458057277441What's needed is fiscal forward guidance--clear, reliable assurances that Congress will continue to deliver relief until it isn't needed. Of course, politics block that, which is why economists like triggers that automatically turn the fiscal spigot on and off.

...at a huge 23%. It's the stimulus payments. Just the UI plus up itself is $700bn, annualized!! That's 4 freakin' % of income. With unemp stuck at recessionary levels, and the reopening stumbling due to the absence of any virus control, to take that much $...

...at a huge 23%. It's the stimulus payments. Just the UI plus up itself is $700bn, annualized!! That's 4 freakin' % of income. With unemp stuck at recessionary levels, and the reopening stumbling due to the absence of any virus control, to take that much $...

As my @CenterOnBudget colleagues point out, pre-pandemic, no ACA means 20 mil would lose coverage. But if SCOTUS strikes the law next year, millions more will lack coverage due to economic downturn and unique US system of coverage through work.

As my @CenterOnBudget colleagues point out, pre-pandemic, no ACA means 20 mil would lose coverage. But if SCOTUS strikes the law next year, millions more will lack coverage due to economic downturn and unique US system of coverage through work.

This is indicative of what I suspect we'll see with most important econ variables. Some improvement, even a big bounce (eg, may jobs, retail sales) followed by a flattening at recessionary levels. The political/economy/macro here is simple:

This is indicative of what I suspect we'll see with most important econ variables. Some improvement, even a big bounce (eg, may jobs, retail sales) followed by a flattening at recessionary levels. The political/economy/macro here is simple:

Do not conflate "we're at the bottom" with "ample jobs for all seekers!" Labor demand still far more slack than at the worst of last downturn. That's precisely why we need UI. And UIs usual replacement rates (~45% of past pay) are insufficient. Ergo, the plus up.

Do not conflate "we're at the bottom" with "ample jobs for all seekers!" Labor demand still far more slack than at the worst of last downturn. That's precisely why we need UI. And UIs usual replacement rates (~45% of past pay) are insufficient. Ergo, the plus up.