If you had N1m, how would you invest it?

This question is really asking how you would allocate N1 million amongst different asset classes. But before we consider that, let us start from the basics.

#FinPlanAssetAllocation

This question is really asking how you would allocate N1 million amongst different asset classes. But before we consider that, let us start from the basics.

#FinPlanAssetAllocation

What are asset classes?

Asset classes are securities that exhibit the same characteristics. For instance, Fixed Income as an asset class, will include all financial instruments that pay fixed returns.

#FinPlanAssetAllocation

Asset classes are securities that exhibit the same characteristics. For instance, Fixed Income as an asset class, will include all financial instruments that pay fixed returns.

#FinPlanAssetAllocation

They will range from “risk free” securities like Sovereign Bonds, to risky junk Bonds issued by the private sector. Look at asset classes as cars that take you to an investment destination.

#FinPlanAssetAllocation

#FinPlanAssetAllocation

Variable income as an asset class group will include all financial instruments whose return are not fixed, but variable in nature. These asset classes range from Equities, to include Real Estate Investment Trust (REITS), and even Derivatives.

#FinPlanAssetAllocation

#FinPlanAssetAllocation

So, how would you allocate N1 million?

Well, it depends on:

1. your age,

2. how much risk you are willing to take, and

3. how long you want to wait before you need your principal.

#FinPlanAssetAllocation

Well, it depends on:

1. your age,

2. how much risk you are willing to take, and

3. how long you want to wait before you need your principal.

#FinPlanAssetAllocation

To be clear, we are investing, not saving. What is the difference? Saving is simply the act of putting money away, while investing is the act of putting away money with a specific objective in mind, & the expectation of a positive return.

#FinPlanAssetAllocation

#FinPlanAssetAllocation

First consideration: how old are you?

Age is a very important factor because the younger you are, the more risk you can take. Why? If you are younger & lose all your investment capital, you have a better chance of starting over & replacing lost income

#FinPlanAssetAllocation

Age is a very important factor because the younger you are, the more risk you can take. Why? If you are younger & lose all your investment capital, you have a better chance of starting over & replacing lost income

#FinPlanAssetAllocation

Also on a positive note, age in finance means more compounding periods i.e., age means that your investments have more opportunities for earning to be ploughed back to grow compounded

#FinPlanAssetAllocation.

#FinPlanAssetAllocation.

If you are younger, its advised you invest more in variable income securities like equities, because over time they offer greater chances of higher Capital Appreciation returns, but with a higher risk.

#FinPlanAssetAllocation

#FinPlanAssetAllocation

If you are nearing retirement, then you should not under any circumstance invest more than 20% in variable income securities like Equity, no matter the return potential.

#FinPlanAssetAllocation

#FinPlanAssetAllocation

Ok...give you time to take it all in..we discuss Risk Profile and Investment Duration tommorow..

Same time

#FinPlanAssetAllocation

Same time

#FinPlanAssetAllocation

Second consideration: What are your objectives?

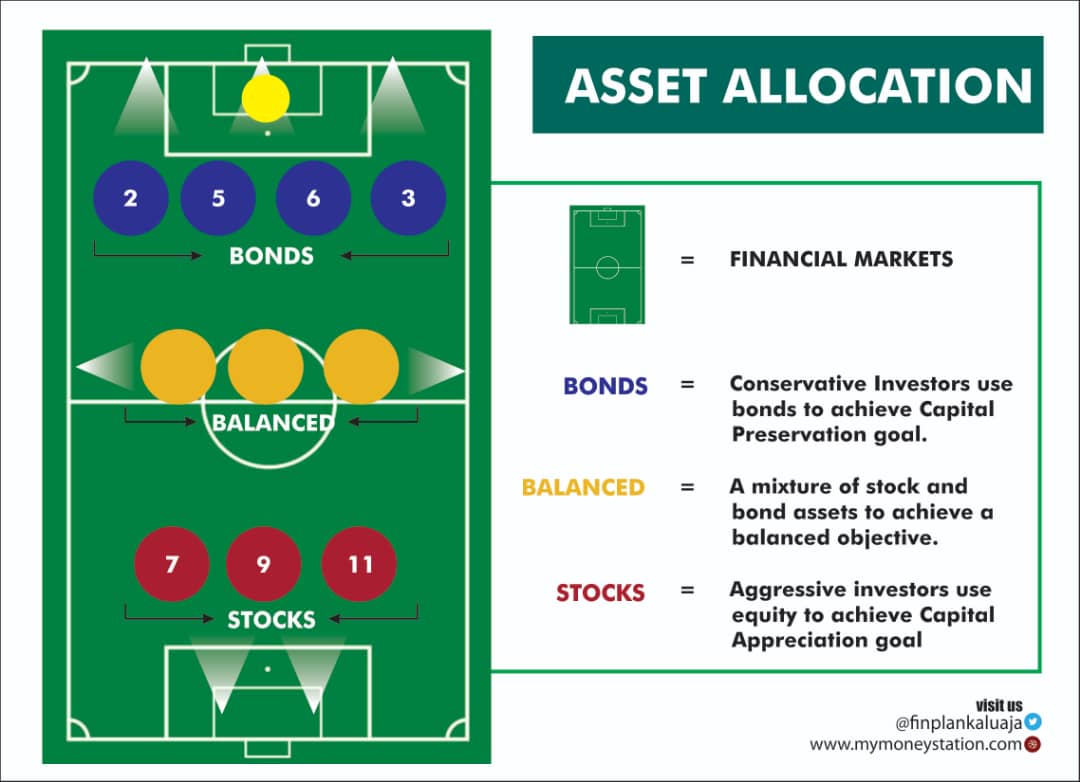

If your investment objective is to GROW your investment capital ie Capital Appreciation Goal, then you want to invest in variable income asset classes like shares.

#FinPlanAssetAllocation

If your investment objective is to GROW your investment capital ie Capital Appreciation Goal, then you want to invest in variable income asset classes like shares.

#FinPlanAssetAllocation

This is because variable income securities can appreciate your principal and have a higher propensity to beat inflation than fixed income securities. Keep in mind that more variable investment means more risk.

#FinPlanAssetAllocation

#FinPlanAssetAllocation

If, however, your objective is to protect your principal from loss with a Capital Preservation goal, then you should invest in fixed income. The risk here is that your returns may not beat inflation.

#FinPlanAssetAllocation

#FinPlanAssetAllocation

Last Consideration: How long do you have to stay invested?

If you have a long investment horizon, i.e. you can keep your investment in the financial market without seeking it back for more than 5 years, then you want to stay in variable income like equities.

If you have a long investment horizon, i.e. you can keep your investment in the financial market without seeking it back for more than 5 years, then you want to stay in variable income like equities.

This is because equities as an asset class allow the investor participate in the long term success of the company by reaping capital Appreciation and/or Dividends.

#FinPlanAssetAllocation

#FinPlanAssetAllocation

However, if your will want your investment capital back in less than 24 months, it is advisable you invest in fixed income because you can determine exactly how long you want to stay invested.

#FinPlanAssetAllocation

#FinPlanAssetAllocation

Let us look at scenarios:

Recently-employed 21-year old Ade, was gifted N1 million by his rich aunty. He wants to save this to fund his wedding in 10 years. How should he invest this fund?

#FinPlanAssetAllocation

Recently-employed 21-year old Ade, was gifted N1 million by his rich aunty. He wants to save this to fund his wedding in 10 years. How should he invest this fund?

#FinPlanAssetAllocation

I recommend:

70% in Variable Income, specifically mid and large capitalization stock

20% in Fixed Income, specifically 2yr Saving Bond

10% in Cash as Money on Call with a Bank

Why?

#FinPlanAssetAllocation

70% in Variable Income, specifically mid and large capitalization stock

20% in Fixed Income, specifically 2yr Saving Bond

10% in Cash as Money on Call with a Bank

Why?

#FinPlanAssetAllocation

His Objective is long term capital appreciation so Shares 70%

He may need cash before 10 years, so I invested 20% in safe Government bonds payable every 24 months. This is also diversification to protect the portfolio.

#FinPlanAssetAllocation

He may need cash before 10 years, so I invested 20% in safe Government bonds payable every 24 months. This is also diversification to protect the portfolio.

#FinPlanAssetAllocation

Ade may need cash to buy his engagement ring, we put 10% in Call bank to prevent breaking any invested principal before maturity.

Asset Allocation is the most important ingridient for investment success.

Asset Allocation is the most important ingridient for investment success.

Lesson is basically done but I will give you homework😊

2. Okoro, 64, about to retire, received N1m as gratuity advance payment. How should he deploy this?

Can you post a sample Asset allocation for Okoro?

I will post mine tommorow....we can compare

#FinPlanAssetAllocation

2. Okoro, 64, about to retire, received N1m as gratuity advance payment. How should he deploy this?

Can you post a sample Asset allocation for Okoro?

I will post mine tommorow....we can compare

#FinPlanAssetAllocation

These case studies have picked both extremes of investors. You may find yourself with similar objectives as either examples, e.g., low risk profile but seeking capital appreciation, which then means that you need a balanced portfolio.

#FinPlanAssetAllocation

#FinPlanAssetAllocation

Again this is not a recommendation to buy or sell, shares are very risky and you can lose 100% of your capital....always consult a financial adviser before investing.

tommorow....same time

#FinPlanAssetAllocation

tommorow....same time

#FinPlanAssetAllocation

• • •

Missing some Tweet in this thread? You can try to

force a refresh