Your savings lie in 2 bank acs - Bank B (for contingencies) & in Bank A (for daily expenses).

Due to an externality, you estimate that your expenses > than income + Bank A savings.

You have surplus savings in Bank B.

Will it be a good move to transfer the surplus from B to A?

Due to an externality, you estimate that your expenses > than income + Bank A savings.

You have surplus savings in Bank B.

Will it be a good move to transfer the surplus from B to A?

https://twitter.com/VishakhaJ18/status/1166323567195230209

In absence of this transfer, you may have to borrow to meet the expenses for the contingency.

Would it not be preferable to minimize increasing the debt burden when surplus savings can help partly meet the contingency?

That essentially is what’s happening with RBI transfer.

Would it not be preferable to minimize increasing the debt burden when surplus savings can help partly meet the contingency?

That essentially is what’s happening with RBI transfer.

1. On behalf of We The People, Government manages the Public Exchequer. (Bank A)

2. Government (We The People) is the shareholder of RBI (Bank B)

3. Transferring Surplus from Bank B to Bank A does not alter claim of We The People.

4. It is an accounting entry for WTP!

2. Government (We The People) is the shareholder of RBI (Bank B)

3. Transferring Surplus from Bank B to Bank A does not alter claim of We The People.

4. It is an accounting entry for WTP!

“Government looting RBI” sounds as intelligent as claiming “I looted myself” by transferring my surplus from Bank B to Bank A!

Oversimplification?

Well of course yes!

For refined nuances, refer to @teasri’s thread.

Oversimplification?

Well of course yes!

For refined nuances, refer to @teasri’s thread.

https://twitter.com/teasri/status/1166311511838642176

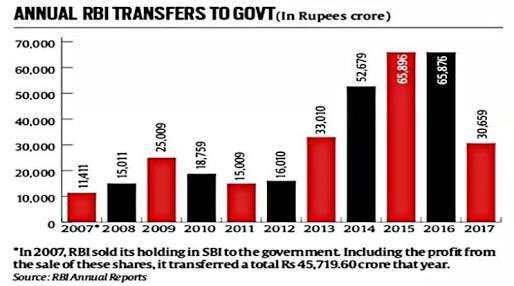

Transferring Surplus to the Government in form of Dividends or One Time Gains is normal practice.

In India, and globally!

In India, and globally!

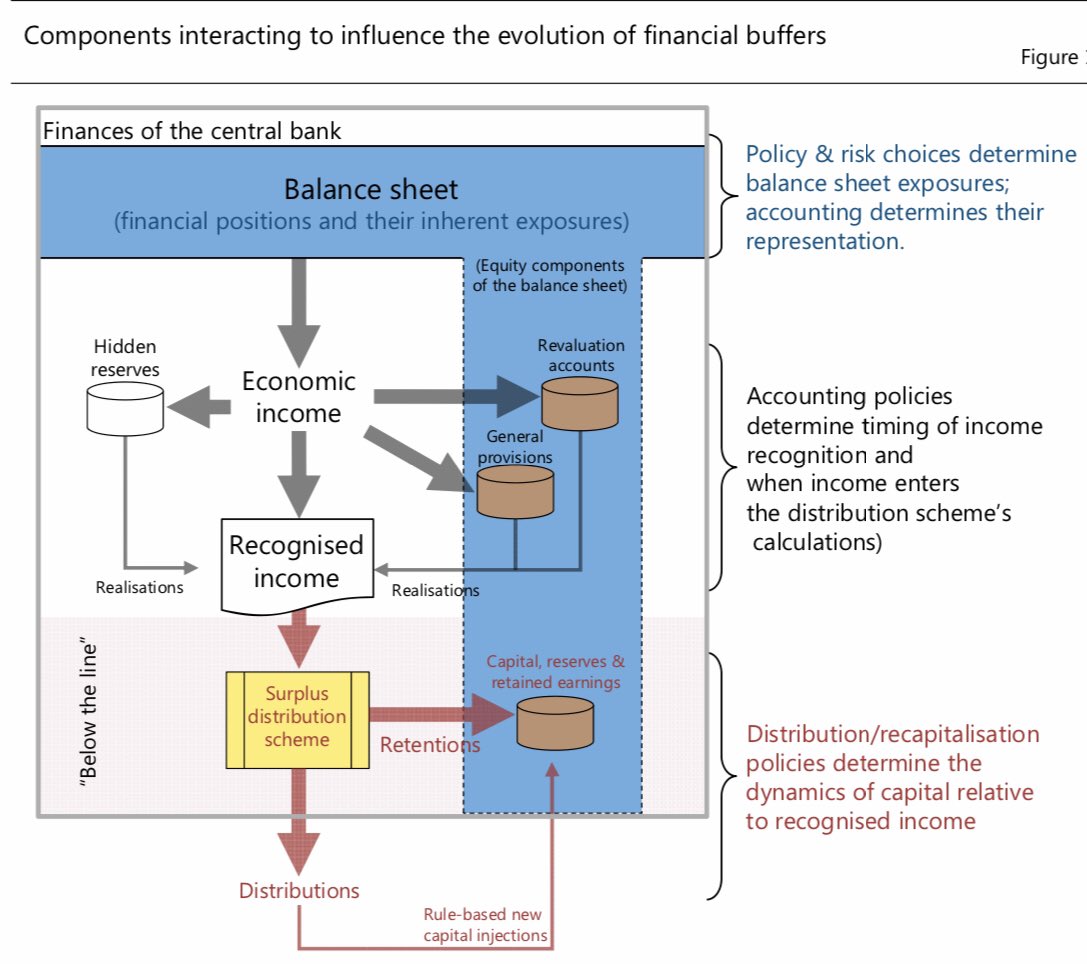

The BIS Paper on Central Bank Finances can be referred for understanding in detail which component of the Equity is distributable and which part should be left untouched.

The Bimal Jalan Committe has undertaken a comprehensive review of the Economic Capital Framework of the RBI in line with the Global Central Banking Standards.

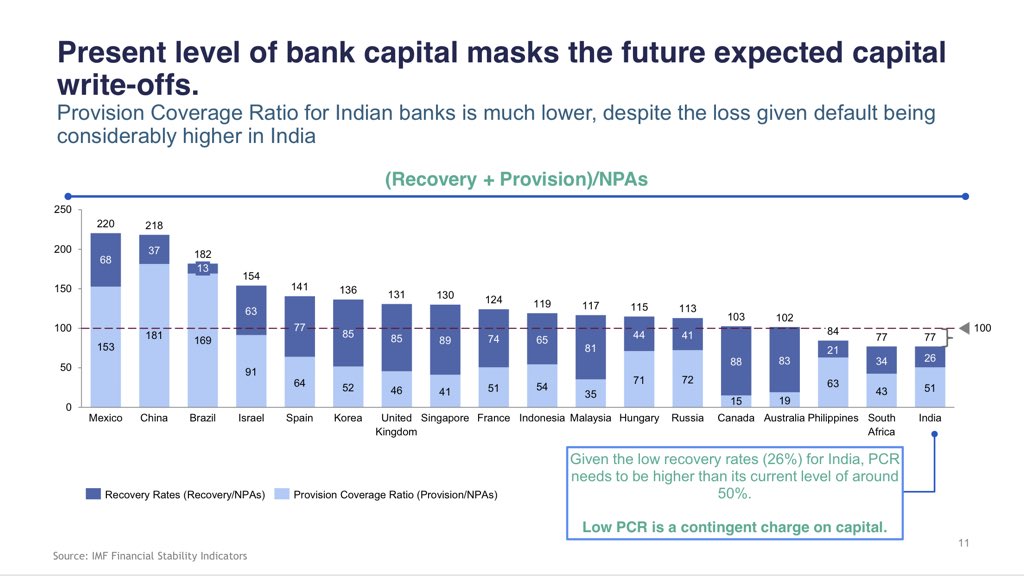

Even after the transfer, RBI stands as a central bank with one of the highest levels of financial resilience globally!

Even after the transfer, RBI stands as a central bank with one of the highest levels of financial resilience globally!

So why is this transfer required?

Opens up fiscal space for Govt to Capitalize SOE Banks or Undertake GST Rate Cuts to give the Growth Stimulus to the Economy.

(Wasn’t this being demanded until last week? ₹5 ParleG?)

Stimulus with minimal incremental borrowing now possible!

Opens up fiscal space for Govt to Capitalize SOE Banks or Undertake GST Rate Cuts to give the Growth Stimulus to the Economy.

(Wasn’t this being demanded until last week? ₹5 ParleG?)

Stimulus with minimal incremental borrowing now possible!

• • •

Missing some Tweet in this thread? You can try to

force a refresh