How to get URL link on X (Twitter) App

https://twitter.com/bw/status/1499366050495877120The Allure of holding treasuries can reduce dramatically post this event for Non-Western Nations.

https://twitter.com/ANI/status/1373187694847619073After Sachin Vaze, the next in line for interrogation could likely be the ex-Mumbai CP Parambir Singh.

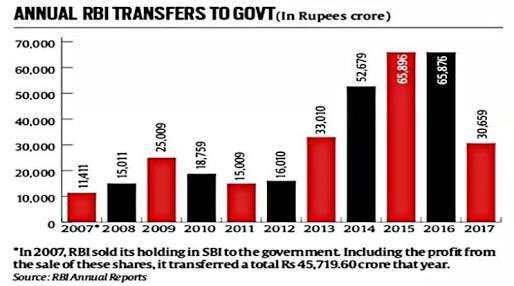

https://twitter.com/VishakhaJ18/status/1166323567195230209In absence of this transfer, you may have to borrow to meet the expenses for the contingency.

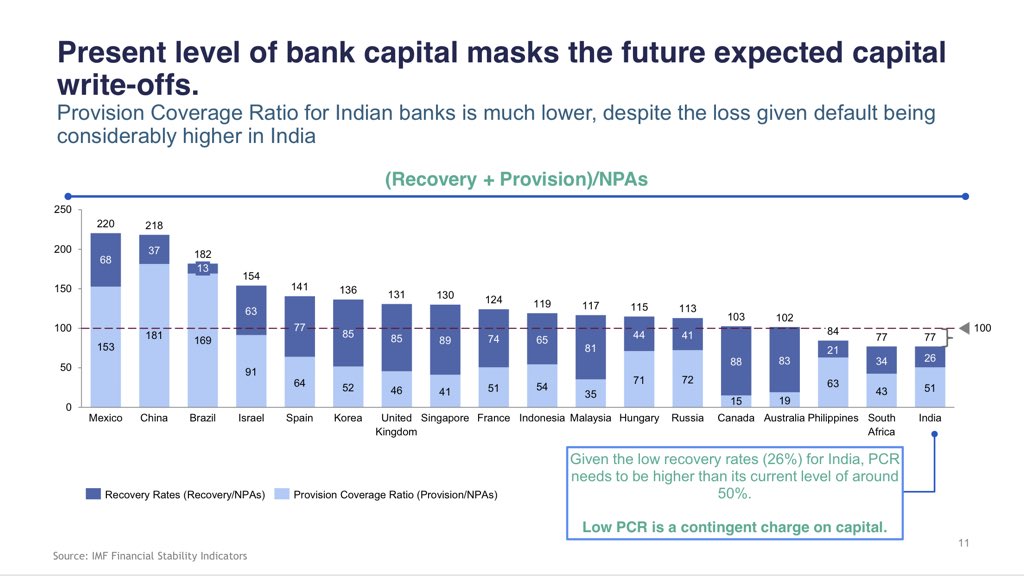

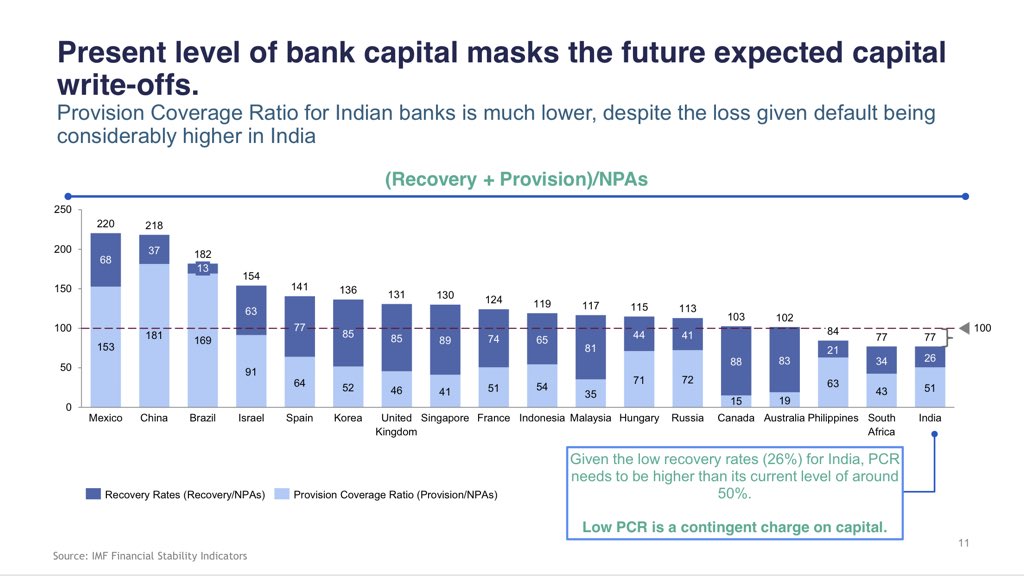

Dr. Patel has dispassionately analyzed why Indian Banks have been structurally challenged.

Dr. Patel has dispassionately analyzed why Indian Banks have been structurally challenged.