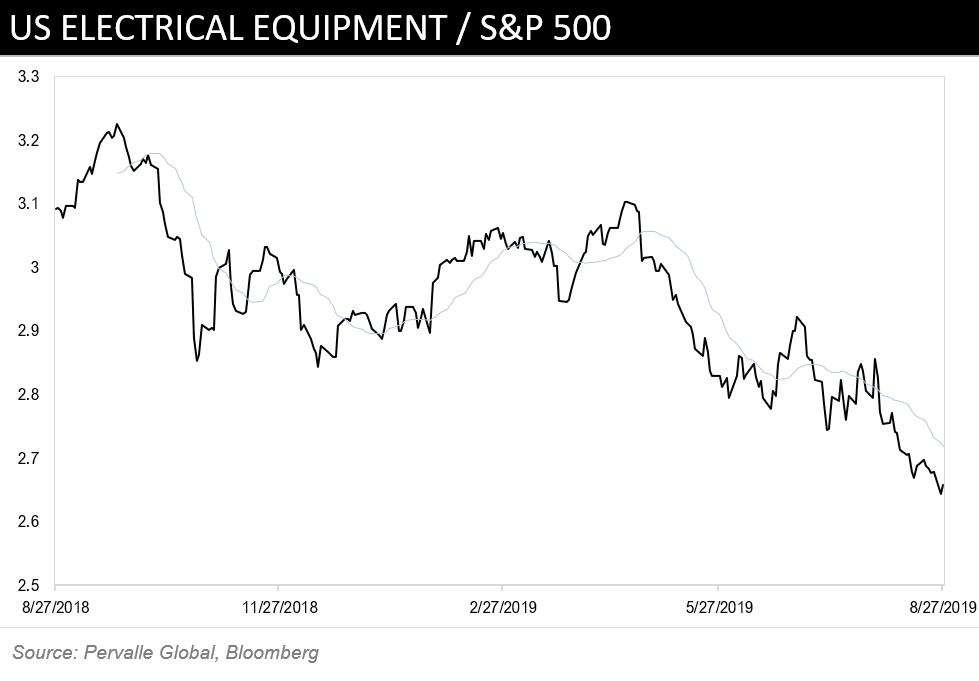

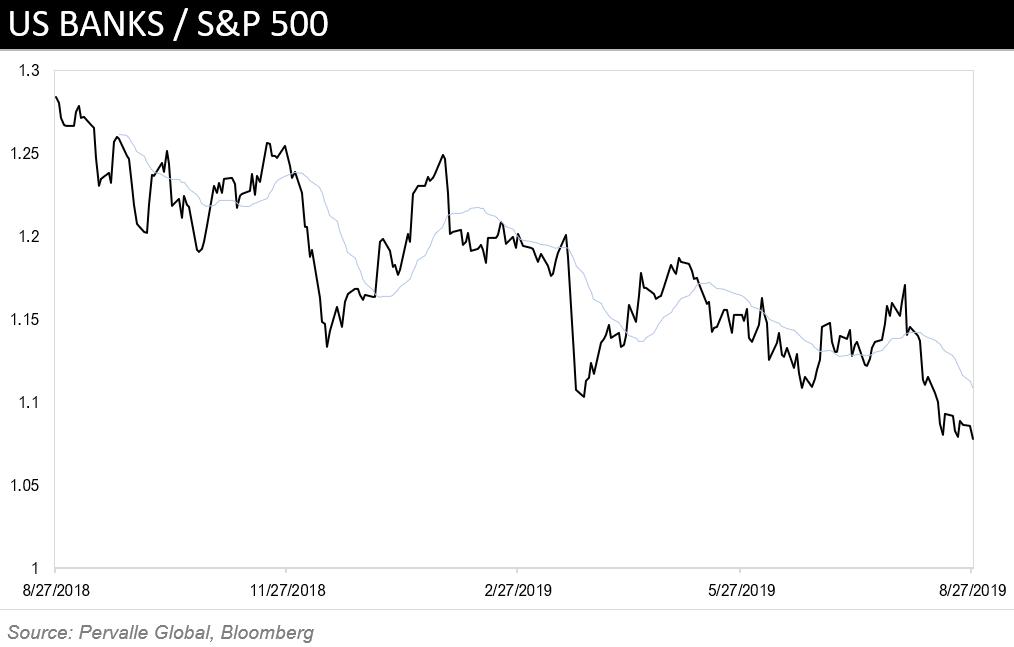

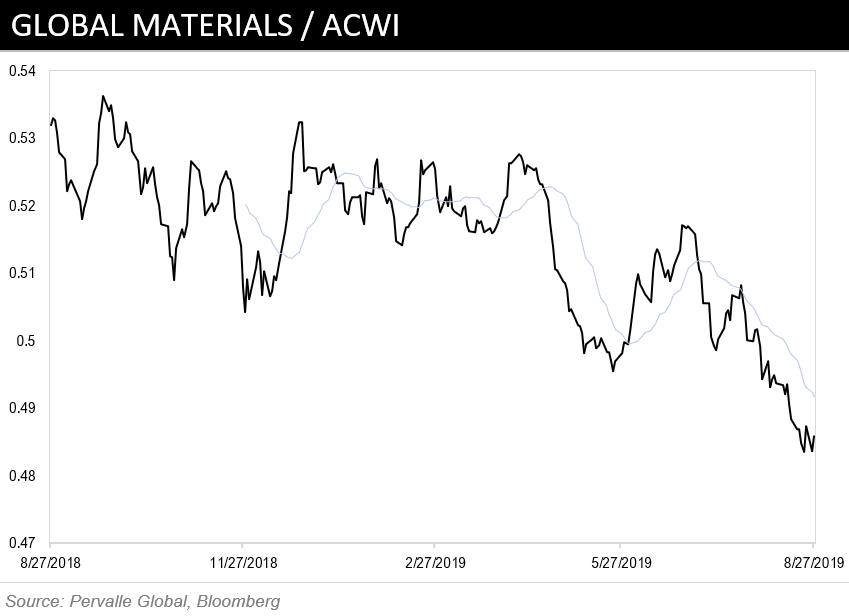

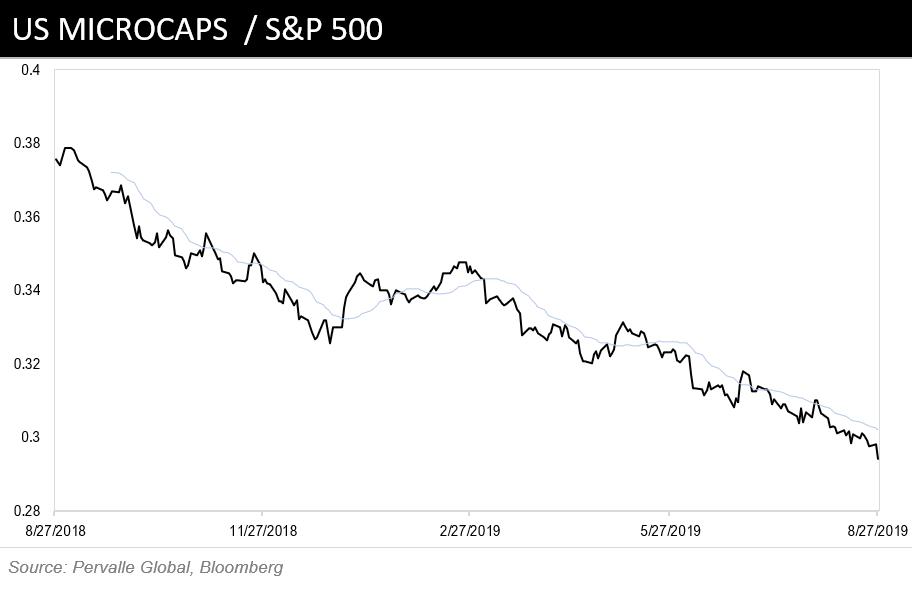

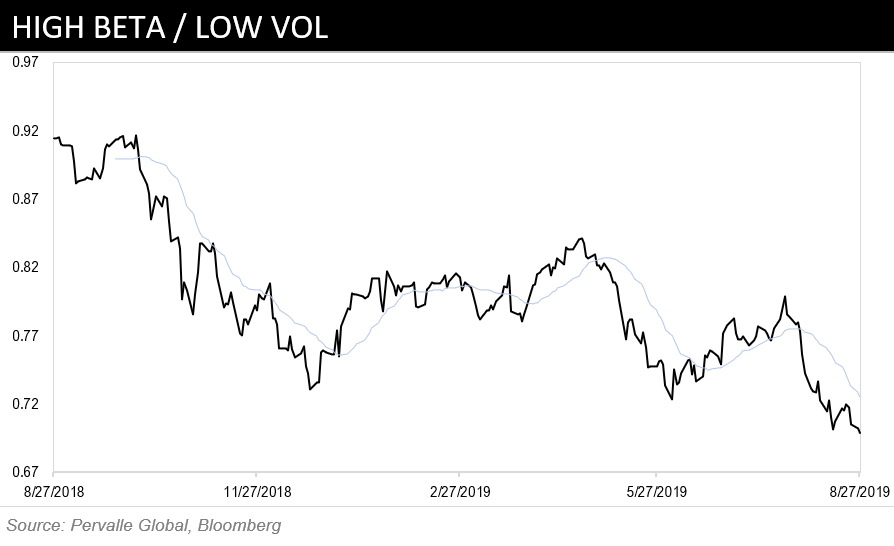

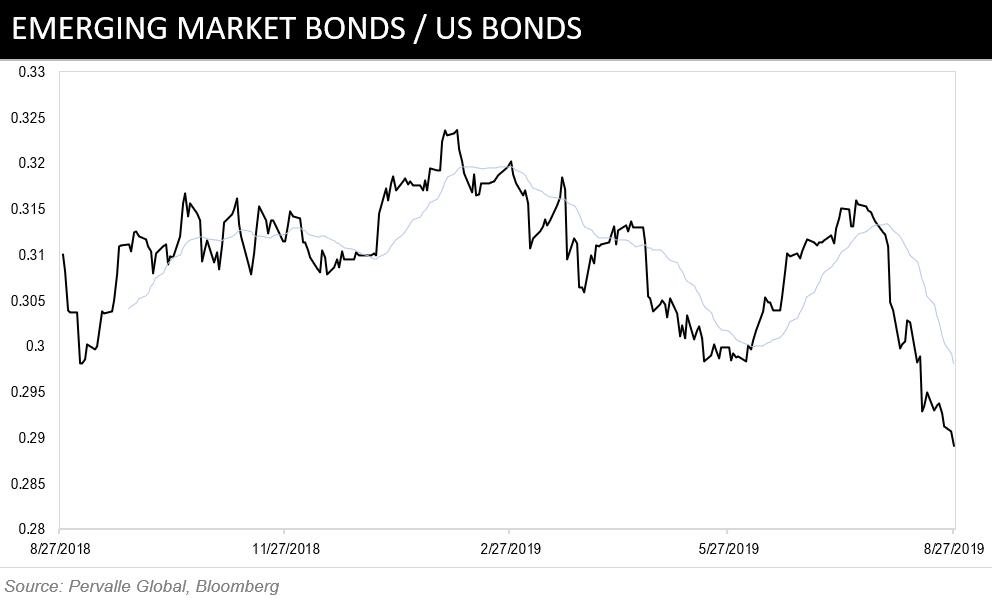

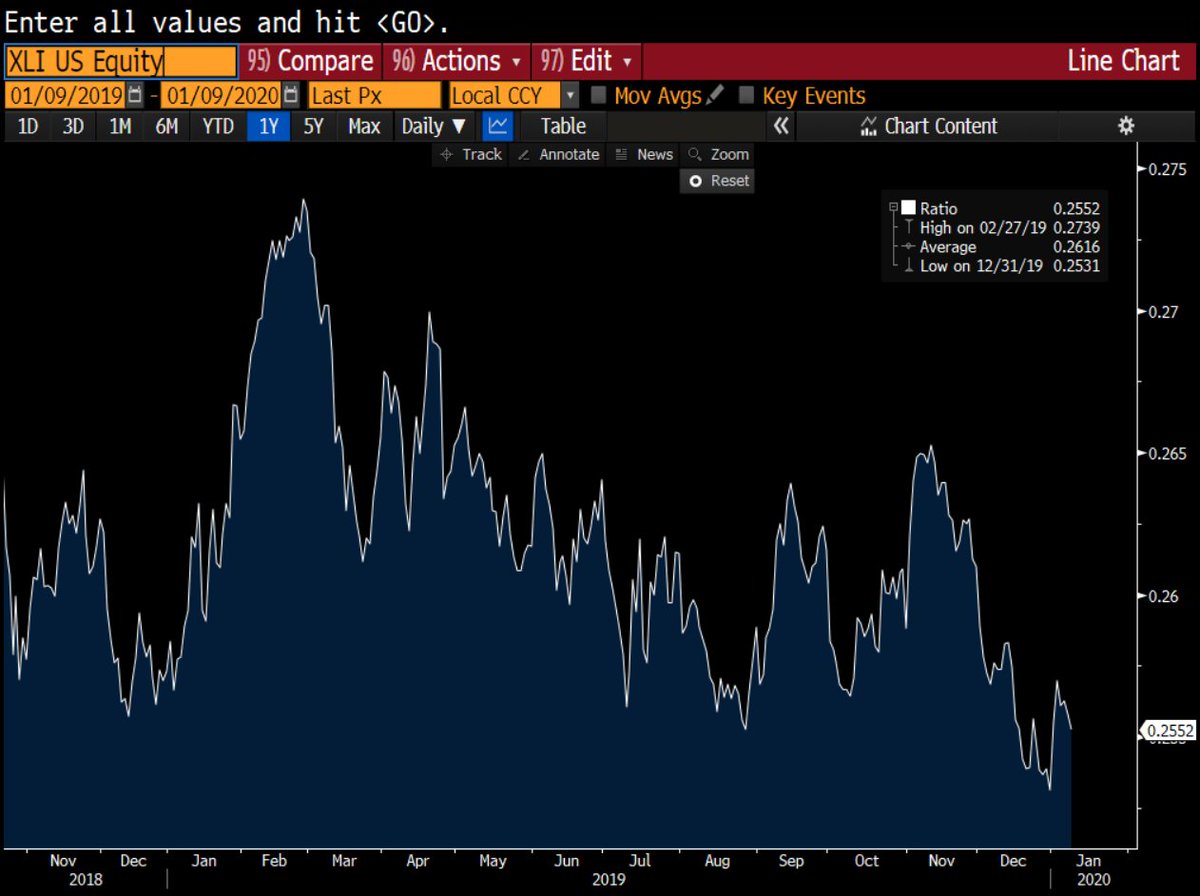

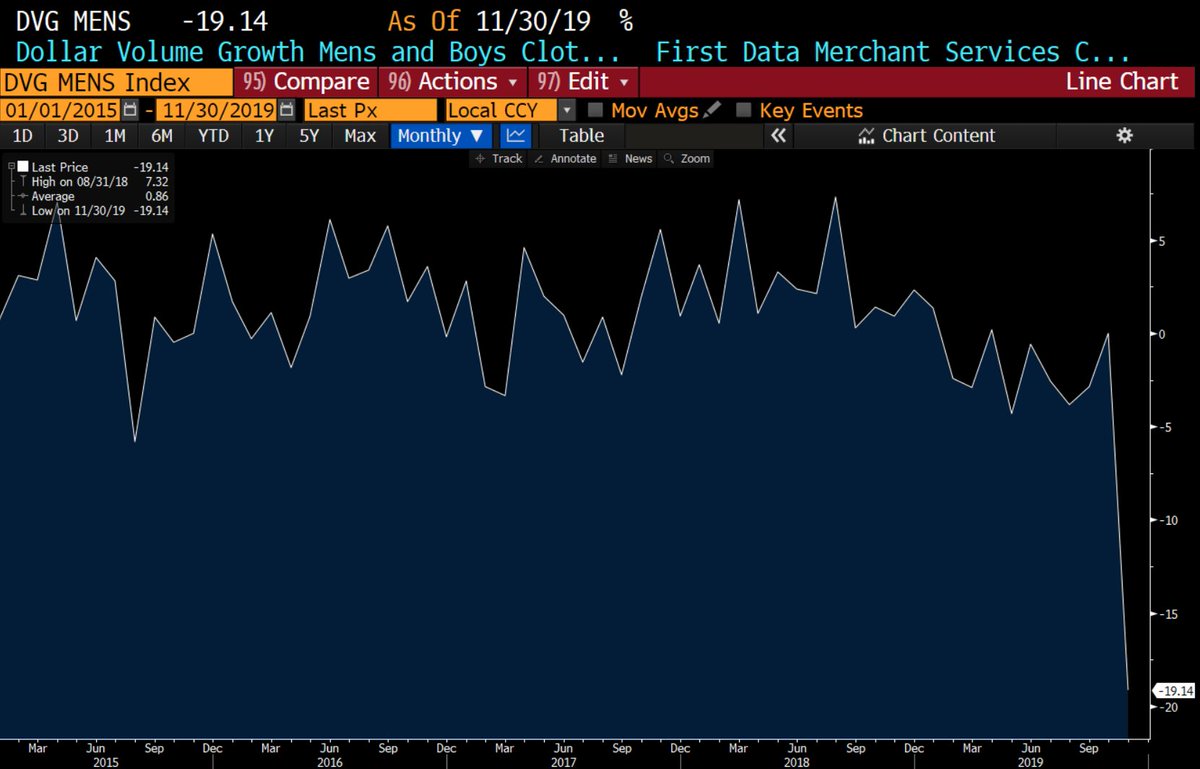

Some charts on relative performance confirming out leads.

• • •

Missing some Tweet in this thread? You can try to

force a refresh