How to get URL link on X (Twitter) App

Wage withholding data below:

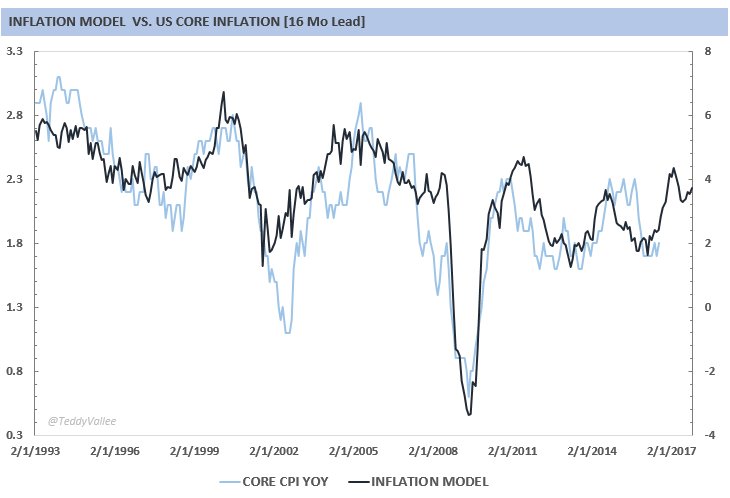

Wage withholding data below: https://twitter.com/TeddyVallee/status/1566126196106166274?s=20&t=lmAokuTcH1A3JjBhsuGoyQ

https://twitter.com/TeddyVallee/status/1491130381017706497?s=20&t=xGLuDxabwkfI09ch3zbwHA

Giddy up

Giddy up