What's wrong with the Nigerian Economy?

1. High MPR

A high CBN MPR rate is a DISincentive to investment.

Why invest in an SME when you can lend N1m to the best lender in town, the Federal Government and earn N130,000k a year.."RISK FREE"

1. High MPR

A high CBN MPR rate is a DISincentive to investment.

Why invest in an SME when you can lend N1m to the best lender in town, the Federal Government and earn N130,000k a year.."RISK FREE"

2. An Official "strong" Naira policy

The Naira derives her value from the strength of US $ foreign reserves and level of imports

Reserves rise, Naira up

Reserves fall, Naira down

Imports Rise, Naira falls

Imports fall, Naira rise

A strong Naira =more imports

The Naira derives her value from the strength of US $ foreign reserves and level of imports

Reserves rise, Naira up

Reserves fall, Naira down

Imports Rise, Naira falls

Imports fall, Naira rise

A strong Naira =more imports

3. Nigeria exports crude oil, imports PMS

High Crude oil prices= Good

High Crude oil prices = Bad

(No typo)

Nigeria earns more as crude oil rises but also pays more to import PMS

High Crude oil prices= Good

High Crude oil prices = Bad

(No typo)

Nigeria earns more as crude oil rises but also pays more to import PMS

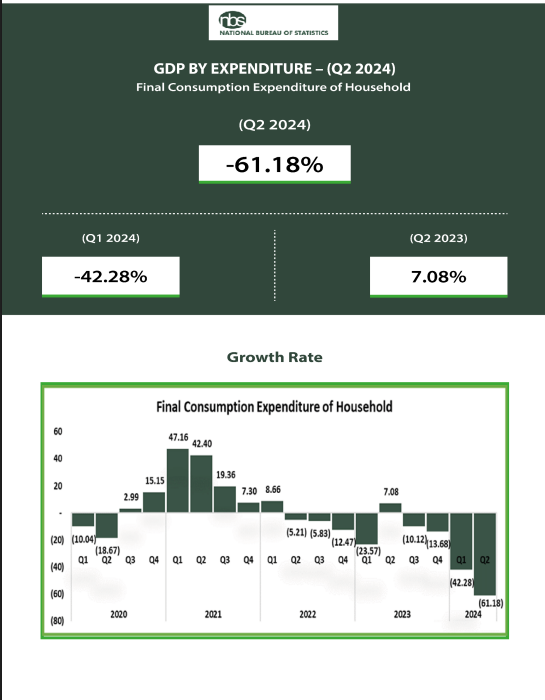

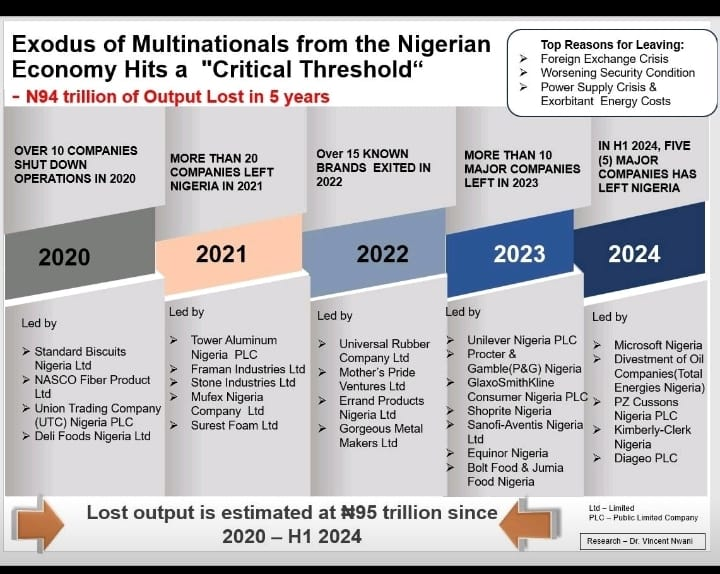

4. Productivity gains absent.

Nigeria failing infrastructure means productivity gains are lost.

Eg Nigeria has no East to West railway, Nor does she have constant electricity

Nigeria failing infrastructure means productivity gains are lost.

Eg Nigeria has no East to West railway, Nor does she have constant electricity

5. Land Use Act

Land Use act makes creation of mortgages difficult and expensive, also trying up vast amounts of home equity....creating "dead capital"

Land Use act makes creation of mortgages difficult and expensive, also trying up vast amounts of home equity....creating "dead capital"

• • •

Missing some Tweet in this thread? You can try to

force a refresh