"Slightly lower rate of incoming orders may be seasonal or a sign of a general slowdown. Monitoring closely." (Fabricated Metal Products)

"Incoming sales seem to be slowing down, and this is usually our busiest season. Concerns about the economy and tariffs." (Furniture & Related Products)

"Business is starting to show signs of a broad slowdown." (Machinery)

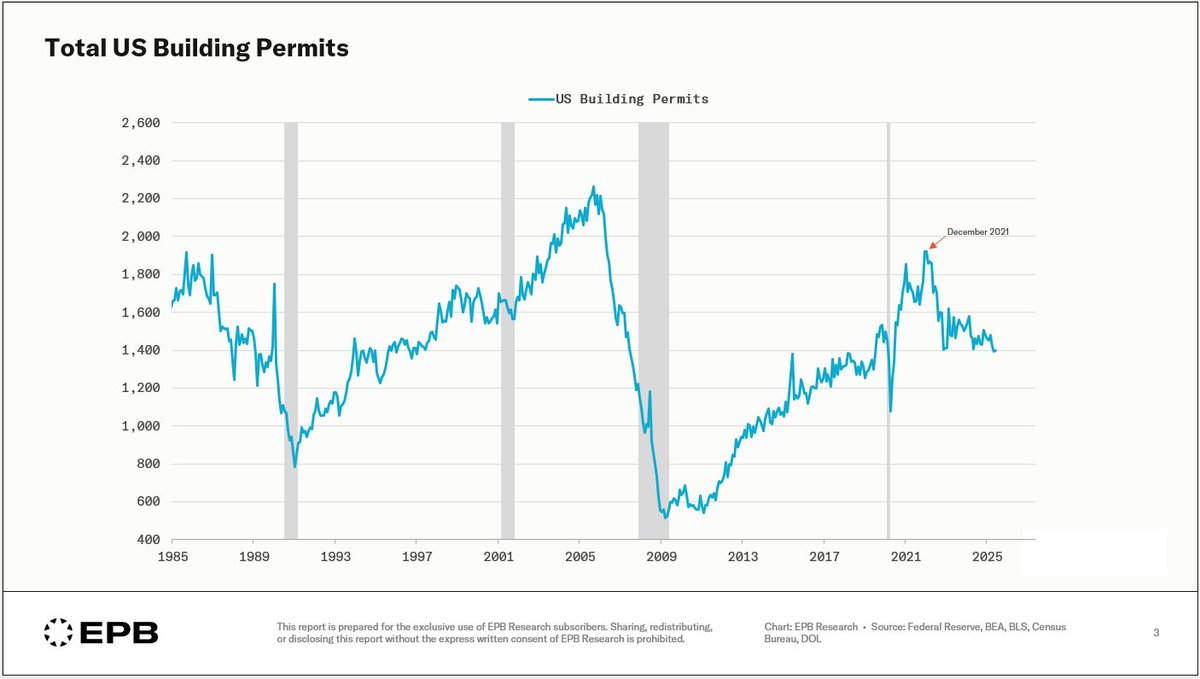

"The market for large building structures is slowing." (Nonmetallic Mineral Products)

• • •

Missing some Tweet in this thread? You can try to

force a refresh