Weekly Trade Results Thread :

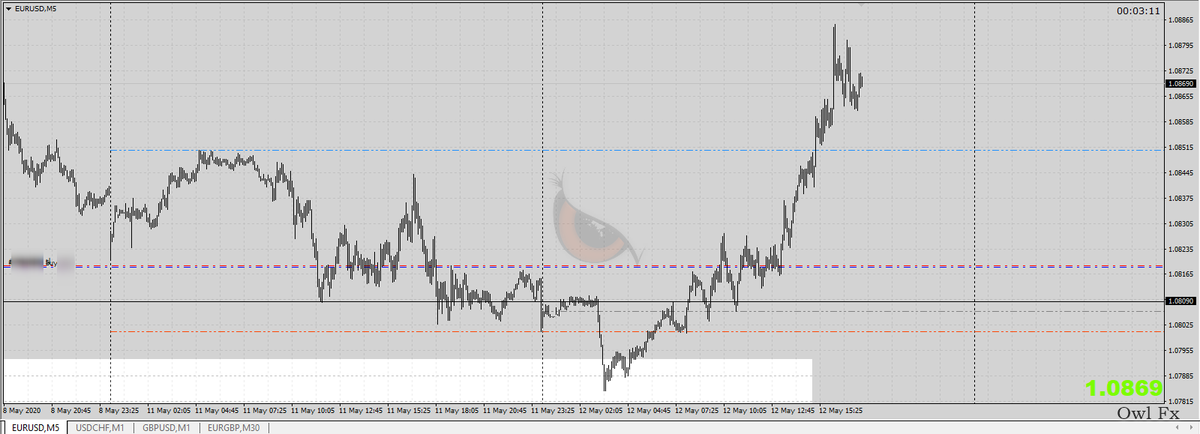

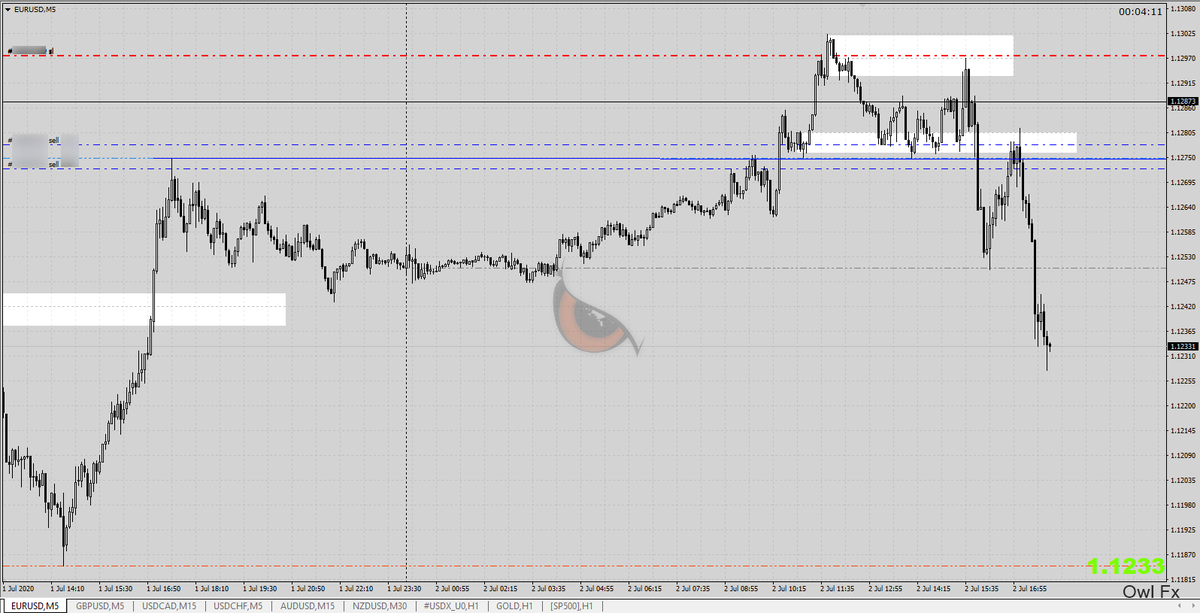

Long Trades = 11.3R

Long Trade = 2.7R

Short Trade = 3.2R

short Trade = -1R

Total Reward = 16.2R

Few other trades as well but forgot to shared not added on this twitter journal record, try to share more trades from now.

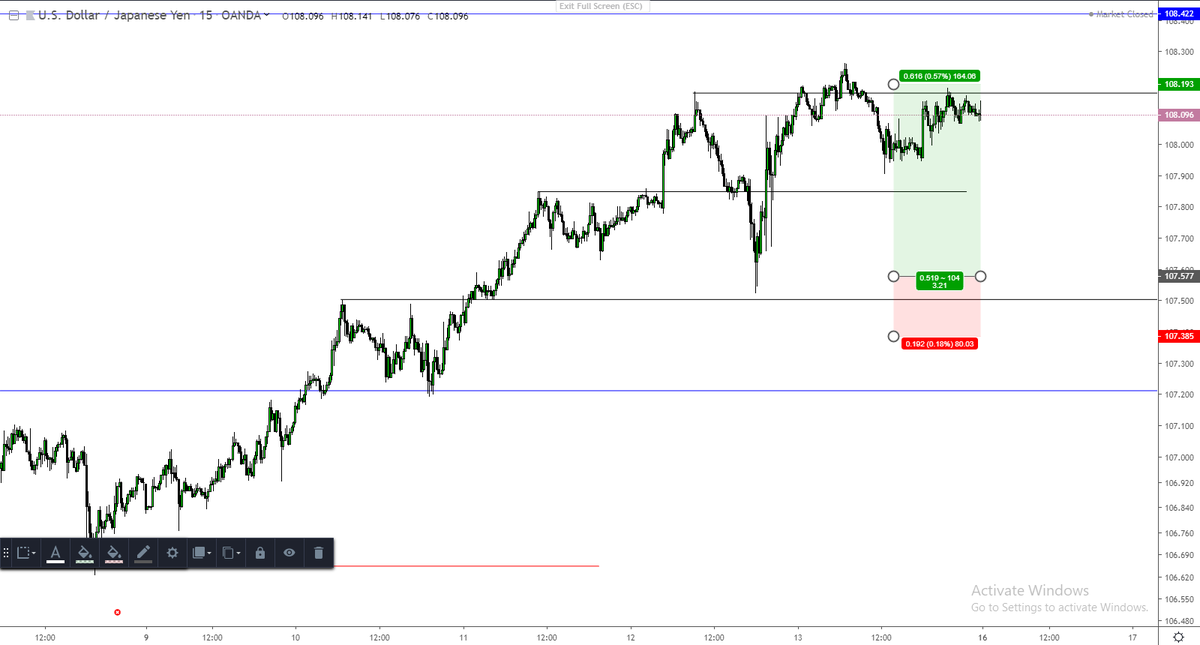

Long Trades = 11.3R

Long Trade = 2.7R

Short Trade = 3.2R

short Trade = -1R

Total Reward = 16.2R

Few other trades as well but forgot to shared not added on this twitter journal record, try to share more trades from now.

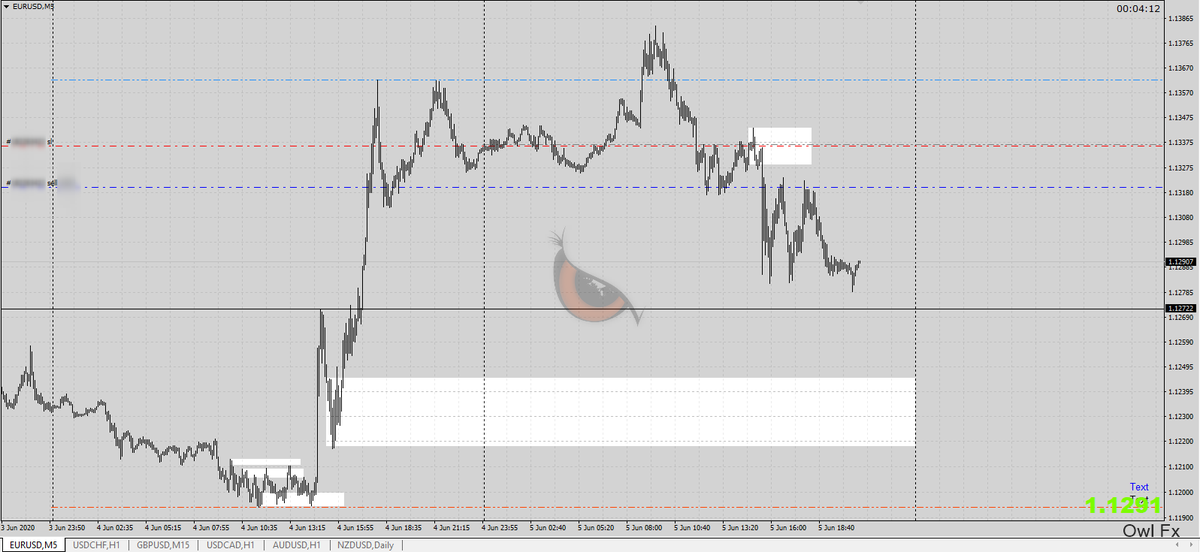

Weekly 2 Trade Results :

Long = 4R

Short = B,E(close manually before SL hit)

Short = 2R (was trade without stop)

Long = 2R

Long = 3R

Short =2R

Short = -1R

Total Reward = 12R

Long = 4R

Short = B,E(close manually before SL hit)

Short = 2R (was trade without stop)

Long = 2R

Long = 3R

Short =2R

Short = -1R

Total Reward = 12R

3rd Week Trade Results :

: 4.2R

: -1R

: 5R(avg exit)

: 10R(avg exit)

: 2R(avg exit)

: 7R

: 9R(avg exit)

and : B.E

Total Reward: 37.2-1= 36.2R

: 4.2R

: -1R

: 5R(avg exit)

: 10R(avg exit)

: 2R(avg exit)

: 7R

: 9R(avg exit)

and : B.E

Total Reward: 37.2-1= 36.2R

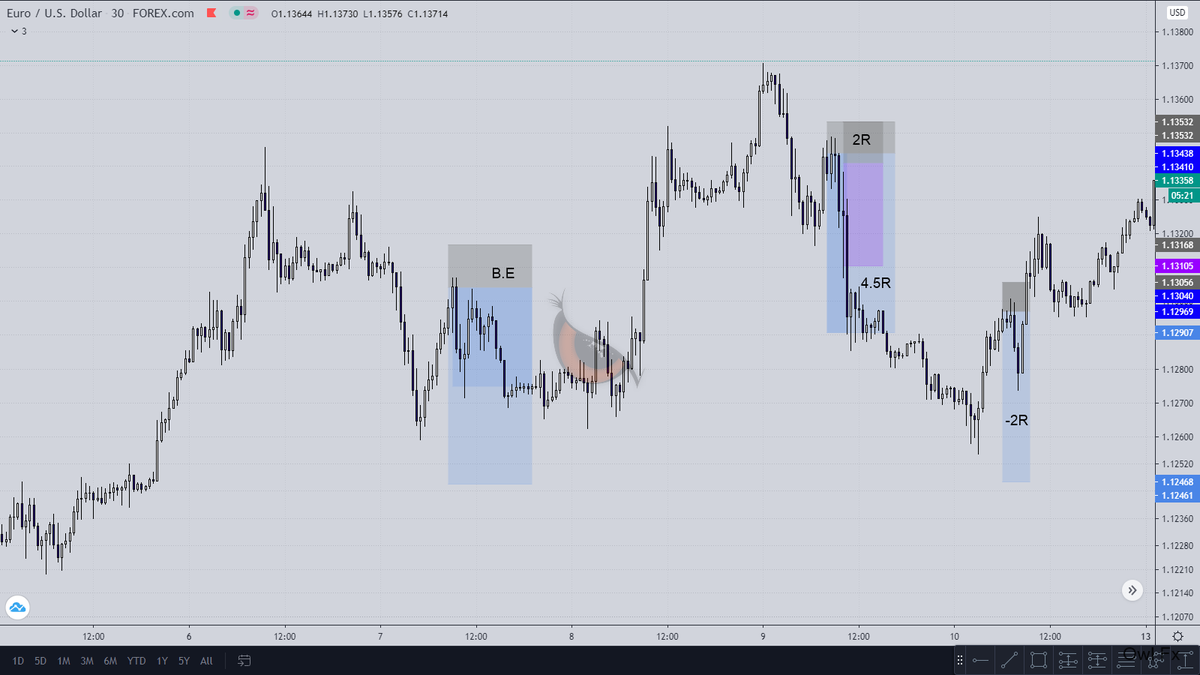

4th Week Trade Results :

: -1R

: -1R

: 3R (have personal aggressive entry as well with 4.5R but cant count)

: 4R

Total : 5R

: -1R

: -1R

: 3R (have personal aggressive entry as well with 4.5R but cant count)

: 4R

Total : 5R

Sept Month Trade Results :

Week 1: 16.2R

Week 2: 12R

Week 3: 36.2R

Week 4: 5R

Total R Monthly : 69.4R

All the trades were shared on twitter feed hope keep this form alive next month as well.

Week 1: 16.2R

Week 2: 12R

Week 3: 36.2R

Week 4: 5R

Total R Monthly : 69.4R

All the trades were shared on twitter feed hope keep this form alive next month as well.

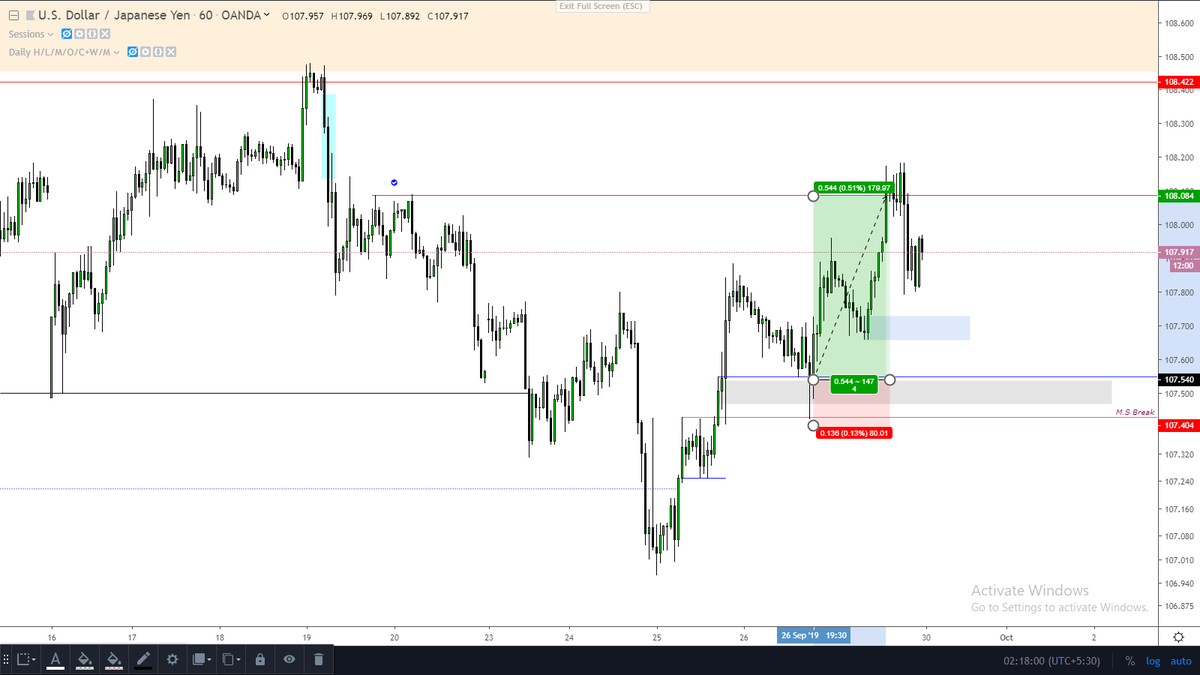

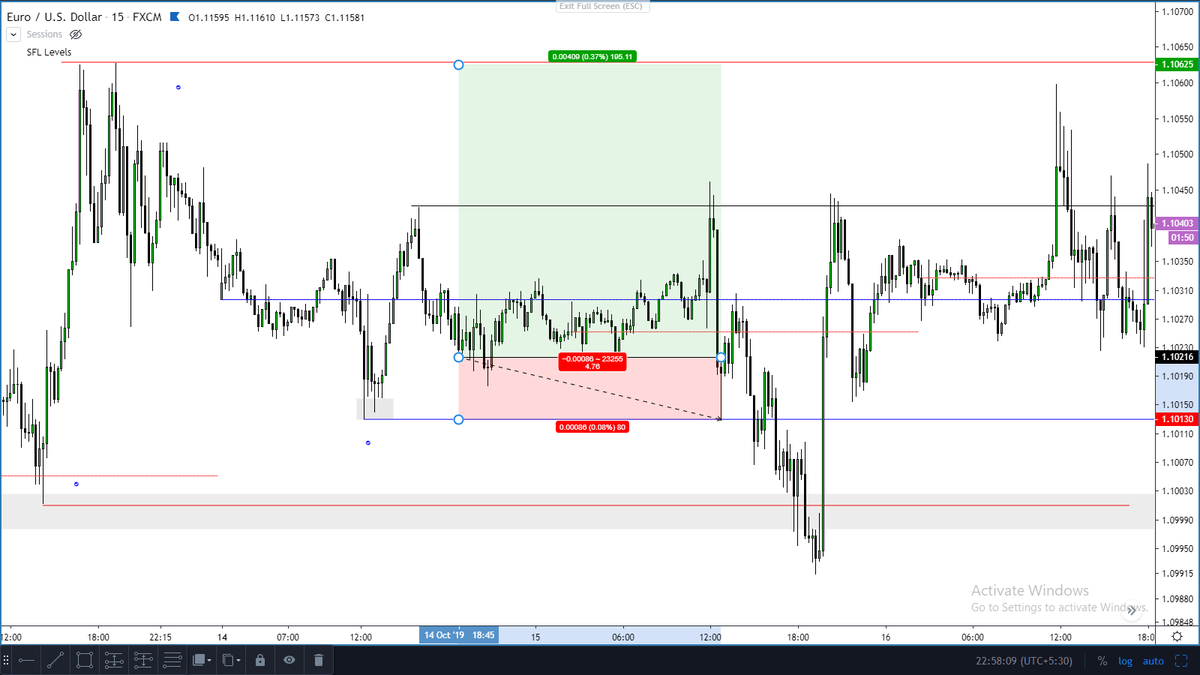

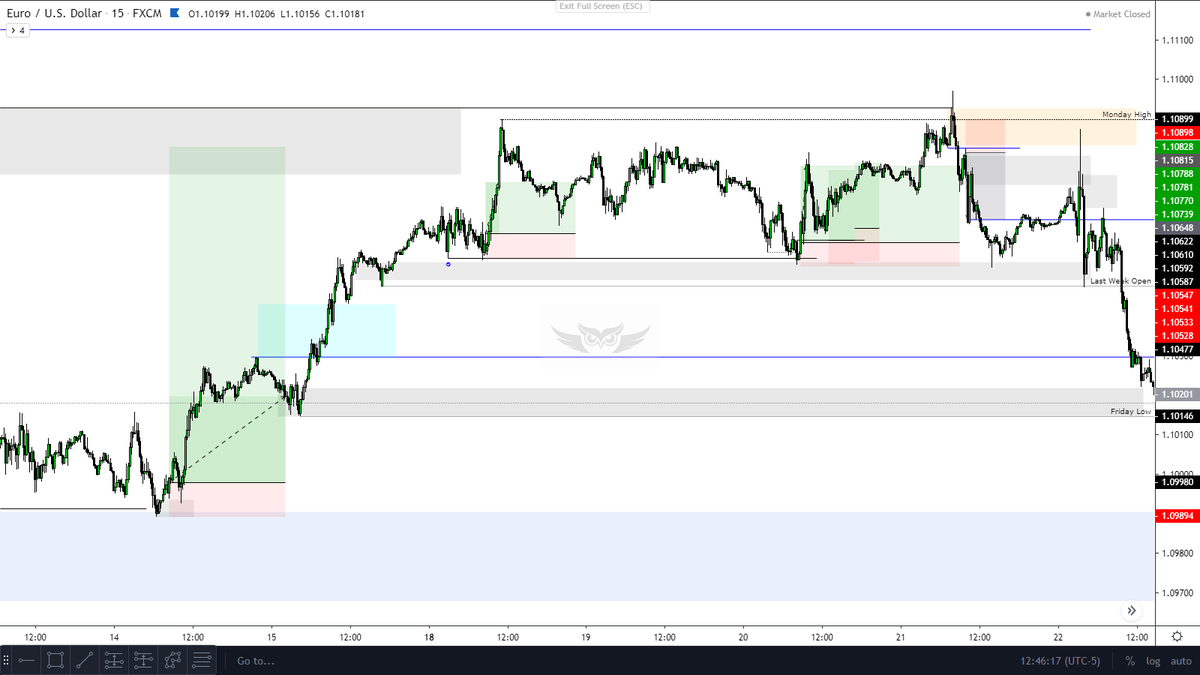

Oct 3rd Week Trade Results:

: -1R

: B.E

: 2.8R

: 1.8R

: 1.2R

: -1R

: -1R

: 4..7R

: 4.3R

Total: 14.8-3= 11.8R

: -1R

: B.E

: 2.8R

: 1.8R

: 1.2R

: -1R

: -1R

: 4..7R

: 4.3R

Total: 14.8-3= 11.8R

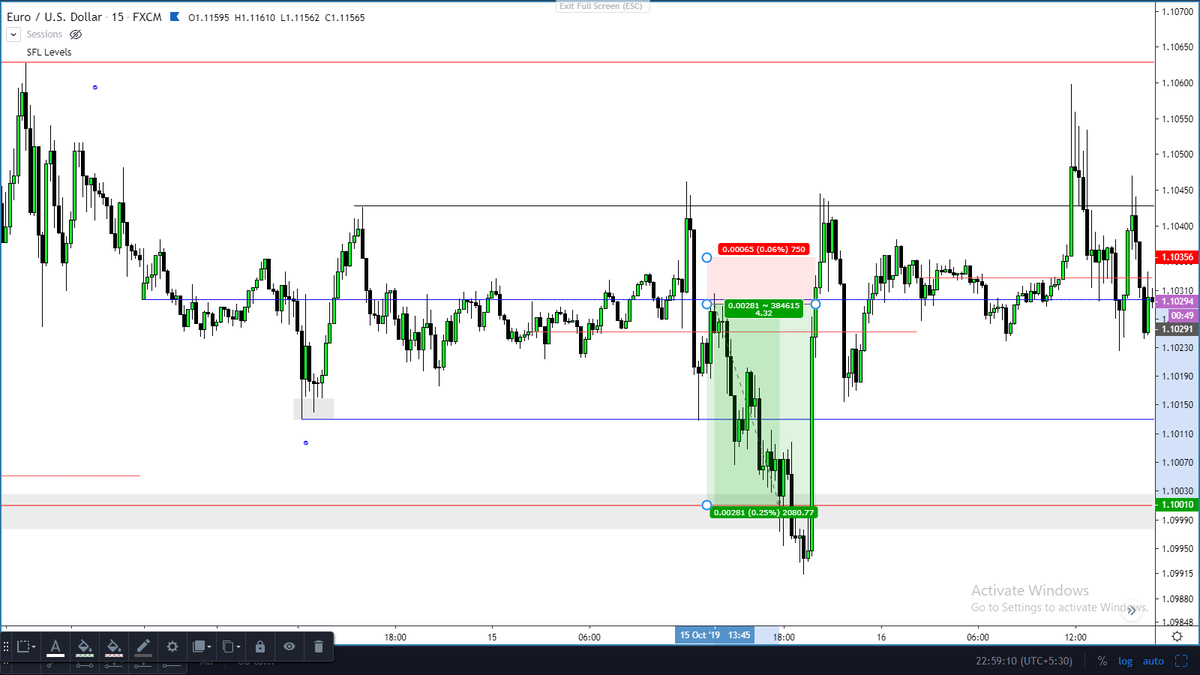

Oct 4th Week Trade Results:

: 4.10R

: 3.8R

: 12.5R

: 15R

: -1R

: -1R

: -1R

: 2.8R

: 6.3R

Total R: 44.5-3= 41.5R

2 Trade of and one closed at B.E.

: 4.10R

: 3.8R

: 12.5R

: 15R

: -1R

: -1R

: -1R

: 2.8R

: 6.3R

Total R: 44.5-3= 41.5R

2 Trade of and one closed at B.E.

Oct 5th Week Trade Results:

: 2.5R

: 3.5R

: 1R

: 1R

: 4.2R

: -2R

: 2.8R

: -1R

: -1R

Total R: 15-4= 11R

: 2.5R

: 3.5R

: 1R

: 1R

: 4.2R

: -2R

: 2.8R

: -1R

: -1R

Total R: 15-4= 11R

Oct Month Trade Results :

Week 1: 18.8R

Week 2: 9.4R

Week 3: 11.8R

Week 4: 41.5R

Week 5: 11R

Totall Monthly R: 92.5R

All Trades shared in each weekly trade threads and trades setup s,s available in weekly results threads.

Ready for Nov month with plan and risk management.

Week 1: 18.8R

Week 2: 9.4R

Week 3: 11.8R

Week 4: 41.5R

Week 5: 11R

Totall Monthly R: 92.5R

All Trades shared in each weekly trade threads and trades setup s,s available in weekly results threads.

Ready for Nov month with plan and risk management.

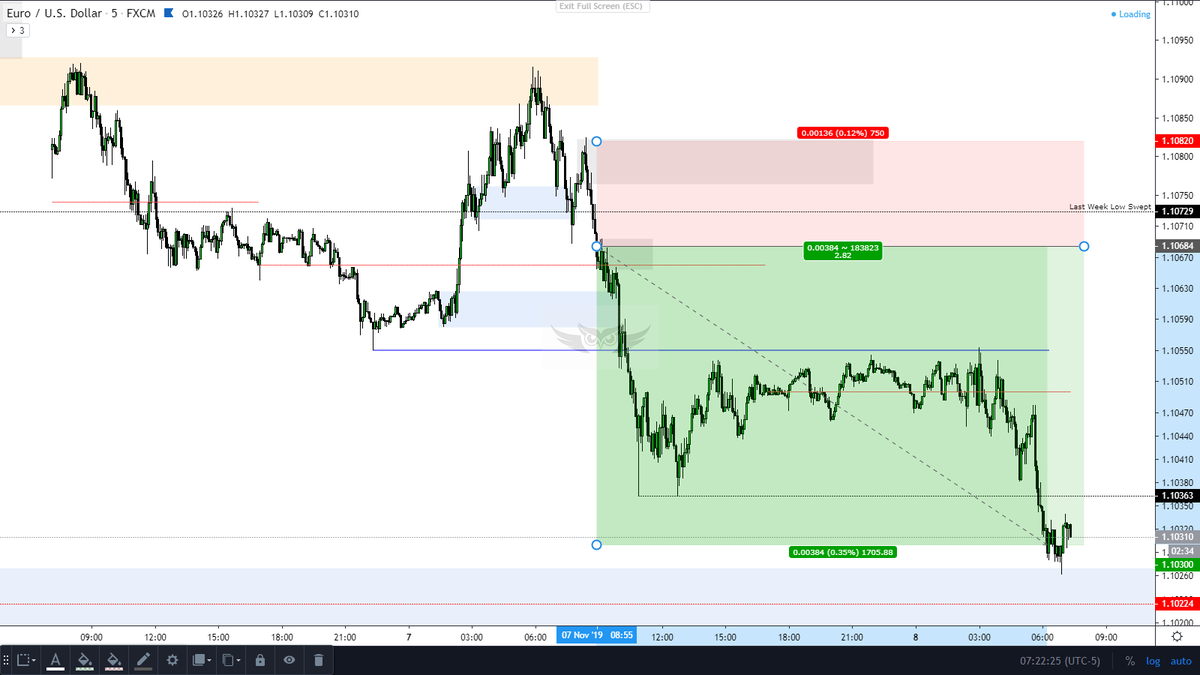

Nov 1st Week Trade Results :

: -2R

: -1R

: 2R

: 2R(Avg)

: 2.8R

Total R : 6.8-3= 3.8R

5R not include b.coz forgot to share on twitter.

: -2R

: -1R

: 2R

: 2R(Avg)

: 2.8R

Total R : 6.8-3= 3.8R

5R not include b.coz forgot to share on twitter.

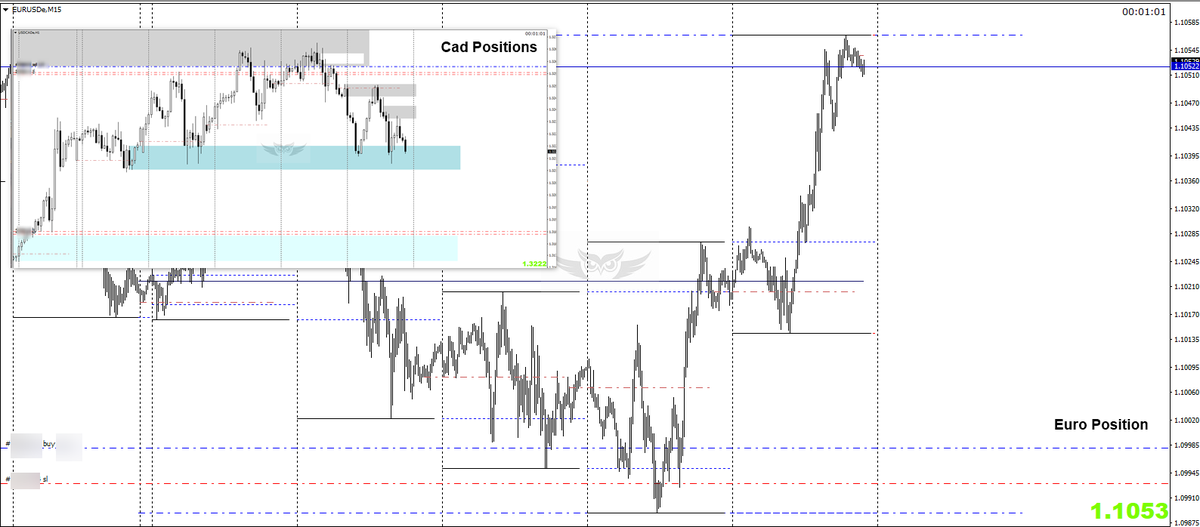

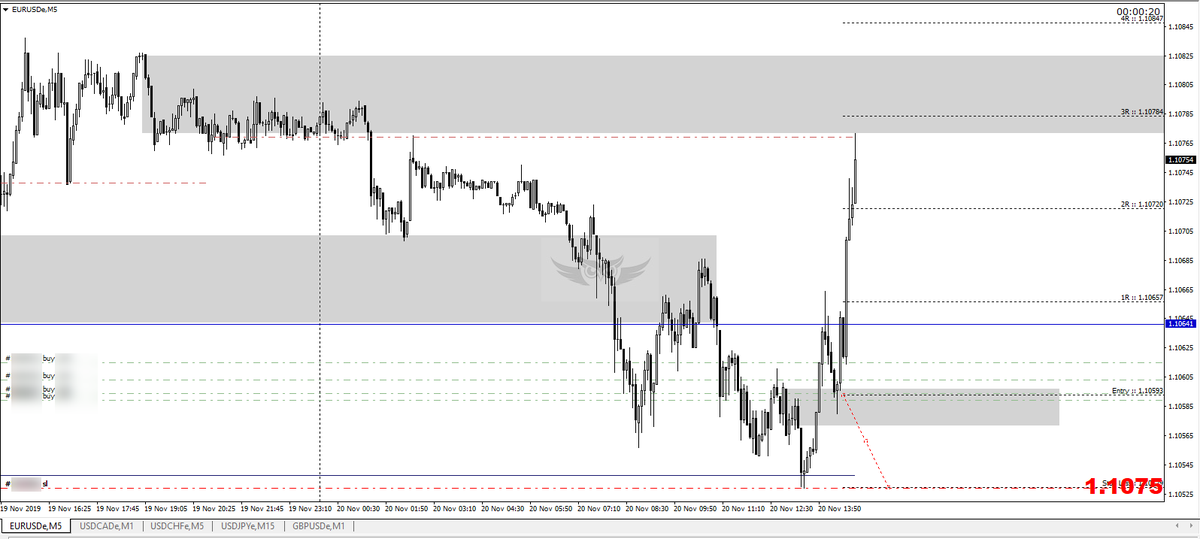

Nov 2nd Week Trade Results :

: -1R

: 3.6R

: 4.8R

Total R : 6.4-1= 5.4R

Unrealised R in open trades are

: 7R

: 2.4R

: 4.9R

I don't like remain open positions on weekend, but due to last week slow p.a decided to ride with these.

: -1R

: 3.6R

: 4.8R

Total R : 6.4-1= 5.4R

Unrealised R in open trades are

: 7R

: 2.4R

: 4.9R

I don't like remain open positions on weekend, but due to last week slow p.a decided to ride with these.

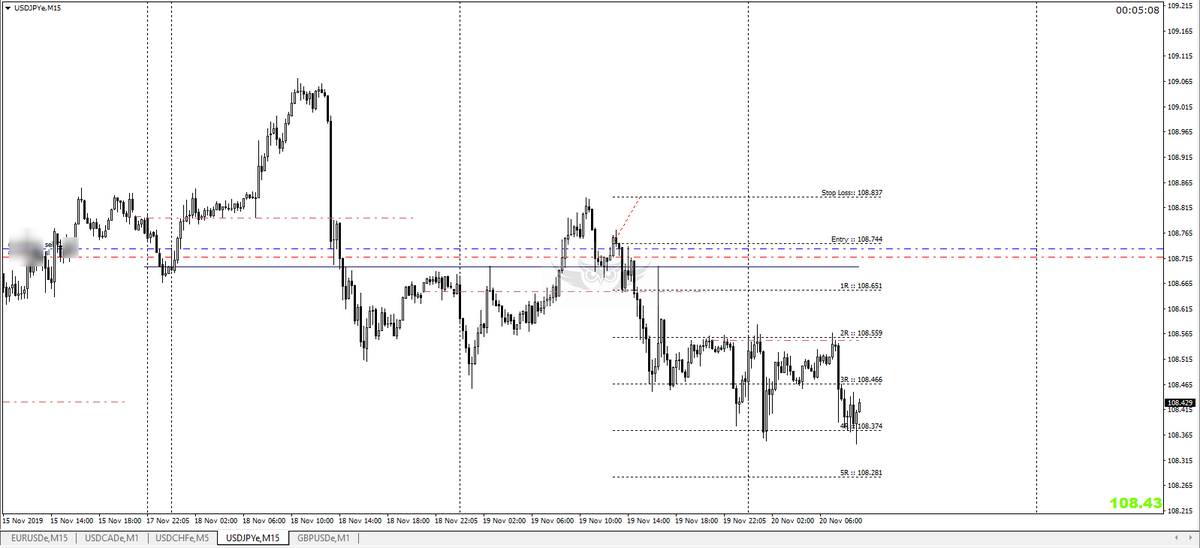

Nov 3rd Week Trade Results :

: 9.8R(2nd week)

: 2R

: 1.4R

: -0.5R

: 4R

: 3R

: 3R

: 3R

: 2R

: 3R

:2R

:6R

:-1R

:9R

Total R: 48.2-1.5= 46.7R

All trades shared on weekly trade thread🙏

: 9.8R(2nd week)

: 2R

: 1.4R

: -0.5R

: 4R

: 3R

: 3R

: 3R

: 2R

: 3R

:2R

:6R

:-1R

:9R

Total R: 48.2-1.5= 46.7R

All trades shared on weekly trade thread🙏

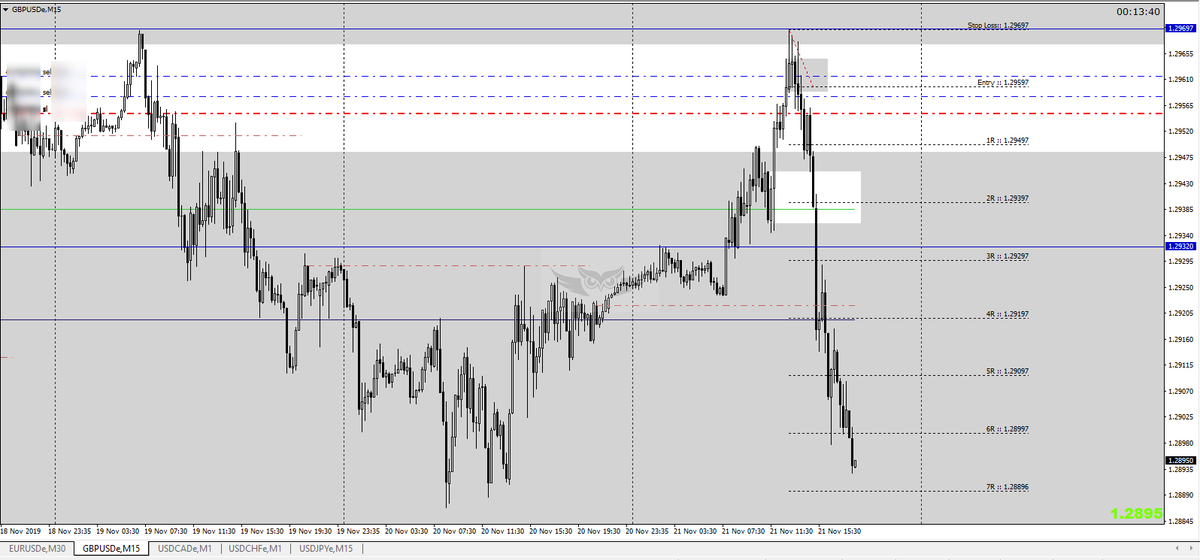

Nov 4th Week Trade Results :

: -2R

: -2R

: -2R

Total R: -6R

Totally my own fault about these failure setups open positions without confirmation, Reason Greed(want to grab more better RR)

Nov 4th Week is first negative week for my twitter journal.🙏

: -2R

: -2R

: -2R

Total R: -6R

Totally my own fault about these failure setups open positions without confirmation, Reason Greed(want to grab more better RR)

Nov 4th Week is first negative week for my twitter journal.🙏

Nov Monthly Trades Result:

Week 1: 3.8

Week 2: 5.4

Week 3: 46.7

Week 4: -6

Total Monthlty R: 55.9-6= 49.9R

All Trades shared in each weekly trade threads & trades setup s.s available in weekly result threads.

Week 1: 3.8

Week 2: 5.4

Week 3: 46.7

Week 4: -6

Total Monthlty R: 55.9-6= 49.9R

All Trades shared in each weekly trade threads & trades setup s.s available in weekly result threads.

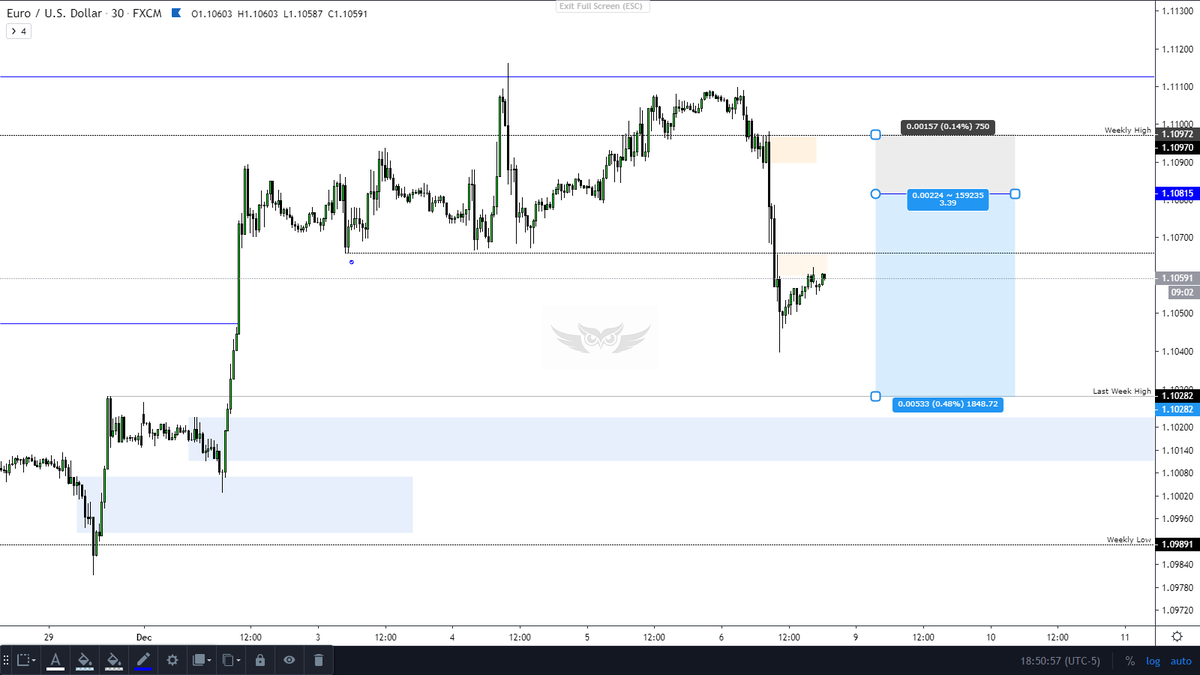

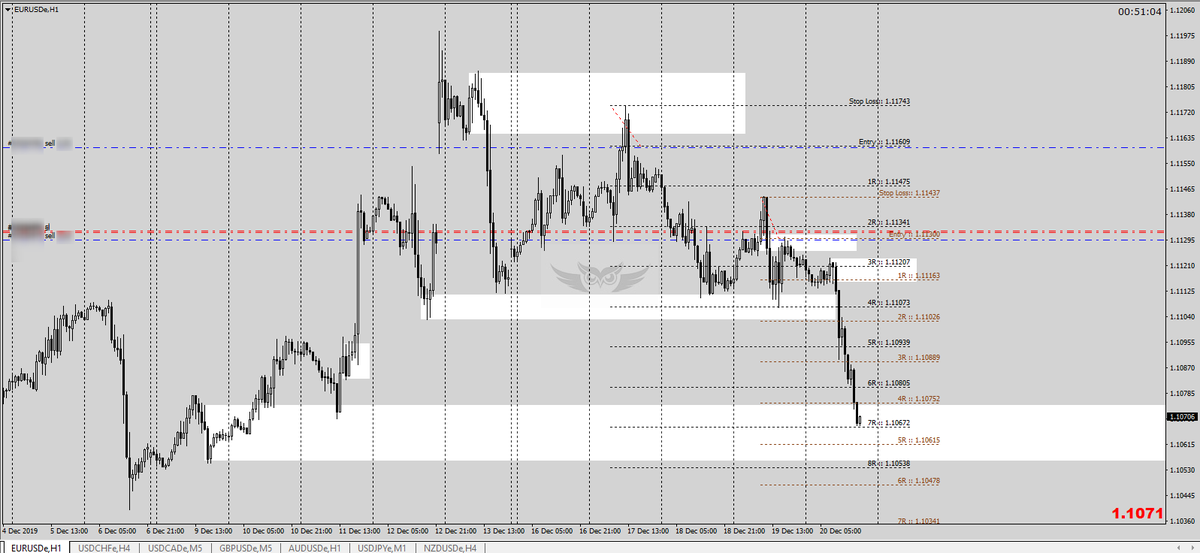

Dec 1st week trade results:

Nothing for this week for me as missed last week monday bullish euro move.

2 positions open from last week friday for (targeting 3.40R)

Nothing for this week for me as missed last week monday bullish euro move.

2 positions open from last week friday for (targeting 3.40R)

Dec 2nd Week Trade results:

: B.E (2 positions from week 1)

: -1R

: -2R

: 2R

: 3R

: B.E

: B.E

: (1 open postion)

Tatal R: 5-3=2R

Tbh past week is one of the tough week for me from year few quality setups failed(Thu trades)

: B.E (2 positions from week 1)

: -1R

: -2R

: 2R

: 3R

: B.E

: B.E

: (1 open postion)

Tatal R: 5-3=2R

Tbh past week is one of the tough week for me from year few quality setups failed(Thu trades)

Plus usually i change my bias what price action tells me but in 2nd week was lacking somehow to change my bias will try not to repeat this.

The reason write remarks publicly it reminds me.

I never trade to maintain 80% strike rate the reward is matter only in long run.

The reason write remarks publicly it reminds me.

I never trade to maintain 80% strike rate the reward is matter only in long run.

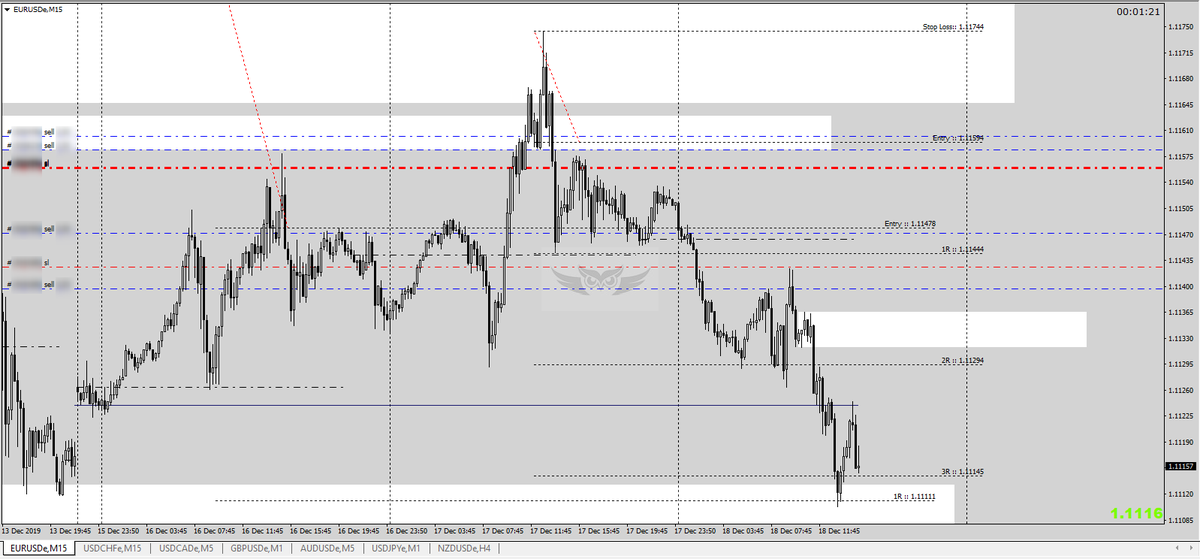

Dec 3rd Week Trade Results:

: -1R(Prev Week)

: 1R

: 3R

:2R

:2R

:4.5R

Total R : 12.5-1 = 11.5R

One position still open at 7R will ride with this.

: -1R(Prev Week)

: 1R

: 3R

:2R

:2R

:4.5R

Total R : 12.5-1 = 11.5R

One position still open at 7R will ride with this.

Dec Month trade results :

Week 1 : Nil

Week 2 : 2R

Week 3 : 11.5R

Week 4 : Holidays

Total monthlty reward : 13.5R

Week 1 : Nil

Week 2 : 2R

Week 3 : 11.5R

Week 4 : Holidays

Total monthlty reward : 13.5R

Sept Month Trade Results : 69.4R

Oct Month Trade Results : 92.5R

Nov Monthly Trades Result: 49.9R

Dec Month trade results : 13.5R

Total 4 Months Reward : 225.3R

Lets start 2020 Year more then this.

Oct Month Trade Results : 92.5R

Nov Monthly Trades Result: 49.9R

Dec Month trade results : 13.5R

Total 4 Months Reward : 225.3R

Lets start 2020 Year more then this.

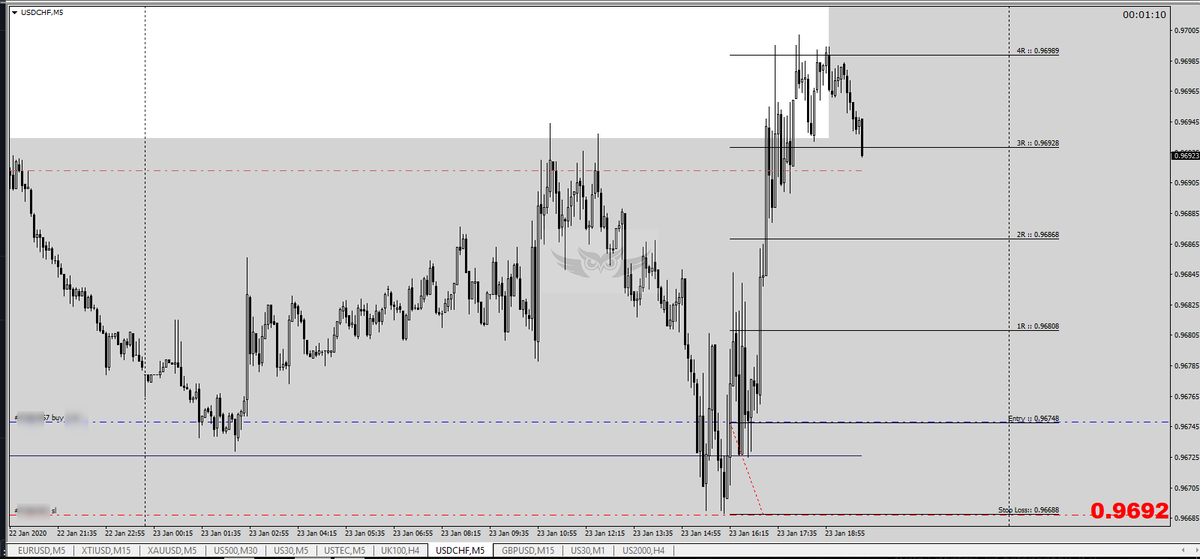

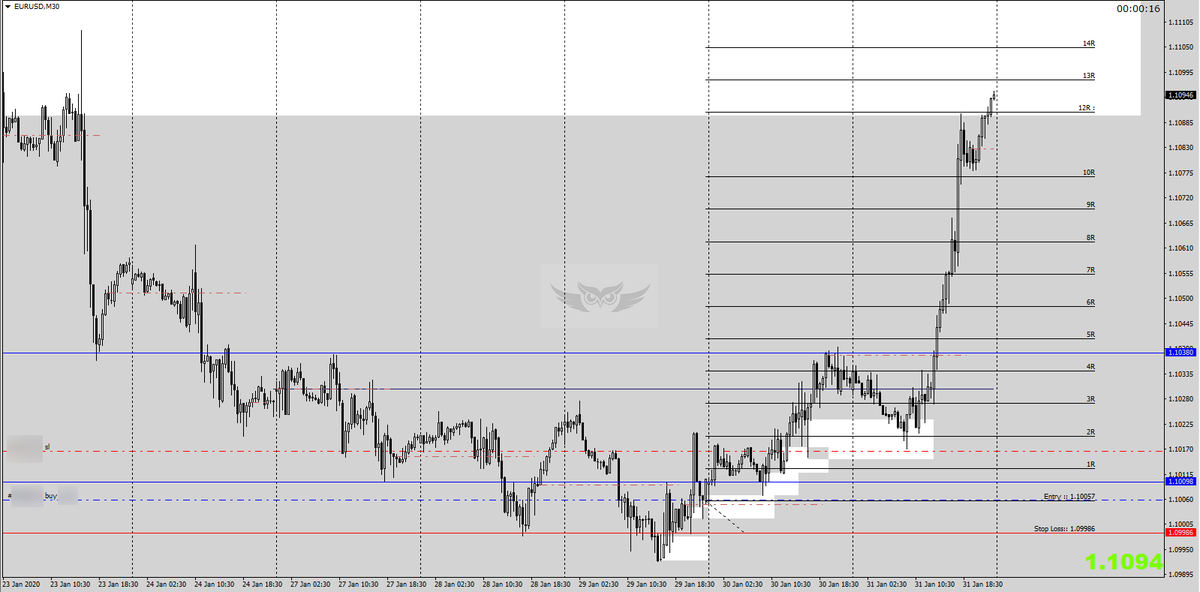

Jan 4th Week Trade Results:

-1R

5.3R

6R

#Us30 4.2R

8R

4.8R

Total R: 28.3-1 = 27.3R

Unrealized R from Euro Open Trade : 12.5R

Jan Month Total R : 11.9+27.3=39.2R👊

Unrealized R : 12.5R

Ready for Feb Month😇

-1R

5.3R

6R

#Us30 4.2R

8R

4.8R

Total R: 28.3-1 = 27.3R

Unrealized R from Euro Open Trade : 12.5R

Jan Month Total R : 11.9+27.3=39.2R👊

Unrealized R : 12.5R

Ready for Feb Month😇

Feb 1st Week Trade results :

: -2R

: -1R

Total : -3R

: -2R

: -1R

Total : -3R

Feb 2nd Week Trade Results:

No trade for me in 2nd week of feb as there is no swing setup for me, my anticipate scenarios not follow exact plan plus managed less screen time for intra day setups

Tryin to focus swing setups for next 2 weeks due to personal busy offline stuff.

No trade for me in 2nd week of feb as there is no swing setup for me, my anticipate scenarios not follow exact plan plus managed less screen time for intra day setups

Tryin to focus swing setups for next 2 weeks due to personal busy offline stuff.

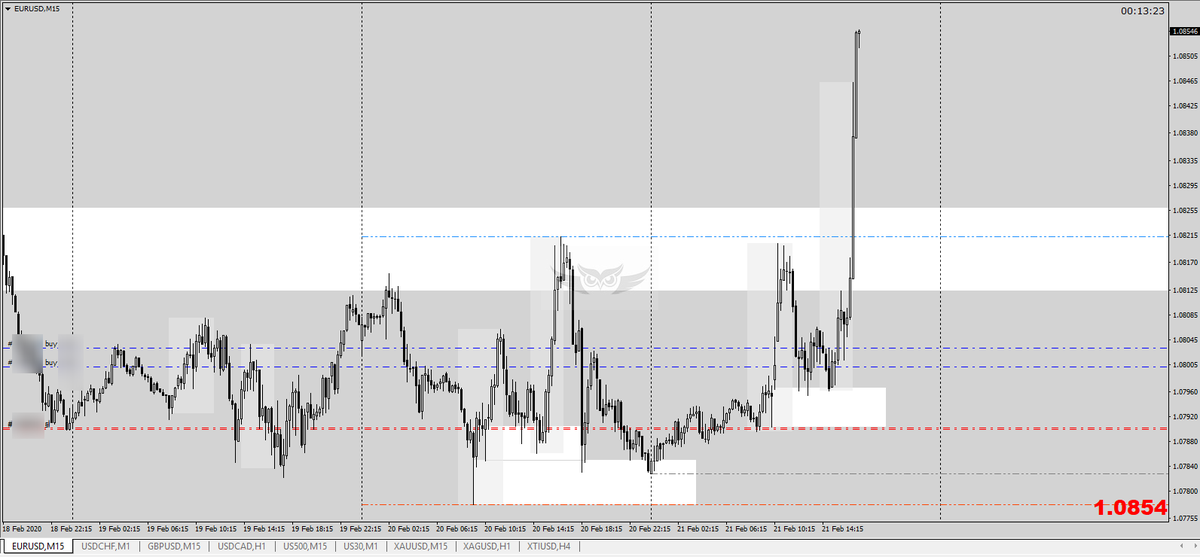

Feb 4th Week Trade Results:

: 3R

: 4.5R

: 4.3R

: 6.8R

: -0.5R(Manual close)

: -0.5R(Manual close)

: -2R(

Total R : 15.6R

: 3R

: 4.5R

: 4.3R

: 6.8R

: -0.5R(Manual close)

: -0.5R(Manual close)

: -2R(

Total R : 15.6R

Feb Month Results:

1st Week: -3R

2nd Week: No Trade

3rd Week: 9.5R

4th Week: 15.6R

Monthly R: 25-3= 22R

1st Week: -3R

2nd Week: No Trade

3rd Week: 9.5R

4th Week: 15.6R

Monthly R: 25-3= 22R

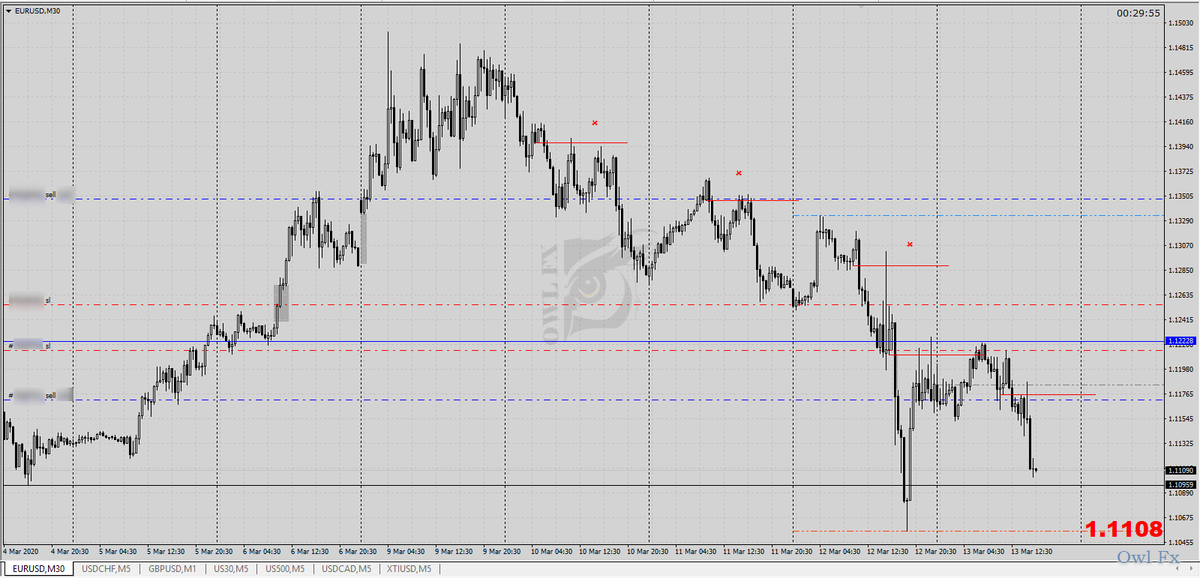

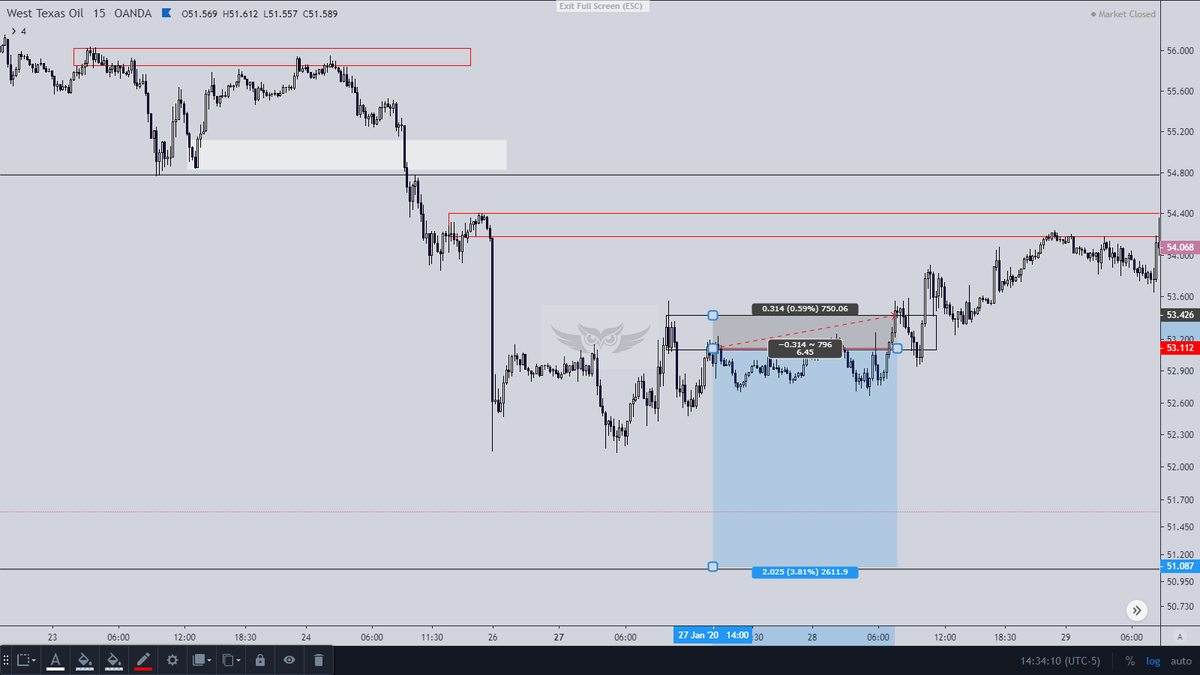

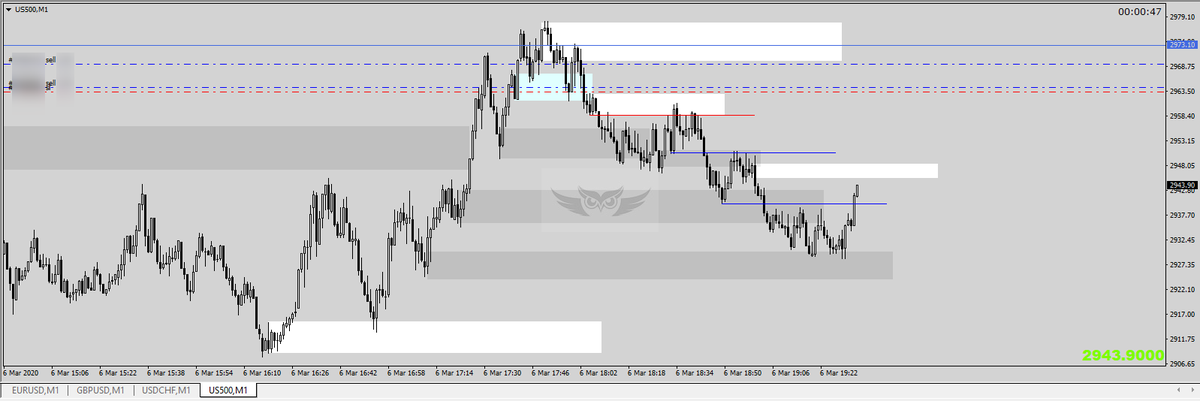

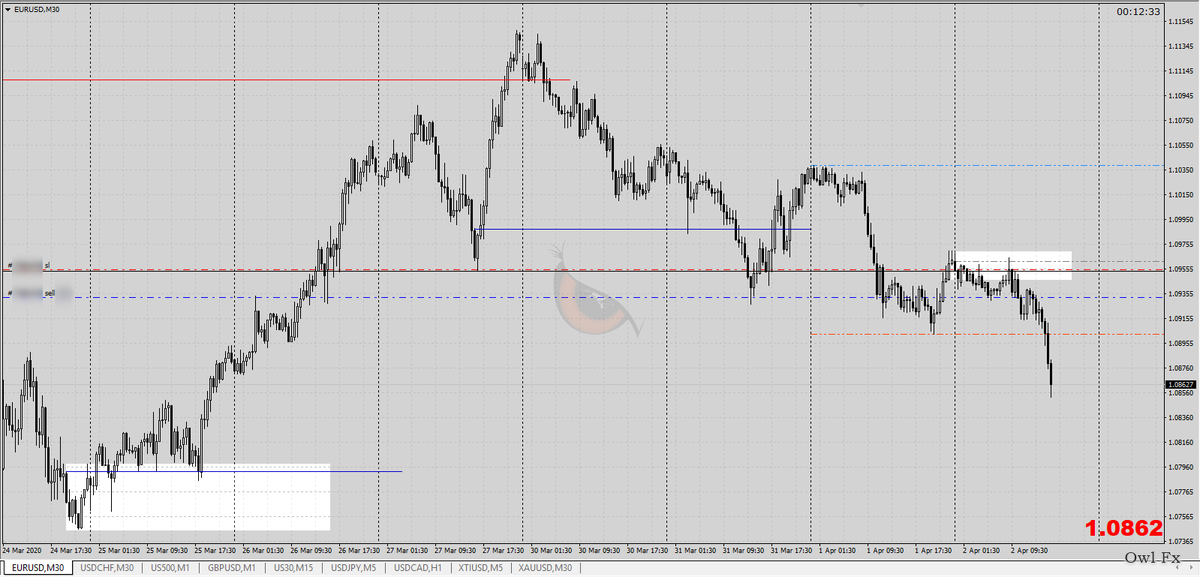

March 1st Week Trade Results:

: 3R

: 2R

: -2R

#Us500: 2R

#Us500: 3.6R

Total R: 8.6R

Had many other scalp trade positions from #Us30 and #us500 but not count for twitter journal.

I am free this week as well from offline stuff so will give most of my time.

: 3R

: 2R

: -2R

#Us500: 2R

#Us500: 3.6R

Total R: 8.6R

Had many other scalp trade positions from #Us30 and #us500 but not count for twitter journal.

I am free this week as well from offline stuff so will give most of my time.

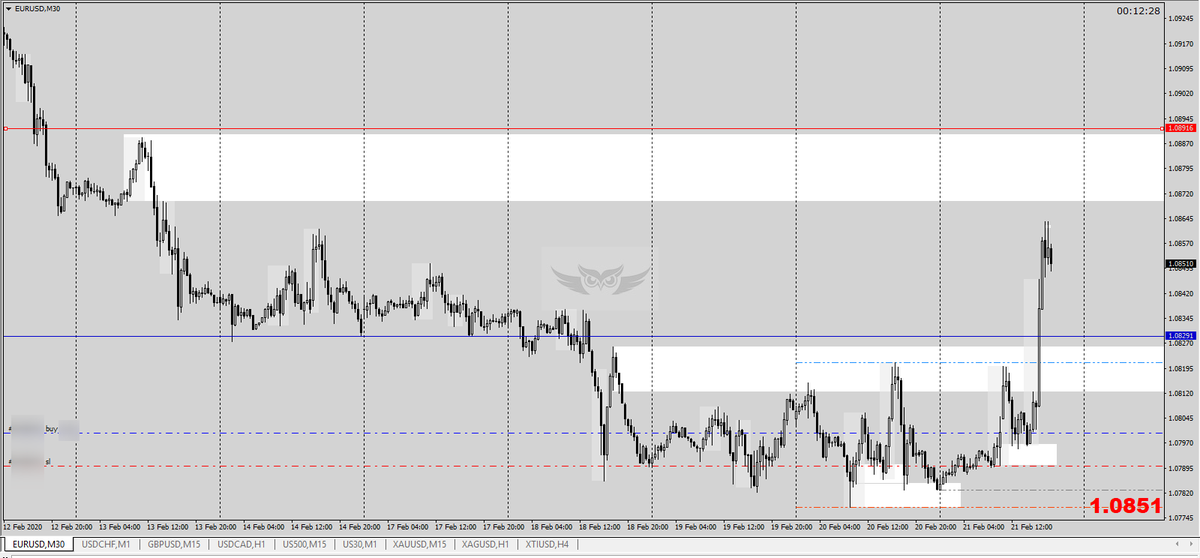

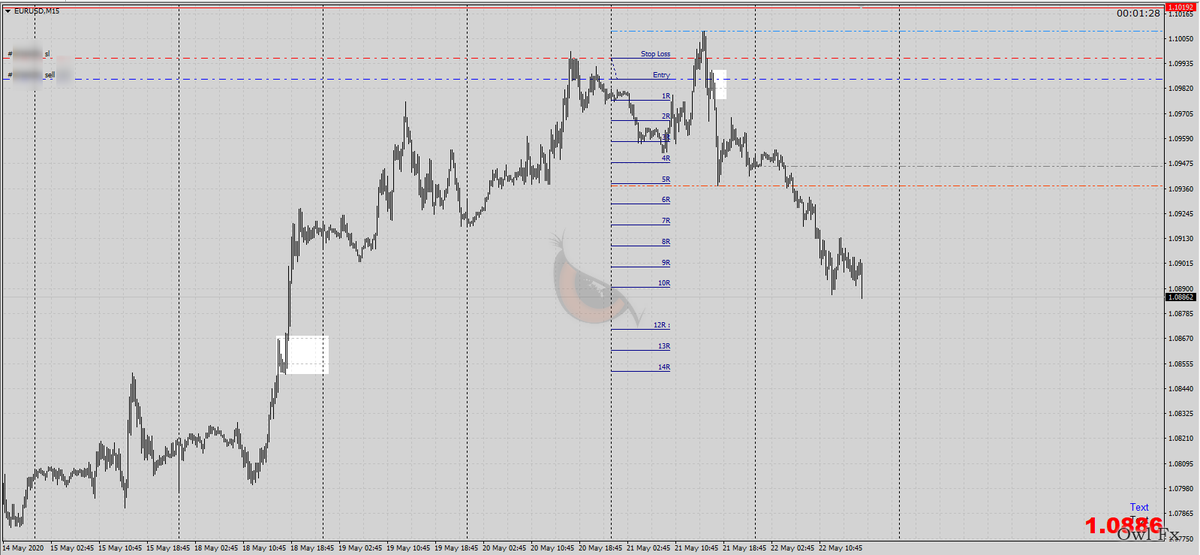

March 2nd Week Trade Results:

: 8R

: 4.8R

: B.E

: 6R(closed half position)

: 2.2R

Total R: 21R

Unrealised R from open position : 6.5R

: 8R

: 4.8R

: B.E

: 6R(closed half position)

: 2.2R

Total R: 21R

Unrealised R from open position : 6.5R

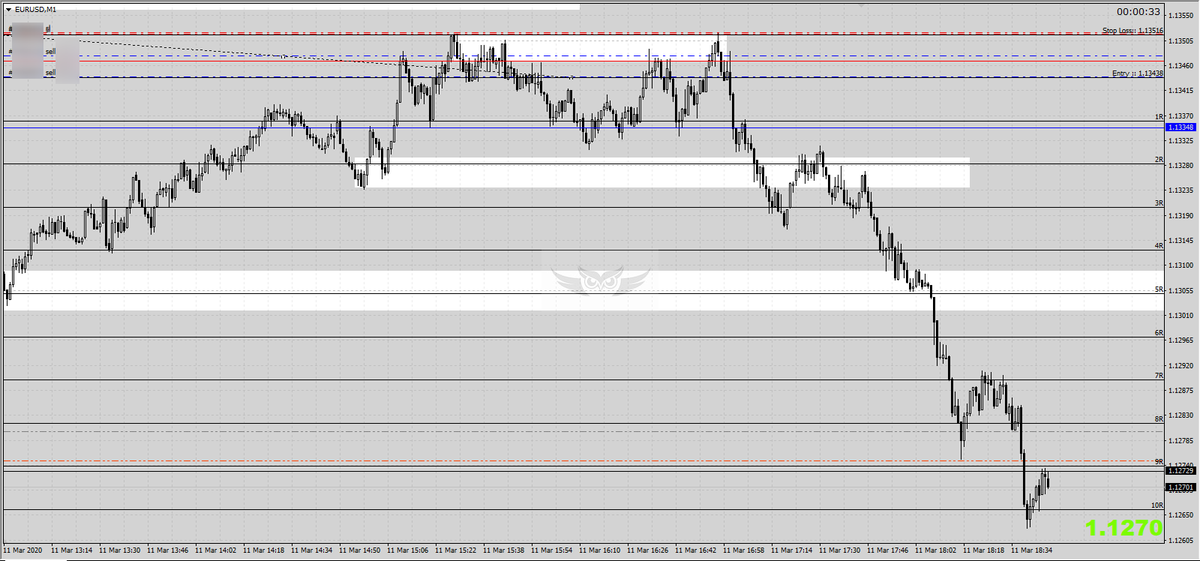

March 3rd Week Trade Results:

: 4.5R(2nd week position)

: 3.8R

: 3.8R

: 6.7R

: 3.3R

: -1R

: 5.8R

: 4R

: 4.2R

: 3.3R

: 3.4R

: 1.8R

Total R: 44.6-1= 43.6R

: 4.5R(2nd week position)

: 3.8R

: 3.8R

: 6.7R

: 3.3R

: -1R

: 5.8R

: 4R

: 4.2R

: 3.3R

: 3.4R

: 1.8R

Total R: 44.6-1= 43.6R

March 4th Week Trade Results:

: -2R

: -1R(Closed before S.L)

: -1R(Closed bfore S.L)

Total R: -4R

5th Week Trade Results:

: 3R

: 4.8R

Total R: 7.8R

: -2R

: -1R(Closed before S.L)

: -1R(Closed bfore S.L)

Total R: -4R

5th Week Trade Results:

: 3R

: 4.8R

Total R: 7.8R

March Month Trade Results:

Week 1: 8.6R

Week 2: 21R

Week 3: 43.6

Week 4: -4R

Week 5: 7.8R

Total Monthly R: 77R

Most Trade on EU pair s.s attached with setups

Week 1: 8.6R

Week 2: 21R

Week 3: 43.6

Week 4: -4R

Week 5: 7.8R

Total Monthly R: 77R

Most Trade on EU pair s.s attached with setups

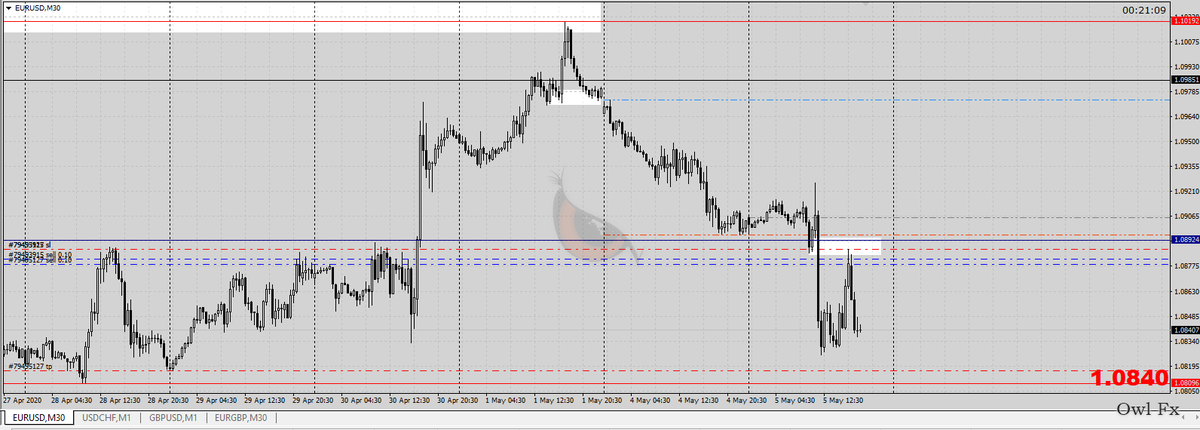

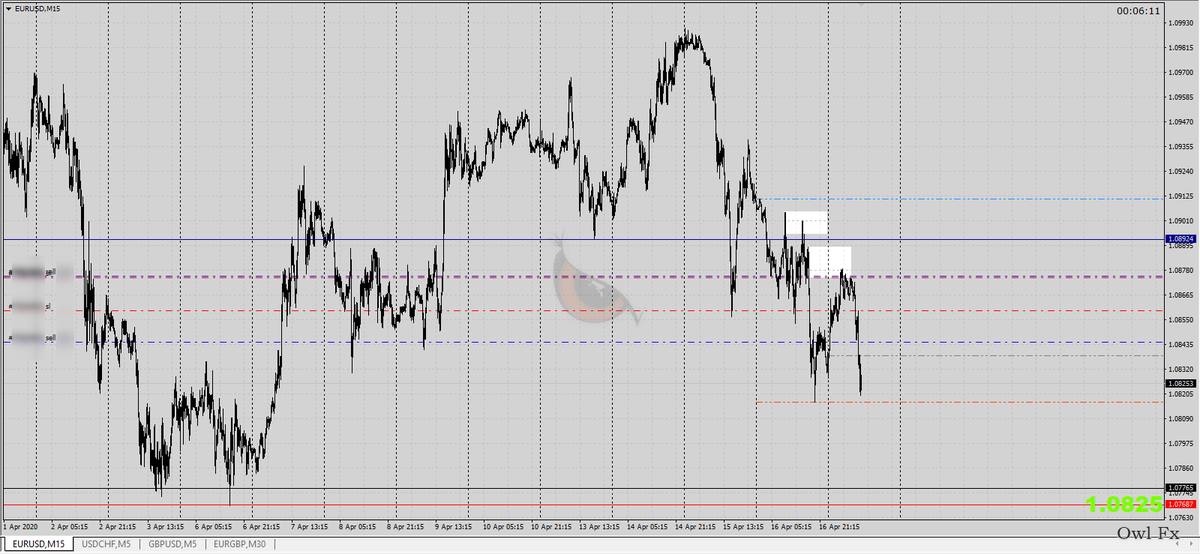

April 2nd Week Trade Results:

: -1R

: -1R

: B.E

Total R : -2R

All these loser trades was in profits more then 2R intraday basis but i was focus to hold these trades for swing atleast 100-150 pips.

: -1R

: -1R

: B.E

Total R : -2R

All these loser trades was in profits more then 2R intraday basis but i was focus to hold these trades for swing atleast 100-150 pips.

April 3rd Week Trade Results:

: -2R

Total R: -2R

Few more personal trades but not share on twitter as euro trade between tight range so less confidence in these.

: -2R

Total R: -2R

Few more personal trades but not share on twitter as euro trade between tight range so less confidence in these.

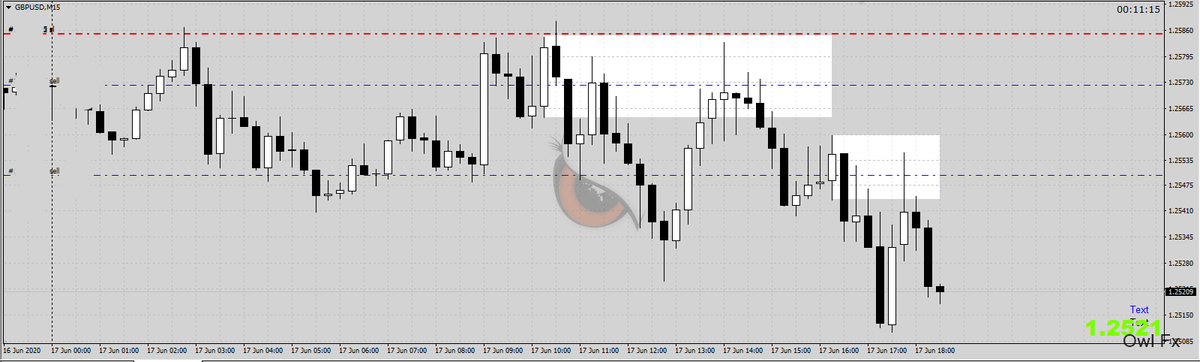

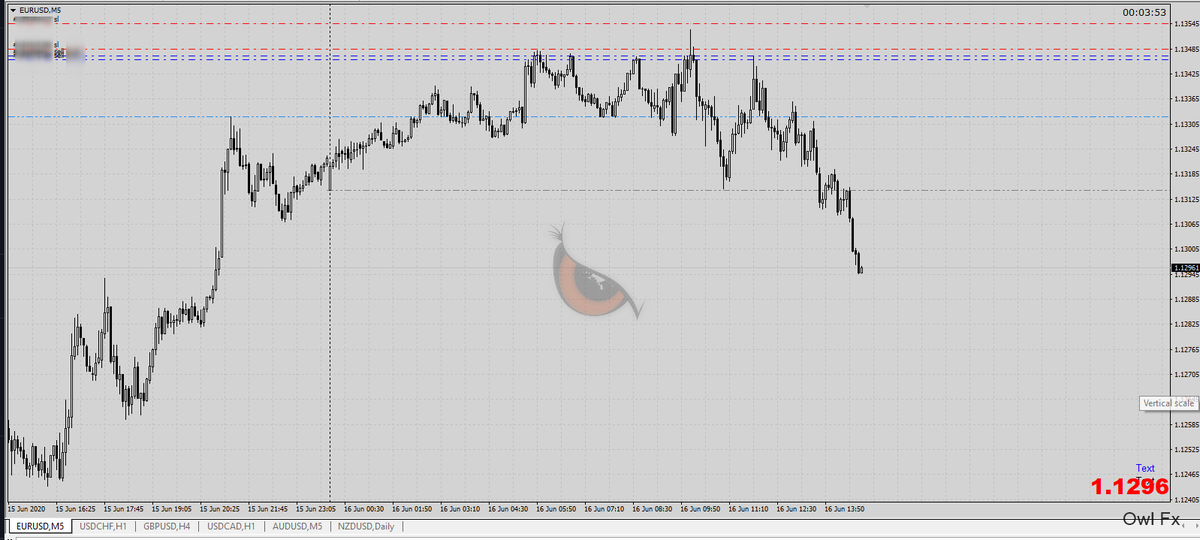

June 3rd Week Trade Results:

: 8R

: 13R

Total R: 21R

Few other trades as well but not shared the idea on twitter so not include for twitter journal.

: 8R

: 13R

Total R: 21R

Few other trades as well but not shared the idea on twitter so not include for twitter journal.

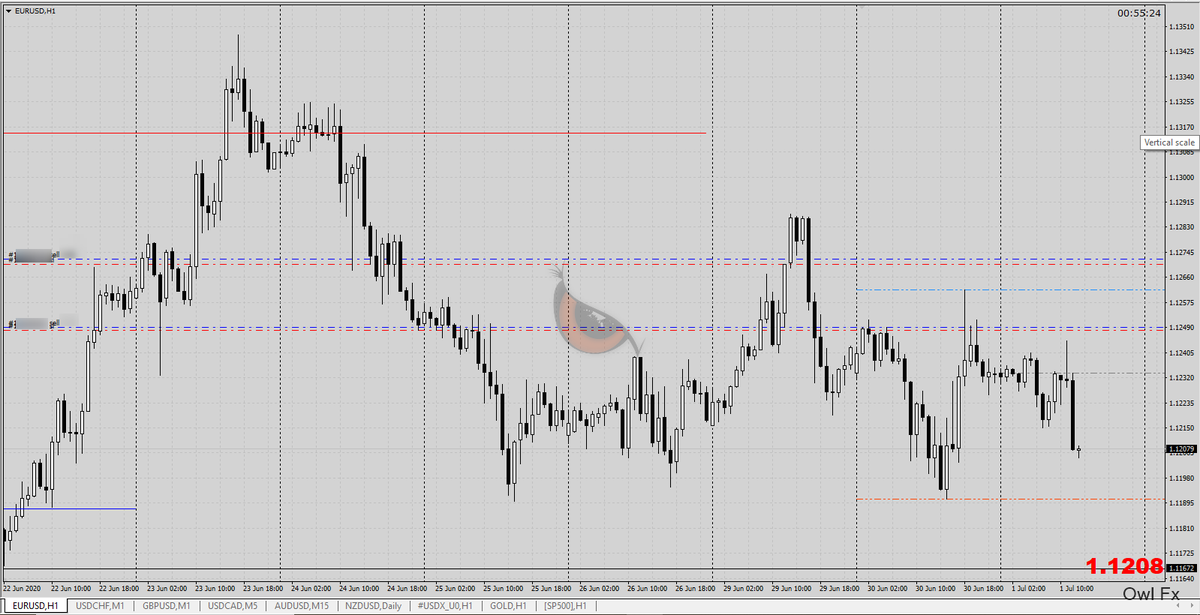

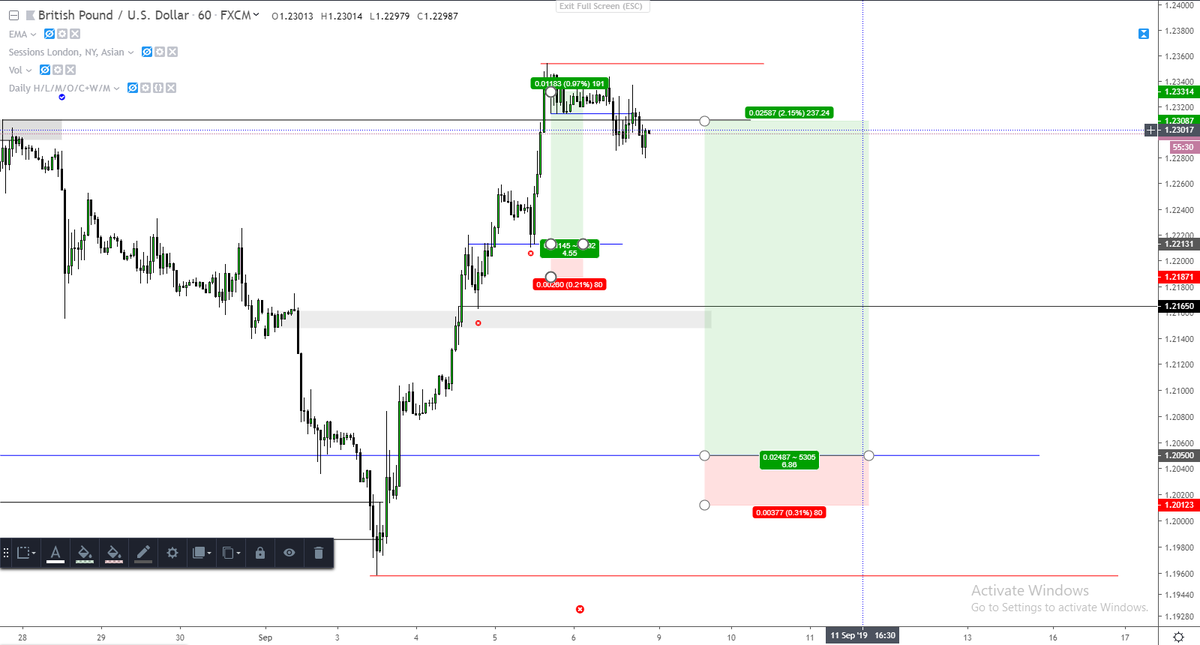

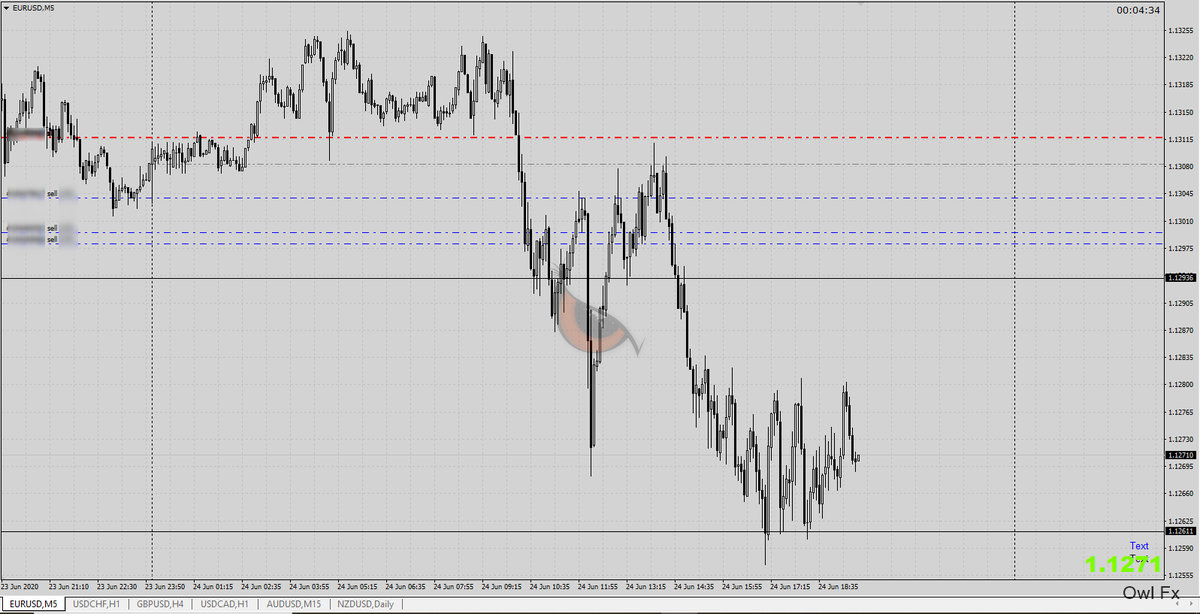

June 4th Week Trade Results:

#Eurusd:1.6R

#Eurusd:2.7R

#Eurusd:4R

#Eurusd:3R (1.5R from two positions)

Total R: 11.3

These trades which I call on my twitter feed.

#Eurusd:1.6R

#Eurusd:2.7R

#Eurusd:4R

#Eurusd:3R (1.5R from two positions)

Total R: 11.3

These trades which I call on my twitter feed.

June Month Trade Results:

1st Week: 1.8R

2nd Week: No trade(Consolidation)

3rd Week: 21R

4th Week: 11.3R

Total R monthly: 34.1R

1st Week: 1.8R

2nd Week: No trade(Consolidation)

3rd Week: 21R

4th Week: 11.3R

Total R monthly: 34.1R

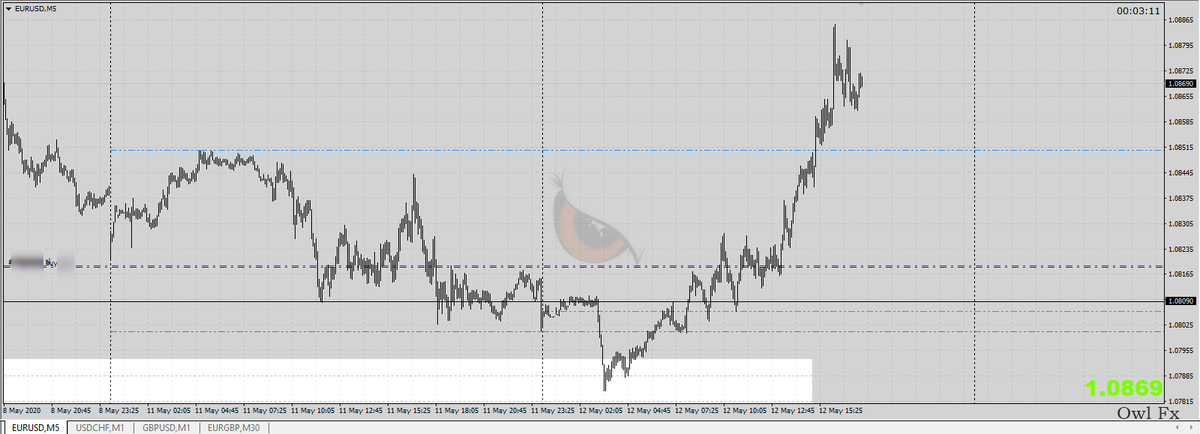

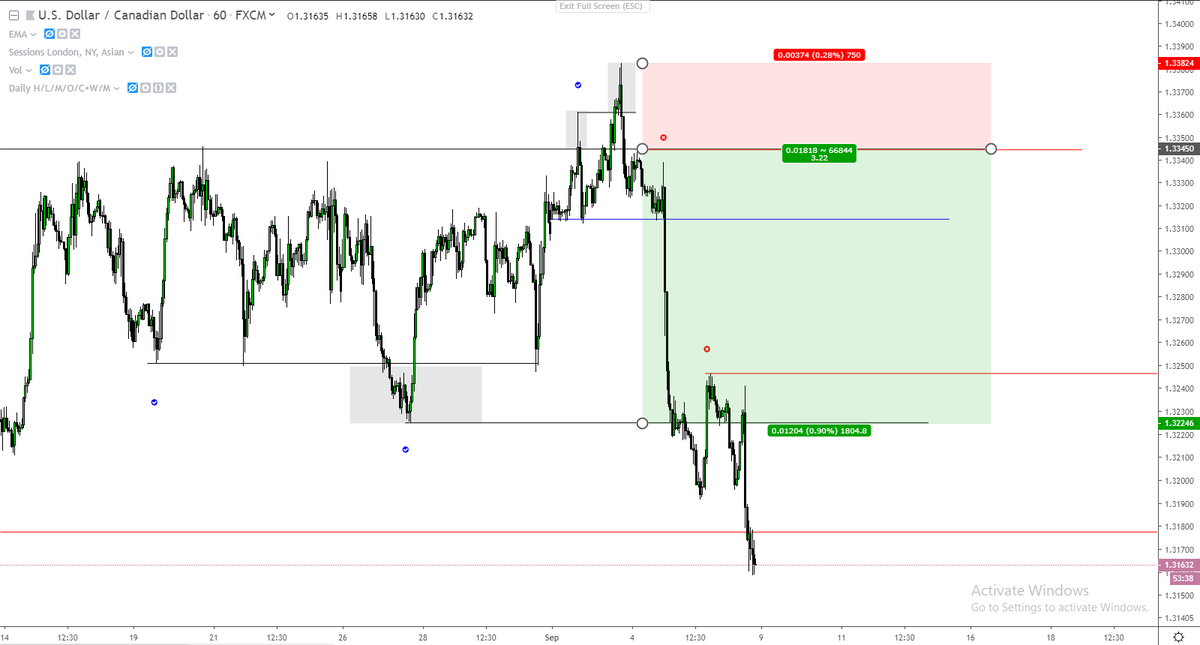

July 2nd Week Trade Results:

#Eurusd: B.E

#Eurusd: 2R

#Eurusd: 4.5R

#Eurusd: -2R( had 2 postions)

Total R: 4.5R

1st three trade call on my twitter feed before position, last trade only shared idea which invalidated later i took the loss on it so i count this loser too.

#Eurusd: B.E

#Eurusd: 2R

#Eurusd: 4.5R

#Eurusd: -2R( had 2 postions)

Total R: 4.5R

1st three trade call on my twitter feed before position, last trade only shared idea which invalidated later i took the loss on it so i count this loser too.

July 3rd Week: No Trade

July 4th Week : -1R (Missed winner trade due to bad trade management moved stop at b.e)

July 4th Week : -1R (Missed winner trade due to bad trade management moved stop at b.e)

Aug: Not share Trades Publically Only Update Price Movement thread.

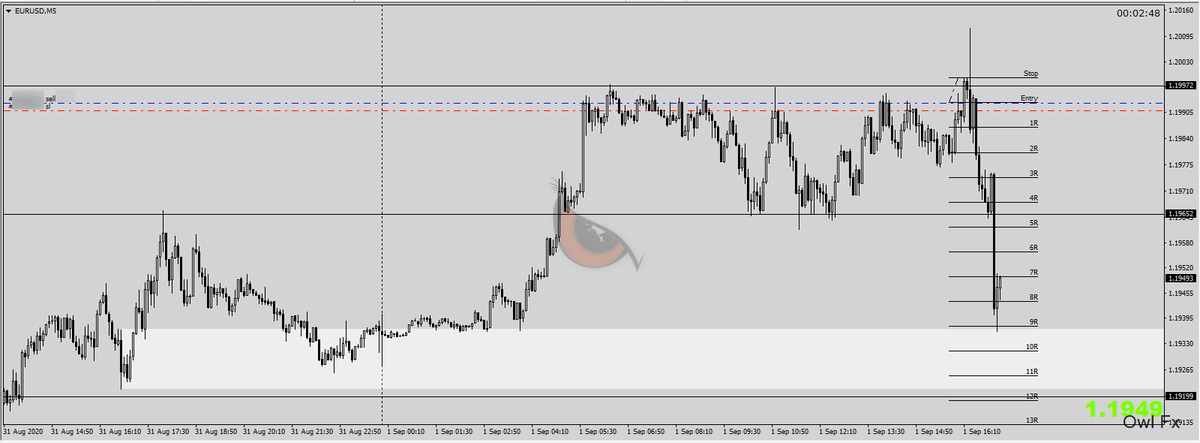

Sept 1st Week:

#EURUSD 2 Pos: 7R+9R= 16R

#EURUSD 2 Pos: 11R+B.E= 11R

#EURUSD 2 Pos: 4R+B.E=4R

Total: 21R (with 2 Friday b.e Trades)

That's me done for the Week🙏

Sept 1st Week:

#EURUSD 2 Pos: 7R+9R= 16R

#EURUSD 2 Pos: 11R+B.E= 11R

#EURUSD 2 Pos: 4R+B.E=4R

Total: 21R (with 2 Friday b.e Trades)

That's me done for the Week🙏

Dm for info about Join #Owl_Fx_Group.

I am done for the twitter Public Feed.

Was a nice journey with all of you Guys🙏

I am done for the twitter Public Feed.

Was a nice journey with all of you Guys🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh