Thread updating you about China vs The US. You're about to become incredibly smart, wise, you’ll really really like yourself and you’ll wake up tomorrow with new kitchen skills.

Year-to-date, the U.S. goods deficit with China is at $199b, down 10.2% from the same time last year

Year-to-date, the U.S. goods deficit with China is at $199b, down 10.2% from the same time last year

“Whatever must happen ultimately should happen immediately” Henry Kissinger

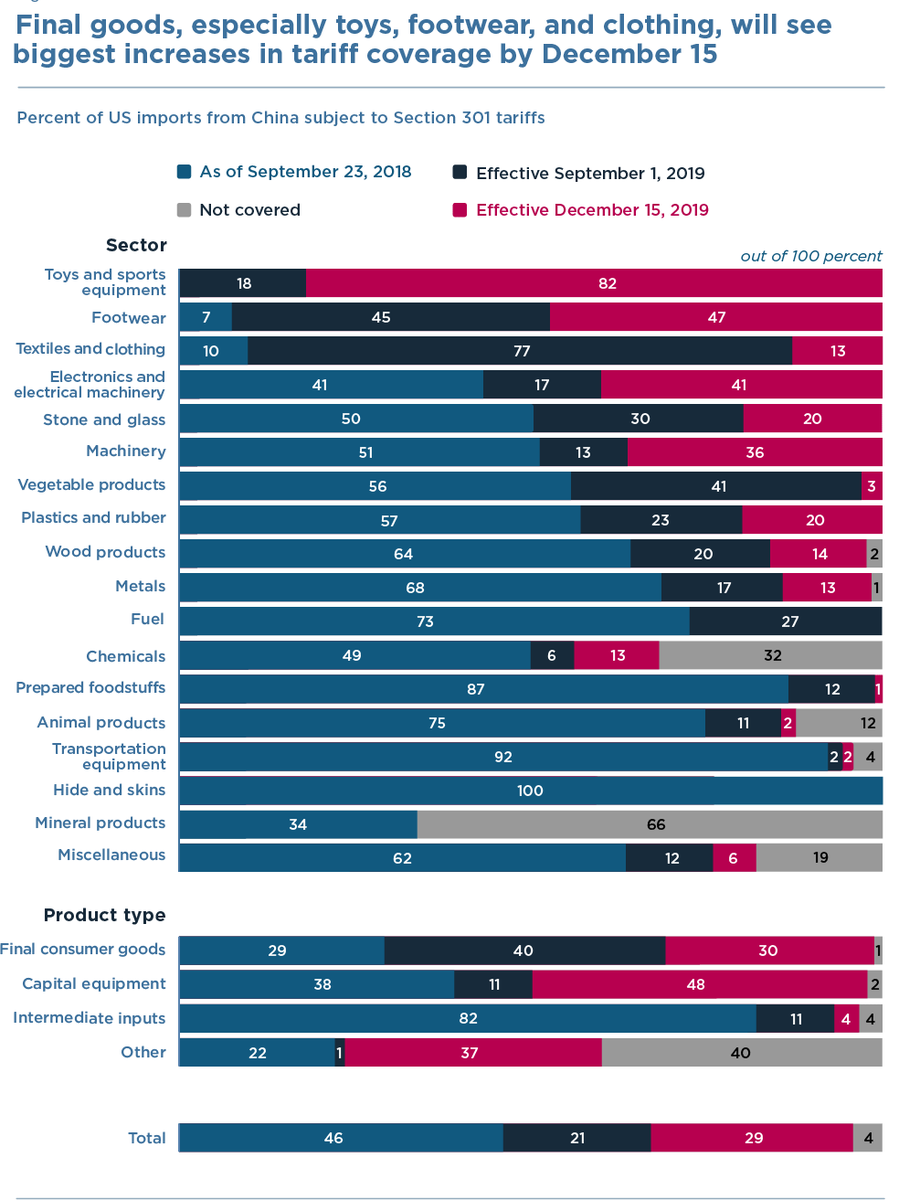

In August 2019, Trump implementation of new 10% tariffs on $300b worth of imports

Sept = 112b in clothing, footwear, textiles

Dec = 160b in consumer electronics, toys, Christmas ornaments

In August 2019, Trump implementation of new 10% tariffs on $300b worth of imports

Sept = 112b in clothing, footwear, textiles

Dec = 160b in consumer electronics, toys, Christmas ornaments

“Most foreign policies that history has marked highly, in whatever country, have been originated by leaders who were opposed by experts” Henry Kissinger

The existing tariffs on $250b was +/- 29% of imported goods

The September tariffs increased that to 69% nbcnews.com/business/busin…

The existing tariffs on $250b was +/- 29% of imported goods

The September tariffs increased that to 69% nbcnews.com/business/busin…

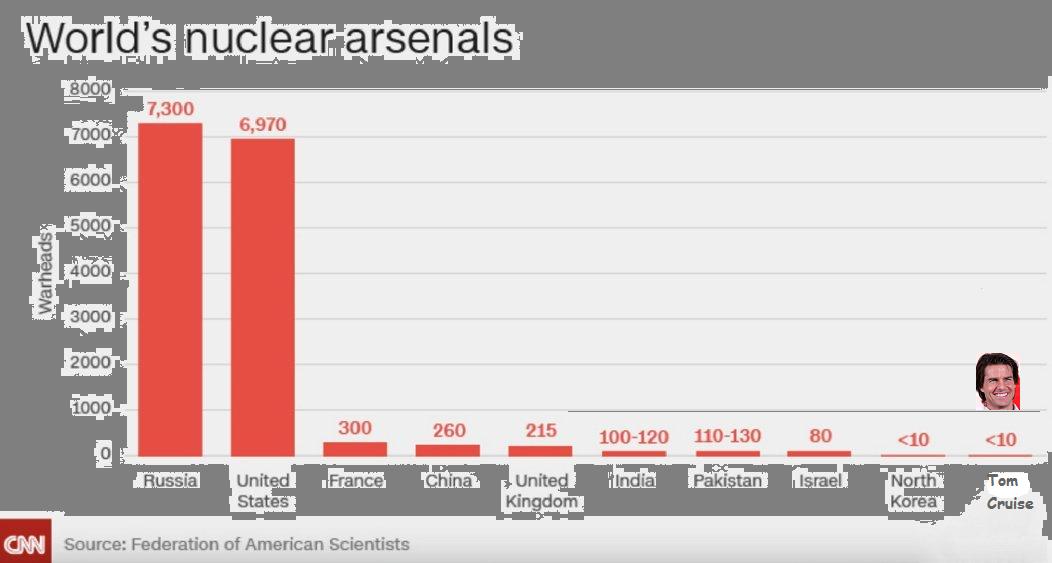

“I didn't become an actor to have power, but it just happens that I have it and so I have a lot of opportunities” Tom Cruise

China retaliated by announcing tariffs on $75b of U.S. exports of auto’s, crude oil, agri products like corn, pork, soybeans, to be phased in Sept and Dec

China retaliated by announcing tariffs on $75b of U.S. exports of auto’s, crude oil, agri products like corn, pork, soybeans, to be phased in Sept and Dec

Trump retaliated to their retaliation, U.S will...

Raise tariffs on $550b worth of Chinese imports by 5%

Increase the existing 25% tariff on $250b worth of Chinese goods to 30% on October 1

Raise the previously announced 10% tariffs on $300b worth of Chinese imports to 15%

Raise tariffs on $550b worth of Chinese imports by 5%

Increase the existing 25% tariff on $250b worth of Chinese goods to 30% on October 1

Raise the previously announced 10% tariffs on $300b worth of Chinese imports to 15%

Got that, let’s move on...

President Trump called on U.S. companies to “immediately start looking for an alternative to China” and to make more products in the United States

President Trump called on U.S. companies to “immediately start looking for an alternative to China” and to make more products in the United States

According to a U.S. China Business Council survey published in August 2019, 87% of American companies with operations in China reported they have not moved or do not plan to move any operations out of China. bloomberg.com/news/articles/…

However, surveys and polling rarely correspond to reality.

“... in conference calls with investors...dozens of executives have signaled plans to further diversify their supply chain...substantially reduce their dependence on Chinese manufacturing....” cnbc.com/2019/09/01/tru…

“... in conference calls with investors...dozens of executives have signaled plans to further diversify their supply chain...substantially reduce their dependence on Chinese manufacturing....” cnbc.com/2019/09/01/tru…

Then this happened in September… “Apple today confirmed that its newly redesigned Mac Pro will be manufactured in Austin, Texas”

apple.com/newsroom/2019/…

apple.com/newsroom/2019/…

Not all companies leaving China are returning to the US, entire new industries are being created in Vietnam and other friendly countries. This is good because they become our new trading partners wsj.com/articles/manuf…

🤣 Worst biz model. Ever. Holds pose until someone gives him 💰 then he moves like a robot or sumtin for about 20 seconds, then back into the pose.

I'm much more impressed with watching him stand motionless for hours,

get upset when people give him money and ruin the show

I'm much more impressed with watching him stand motionless for hours,

get upset when people give him money and ruin the show

Let's talk about money.

In August, China’s central bank coerced its currency, the renminbi (RMB) to weaken to 7 RMB to the U.S. dollar offsetting the effects of US tariffs. This is the lowest its traded since 2008

In August, China’s central bank coerced its currency, the renminbi (RMB) to weaken to 7 RMB to the U.S. dollar offsetting the effects of US tariffs. This is the lowest its traded since 2008

🔥Scrabble Intermission

What would you do. If you saw me post before, shhhh, pls

Answer is a few tweets down, so be patient, patient

What would you do. If you saw me post before, shhhh, pls

Answer is a few tweets down, so be patient, patient

In response, the U.S. Treasury labeled China a currency manipulator. It “will engage with the International Monetary Fund to eliminate the unfair competitive advantage created by China’s latest actions” bloomberg.com/news/articles/…

"You see the dilemma don't you. If you don't kill me, precogs were wrong and precrime is over. If you do kill me, you go away, but it proves the system works. The precogs were right. So, what are you going to do now?" Tom Cruise as John Anderton (Minority Report)

The trade war and a weak RMB ain't pretty... for China. The devaluation is a band-aid but beneath it is internal wounds for China’s economy. Buckle up...

Pricing power of Chinese firms in export intensive industries are seeing negative price growth = lowering wholesale prices to counteract tariffs.

As pricing power weakens, they still need to pay interest on debt and also increasing wages due to internal inflation/food prices

As pricing power weakens, they still need to pay interest on debt and also increasing wages due to internal inflation/food prices

The devaluation increases the credit risk of Chinese corporate debtors who have cash flows and collateral mainly denominated in RMB but have borrowed $3trillion from foreign lenders and counterparties in US dollar-denominated debt, $650b of this matures +/- 2020

"We just rolled up a snowball and threw it into Hell. Now we'll see if it has a chance." Tom Cruise as Ethan Hunt (Mission Impossible 2)

The faster devaluation occurs, the more debtors will seek to convert their RMB into dollars in an attempt to limit their losses = a rapid drainage in China’s foreign exchange reserve

What if...the Chinese government didn’t allow allow Chinese debtors to obtain dollars, forcing them to default on their international creditors? bloomberg.com/news/articles/…

“There are more things, Lucilius, that frighten us than injure us, and we suffer more in imagination than in reality” Seneca.

China has relied on tax cuts and infrastructure spending to remedy its slowing economy. From Jan to June 2019, China cut taxes by $163b

China has relied on tax cuts and infrastructure spending to remedy its slowing economy. From Jan to June 2019, China cut taxes by $163b

Local provinces are caught between fiscal stimulus and tax cuts. The govt can plug deficits for its poorest areas, problems don’t end there

🔥TV intermission Unseen Seinfeld episode:

Kramer thinks the NSA is spying on him, so he goes "off the grid." Except he uses Jerry's phone, computer & email.

Jerry: "You're just on MY grid!"

Kramer thinks the NSA is spying on him, so he goes "off the grid." Except he uses Jerry's phone, computer & email.

Jerry: "You're just on MY grid!"

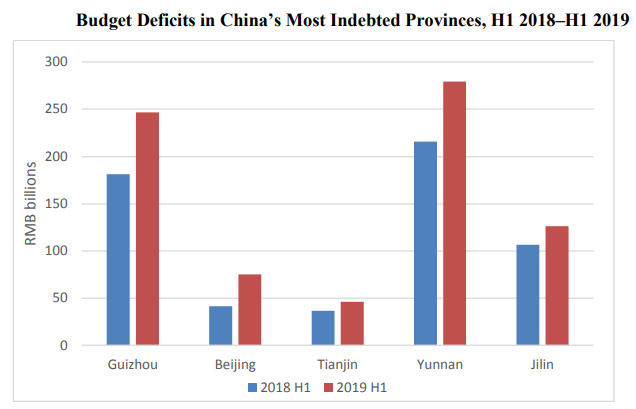

Every province (except Shanghai) that has reported fiscal data for the first half of 2019 increased its budget deficit compared to the same period in 2018.

Revenues in 11 provinces contracted year-on-year in the first half of 2019 and revenue growth deceleration in 12 others

Revenues in 11 provinces contracted year-on-year in the first half of 2019 and revenue growth deceleration in 12 others

Guangdong is China’s least debt-laden province and its largest provincial budget, their tax revenue growth decelerated from 13% year-on-year in the first half of 2018 to 2.4% over the same period this year. Expenditures accelerated from 3.4% to 13%

Guangdong joined other provinces in selling/leasing state-owned assets to raise extra revenues. Guangdong generated RMB 40b this way in the first half of 2019, a 65% increase over the same period last year. caixinglobal.com/2019-09-03/chi…

China’s high debt level, especially among local governments, has caused a slow-down in investment, a high hurdle. Due to excessively high local debt of +/- 70% of nominal GDP, the Chinese govt began a campaign to slow the pace of leveraging

ft.com/content/1eb6d9…

ft.com/content/1eb6d9…

Creditors in China have been forced to extend mo' money to debtors to prevent their bankruptcies. Provincial govts have expended billions bailing out co's, and in doing so, they have become the de facto owners of thousands of previously private companies reuters.com/article/us-chi…

Anbang Group, which went on a buying spree acquiring U.S assets, was placed under China Banking and Insurance Regulatory Commission receivership last year, it is just one of thousands of ships that go bump in the night

scmp.com/business/compa…

scmp.com/business/compa…

China’s businesses and citizenry need to invest outside of China into other countries and industries as a hedge of political and currency devaluation risks, but China won’t permit it, The draw-down of the foreign exchange reserve would undermine the continual rule of the CCP

Chinese citizens can legally still convert USD $50k from RMB to the dollar per year, they now have to fill out an extensive form stating the purpose of their conversion. Other’s find old fashioned ways… nypost.com/2019/10/02/cop…

China has pushed its banks to lend to firms in sectors prioritized by the Chinese govt and increase credit for high technology sectors. Innovation is expensive and it can be low yield, putting more pressure on indigenous tech companies to steal US tech scmp.com/news/world/uni…

Chinese funds would like to provide more capital to the very profitable real estate sector, however, govt does not want all the money it prints to go into real estate, so it has ordered banks to limit the share of new credit going to real estate ftalphaville.ft.com/2018/03/29/152…

U.S. banks, pension/mutual funds have claims +/- $180b in China liabilities and billions more in bonds issued by Chinese entities, whose cash flows are dominated by RMB. and even more unknown unknowns due to Chinese borrowing from overseas locations and cross guarantees.

In Sept Trump announced that he was considering delisting China’s companies from US financial markets. “...a radical escalation of U.S/China trade tensions” I've never heard of defending oneself from an assault as "escalation", but here we are...

reuters.com/article/us-usa…

reuters.com/article/us-usa…

One day there will be a post-mortem on $BABA (One of China's largest copanies traded in U.S markets) but we can start early, my team has looked at quarters for years to glean insights on volumes, sales, growth, real estate, actual/possible acquis, analyst Q and A's etc,..

There is accounting failures, oddly booked sales, financials that don't reconcile, The forensics by @DeepThroatIPO are painstaking, funny and scary

deep-throat-ipo.blogspot.com/2019/08/the-ba…

deep-throat-ipo.blogspot.com/2019/08/the-ba…

There are additional problems, $BABA stock is supported by undisclosed offshore funds that soak up big chucks of stock that hit the bid, this occurs away from SEC purview/authority. What happens if that mysterious money stops supporting its unnaturally high price?

Who foots the bill if and when these companies collapse, the pension funds ultimately need to be made whole. Banks/mutual/pension funds will sue for fraud and likely win, but being awarded money is different than collecting it ai-cio.com/news/pension-f…

Concerns of infiltrating into US markets. "...main retirement savings fund to reverse a decision that they say would shift billions in investments into Chinese companies" bloomberg.com/news/articles/…

We did it folks. You are the chef of the future. Now go out, core a apple and impress your friends. Enjoy

/end

/end

• • •

Missing some Tweet in this thread? You can try to

force a refresh