1. Just finished reading the EPA Supplemental proposal for 2020 RVOs. I have to give credit where credit is due to the influence of the oil refiners over at the EPA. After reading this over, I am officially declaring the #Grassley rule as dead.

2. The cleverness of those oil refinery lobbyists and lawyers is truly impressive. So, now we get the supplemental rule with the much ballyhooed moving average reallocation. Straightforward right? Wrong Buddy Ruff.

3. To understand the clever way that the refiners limited their losses in this front of the #RFSwars, it helps to start with what I would call the common sense interpretation of the history of EPA SRE waivers. Column (4) shows the SRE exempted gasoline and diesel vol over 16-18

4. These are not my numbers. These are drawn exactly from the EPA's own website. The key is that the average of of exempted gasoline and diesel volume under SREs is 12.77 billion gallons for 2016-2018. So, you would think that is the number EPA would project for 2020. Wrong.

5. The EPA now says that they are going to maybe possibly give partial SREs starting in 2020 despite their policy of forever not doing this. And these means they need to go back and revise the history of SREs as if they followed this policy in the past.

6. EPA even states in the proposal that in the Aug 9, 2019 Memorandum on SRE petitions that they granted no partial exemptions even when DOE recommended partial exemptions. Oh well. Guess that's all changed now.

7. So, the EPA went back and said here are the SRE exempted volumes over 2016-2018 if we had followed DOE guidance on giving partial exemptions. Now compare my earlier table with this one from the EPA proposal. Their 3-yr avg. is now magically 7.26BG instead of 12.77BG.

8. The result is that that the reallocation of 2020 RVOs is only 7.26BG instead of the 12.77BG that any reasonable analysis would have anticipated. The reallocation is 56.9% of what it should have been based on SREs ACTUALLY AWARDED OVER 2016-2018.

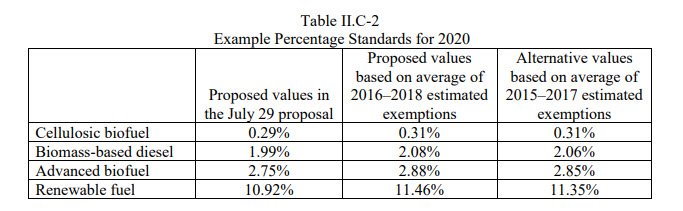

9. Here are the proposed % standards for 2020 now. To see how much difference this little trick makes, note that the total renewable RVO is 11.46% (or 11.35% even lower). It would have been 12.74% if actual SRE levels had been used.

10. So what to make of all this? If EPA does grant partial SREs for 2020 (sometime in 2021) as projected today, then it could be said that the RFS mandates for 2020 will be fully enforced. But that is missing the forest for the trees.

11. The reality is that the reallocation of gallons for 2020 will be a little more than half of what was lost on average over 2016-2018. Plus, the EPA has to be trusted to grant partial waivers far in to the future that match projections today for this to work at all.

• • •

Missing some Tweet in this thread? You can try to

force a refresh