Agricultural Economist at the University of Illinois; Lifelong fascination with commodity markets; Iowa farmboy

https://t.co/3zBDWxQFsH

7 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/kannbwx/status/18777653470732329012. Lots of discussion in the trade this fall about the impact of harvesting low moisture crops on yields. In theory, everyone should be discussion yields standardized to 15% moisture. The USDA does this for the objective yield (field sample) estimates. However, they take what farmers report to them based on whatever moisture assumption farmers make. This may bias yield reports from farmers down compared to standard 15% moisture bushels. This would in turn bias USDA yield estimate overall downwards. Any bias would be amplified in January report (today) because it is mainly based on the large December agricultural survey of farm operators.

2. I am going to use the following yield/price combinations just to get the convo started. Corn: 240 bu./$3.70. Soybeans: 75 bu./$10.30. I use higher yield expectations based on the expectation that Beryl rains will go a long ways to improving prospects. Mr. Market sure thinks so. Without taking into account LDP and crop insurance proceeds, this results in estimated farmer returns of -$244/acre for corn and -$98/acre for soybeans. For farms with 50/50 rotations that results in average farmer returns for all acres of -$171 per acre.

2. I am going to use the following yield/price combinations just to get the convo started. Corn: 240 bu./$3.70. Soybeans: 75 bu./$10.30. I use higher yield expectations based on the expectation that Beryl rains will go a long ways to improving prospects. Mr. Market sure thinks so. Without taking into account LDP and crop insurance proceeds, this results in estimated farmer returns of -$244/acre for corn and -$98/acre for soybeans. For farms with 50/50 rotations that results in average farmer returns for all acres of -$171 per acre.

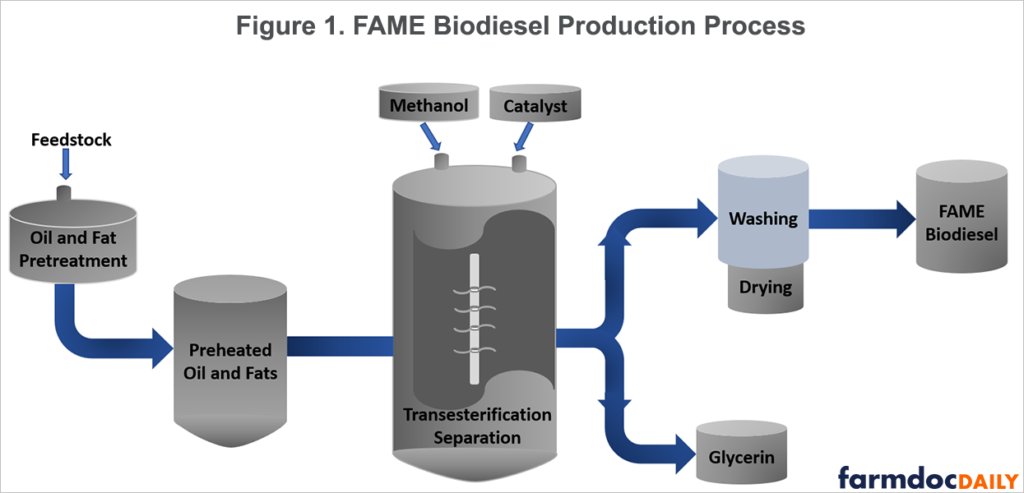

2. We can use the proposed RVOs to come up with a defensible estimate of the maximum demand for biomass-based diesel (BBD) for 2023, 2024, and 2025. We can do this because we know mandates are and will be binding.

2. We can use the proposed RVOs to come up with a defensible estimate of the maximum demand for biomass-based diesel (BBD) for 2023, 2024, and 2025. We can do this because we know mandates are and will be binding.

https://twitter.com/FarmPolicy/status/1623668844748324865@JaysonLusk 2. Jayson has the lowdown on egg prices in this chart. Yes, egg prices have gone up a lot lately.

@ASmithUCD 2. Besides a glimpse at very cool new ag tech, I found the discussion of the economic impact of new tech to be the most interesting. Really like this "layered" way of thinking about the economic impact of new tech.

@ASmithUCD 2. Besides a glimpse at very cool new ag tech, I found the discussion of the economic impact of new tech to be the most interesting. Really like this "layered" way of thinking about the economic impact of new tech.

https://twitter.com/ASmithUCD/status/1621666387361140736@ASmithUCD 2. We have nothing to fear in general from machines and automation based on a long history. There will always be new jobs created (that we could not imagine) to replace the old lost ones due to automation. Market economies are job machines in the long run.

https://twitter.com/FarmPolicy/status/15565991992354570242. An awfully lot of opinion out there about organic vs. conventional crop returns. Mike has assembled invaluable comparisons from the same FINBIN database. Here are five-year average yields. Hits to organic yields are obvious and big for corn and soybeans.

2. Here is the 30 day % of normal. Shows the accumulating dryness in the western Corn Belt. Southern half of IA is a major area of concern. Most of the IA has really dried out the last few weeks.

2. Here is the 30 day % of normal. Shows the accumulating dryness in the western Corn Belt. Southern half of IA is a major area of concern. Most of the IA has really dried out the last few weeks.