A thread on altcoins.

They are nuanced. We have:

-Protocol coins

-Utility tokens

-Security tokens

-Non-fungible tokens

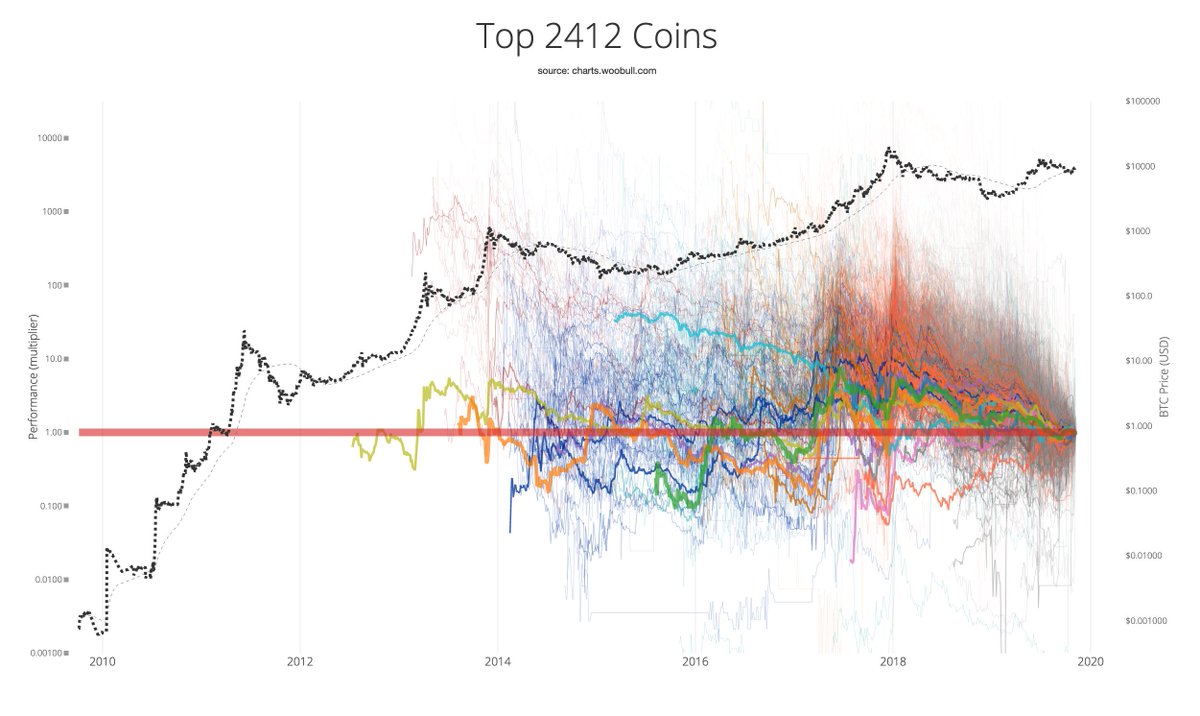

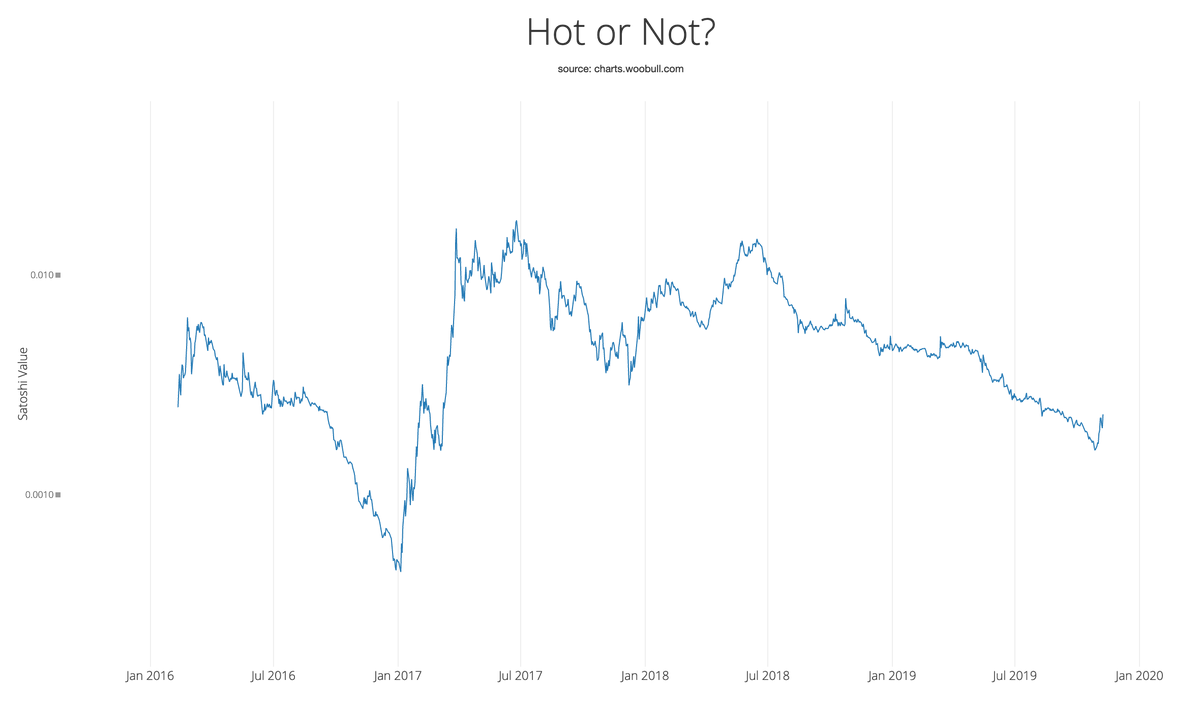

But to an investor, there's only 2 types of altcoins. Oscillators and Degenerators. You can spot them on this chart of the entire market.

/1

They are nuanced. We have:

-Protocol coins

-Utility tokens

-Security tokens

-Non-fungible tokens

But to an investor, there's only 2 types of altcoins. Oscillators and Degenerators. You can spot them on this chart of the entire market.

/1

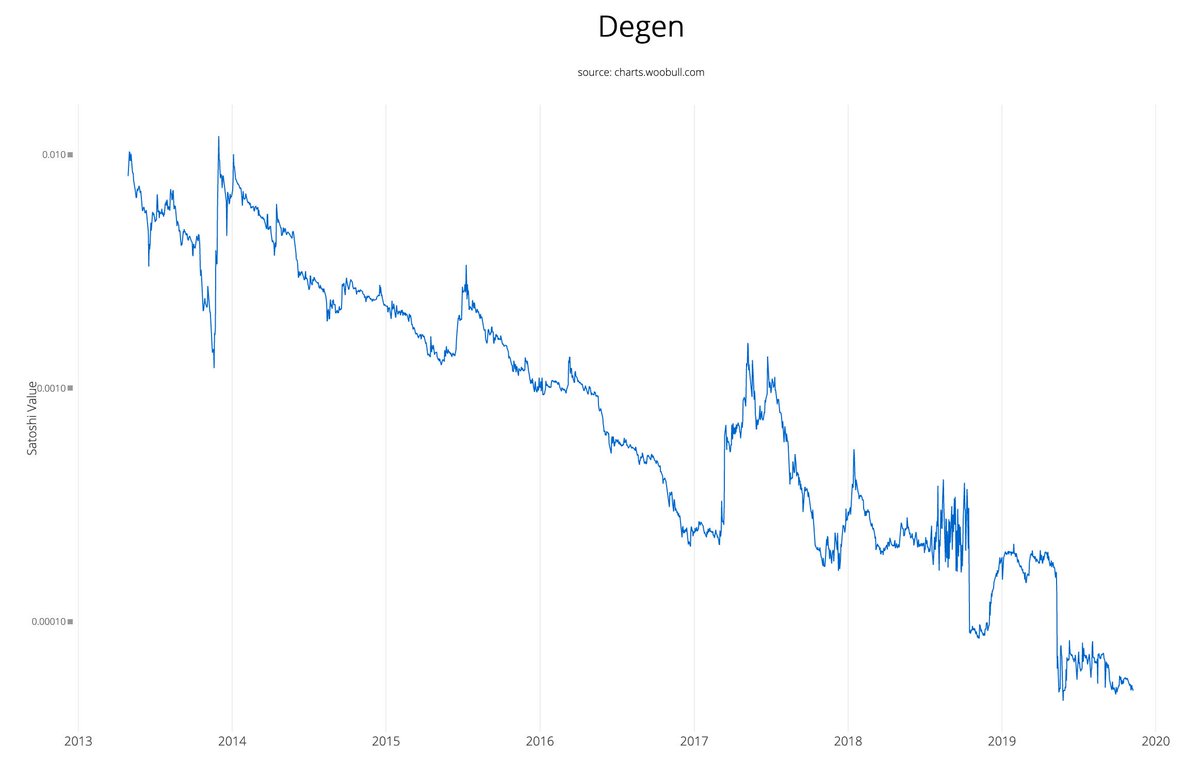

The vast majority of alt-coins are Degens. Their price chart has a measurable half-life, like radioactive decay. Plotted on a log chart, it's a straight line down. (This one is Namecoin, a promising coin of its era, there's over 2000 examples like this).

/2

/2

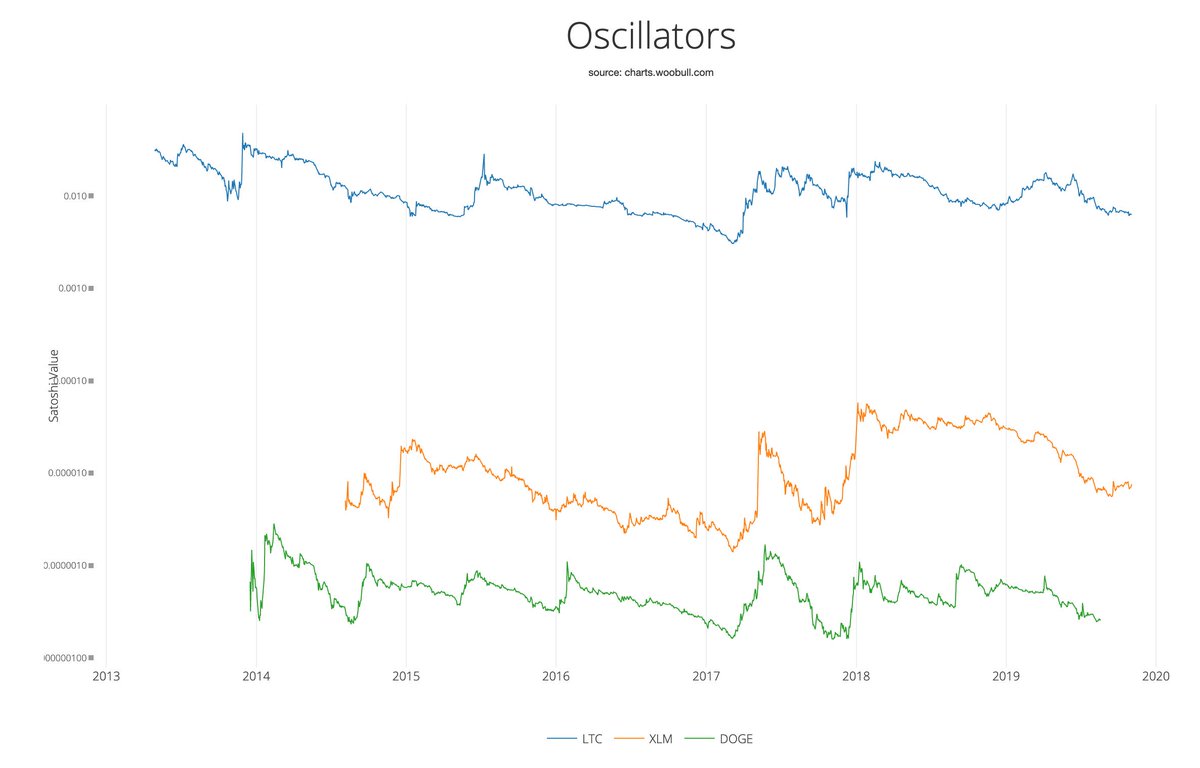

A handful are oscillators. Oscillators are proving SoV properties.

To qualify they need to keep up with BTCUSD gains. To find them, plot their BTC value. It must oscillate around a horizontal line, for at least one full bull-bear cycle (around 4yrs). More cycles are better.

/3

To qualify they need to keep up with BTCUSD gains. To find them, plot their BTC value. It must oscillate around a horizontal line, for at least one full bull-bear cycle (around 4yrs). More cycles are better.

/3

Let me bring up this Oscillator. It's DOGE, a coin that was created as a joke, it has had no active development for years. It's a humour fork of Bitcoin offering no technical innovation.

And it's a freaking oscillator.

/4

And it's a freaking oscillator.

/4

DOGE achieved SoV because of Lindy Effect. It's listed on nearly all exchanges, it's supported by most wallets, it has a liquid market.

Note I didn't say it has cutting edge technology, scaleability, fancy smart contracts, governance, or has solved sharding.

/5

Note I didn't say it has cutting edge technology, scaleability, fancy smart contracts, governance, or has solved sharding.

/5

I point this out to mock the common thought train that you need innovation and cutting edge tech to build value in your coin.

These are monetary instruments, they build value with economic network effects.

/6

These are monetary instruments, they build value with economic network effects.

/6

Here's an interesting one. It's DCRBTC. It's at a critical stage coming onto completing it's very first full bull-bear cycle, it needs to emerge cleanly holding it's horizontal oscillation against BTC. Only then can we say it's achieving SoV properties.

/7

/7

If you plan on being in altcoins here's my rules of engagement:

1) It's critical to determine a Oscillator from a Degen.

2) Oscillators are good to enter and exit to stack more BTC

3) Never HODL a Degen, period. GTFO

4) Be careful on the coins younger than one full cycle.

/8

1) It's critical to determine a Oscillator from a Degen.

2) Oscillators are good to enter and exit to stack more BTC

3) Never HODL a Degen, period. GTFO

4) Be careful on the coins younger than one full cycle.

/8

• • •

Missing some Tweet in this thread? You can try to

force a refresh