One year is about to complete.

Capital : 18.6L

P&L F&O : 7.51L

P&L Equity : 30.6K

Total P&L : 7.816L

ROI : 42% Per annum (3 weeks left)

Consistency is the key ✌️✌️

Capital : 18.6L

P&L F&O : 7.51L

P&L Equity : 30.6K

Total P&L : 7.816L

ROI : 42% Per annum (3 weeks left)

Consistency is the key ✌️✌️

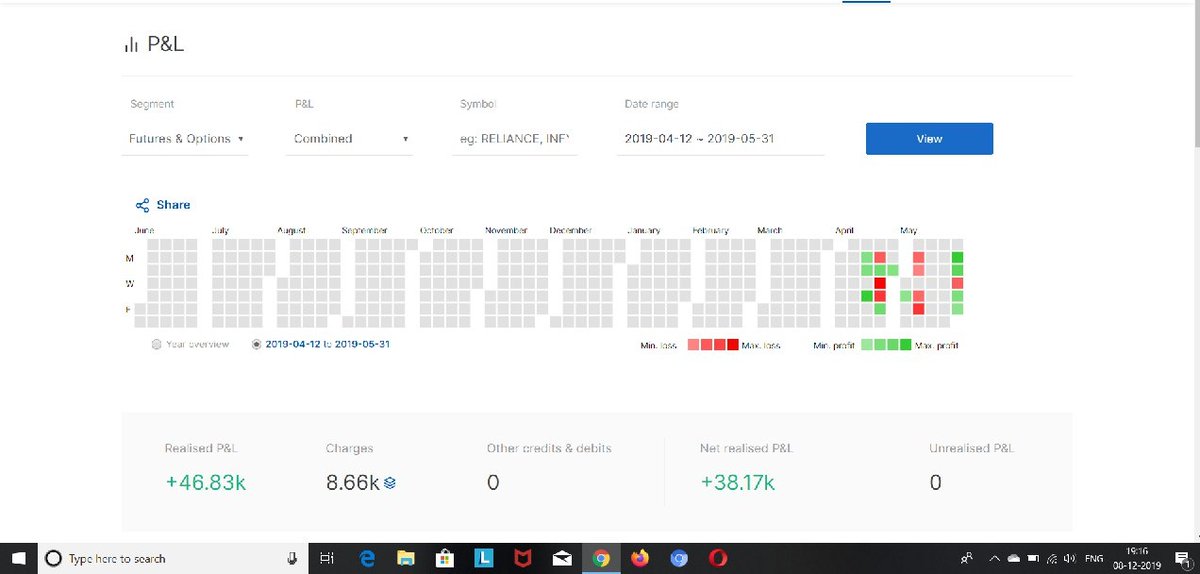

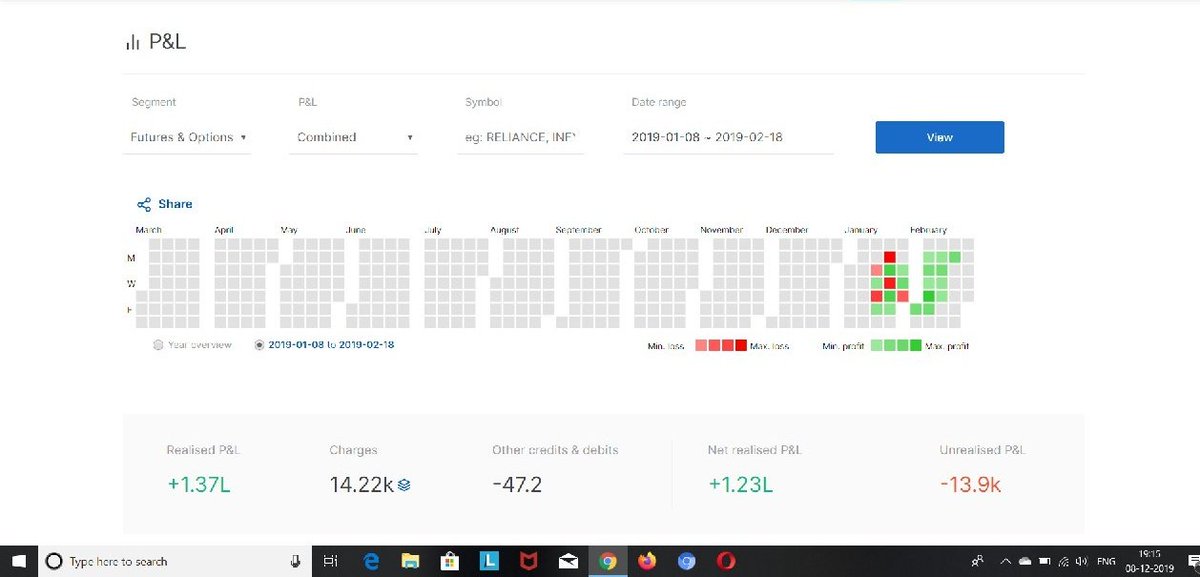

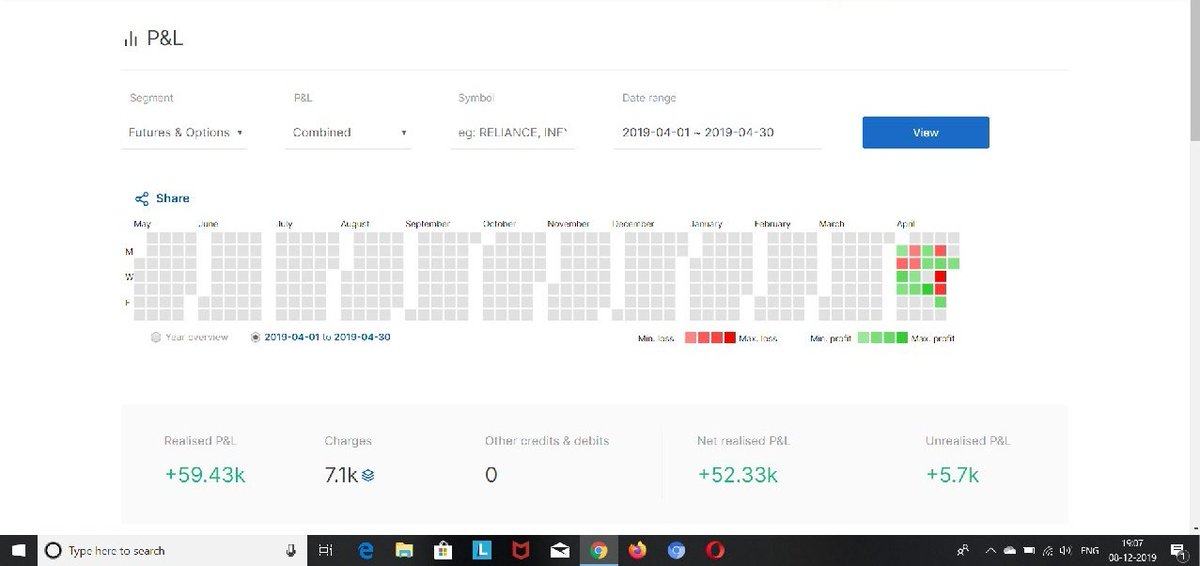

4 Quarterly Earnings Season of 2019.

Net P&L during earnings season : 623170

80% of overall gains came during Earnings season.

Note : There were expiries as well inclusive in this p&l during that period.

Net P&L during earnings season : 623170

80% of overall gains came during Earnings season.

Note : There were expiries as well inclusive in this p&l during that period.

#monthly performance

Out of 12 months faced draw down in 3 months were in "Red" but max drawdown in any month has not breached even 2% of capital.

Out of 12 months faced draw down in 3 months were in "Red" but max drawdown in any month has not breached even 2% of capital.

#monthly performance

#monthly performance.

• • •

Missing some Tweet in this thread? You can try to

force a refresh