Expiry, Earnings & Breakout trader with option selling. Believer of consistency.

36 subscribers

How to get URL link on X (Twitter) App

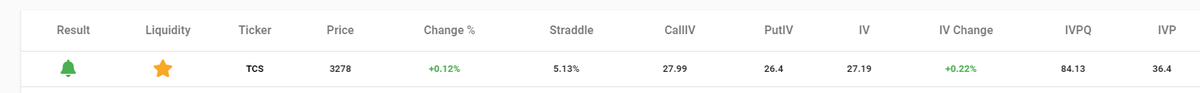

Current IV : 27-28

Current IV : 27-28

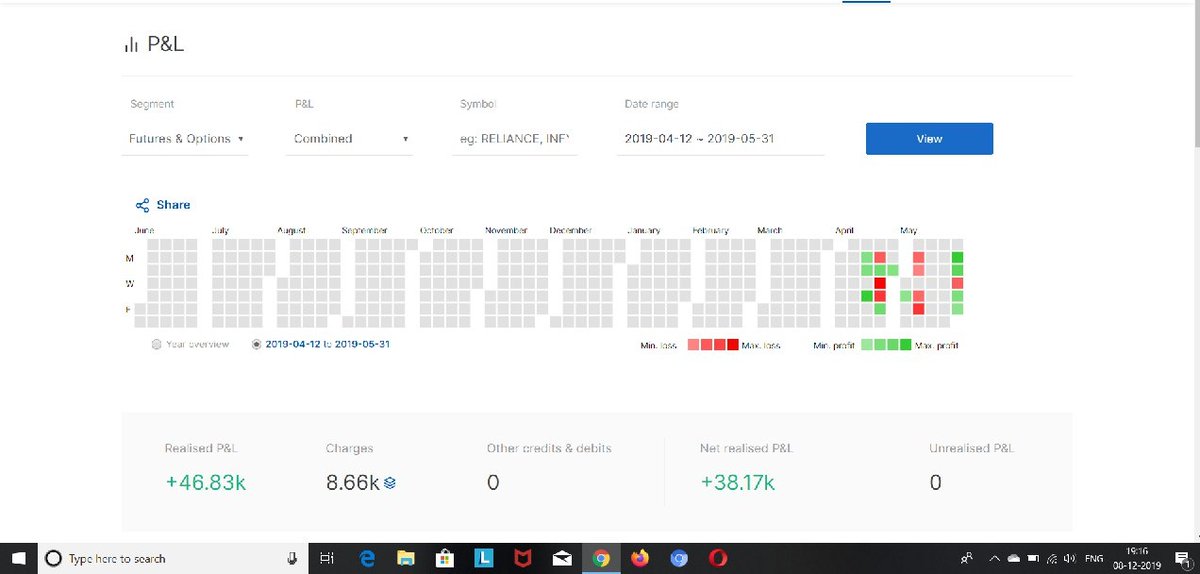

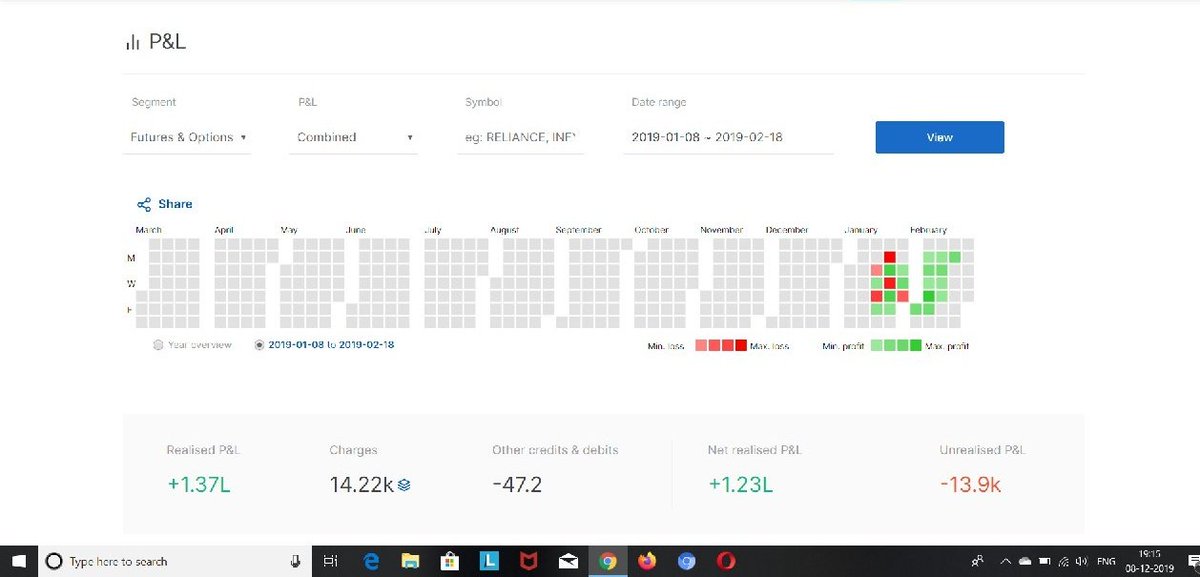

4 Quarterly Earnings Season of 2019.

4 Quarterly Earnings Season of 2019.