Worth reiterating (a lot): in recent decades, income has been shifting to the wealthy and away from the working class, and the 2017 tax law exacerbated those trends by giving the largest tax cuts to the wealthy. #2YearsOfTCJA

https://twitter.com/CenterOnBudget/status/1204839013430906882

The law:

-Cut the corp rate from 35% to 21%

-Created an unprecedented 20% deduction for pass-throughs

-Doubled (to $22M) the amt that can be passed on to heirs tax-free

-Cut the top rate from 39.6% to 37%

These cuts overwhelmingly benefit the wealthy.

-Cut the corp rate from 35% to 21%

-Created an unprecedented 20% deduction for pass-throughs

-Doubled (to $22M) the amt that can be passed on to heirs tax-free

-Cut the top rate from 39.6% to 37%

These cuts overwhelmingly benefit the wealthy.

The law cost almost $2 trillion over 10 years, an irresponsible tax cut at a time when we should be raising MORE revenue to cover rising fiscal challenges due to an aging population, rising health care costs, etc. #2YearsOfTCJA

And instead of creating real tax reform that simplifies the code & narrows the gaps between how different times of income are taxed, the 2017 law did the opposite and increasing complexity, which has “turned us into a nation of tax shelter hunters,” according to @HowardGleckman.

@HowardGleckman Proponents promised the law would spur investment, raise wages, create so much economic growth that the bill would pay for itself. #2YearsOfTCJA

Well?

cbpp.org/blog/crs-2017-…

Well?

cbpp.org/blog/crs-2017-…

@HowardGleckman Since the 2017 law, GOP lawmakers have doubled down on the law's flaws by trying to make the indiv. provisions permanent. Just yesterday, Mulvaney promised a grp of CEOs that the Trump admin wants more drastic cuts to the corporate rate. #2YearsOfTCJA

taxnotes.com/tax-notes-toda…

taxnotes.com/tax-notes-toda…

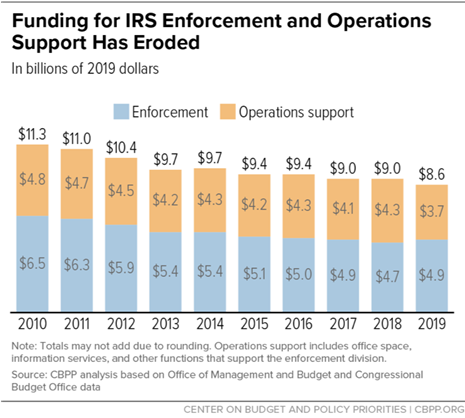

@HowardGleckman Policymakers should set a new course & pursue true, progressive tax reform that prioritizes the needs of working people w/low or modest incomes; raises revenue to meet national needs; & improves efficiency & strengthens the integrity of the tax code.

cbpp.org/research/feder…

cbpp.org/research/feder…

That means raising substantial revenues in a progressive manner by taxing more types of income that currently escape income tax (lookin' at you, stepped-up basis) & improving the way we tax other kinds of income.

cbpp.org/research/feder…

cbpp.org/research/feder…

Instead of giving massive tax cuts to the wealthiest Americans, we should invest in the low-income workers & families who would benefit the most. For instance, the Working Families Tax Relief Act would boost the incomes of ~46M households by expanding the EITC & CTC.

• • •

Missing some Tweet in this thread? You can try to

force a refresh