How to get URL link on X (Twitter) App

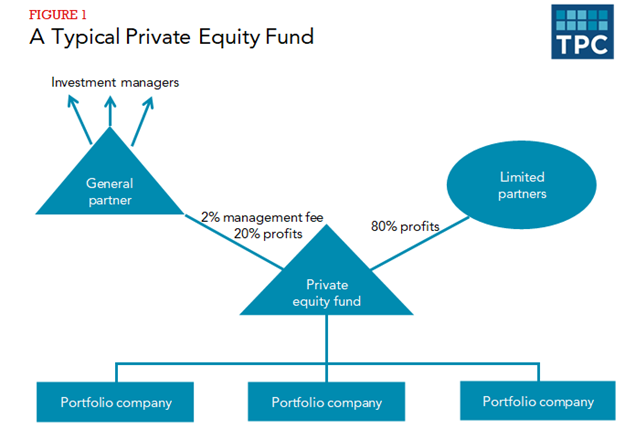

https://twitter.com/ChuckCBPP/status/1552669041646608384First, it's helpful to understand how private equity funds generally work. The fund is a partnership, which is a “pass-through” entity, so the fund’s profits are taxed in the hands of the owners as if the owners received the income directly.

https://twitter.com/Connor__Maxwell/status/1268196028341256192

https://twitter.com/GreensteinCBPP/status/1240778506746896385On the biz tax side, they seem to be throwing everything at the wall just to see what sticks. Some things make sense, e.g., turning off TCJA changes to NOL rules (which probably shouldn’t have helped pay for corporate tax cuts in the first place).

https://twitter.com/CenterOnBudget/status/1204839013430906882

The law:

The law:

The law says property must be purchased from an unrelated party after 12/31/17. So a property developer who owned land in an OZ before the law was passed couldn’t count that land as qualifying property & couldn’t just “sell” it to his brother to avoid the purchase requirement.

The law says property must be purchased from an unrelated party after 12/31/17. So a property developer who owned land in an OZ before the law was passed couldn’t count that land as qualifying property & couldn’t just “sell” it to his brother to avoid the purchase requirement.

https://twitter.com/Pat_Garofalo/status/1181540517705850881It's not *necessarily* a bad thing for an area w/a sports stadium to be designated as an OZ. There could, of course, be high poverty in such areas, and those folks could benefit from government intervention. /2