1/11 @AngelList released report on early stage venture investing angel.co/blog/venture-r… Dense math to make a case that spray and pray (only) works in early stage venture. Made perhaps to trigger a Moneyball moment in a investor community that talks bets like astrologers

2/11 @RonConway & @davemcclure demonstrated this clearly through their experience of investing in 500-700 startups. Then why the report ?

3/11 @AswathDamodaran regularly reminds us that "Numbers gives strength to Narratives". Put another way Data is the armor of the modern day Story teller. amazon.com/dp/B07KLNHQJX/…. Perhaps that is why the data and the report was needed i.e to convince better

4/11 Key assumption in the report is startup returns follow power law. @fredwilson asked his readers of this question a decade ago.

https://twitter.com/fredwilson/status/1643019747Found that even if it is power law then kurtosis matters. avc.com/2009/04/the-ve…

5/11 @fredwilson may not have found the kurtosis or found proof that it is power law. However found a judgement and a position that helps him to consistently hit an IPO or massive exit every year for the last five years to net a mind boggling IRR.

https://twitter.com/jasonlk/status/1140204929346412544

6/11 Majority of investors do believe returns are a power law but at best that is empirical. Which means it is a mental model or a thesis.

https://twitter.com/trengriffin/status/1156221236097064961

7/11 When you send a startup on a star trek type mission to Mars like @MUSK is trying we are dealing with Knightian uncertainty not well understood probability distributions. No mental model or probability distribution can model that outcome at the start

https://twitter.com/trengriffin/status/1080551733539962880

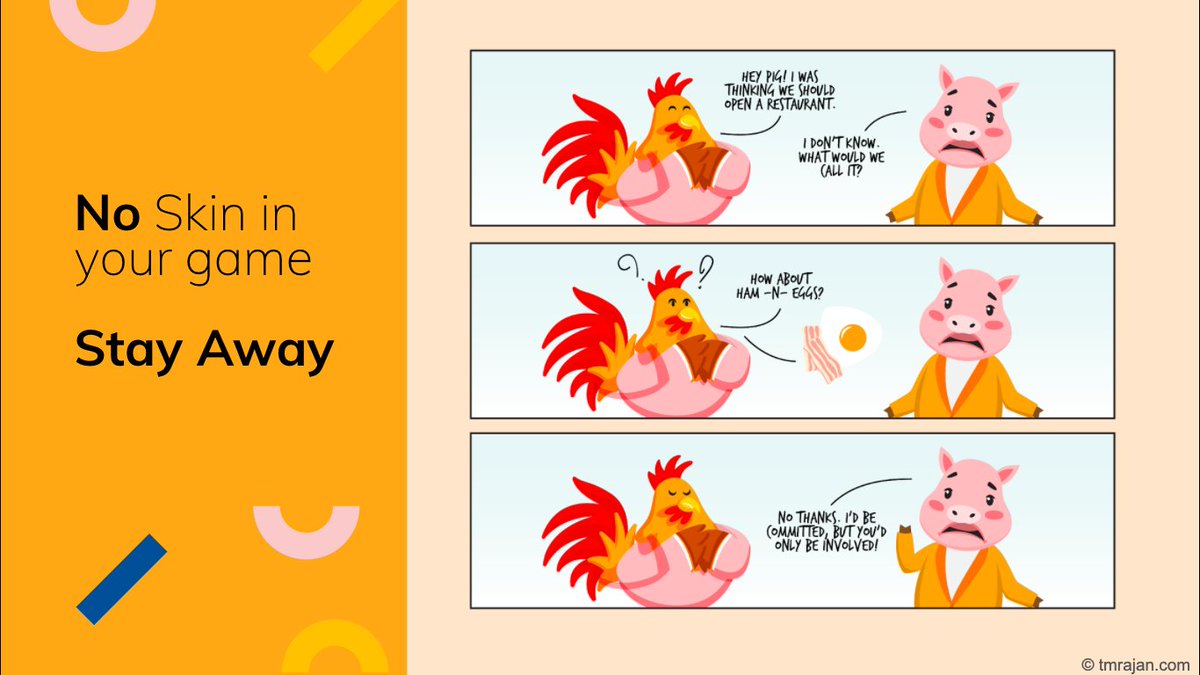

8/11 In the report there is reference to @taleb & power law to lend credibility to case made. However @taleb argues something different. In the world of uncertainty (ex-startup) that you don't understand, position yourself in a way to benefit from it & not got ruined. #convexity

9/11 “Not everything that counts can be counted, and not everything that can be counted counts.” - Albert Einstein

10/11 Describing a thesis should be enough as long as bets are bounded. @peterthiel @fredwilson do this, that maybe better than to fit data. @naval @nivi are top thinkers of world who can frame thesis and they must do. This data/report only raises more question than it answers

11/11 Outliers by definition don't come from a model. Investors or anyone as long as they take affordable bets they will survive and increase the likelihood of getting lucky

• • •

Missing some Tweet in this thread? You can try to

force a refresh