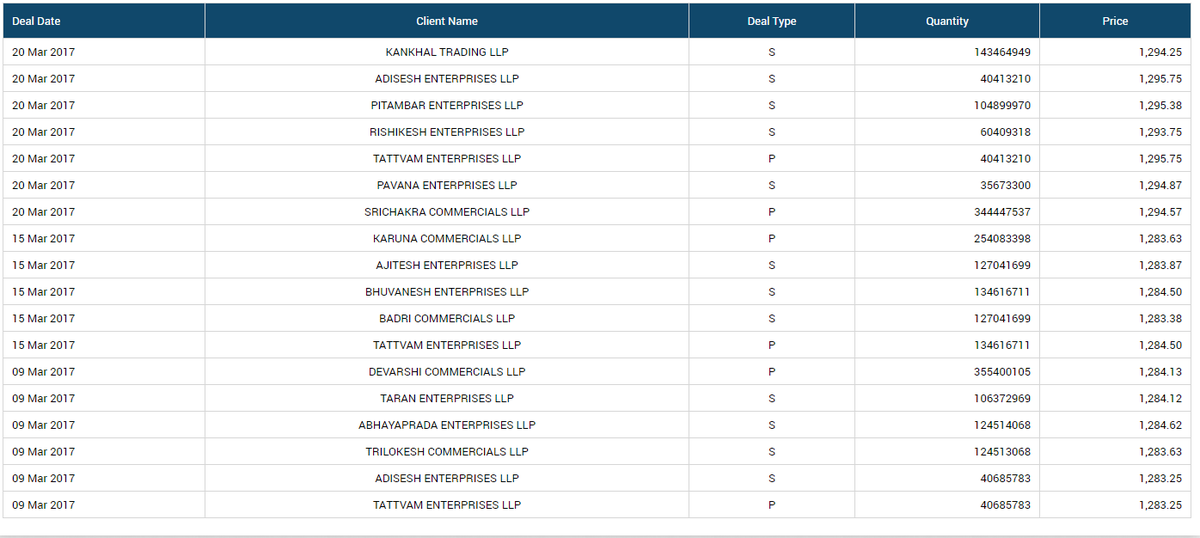

#TweetStorm In the year of consideration for #LTCG where 3.67 lakh crores was supposed to be booked. There was a one-off bulk deal ( promoter to promoter entity ) of #RelianceInds of almost 1.5 lakh crores which might have got considered as #LTCG.

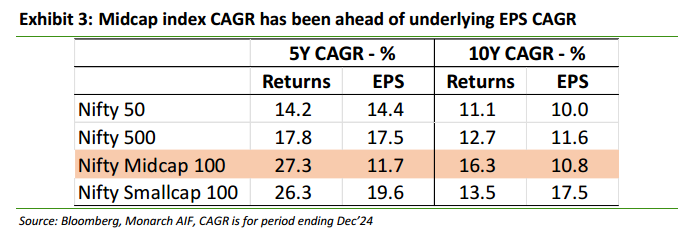

Our calculations suggest even in a case of 3% Equity changing hands and 15% cagr the expected 20k crores Tax Revenue will not happen in any of the next 10 years !! May not cross STT numbers also for 5 years !! Low Revenue Tax in practical case may not even get 3000 cr a year.

A guesstimate of 2-3 crore Unique Individual Investors are being taxed for #LTCG and will fill more columns in IT returns instead of catching and penalizing Tax Evaders/Money Launders nooreshtech.co.in/2019/07/ltcg-t…

• • •

Missing some Tweet in this thread? You can try to

force a refresh