Technical Analyst/Blogger/Educator. Blogging on Technical Analysis for 17 yrs. Vested interests in stocks -SEBI RA. Whatsapp 7977801488 for queries & updates

9 subscribers

How to get URL link on X (Twitter) App

Step 2)

Step 2)

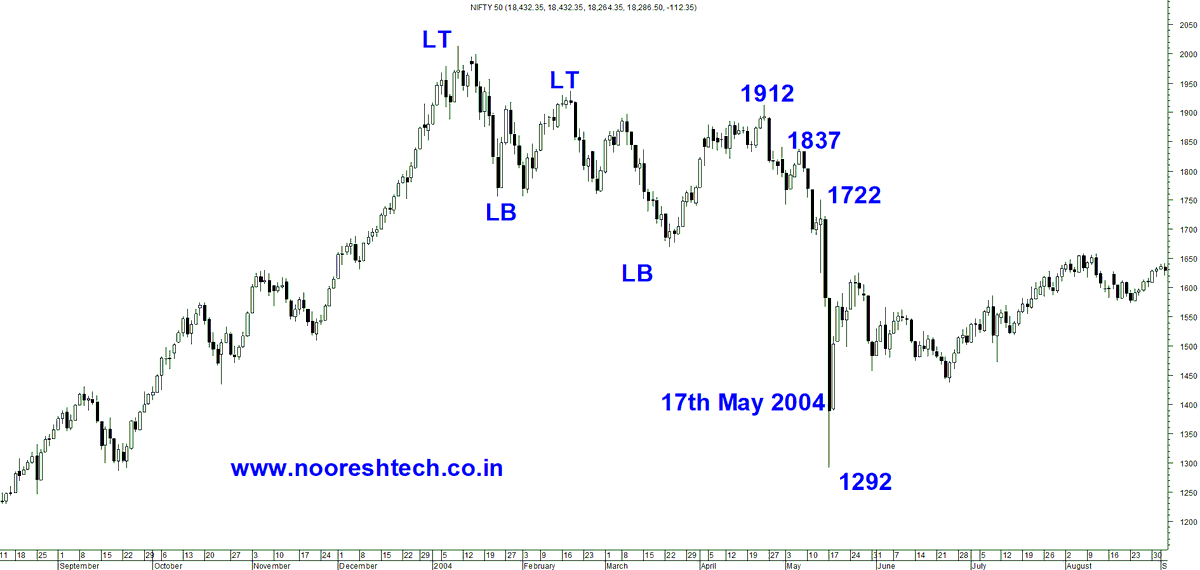

The past instances

The past instances

A) March 1992.

A) March 1992.

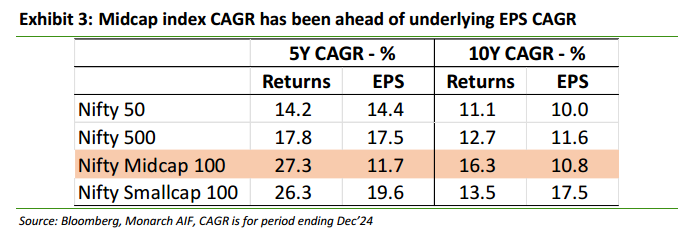

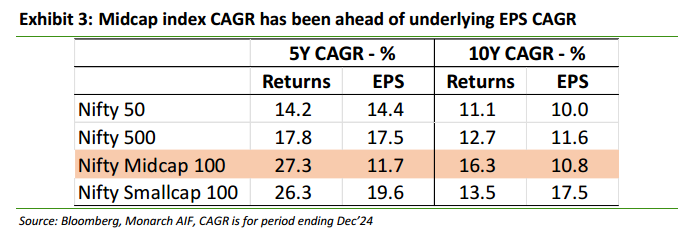

1) The Constituents tell you the Story

1) The Constituents tell you the Story

According to him both the studies contradicts each other, example, A technical chart will tell you to sell it 20% below your purchase price and as a Fundamental analyst you will double your position at 50% below your purchase price so those things are conflicting

According to him both the studies contradicts each other, example, A technical chart will tell you to sell it 20% below your purchase price and as a Fundamental analyst you will double your position at 50% below your purchase price so those things are conflicting

2) Recession -

2) Recession -