1/n A series of tweets on Diversification from Mr Buffett's Jan 1966 letter. Lately there has been a stance of movement towards higher diversification with many Gurus pointing out the same. I think this letter is *one of the best content* on the subject. Quoting Mr Buffett below:

2/n We diversify substantially less than most investment operations.

3/n We might invest up to 40% of our net worth in a single security under conditions coupling an extremely high probability that our facts & reasoning are correct with a very low probability that anything could drastically change the underlying value of the investment.

4/n We are obviously following a policy regarding diversification which differs markedly from that of practically all public investment operations.

5/n Frankly, there is nothing I would like better than to have 50 different investment opportunities, all of which have a mathematical expectation of achieving performance surpassing the Dow by, say, fifteen percentage points per annum.

6/n If the 50 individual expectations were not intercorelated I could put 2% of our capital into each one & sit back with a very high degree of certainty that our overall results would be very close to such a 15% point advantage. It doesn't work that way.

7/n We have to work extremely hard to find just a very few attractive investment situations. Such a situation by definition is one where my expectation of performance is at least 10% points p.a. superior to the Dow. Among the few we do find, the expectations vary substantially.

8/n The question always is, “How much do I put in number 1 (ranked by expectation of relative performance) & how much do I put in number 8?" This depends to a great degree on the wideness of the spread between the mathematical expectation of number 1 versus number 8.”

9/n It also depends upon the probability that number 1 could turn in a really poor relative performance. Two securities could have equal mathematical expectations, but one might have .05 chance of performing 15% points or more worse than the Dow,….

10/n ….and the second might have only .01 chance of such performance. The wider range of expectation in the first case reduces the desirability of heavy concentration in it. The above may make the whole operation sound very precise. It isn't.

11/n Nevertheless, our business is that of ascertaining facts & then applying experience & reason to such facts to reach expectations. Imprecise & emotionally influenced as our attempts may be, that is what the business is all about.

12/n The results of many years of decision-making in securities will demonstrate how well you are doing on making such calculations - whether you consciously realize you are making the calculations or not.

13/n I believe the investor operates at a distinct advantage when he is aware of what path his thought process is following.

14/n There is one thing of which I can assure you. If good performance of the fund is even a minor objective, any portfolio encompassing one hundred stocks (whether the manager is handling one thousand dollars or one billion dollars) is not being operated logically.

15/n The addition of the one hundredth stock simply can't reduce the potential variance in portfolio performance sufficiently to compensate for the negative effect its inclusion has on the overall portfolio expectation.

16/n Anyone owning such numbers of securities after presumably studying their investment merit (and I don't care how prestigious their labels) is following what I call the Noah School of Investing - two of everything. Such investors should be piloting arks.

17/n While Noah may have been acting in accord with certain time-tested biological principles, the investors have left the track regarding mathematical principles.

18/n Of course, the fact that someone else is behaving illogically in owning one hundred securities doesn't prove our case. While they may be wrong in over diversifying, we have to affirmatively reason through a proper diversification policy in terms of our objectives.

19/n The optimum portfolio depends on the various expectations of choices available and the degree of variance in performance which is tolerable.

20/n The greater the number of selections, the less will be the average year-to-year variation in actual versus expected results. Also, the lower will be the expected results, assuming different choices have different expectations of performance.

21/n I am talking of performance relative to the Dow in order to achieve better overall long-term performance.

22/n Simply stated, this means I am willing to concentrate quite heavily in what I believe to be the best investment opportunities recognizing very well that this may cause an occasional very sour year - one somewhat more sour, probably, than if I had diversified more.

23/n While this means our results will bounce around more, I think it also means that our long-term margin of superiority should be greater.

24/n Again let me state that this is somewhat unconventional reasoning (this doesn't make it right or wrong - it does mean you have to do your own thinking on it), and you may well have a different opinion - if you do, the Partnership is not the place for you.

25/n We are obviously only going to go to 40% in very rare situations - this rarity, of course, is what makes it necessary that we concentrate so heavily, when we see such an opportunity.

26/n We probably have had only 5 or 6 situations in the 9 yr history of the Partnership where we have exceeded 25%. Any such situations are going to have to promise very significantly superior performance relative to the Dow compared to other opportunities available at the time.

27/n They r also going 2 have 2 possess superior qualitative &/or quantitative factors that the chance of serious permanent loss is minimal (anything can happen on a short-term quotational basis which partially explains the greater risk of widened yr to yr variation in results)

28/n In selecting the limit to which I will go in anyone investment, I attempt to reduce to a tiny figure the probability that the single investment(or group, if intercorrelation) can produce a result for our total portfolio that would be more than 10% points poorer than the Dow.

29/ Interestingly enough, the literature of investment management is virtually devoid of material relative to deductive calculation of optimal diversification.

30/n All texts counsel "adequate" diversification, but the ones who quantify "adequate" virtually never explain how they arrive at their conclusion.

31/n Hence, for our summation on over diversification, we turn to that eminent academician Billy Rose, who says, "You've got a harem of seventy girls; you don't get to know any of them very well.”

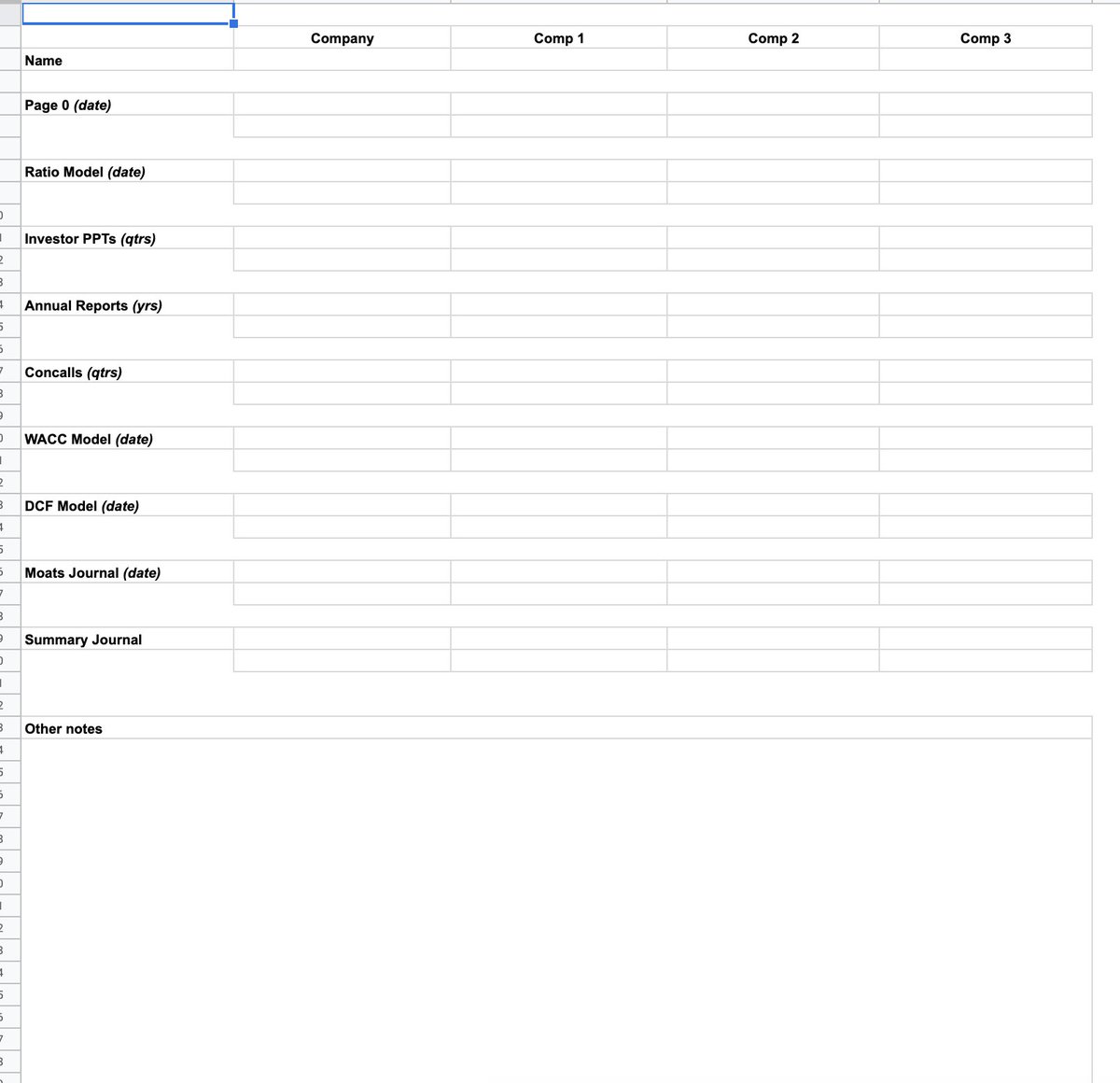

32/n Summarized the pointers in a document. Please find the google drive link here:

drive.google.com/file/d/1DGrB8g…

drive.google.com/file/d/1DGrB8g…

• • •

Missing some Tweet in this thread? You can try to

force a refresh