Interested in science, running & investing | Tweets personal

2 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/deepakshenoy/status/14029034799710904352/ Get your nominees set up. Super important.

2/n Things go wrong more often than they go right. Failure is actually a natural - even crucial - element of a healthy economy. And the people who are willing to acknowledge that fact can make a hell of a lot of money.

2/n Things go wrong more often than they go right. Failure is actually a natural - even crucial - element of a healthy economy. And the people who are willing to acknowledge that fact can make a hell of a lot of money.

2/n

2/n

2/n Another company traded in Amsterdam was The Dutch West India Company which also went into bankruptcy in late 1700s. In the chart below we can see both the Tulip mania & the South Sea Bubble.

2/n Another company traded in Amsterdam was The Dutch West India Company which also went into bankruptcy in late 1700s. In the chart below we can see both the Tulip mania & the South Sea Bubble.

https://twitter.com/deepakvenkatesh/status/12576147659306721282/n Being a govt doctor working on the field most of the time he rarely put in effort to do any detailed analysis. He tried his hand at a business & failed miserably. Went back to job.

https://twitter.com/Prashanth_Krish/status/12435835855435243522/n

https://twitter.com/raizada55/status/12097071198276608002/n

https://twitter.com/deepakvenkatesh/status/10753863351317217292/n

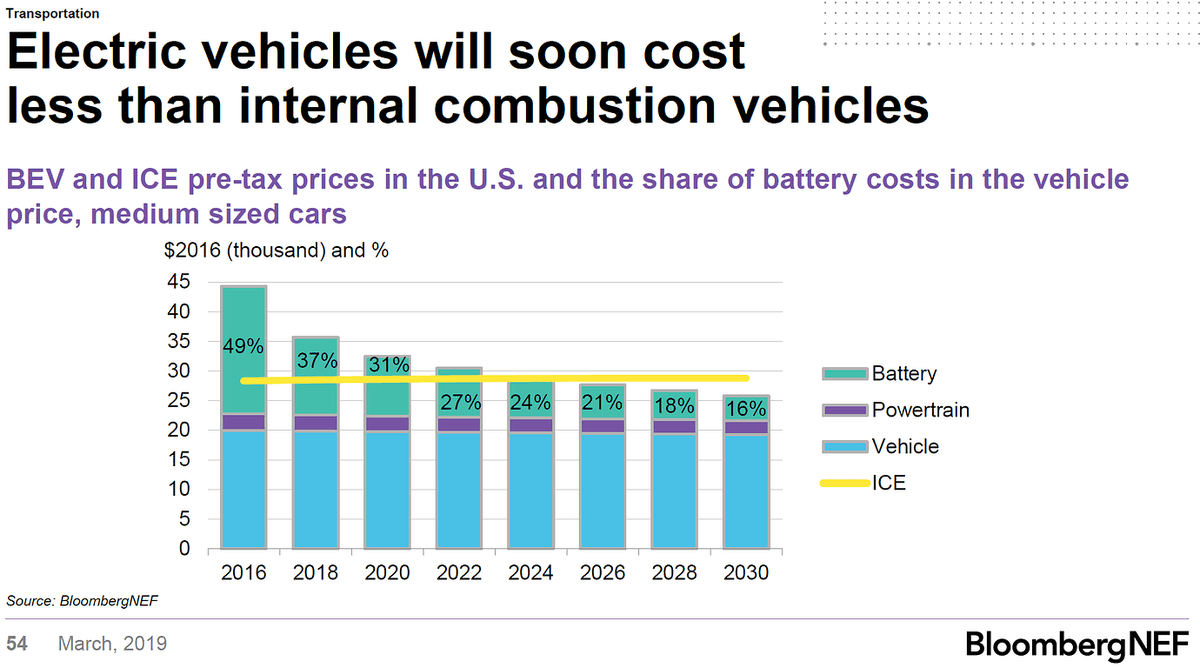

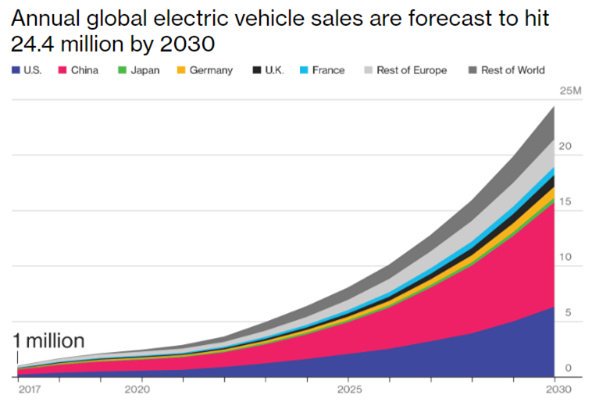

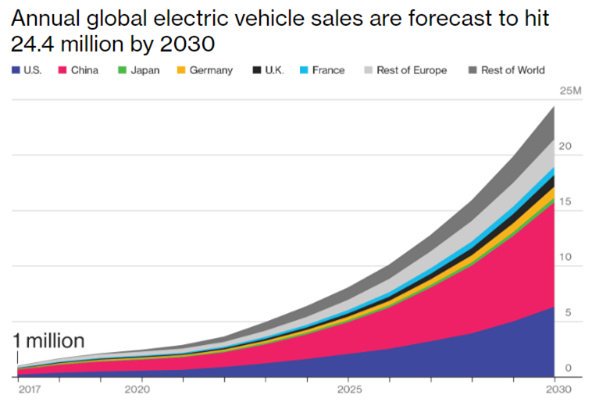

#EV (2/n) In the US EVs cost more & will continue to do so for over half a decade than ICE. The battery cost when it drops as a % to car cost to 20% does EV make acquisition sense for a consumer(not including TCO).

#EV (2/n) In the US EVs cost more & will continue to do so for over half a decade than ICE. The battery cost when it drops as a % to car cost to 20% does EV make acquisition sense for a consumer(not including TCO).