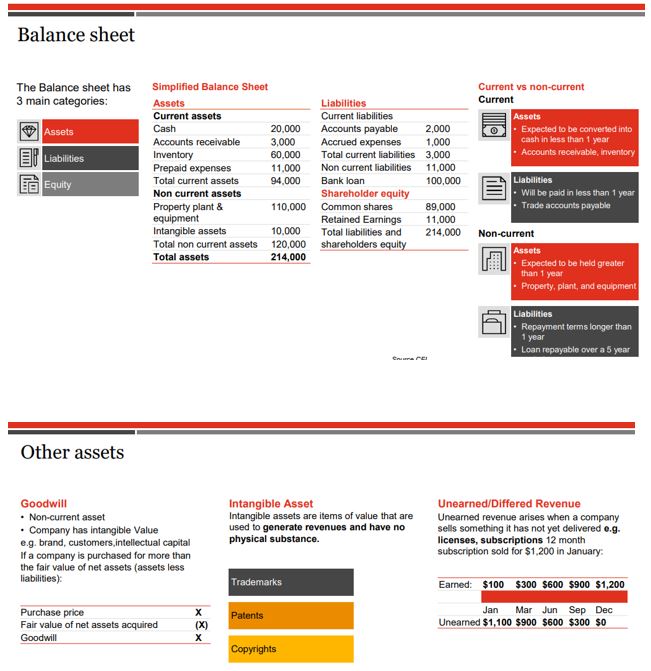

#flashbackFriday Just a fun look at @jimcramer's original CANDIES basket, made in early June 2010.

Chipotle (516%)

Apple (720%)

Netflix (2076%)

Deckers (250%)

Intuitive Surgical (444%)

Express Scripts (85%)

Salesforce (707%)

vs S&P 500 (210%)

@MadMoneyOnCNBC @charliebilello

Chipotle (516%)

Apple (720%)

Netflix (2076%)

Deckers (250%)

Intuitive Surgical (444%)

Express Scripts (85%)

Salesforce (707%)

vs S&P 500 (210%)

@MadMoneyOnCNBC @charliebilello

Most entries absolutely trounced the S&P 500, with the exception of DECK (that had some major gains recently, and still beat S&P) and ESRX (that got acquired in Dec 2018).

Each of these companies had some major business/stock hiccups along the way, but emerged victorious. 🏆

Each of these companies had some major business/stock hiccups along the way, but emerged victorious. 🏆

It's amazing what a combination of a relentless 10+ yrs Bull Market, good economy, and some exceptional companies (with great Mgmts) creating/leveraging the major trends can do. ✌️

• • •

Missing some Tweet in this thread? You can try to

force a refresh