Engineer/Investor. Here to learn and share about Investing. Stay curious.

62 subscribers

How to get URL link on X (Twitter) App

After $LULU did it's 100 bagger for me back in 2021 this is the next one to hit 50+ milestone.

After $LULU did it's 100 bagger for me back in 2021 this is the next one to hit 50+ milestone.

How Capital flows thru the Business⬇️

How Capital flows thru the Business⬇️

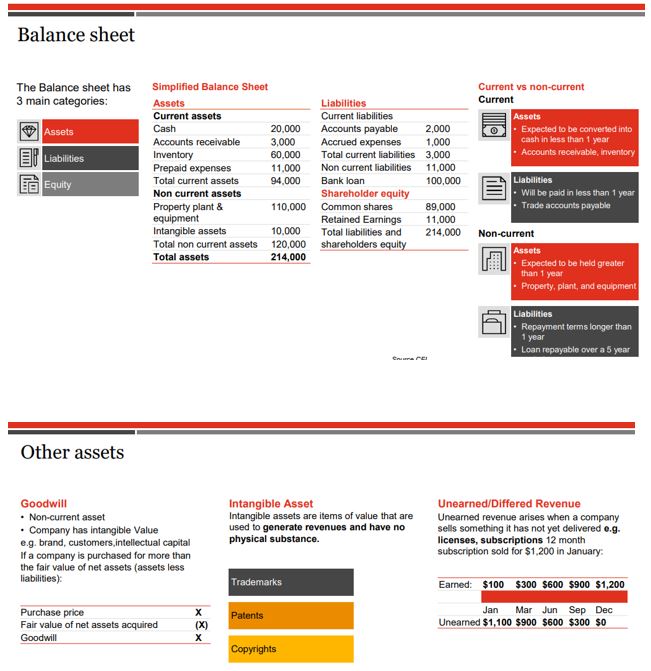

Few important slides from Balance sheet

Few important slides from Balance sheet

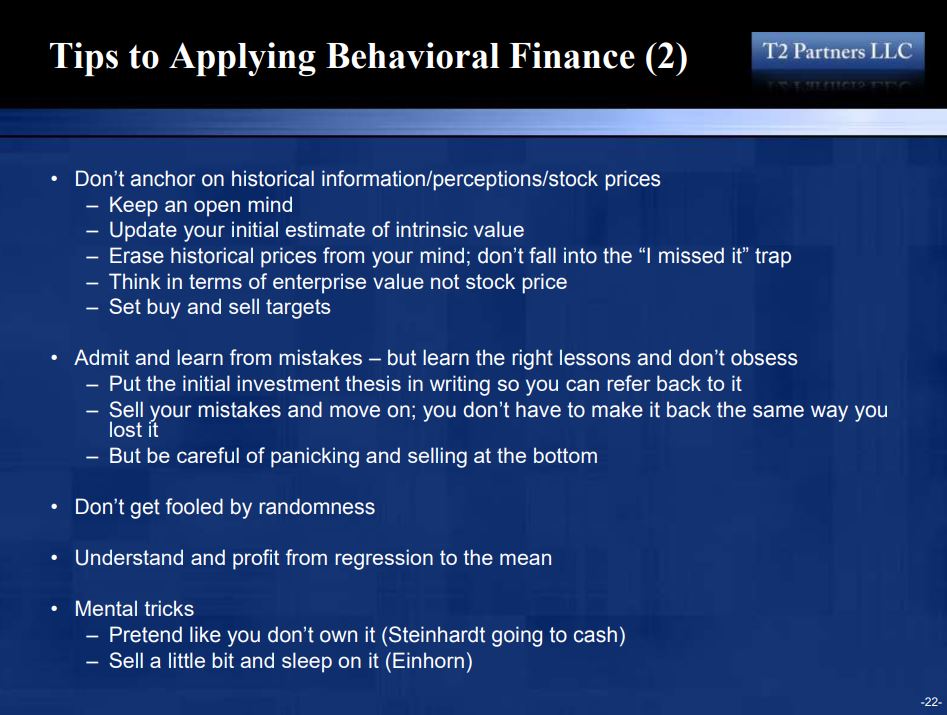

Some very useful tips on how to use Behavioral Finance to improve your process and results. ⬇️

Some very useful tips on how to use Behavioral Finance to improve your process and results. ⬇️

1⃣ The time of maximum pleasure (from all those recent/quick big gains) could actually be the time of maximum risk (when the forward R/R could be quite unfavorable).

1⃣ The time of maximum pleasure (from all those recent/quick big gains) could actually be the time of maximum risk (when the forward R/R could be quite unfavorable).

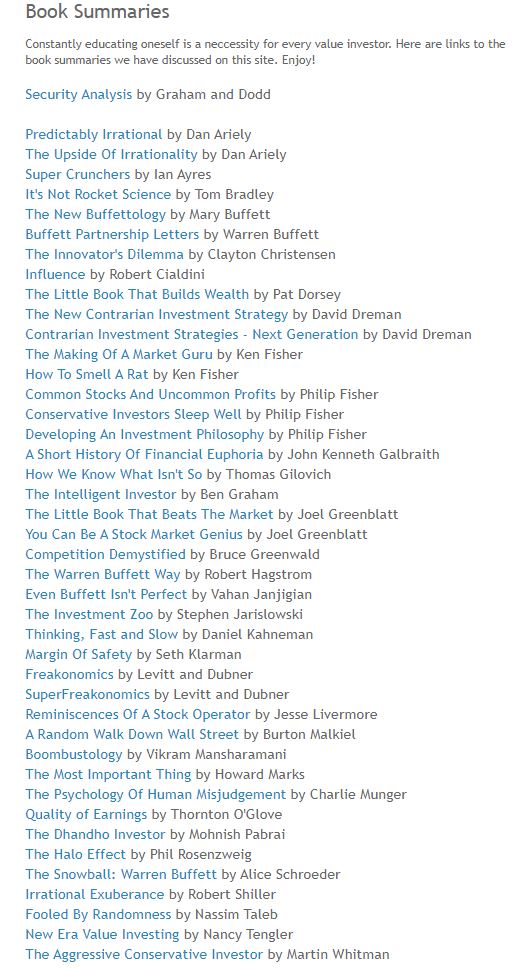

✅Buffett's Partnership Letters (1961-69).

✅Buffett's Partnership Letters (1961-69).

As it stands today, above are what I'm looking forward to (across my 2 portfolios). Not recs.

As it stands today, above are what I'm looking forward to (across my 2 portfolios). Not recs.

1⃣ An Excellent 5 part Infographic series on Buffett by @VisualCap 👏

1⃣ An Excellent 5 part Infographic series on Buffett by @VisualCap 👏

Some of my fav quotes from the document. Part 1⬇️

Some of my fav quotes from the document. Part 1⬇️

None of these were made with the hope of bottom fishing (just lucky if they turn out to be).

None of these were made with the hope of bottom fishing (just lucky if they turn out to be).

Plan is to add very slowly & rotate among my fav sectors/Cos while conserving bulk of the $$ to deploy when we see signs of stabilizing and then easing inflation for few months.

Plan is to add very slowly & rotate among my fav sectors/Cos while conserving bulk of the $$ to deploy when we see signs of stabilizing and then easing inflation for few months.

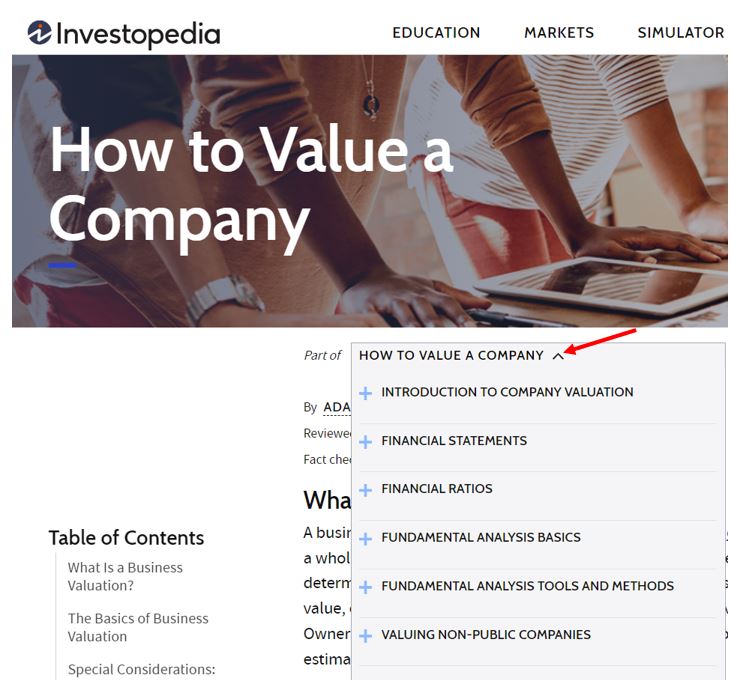

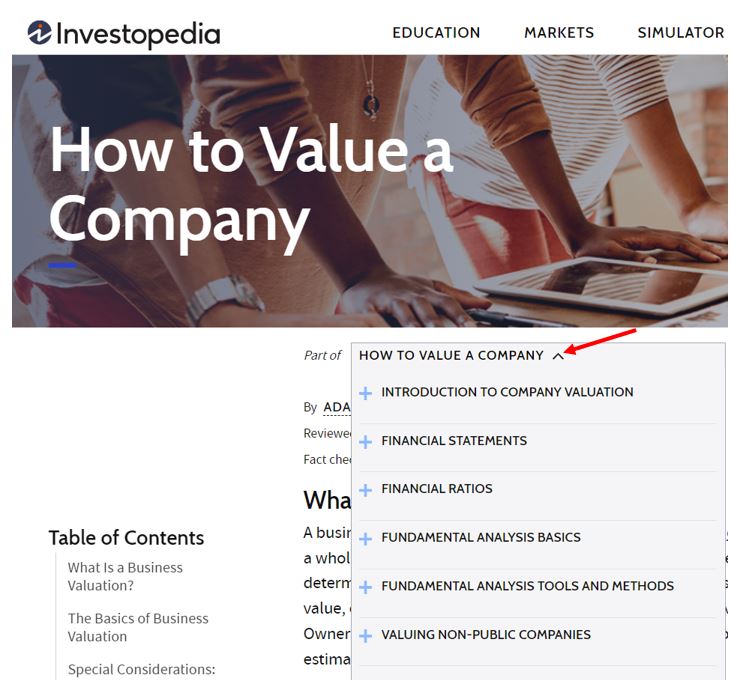

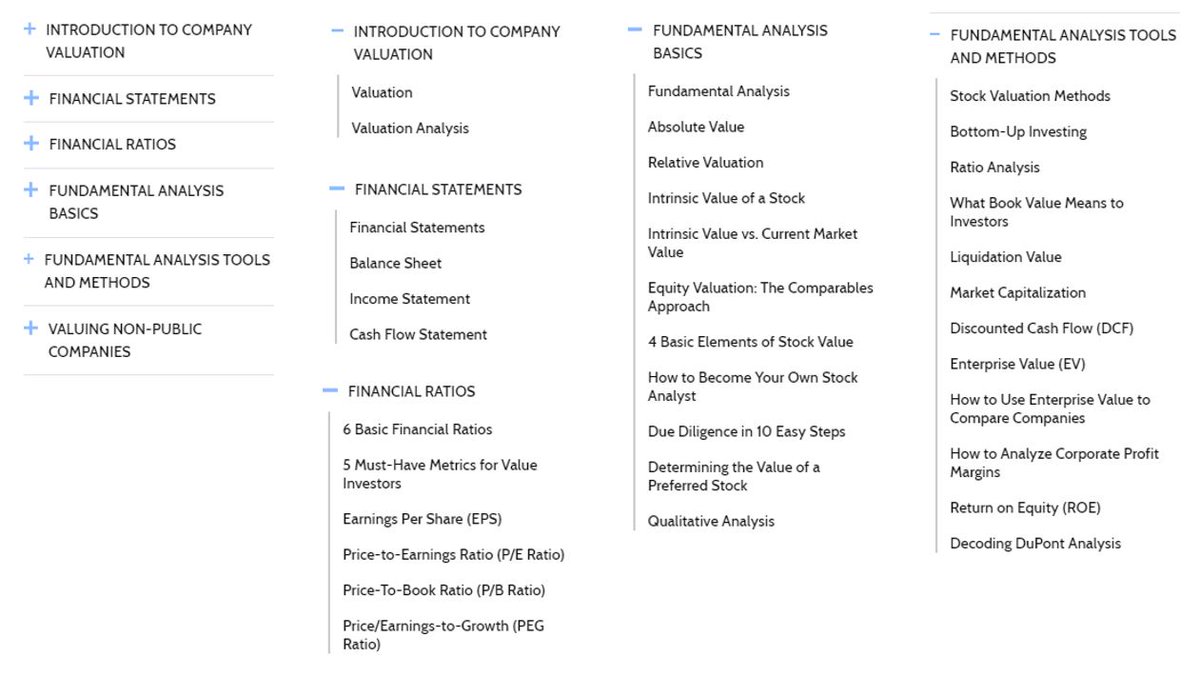

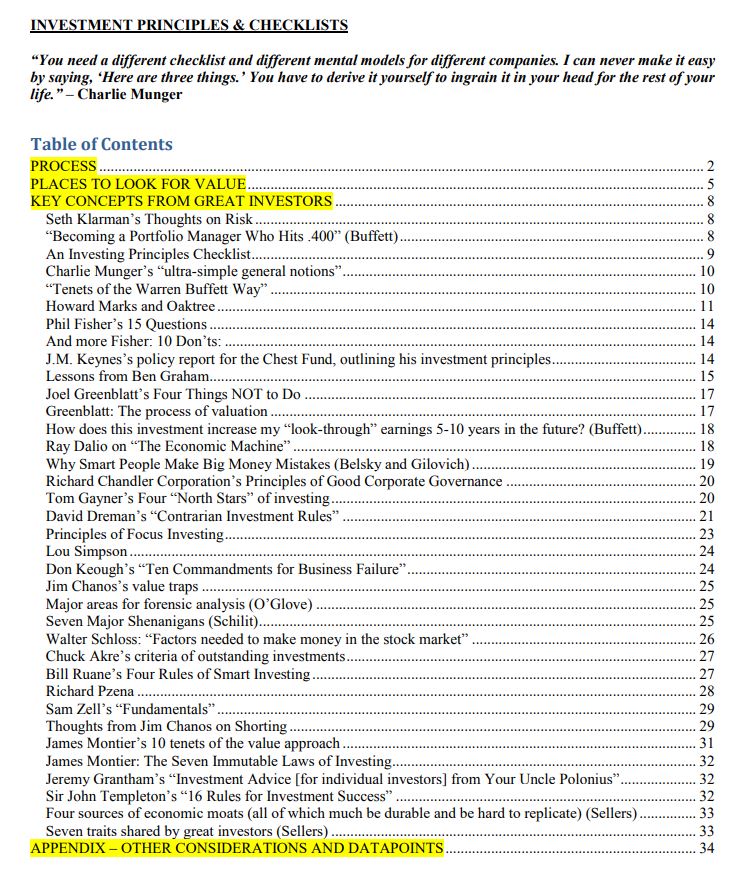

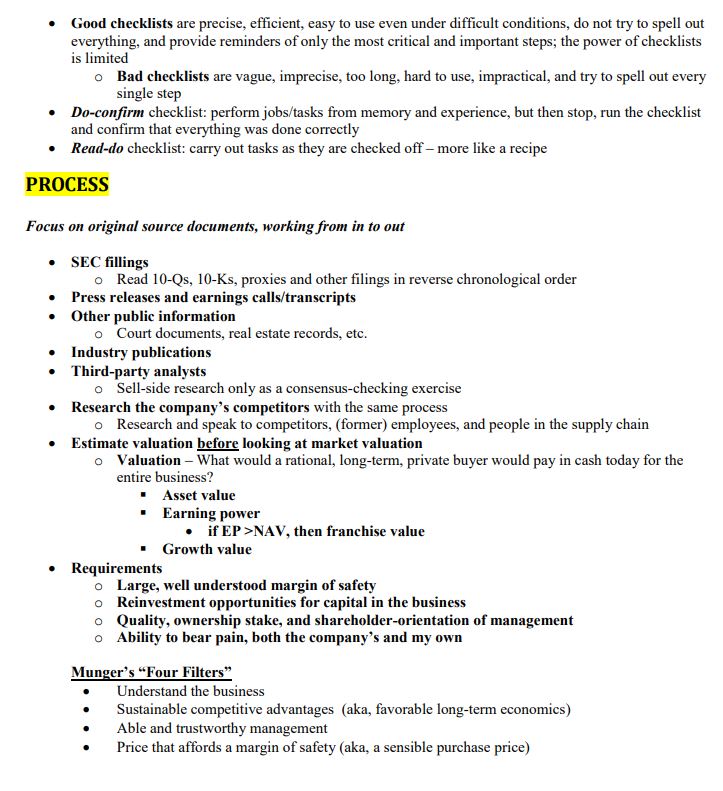

Pretty good process and checklist.

Pretty good process and checklist.

More fav slides ⬇️

More fav slides ⬇️