What explains the rise of State Capacity Libertarianism, @tylercowen's umbrella term for folks with pro-market, pro-growth views who nonetheless favor a strong, capable government?

I identify three central motivations here:

niskanencenter.org/three-motivati…

I identify three central motivations here:

niskanencenter.org/three-motivati…

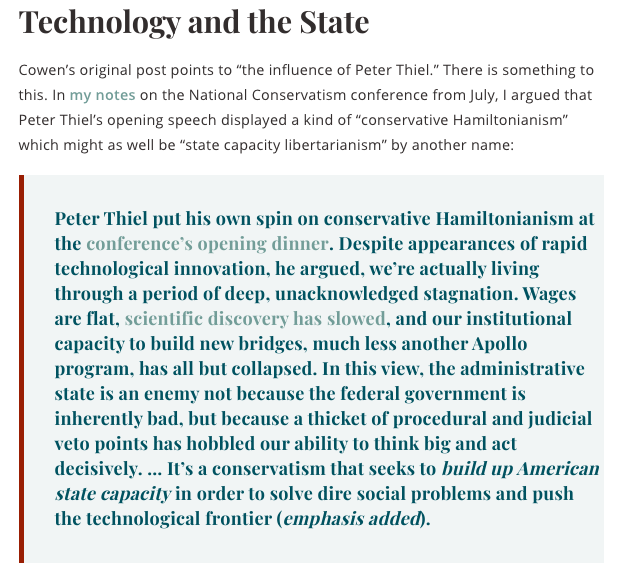

@tylercowen The first motivation I see is the relationship between technology and the state. An entrepreneurial state can enable new technologies, but capturing the benefits of things like AI will require building privacy and civil liberty protections into the technology itself.

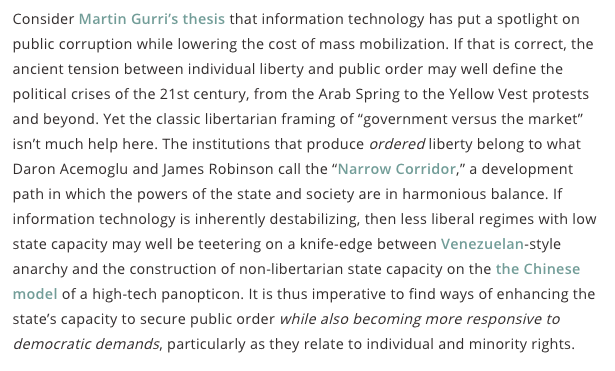

@tylercowen Consider @mgurri's Revolt of the Public thesis. If information tech and mass protest are destabilizing, lower state capacity countries may well attempt to import a Chinese-style panopticon. We need to export tech that can secure public order while protecting minority rights.

@tylercowen @mgurri Cyber-libertarians used to imagine a future where technology undermines the state's authority. State Capacity Libertarianism says that might end up being true, but be careful what you wish for.

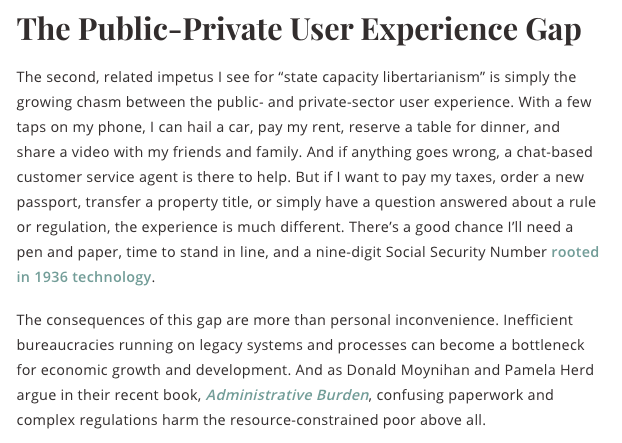

@tylercowen @mgurri The second motivation for SCL is what I call the growing public-private UX gap.

Calling a taxi used to be a pain in the ass, but now we get upset if our Uber is 2 minutes late. Younger libertarians are right to wonder why the US government is built on decades old firmware.

Calling a taxi used to be a pain in the ass, but now we get upset if our Uber is 2 minutes late. Younger libertarians are right to wonder why the US government is built on decades old firmware.

@tylercowen @mgurri An older generation of libertarians promoted dysfunctional government as a strategy; like "culture jamming" but applied to bureaucracy. Taken to its logical extreme, it becomes a strange kind of libertarian masochism. It also doesn't work.

@tylercowen @mgurri In 2015 I argued that libertarians should be directionally for an Estonia-style e-government. "Oh, so they can steal from us more efficiently?"

Yet the same tech that makes taxes and transfers automatic can also dramatically reduce regulatory burdens.

readplaintext.com/disrupting-bur…

Yet the same tech that makes taxes and transfers automatic can also dramatically reduce regulatory burdens.

readplaintext.com/disrupting-bur…

@tylercowen @mgurri The third motivation I identify is the institutional sclerosis that results from diffuse lines of authority and accountability.

Poorly funded and fragmented regulators are easier to capture. And devolution to local governments often makes things worse!

Poorly funded and fragmented regulators are easier to capture. And devolution to local governments often makes things worse!

@tylercowen @mgurri @LHSummers and @patrickc have referred to the “promiscuous distribution of veto power" over things like infrastructure and housing construction. But is the problem that San Fransisco's government is too strong, or is it that SF's executive is not nearly strong enough?

@tylercowen @mgurri @LHSummers @patrickc State capacity is necessary to overcome distributional coalitions that would otherwise block public goods and reforms that benefit everyone. This includes government downsizing! As @tylercowen noted in 2010, high trust in gov't let Chretien cut Canada's federal spending by 20%:

@tylercowen @mgurri @LHSummers @patrickc America abolished slavery and brought the states back into union under the leadership of Abraham Lincoln — perhaps the single most state capacity- and liberty-enhancing move in U.S. history. Today, however, it feels like we can’t even abolish the penny...

@tylercowen @mgurri @LHSummers @patrickc So why don't I adopt the State Capacity Libertarian label?

Because it's an oxymoron. To the extent SCL is focused on understanding the conditions of institutional decline and renaissance, it's speaking the language of conservatism. And there's nothing at all wrong with that. 😁

Because it's an oxymoron. To the extent SCL is focused on understanding the conditions of institutional decline and renaissance, it's speaking the language of conservatism. And there's nothing at all wrong with that. 😁

• • •

Missing some Tweet in this thread? You can try to

force a refresh