1. So just how bad were ethanol losses in 2019? My personal take---losses were real but maybe not as bad as many think.

https://twitter.com/FarmPolicy/status/1222882775503704067

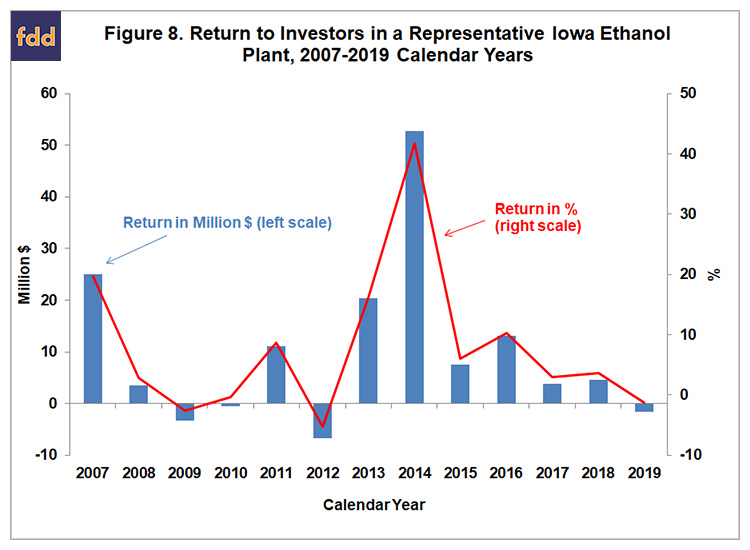

2. My estimated annual profits for a representative Iowa ethanol plant over 2007-2019. I updated my model this year to recognize efficiency gains in ethanol and DDGS conversion since 2015. So profits are higher since 2015 than what I published previously.

3. 6 straight years of annual profits over 2013-2018. So the loss in 2019 was a bummer. My estimate is an average plant lost $1.6 million in 19. Still, trendline for profits in last three years is troubling. Small profit or loss.

4. This chart really shows just how difficult times were last summer for ethanol plants. Ethanol prices came within a dime of the shutdown price for a representative plant.

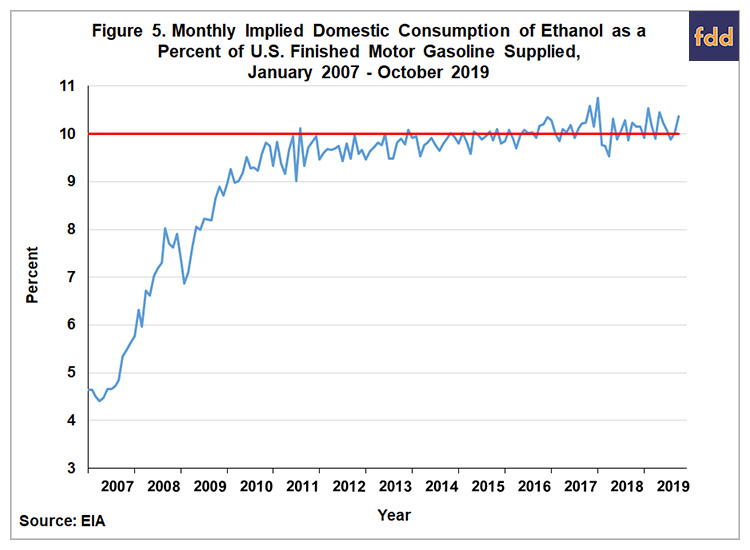

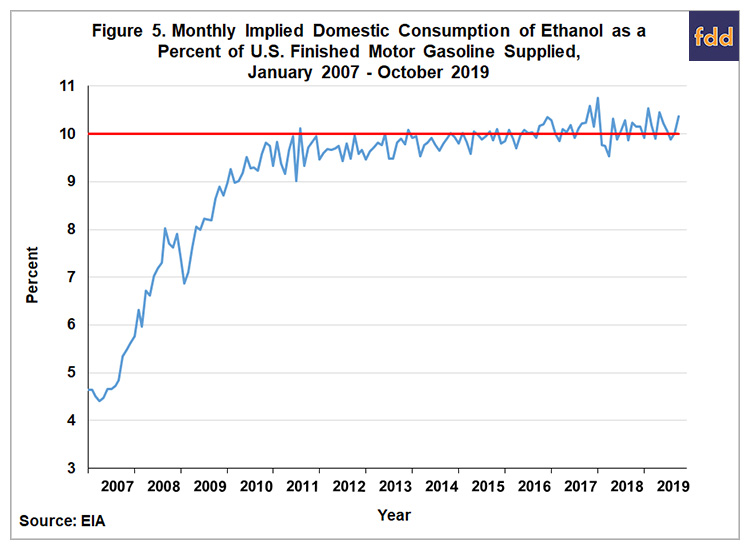

5. So, why were times so tough for ethanol producers in 2019? Headlines seem to all focus on #SREs and #RFSwars. Vast majority of ethanol used in E10. Still don't see any decline in aggregate US blending rate for ethanol. So I don't think it was SREs.

6. Could the blending rate for ethanol in 2019 been much higher without SREs? May have ticked up a little bit, but hard for me to see how that would have made much difference. I still think removing SREs mainly benefits biodiesel.

7. Here is what I think is one of the main culprits for ethanol losses in 2019. Ethanol trade really went backwards in 2019. Exports down 206 mg so far in 19 and imports up 134. Net exports dropped 340mg. Probably end up over a 400mg drop. Significant swing factor.

8. Second major factor was continued growth in efficiency of ethanol production. Conversion rate surged in 2019 towards 3 gallons of ethanol per bushel of corn. Impressive but extra supply when not needed by the market.

9. Can things turnaround in 2020 for ethanol producers? Need some help on the export side from Brazil and China. I don't see a turnaround with Brazil, which means ethanol producers have a lot riding on China following through on the Phase 1 trade agreement purchases.

• • •

Missing some Tweet in this thread? You can try to

force a refresh