Western media’s dooming thesis and sepculation on the Wuhan #Cornoavirus only shows how a black box 📦 China is still to most westerners ..

A few big misunderstanding from what I’ve seen so far (thread)

A few big misunderstanding from what I’ve seen so far (thread)

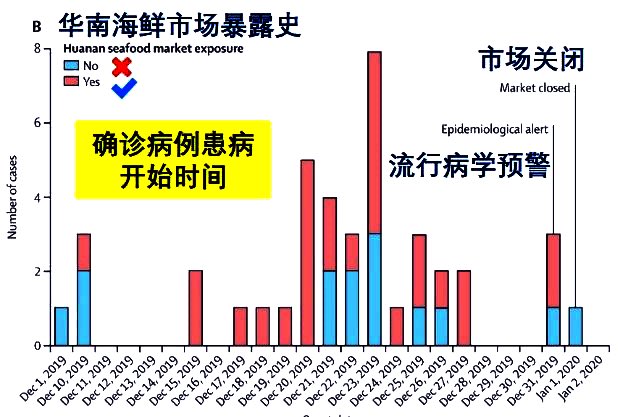

1. The outbreak is primarily due to eating 🦇 and other wild animals

The first case is indentified on Dec 1, without exposure to that sea food market (where wild animal were on sale). Among the first 4 cases, 3 has no exposure. So hard to tell the exact source of the virus

The first case is indentified on Dec 1, without exposure to that sea food market (where wild animal were on sale). Among the first 4 cases, 3 has no exposure. So hard to tell the exact source of the virus

2. The “Quarantine” order is legally enforced to make citizens to stay at home

Different municipalities quarantine at different levels, but none of them, even in Wuhan makes a “martial law” like quarantine for not letting individual walking on the street

Different municipalities quarantine at different levels, but none of them, even in Wuhan makes a “martial law” like quarantine for not letting individual walking on the street

Most citizens in the epicenter like Wuhan and other areas in Hubei stay at home voluntarily afraid of being infected when contacting strangers. The quarantine order mostly hit public transit and most form of transportation hence business have to shut too

I have no problem walking out in Guangzhou/Shanghai/Beijing, dozen local business are still operating, food delivery is still serving, SF express and China postal (like UPS and USPS in China) are working too

Hence the quarantine is not like what you imagine as a total shut down

Hence the quarantine is not like what you imagine as a total shut down

There are many other absurd statements which I can’t recall.

AMA in this thread will try my best to share what’s going on

AMA in this thread will try my best to share what’s going on

• • •

Missing some Tweet in this thread? You can try to

force a refresh