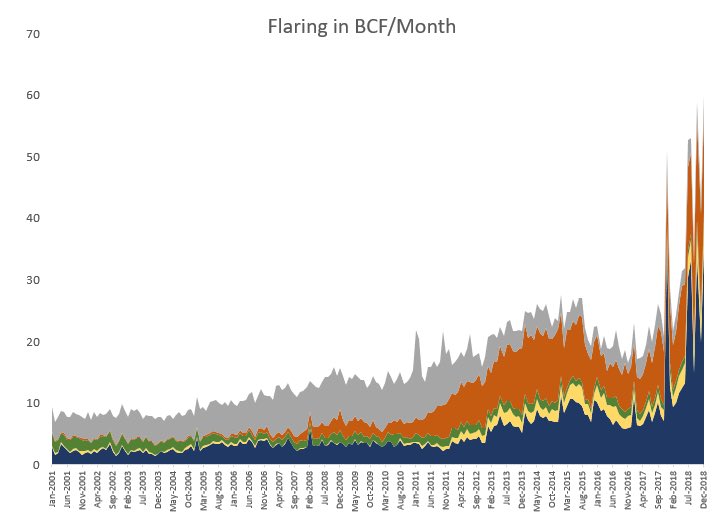

It’s state-by-state for big flarers, with offshore counted as a state, and rest of US lumped together

Blue-Texas

Yellow-New Mexico

Orange-North Dakota

Green-Offshore

Grey-Rest of Country

Yellow-New Mexico

Orange-North Dakota

Green-Offshore

Grey-Rest of Country

• • •

Missing some Tweet in this thread? You can try to

force a refresh