How allocation to bad assets increases with declining AUM

Basically, AMC has to sell good assets to meet redemption payouts and allocation to bad assets keep on increasing.

A small thread taking UTI Credit Risk Fund and underlying holding Vodafone/Idea as example

#mutualfunds

Basically, AMC has to sell good assets to meet redemption payouts and allocation to bad assets keep on increasing.

A small thread taking UTI Credit Risk Fund and underlying holding Vodafone/Idea as example

#mutualfunds

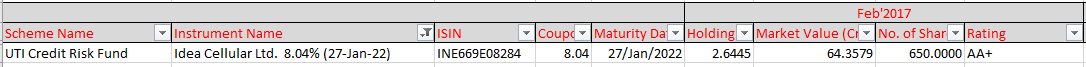

In Feb’2017, the scheme bought 650 debentures of “8.04% UNSECURED REDEEMABLE NON-CONVERTIBLE DEBENTURES. DATE OF MATURITY 27/01/2022” from secondary market.

AA+

Allocation in scheme = 2.6445%; AUM ~ 2433 cr

#vodafoneidea

AA+

Allocation in scheme = 2.6445%; AUM ~ 2433 cr

#vodafoneidea

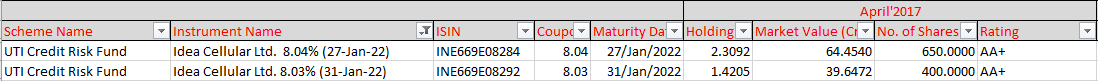

Scheme increased allocation in Idea in April’2017

AA+

Allocation in scheme = 3.7297%

AUM ~ 2791 Cr (increasing)

AA+

Allocation in scheme = 3.7297%

AUM ~ 2791 Cr (increasing)

Scheme increased allocation in Idea in May’2017

AA+

Allocation in scheme = 3.8261%

AUM ~ 3109 Cr (increasing)

AA+

Allocation in scheme = 3.8261%

AUM ~ 3109 Cr (increasing)

Next one year, scheme neither bought/sold these holdings only the allocation in the scheme due to the change in AUM.

In May’2018, the scheme additionally allocated ~ 3% of its assets to the group.

Allocation in scheme = 5.2776%

AUM ~ 4938 Cr

In May’2018, the scheme additionally allocated ~ 3% of its assets to the group.

Allocation in scheme = 5.2776%

AUM ~ 4938 Cr

In July’2018, scheme allocated more and for the last time, this point onwards, all the changes in % allocation in scheme is on account of change in AUM due to redemption or markdown (other securities).

Allocation in scheme = 5.8249%

AUM ~ 5292 Cr

Allocation in scheme = 5.8249%

AUM ~ 5292 Cr

After the IL&FS event, active money started to flee the credit risk category. At the end of september’2018 AUM of credit risk as category was ~88.7K crore & at the end of January’2020 AUM shrink to ~61.5K Crore

Post July’2018, UTI Credit Risk Fund has not bought or sold Idea/Vodafone papers & % allocation to scheme for this group kept on rising due to shrinking of AUM.

The exposure went to 17.549% at the end of December’2019

The exposure went to 17.549% at the end of December’2019

In Jan’2020, after the supreme court event, @FTIIndia marked it down to 0 @utimutualfund marked it down partially. Now UTI has segregated the portfolio.

Always keep an eye on AUM in debt funds & single issuer risk (red flag if AUM is declining & single issuer is increasing).

Always keep an eye on AUM in debt funds & single issuer risk (red flag if AUM is declining & single issuer is increasing).

@FTIIndia @utimutualfund data from Ace MF

• • •

Missing some Tweet in this thread? You can try to

force a refresh