Goal is to help as many families as possible to manage their finances better

Connect with us for - Ethical, Competent and Personalized Financial Guidance

2 subscribers

How to get URL link on X (Twitter) App

Risk-o-meter shall be evaluated on monthly basis & AMC shall disclose it along with portfolios on website and on AMFI website within 10 days from the close of each month

Risk-o-meter shall be evaluated on monthly basis & AMC shall disclose it along with portfolios on website and on AMFI website within 10 days from the close of each month

https://twitter.com/iRadhikaGupta/status/1257256362544775170small schemes in these categories should be choosen over branded Big Elephants.

DHFL was downgraded to D on 04th June'2019

DHFL was downgraded to D on 04th June'2019

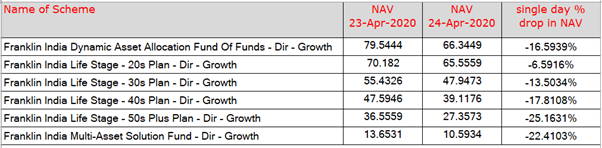

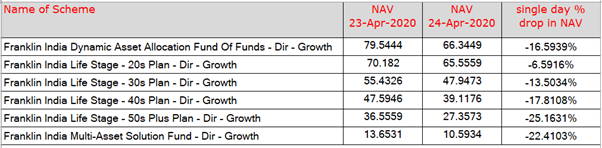

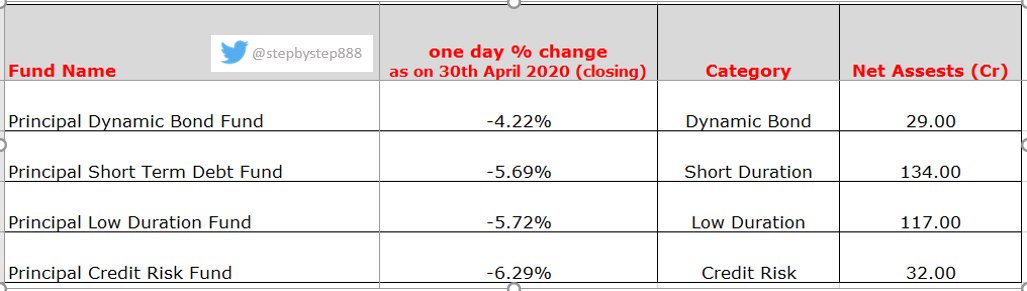

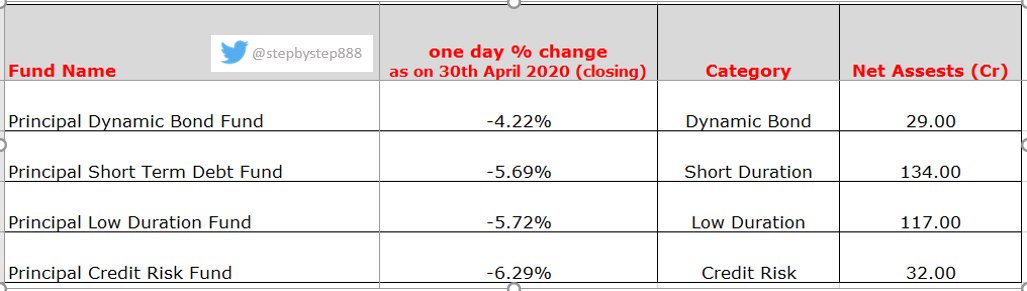

https://twitter.com/stepbystep888/status/1254012454259945472Investors/distributors soon started redeeming across most of the categories of debt schemes, PANIC !

https://twitter.com/stepbystep888/status/124565329667871949018530 crore retail AUM have decided not to invest in PPF/EPF/VPF but to allocate in ELSS.

https://twitter.com/stepbystep888/status/1245653523112407040

https://twitter.com/stepbystep888/status/1245654007332257800

large cap funds:

large cap funds:

below is the performance comparison of small cap schemes from 01 Jan'2018 to 29th March'2020.

below is the performance comparison of small cap schemes from 01 Jan'2018 to 29th March'2020.

https://twitter.com/passivefool/status/1236257201812992000

@NipponIndiaMF is leading ;-)

@NipponIndiaMF is leading ;-)