If a stock gaps up in pre-open due to an event, does it usually continue going up after market opens? Here’s the analysis about #imtraday #gaptrading

To validate if a gap up stocks would continue to move up after market opens, we need to backtest it with huge data sets. I have considered data from 2007 to 2019, taken all gap up stocks, gap is calculated by

(Today’s Open price - Previous Close price)/Prev close price.

(Today’s Open price - Previous Close price)/Prev close price.

I get the list of gap up stocks.

Once I get this list, then I calculate what is the % intraday movement. That is Open to close. So again I calculate the returns

(Today’s close price - Today’s open price)/Today’s open price

Once I get this list, then I calculate what is the % intraday movement. That is Open to close. So again I calculate the returns

(Today’s close price - Today’s open price)/Today’s open price

Then I get the list of stocks that are gaped up and their respective returns for the day, what would have been the returns if people bought the stocks at market open.

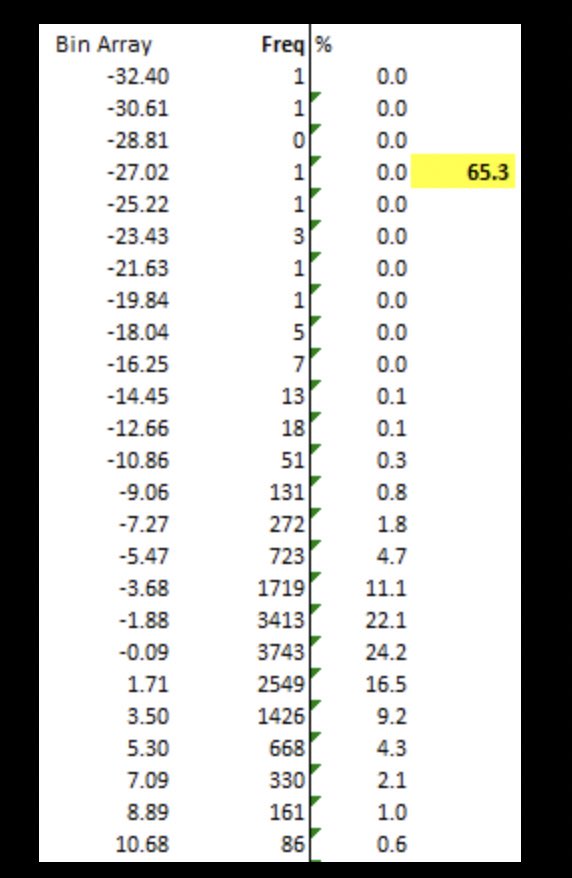

I plotted the return distribution and it looked like below, where most of the times returns are negative. With the data sets, it is clearly shown that more than 65% of the time, returns are negative, which means if you buy the gap up stocks, you can lose 65% of the time.

Though there could be few instances where gap up stocks tend to go up, but most of the time, gap up stocks tend to go down and gap down stocks tend to go up. So its wise to Short the gap up stocks and buy the gap down stocks!

• • •

Missing some Tweet in this thread? You can try to

force a refresh