Vibe Coding | Crypto Trading | Full Time Systematic Trader

18 subscribers

How to get URL link on X (Twitter) App

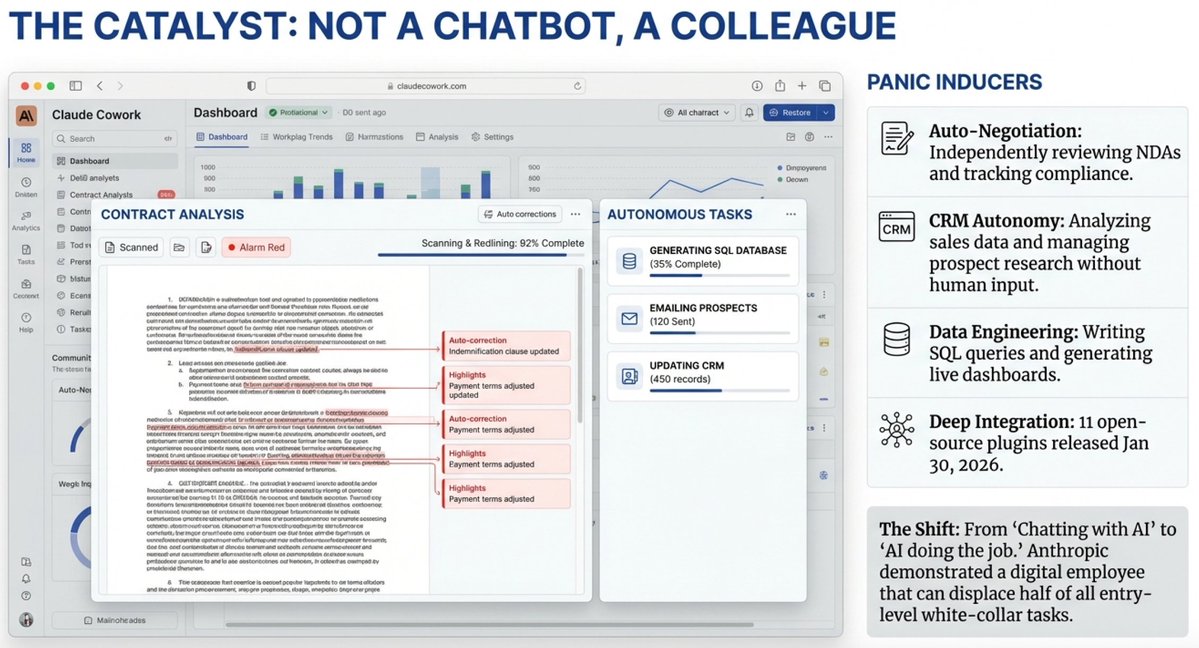

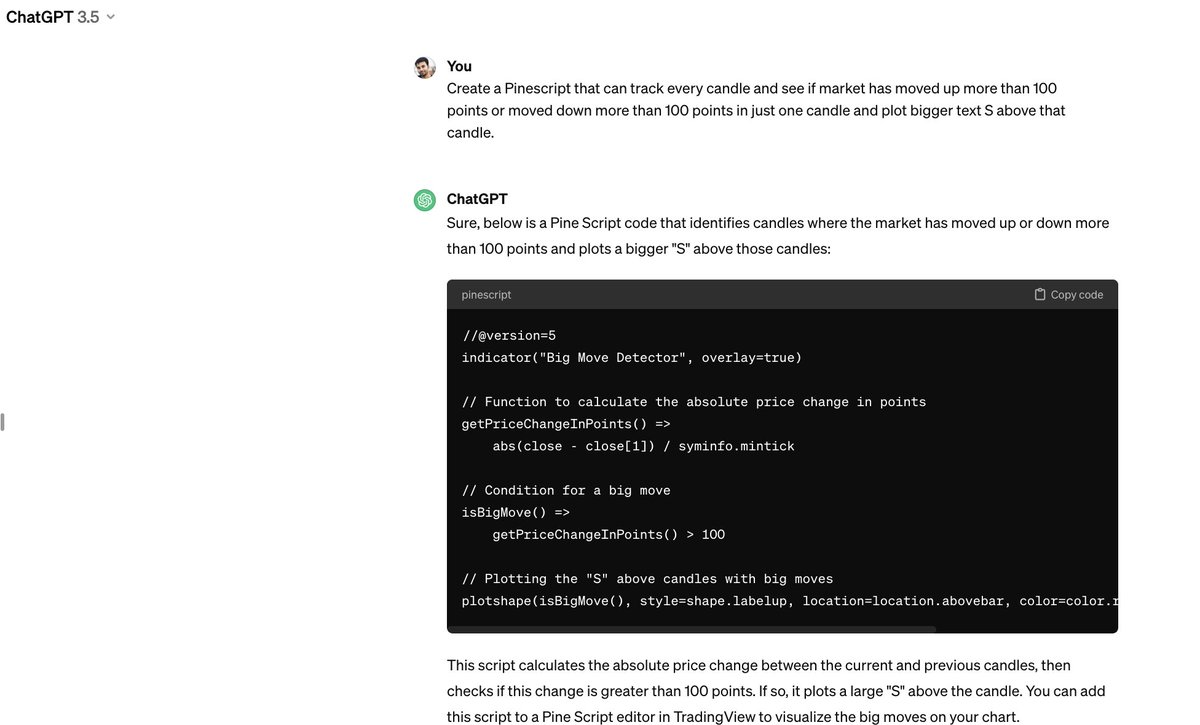

On January 30, Anthropic released 11 plugins for Claude Cowork, an AI agent that doesn't just chat. It reads files, organizes folders, drafts documents, reviews contracts, manages sales pipelines, writes SQL queries, and handles compliance tracking.

On January 30, Anthropic released 11 plugins for Claude Cowork, an AI agent that doesn't just chat. It reads files, organizes folders, drafts documents, reviews contracts, manages sales pipelines, writes SQL queries, and handles compliance tracking.

FLIGHTS: Chennai → Mauritius via Bangalore ₹75k for 2 people (round trip)

FLIGHTS: Chennai → Mauritius via Bangalore ₹75k for 2 people (round trip)

Just like everyone, I had my doubts.

Just like everyone, I had my doubts.

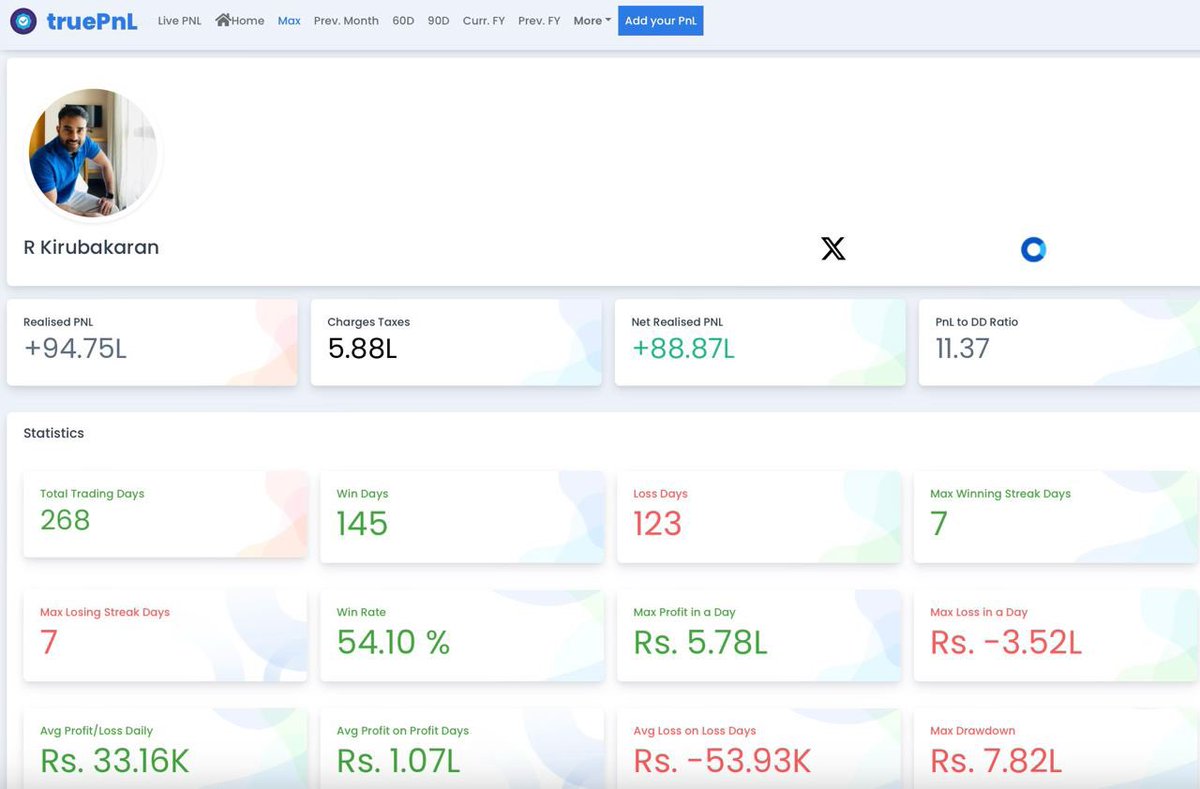

First you need to Download and install Node.js from nodejs.org and install Claude Desktop application.

First you need to Download and install Node.js from nodejs.org and install Claude Desktop application.

While everyone rushes to Hanoi or Ho Chi Minh, Da Nang offers something different - a laid-back vibe where luxury costs less than domestic Indian destinations. You get to see Pristine beaches and beautiful hill station, which is just an hour drive.

While everyone rushes to Hanoi or Ho Chi Minh, Da Nang offers something different - a laid-back vibe where luxury costs less than domestic Indian destinations. You get to see Pristine beaches and beautiful hill station, which is just an hour drive.

Initially, we were looking at Kashmir for the family vacation. But with school holidays, flight tickets from Chennai shot up to ₹1.5 lakhs.

Initially, we were looking at Kashmir for the family vacation. But with school holidays, flight tickets from Chennai shot up to ₹1.5 lakhs.

Many people have Ladakh trip in their bucket list mainly because of the picturesque landscape, high altitude motorable passes for bike ride. But we always wanted to go there because of low light pollution that lets you do star gazing where even Milky Way is clearly visible with naked eye.

Many people have Ladakh trip in their bucket list mainly because of the picturesque landscape, high altitude motorable passes for bike ride. But we always wanted to go there because of low light pollution that lets you do star gazing where even Milky Way is clearly visible with naked eye.

SABTNL is one such stock where stock price gained more than 20500% in less than a year. Inspite of having poor fundamentals the stock price has sky rocketed.

SABTNL is one such stock where stock price gained more than 20500% in less than a year. Inspite of having poor fundamentals the stock price has sky rocketed.

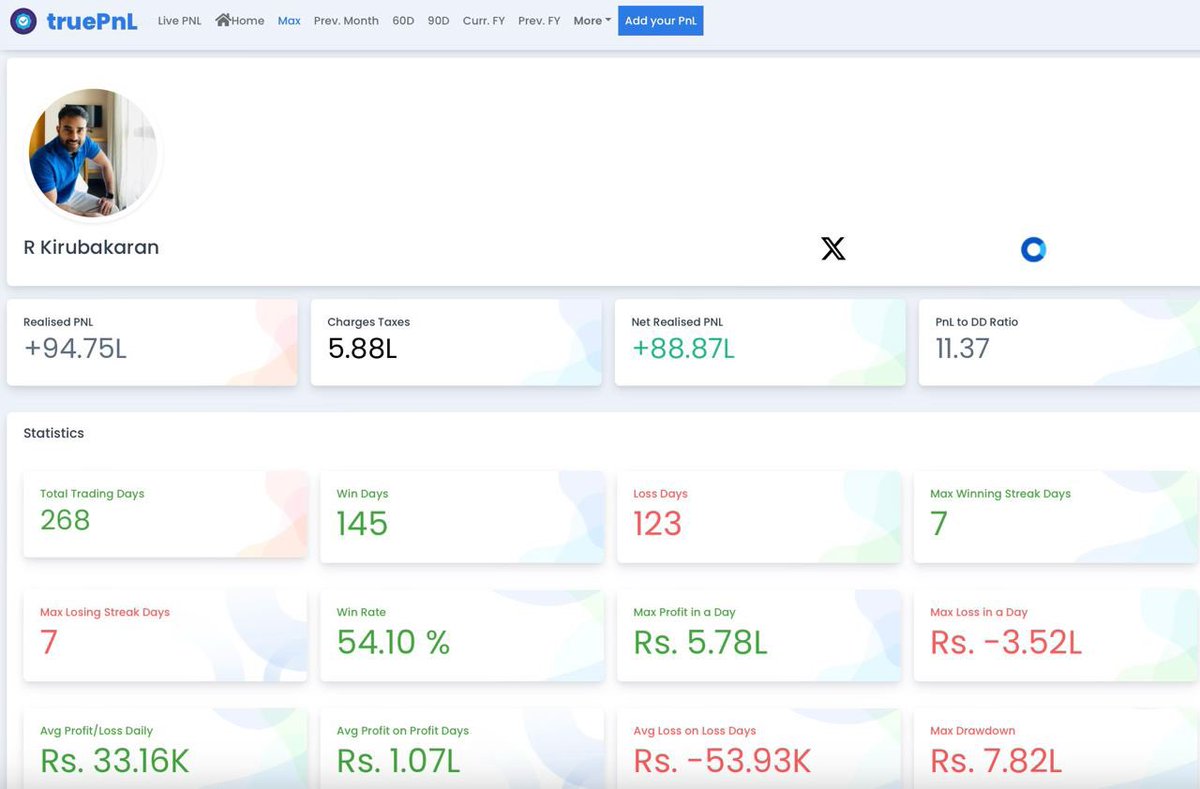

I decided to withdraw profits to buy a flat. If you check all my old tweets, I would have tweeted always against buying a property. What changed my mind to buy a flat instead of compounding my capital. Let me explain that.

I decided to withdraw profits to buy a flat. If you check all my old tweets, I would have tweeted always against buying a property. What changed my mind to buy a flat instead of compounding my capital. Let me explain that.

The moment you arrive at Srinagar none of your other State prepaid mobile network work here. I bought a Jio Sim for 500₹ which is sufficient enough for next ten days to cover my work and to stay connected. If you have postpaid, then no problem.

The moment you arrive at Srinagar none of your other State prepaid mobile network work here. I bought a Jio Sim for 500₹ which is sufficient enough for next ten days to cover my work and to stay connected. If you have postpaid, then no problem.

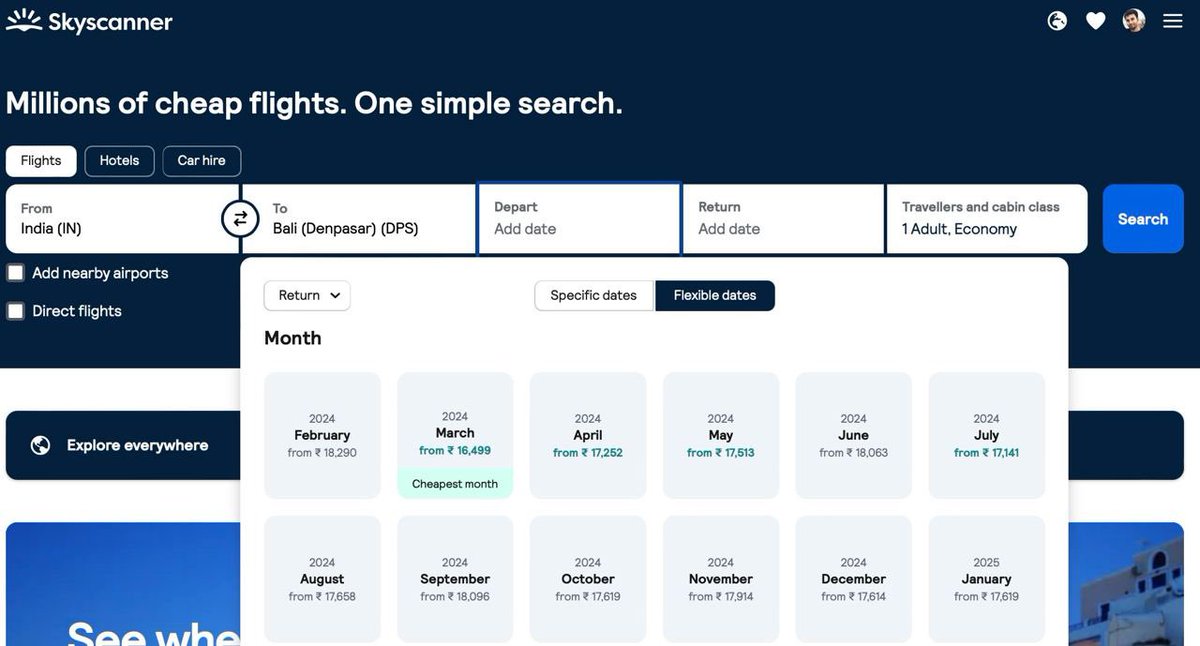

Flight - There is only one direct flight from Delhi to Bali operated by Vistra which costs around 35k. Most flights are connecting via KL or Singapore, Use Skyscanner to find cheapest deals. Extra 20kg baggage cost additional 10k. Default is only 7kg.

Flight - There is only one direct flight from Delhi to Bali operated by Vistra which costs around 35k. Most flights are connecting via KL or Singapore, Use Skyscanner to find cheapest deals. Extra 20kg baggage cost additional 10k. Default is only 7kg.

I used to be very active in Traderji forum back then, was fascinated by all the profits people post there. Looking at those screenshots, I keep pushing myself to learn more about the markets, because one day I wanted to be like them. I wanted to make big profits.

I used to be very active in Traderji forum back then, was fascinated by all the profits people post there. Looking at those screenshots, I keep pushing myself to learn more about the markets, because one day I wanted to be like them. I wanted to make big profits.