I'm maximizing "hit ratio" currently. I need lots of opportunities to answer "did I analyze this opportunity correctly and make money?" thus I own lots of companies.

Constantly learning about huge numbers of companies and owning a lot of them aligns well with only being into investment since 2.5y.

If you apply some filters, like insider ownership & or maybe "involvement of Founder", you really can study almost everything that's out there.

It's more modest, too: It's more about their performance, less about the portfolio manager's ingenuity of trading around.

My performance = companies' long-term performance, not me day-trading.

Me not expecting my performance to come from trading is the same side of the coin for me: It's about the companies & their people...

Most painful for me would be missing out on future tenbaggers. Even if initial position is small, I believe enough right-side exposure will drive meaningful returns.

-> Less risk because you're not operating in a vacuum, but always know relative valuations.

My background is "book person" and "philosophy".

I'm expecting to outperform analytically.

Investment community is becoming aware of negative dialectics of the concept of "circle of competence".

World is way, way more complex than 50y ago. Good luck staying in your comfort zone.

I'm constantly way beyond my "circle of competence" and it's a feature. Being top 1% with one company might protect you, but reality is moving too fast. Too much time and energy required to be top 1% with a single company.

Assume all Co's are awful.

Buy the least awful one you can find.

My $JD writeup imho is a solid example of negative stock picking.

Thus 180° change of perspective follows: PLEASE DON'T try to stock pick positively.

They just stick their hands in that bag and they get what they deserve.

BTW: Microcap level is not a great place for your first year(s) in investing.

Certainly >10x turd:raision ratio vs e.g. in the S&P500.

Anyway.

$AMZN, $LVGO, $JD, $TCEHY, $3690.HK, $WORK, $ESTC, $HMI, $NTDOY, $SPOT, $PDD, $TWTR, $XPEL - most of them need "taste" & some form of philosophy about where our world is going and its driving historical forces.

Also, generally, how I view my job as a PM. I already said that it's about companies' performance.

Personally, I interpret the role of a PM quite analytical. Because that's an interpretation I feel relatively adequate for.

My job would have been to own companies that fare well in disruption of physical & capital infrastructure.

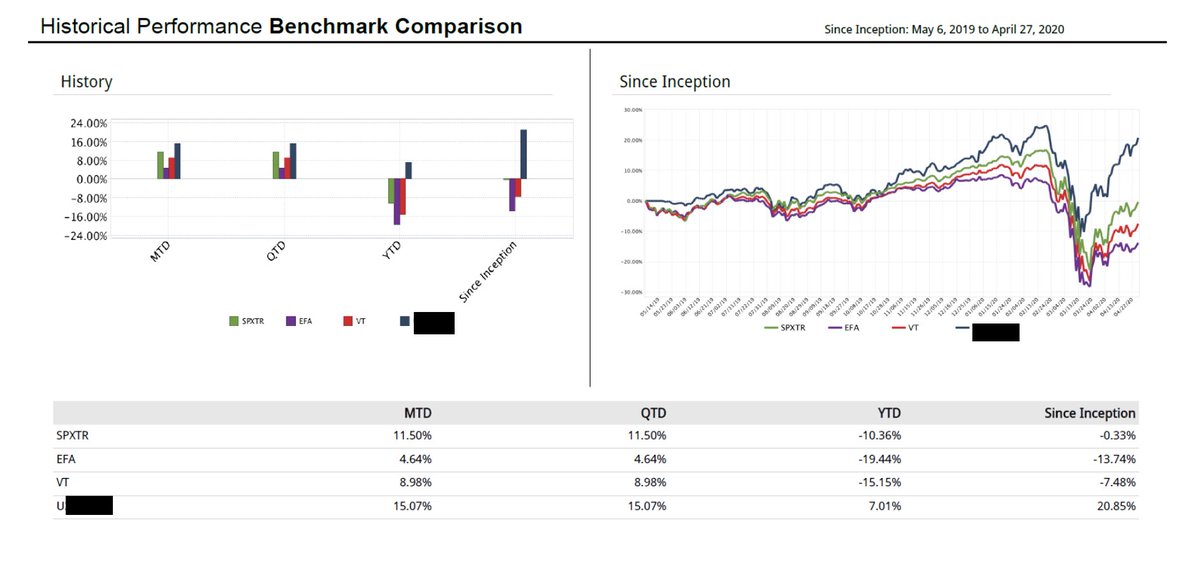

How am I doing there?

When I look at those companies from my "at scale" perspective, they would be very meaningful in solving Coronavirus early. -> Aligned with society.

Is this luck, or is this solid portfolio management? We'll see over longer periods of time, during many more periods of distress. But so far, so good.

(e.g. $TCEHY, $SFTBY, $AMZN, $FB, $NTES, $NTDOY, $DOYU, $YY, $HUYA, $BEST, $SPOT ) Feel good about them (and my choices) on a relative basis vs current situation.

Thanks for reading! <3

Performance is not coming from concentration, I'm long >100 companies.

1. Internet & tech benefiting scale

2. Cost of capital (also influenced by money printing governments) disadvantages smallcap more than my competition thinks

(If u REALLY think inflation is only 2%/y when governments bail out airlines, mb you should work for a central bank)

Absolute amounts of net profits are an optical illusion when governments just make up their own money.

Owning companies that care a lot more about future earnings power (disruptive scale-sharers & innovative breakeven growers) vs current one (cash cows) makes sense to me.

Can't say it often enough but actual valuation work imo isn't looking at one company abstractly and doing a DCF or something, instead:

This develops taste about what you can trust because you are comparing. I mean, is it surprising to find actual cheapness when one actually compares thousands of companies?

Too manual, too time-intensive.

Chances are that you're too old and you have too many other things going on in your life to actually look at companies.

Lot's of time-intensive grind + Sitzfleisch (German for "iron butt")

Poor Buffett didn't have the tech to collect info, but luckily he has this wonderful memory.

1) read a lot (only ~65,000 pub co's!) 2) sort a lot 3) develop concrete filters based on current reality which is only possible as practicioner

Happens that I buy positions after half a day because everything just feels WAY above avg & if u simply trust companies' guidance CAGR should be nice: $FTNT or $ADSK (tiny positions but long)

Often it seems that retail folks only know a handful of companies. It's risky that way. (even though there's lots of intuitive traders' smartness present!)

But I really can say that I mostly decided against alternative options.

Also, if you really know "how big things are" you can get much more ...

E.g. the biggest publically traded Chinese banks are >$1tn in mcap. I can squeeze in a LOT of SaaS companies that seem abstractly expensive. I just view it differently.

Concrete thinking example:

Also, I protect myself with position sizing. $ESTC is 1%. For me this is a very big position.

1. You don't get in trouble with individual mistakes.

2. You could buy more if something goes down a lot.

3. You're overwhelmed in a positive way.

5. You get super fast in analyzing one company after the other.

6. You actually know what's out there & get macro sense.

7. You can own companies with certain risks, e.g. country risk (e.g. $STNE or $PAGS or Chinese companies)

9. I'm not easy to clone

I would do the same even if I would perform ~worse than the market in the short-term.

Investing isn't supposed to be easy. You have to first survive until you get to a point where you can rely on yourself.

Even after 1.5y (last AL) my filters weren't good enough: e.g. Freshii (no position since ~ >1y)

(For a very brief moment in time I had 20% in FCAU, obviously not a good idea in retrospect, as of today. m) )

Hope to be around for some time. If lack of concentration is a problem, I can change.

Mentally, definitely the hardest period of managing solid sums of money for me so far because headline sentiment reads:

"unemployment worst since great depression"

"A dangerous gap - the markets v the real economy".

Investors remain skeptical, but it seems market as a supra-individual quasi-sentient emergent being is understanding value of antifragile digital transformation companies better now.

Staying long & focused:

E-comm ~ <20% of retail.

Yes, if some companies get more respect as well, mostly smaller, US-listed "Chinese" companies: $MOMO, $DOYU, $YY, $BEST, $TME. Oh, & Softbank. $BABA, unlike $AMZN isn't around ATHs, arguably it should.

If Softbank performs, so do I.

Compare $TCEHY to $V. (Has worked whole last y since I mentioned this!)

Compare $BABA to $IDCBY ($370bn mcap)

Tencent+Baba+JD+Meituan = less mcap vs five biggest Chinese banks iirc.

You want to beat the market? Imho this is all you need to know.

What do you feel for non-literate people? Shame? Guilt?

You probably don't tell them they are worse off in most (but not all!) aspects of their live because they can't read.

This "REAL economy" thing as a THING (a something that few people question) shows that we might repeat the internet surge of the 90s since the 2010s.

"Dotcom period" was abstract idea but "in itself" correct!

Cloud is concrete reality more than ever.

2020 market simply said NO to the viewpoint "But the real economy is bad".

Ofc this view is just as ideological, but it's directionally right.

This is a matter of concrete discussion of valuations though.

Take $ADSK.

Traded for ~$28bn mcap in March. Company's 2023 target: $2.3bn FCF.

Compare that to utility & consumer staples... Can you buy Cola for <13x 3y forward FCF? $KO

Internet = New World / America

Offline = Old World / Europa

Reality moves in a direction & it's digital reality.

But so many businesses just OBVIOUSLY became way more valuable, typically the large ones that gain share.

Amazon simply is worth more after Corona vs before.

Market is rational, it's just probably not fashionable to say this bc of actual harm caused to non-competitive small businesses & their people.

Same for today, don't feel guilty for being a digital business, your moral job is to help everyone successfully transition.

Most people now are somewhat literate. Better planet!

Imagine a catastrophe in the 1820s where everyone suddenly had to learn how to read. Bullish or not?

Can you blame the market for bouncing solidly?

When I learned about investing I thought:

"would have loved to invest in the 90s "internet boom", an era comparable to invention of printing press"

Then I understood: I am alive during EARLY internet epoch.