Best resources:

Most useful blog post I've found is this one by @StackInvesting. softwarestackinvesting.com/elastic-estc-s… - Can recommend to check out their A+ work & to follow them on Twitter!

overview: &

youtube.com/channel/UCUaTR…

CEO Shay Banon about SIEM, Endpoint Security:

Keeping Up with the ELK Stack: Elasticsearch, Kibana, Beats, & Logstash:

@GreenhavenRoad in their Q4 letter:

and @MinionCapital, @CrowdedTradeCap, @LibertyRPF @mspacey4415 @LSValue, @afc.

"Super app" is currently one of my most important investment filters.

"Super app ecosystem" is the key to my heart.

But "Super software infrastructure ecosystem" would work for me, too.

"Digital superhighway" - not anymore.

"The whole world is now a computer" - Satya Nadella

TAM of search = infinite game.

Logging is how humanity is archiving. It's a core tech what makes us human.

No spaceship SciFi stuff without the need to put something into "log entry" format.

"Net profit" isn't fully real when certain entities just print profits.

Imho.

Amazon: "it is always day 1"

Elastic: "it is always Day 0"

Btw, I've always told people that we're "still day -1".

Something hasn't started yet. We're mortals, our epistemology & logic itself is limited by death.

(But that's not v important here, read on.)

Are there other companies out there that have a philosophy about this?

I take this seriously, would love to know.

* customer-obsessed, one notices this in the details

* high-energy

* smiling a lot (lots of highly intelligent people smile unusually often, e.g. Bill Gates)

* technical founder into CEO role transition (Benchmark view on great CEOs)

"speed, scale, relevance"

Time value of money -> Acceleration of everything.

Every business gradually is resembling what has been the high-frequency trader decades ago. (mental model)

Elastic introduced nano-second data type...

I think the business that is introducing 10⁻⁹ scale has a good chance to be fast, strong and special.

World gets faster and faster? Elastic helps to drive this (efficiency) & benefits from it.

Mission: "zero latency"

* security libraries seen as network effect

* (Live) visualization via Elastic Canvas is not only relevant for IT stuff, but principally for any data.

* live business data = universal use case

* seems strong w/ government & institutions

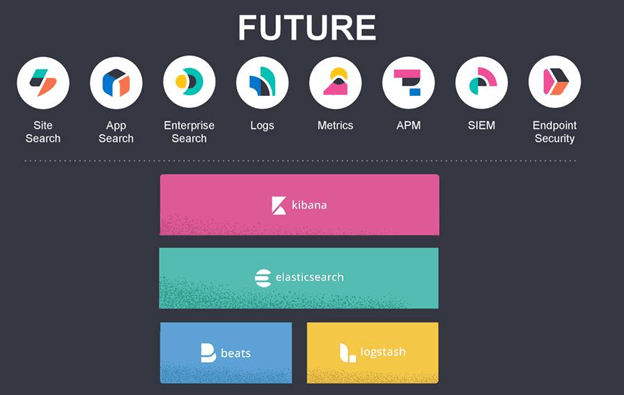

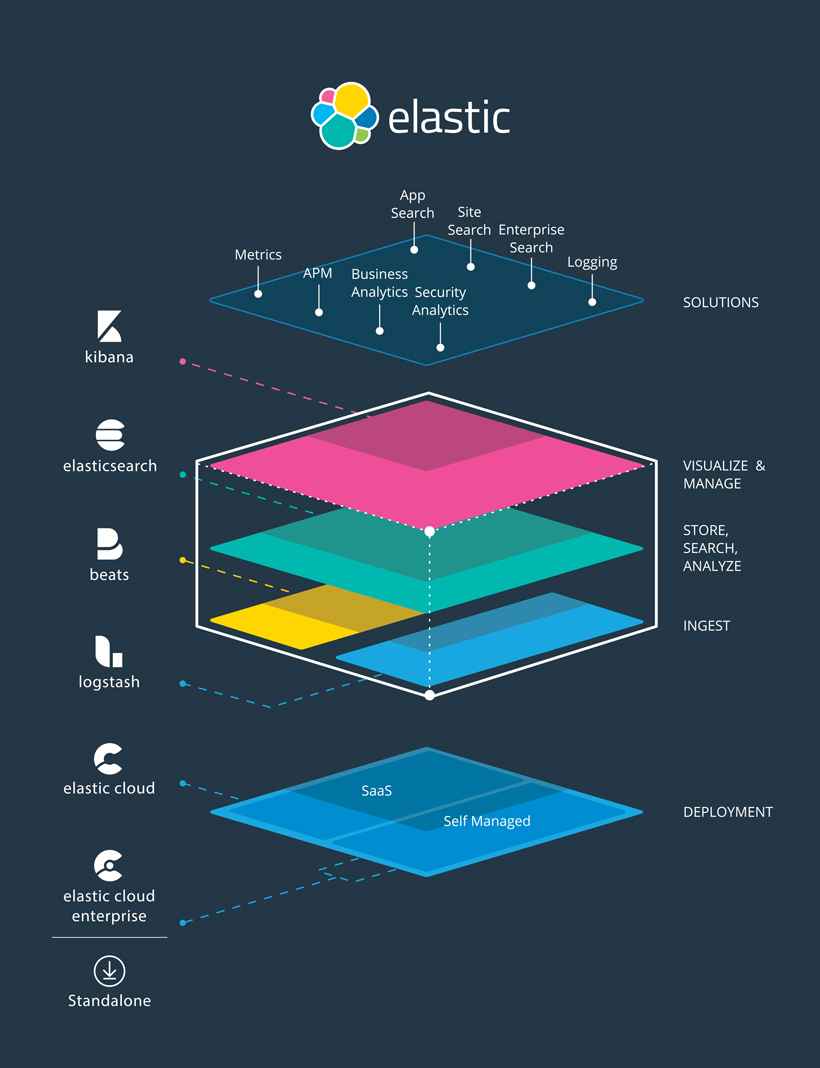

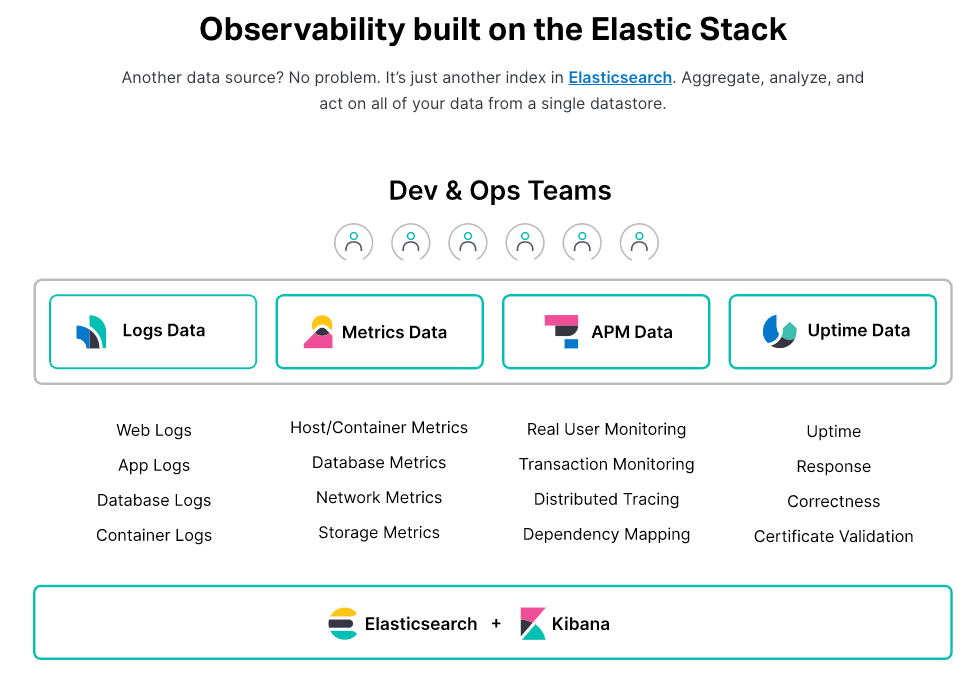

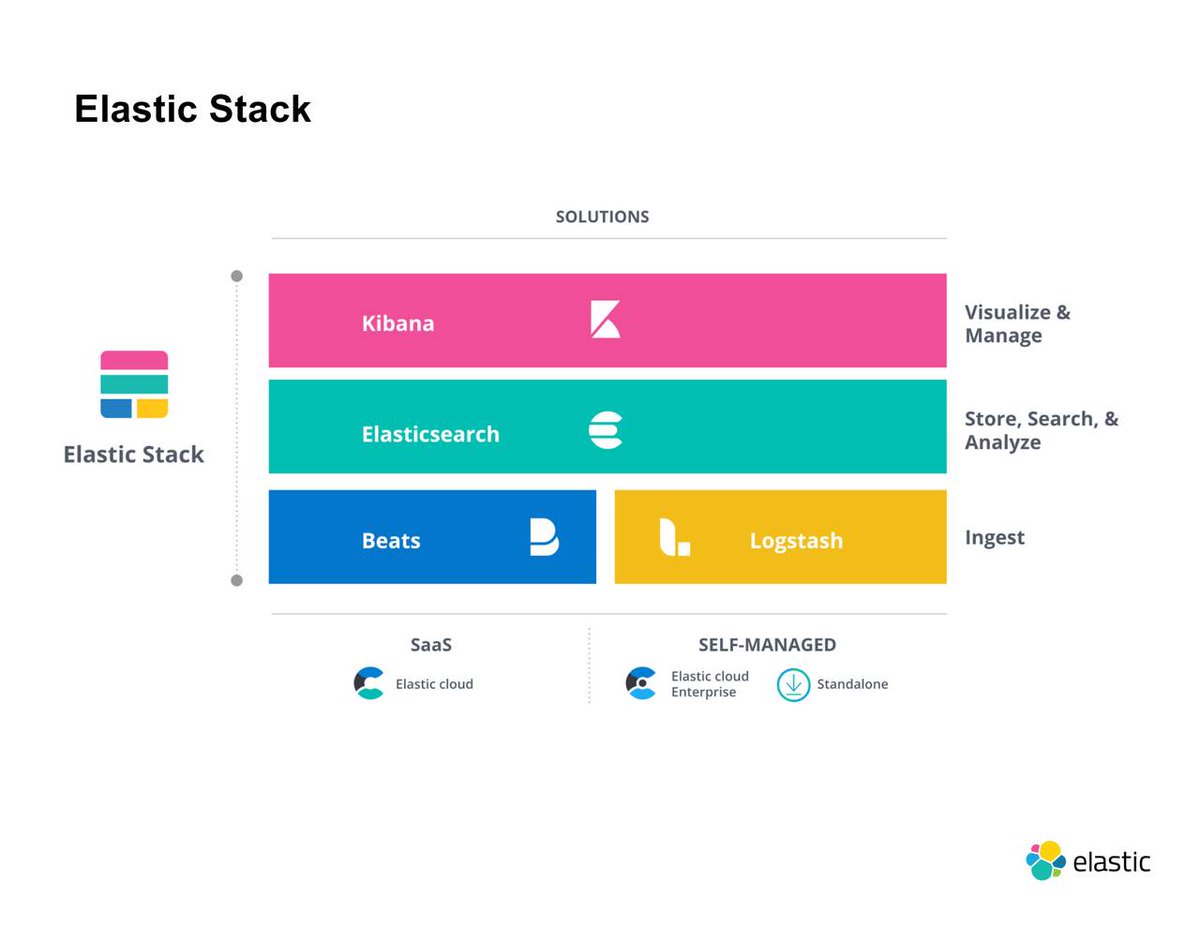

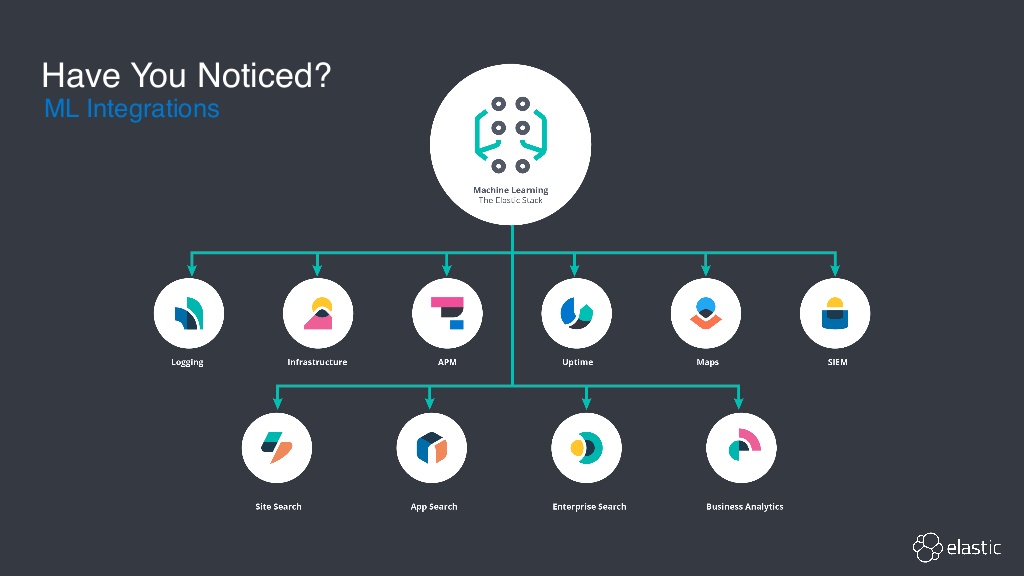

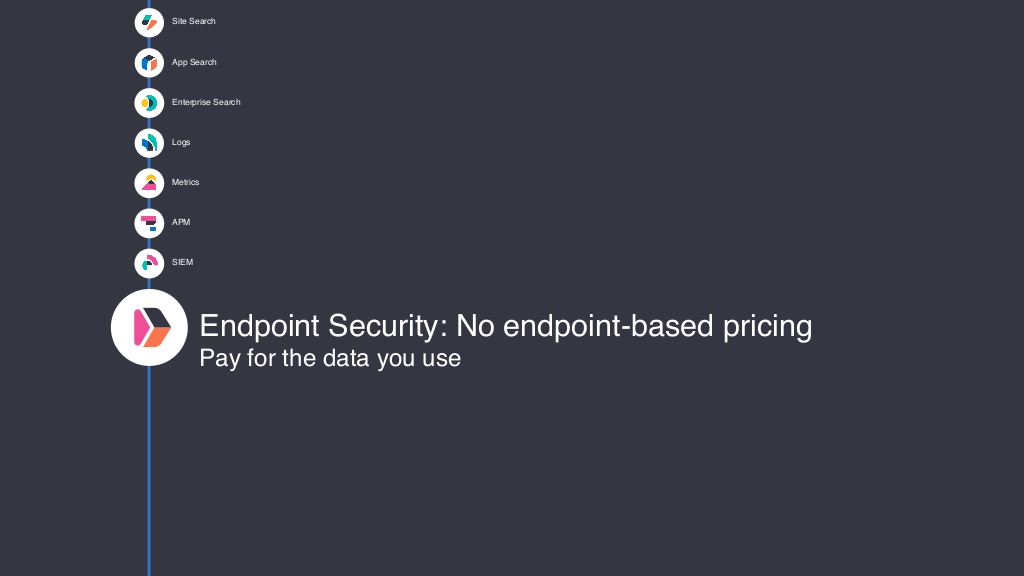

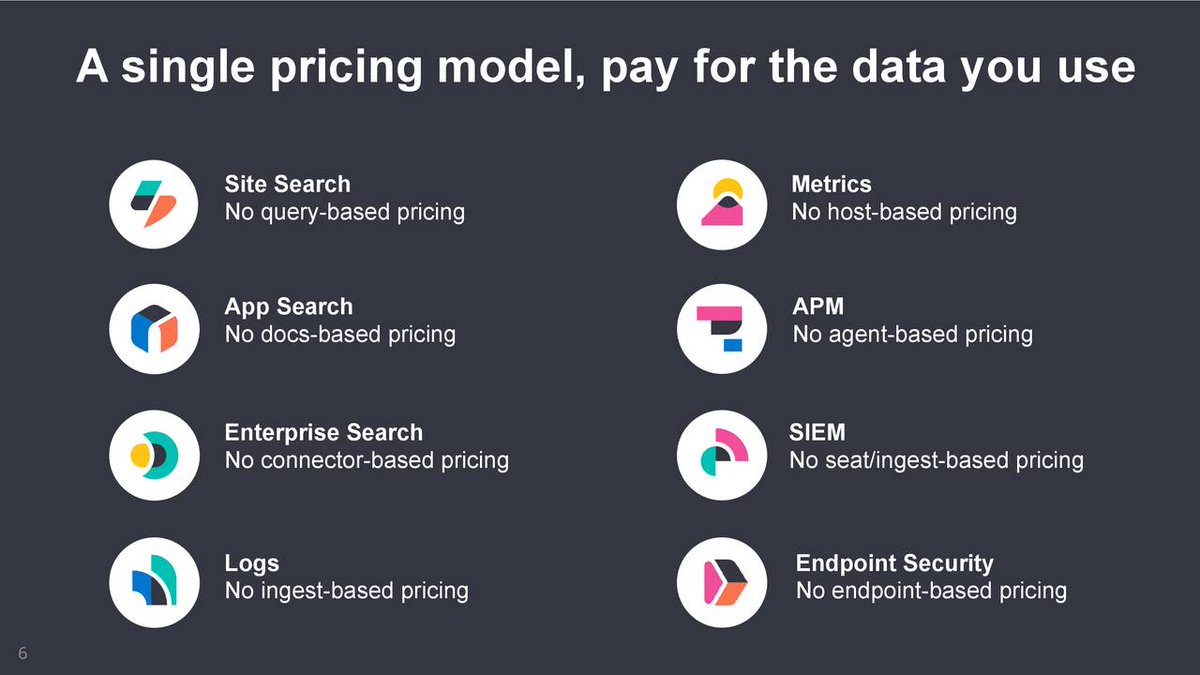

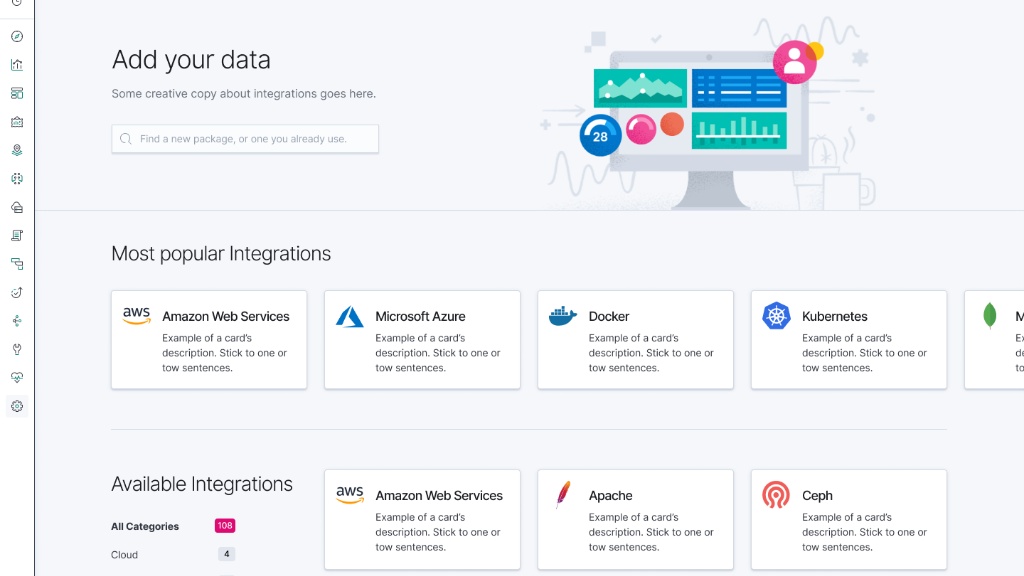

Search, Moore's Law, Data Usage, App & API Economy, Open Source & Developer communities, Connection between smallest things & clouds, Observability (= Accountability of systems), Re-bundling of too fragmented spaces (e.g. APM), Digital Super Infrastructures, SaaS.

2) Hardly any deep dive SA articles yet.

3) Seems not very well known by FinTwit?

4) E.g. Glynn, Sylebra, Benchmark, Greenhaven, Tiger Global, Atreides own it. Whale Rock sold out.

5) Shay Banon at 9.4mn shares, Steven Schuurman at 11.8mn (ex options) ->skin...

I mean, I'm trying to actually follow everything, but in-depth research needs weekends.

Market currently bit too hectic for my taste to focus on one thing for days.

Let's say above $106.193 sometimes in the next 4y, consistently so after 5y.

(slight irony)

But for real, at $106.193, Shay Banon would be a billionaire based on his direct share ownership ex options.

I care about incentives, not DCFs.

Seems feasable to me.

Clearly, now I see how futile and dangerous this was.

Mostly bad companies have upside targets.

Best companies' actual fair value always is shamefully high.

The kind of company where more risk comes from timing & CAGR versus total loss? Tech seems so cool...

Thanks for reading! Thanks for feedback, if you like!