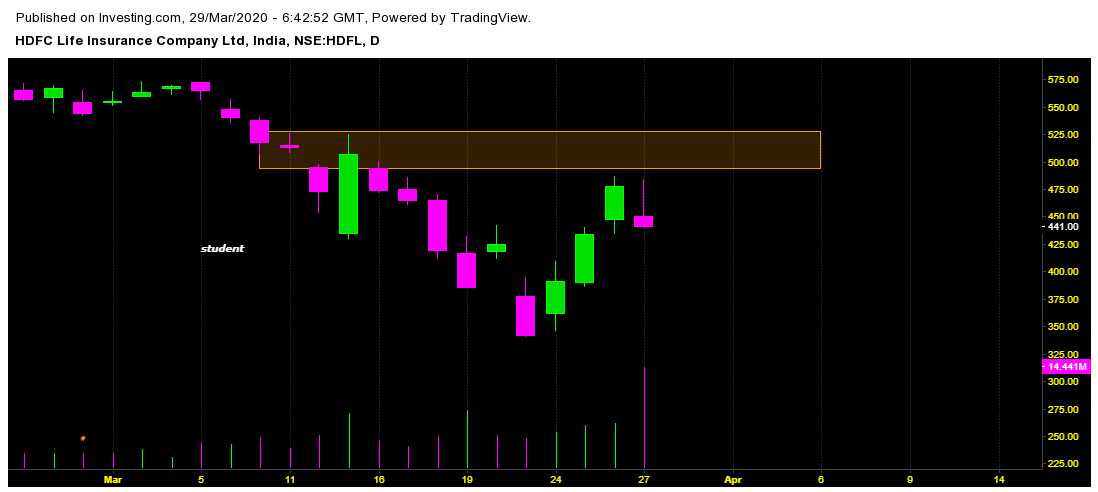

Scrip : #HDFCLIFE

Few drawings first....

Rejection from Middle band of BB... also known as 20DMA with inverted Hammer.... Bearish

COI increase by 26.35 %

Futures price decrease by 8.06...

*** Aggressive short build up with significant increase in trading and delivery volume ... Bearish.

*** Futures closed below VWAP.

***Short CE at OTM and Far OTM contracts... Bearish....

This is my understanding... Which can be 1000% wrong.

I am ready for further learning from My teacher.............

Mr. Market.

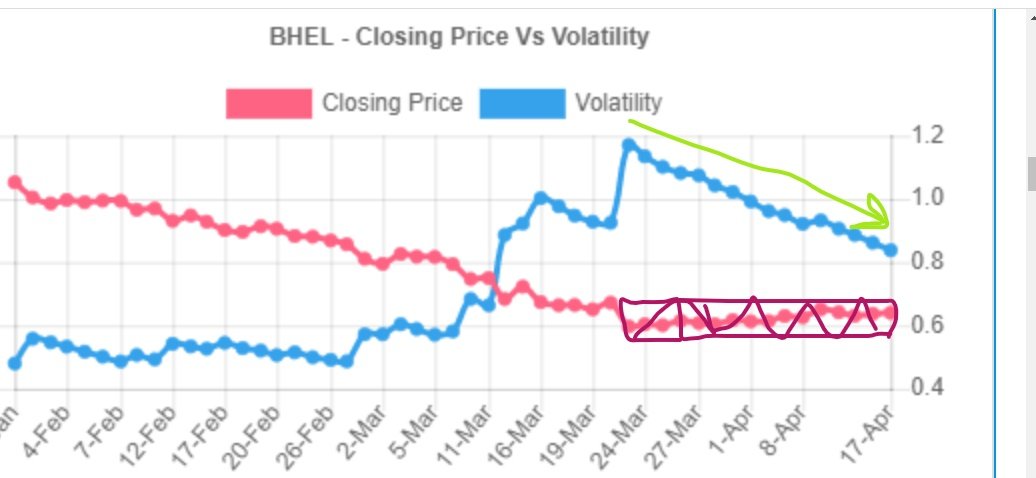

So let me answer it for all...

This conclusion I have drawn on the basis of the time when this positions have built up and the prices of it.

The highest volume CE position has been built up when the cost of CE was high..which is at 0915 -0918, and PE positions have been built up when the cost was lowest which is around 1400 & 1500 when the stock was on its day low and put prices was cheap.

As the stock goes down the price of call will go down...writer in profit and put price will go up...put buyer in profit.

Agian, my understanding and logic....May be wrong. Do your further study prior taking any trade.

421 spot important.. breaking it we may get another rally

Another 2%...